|

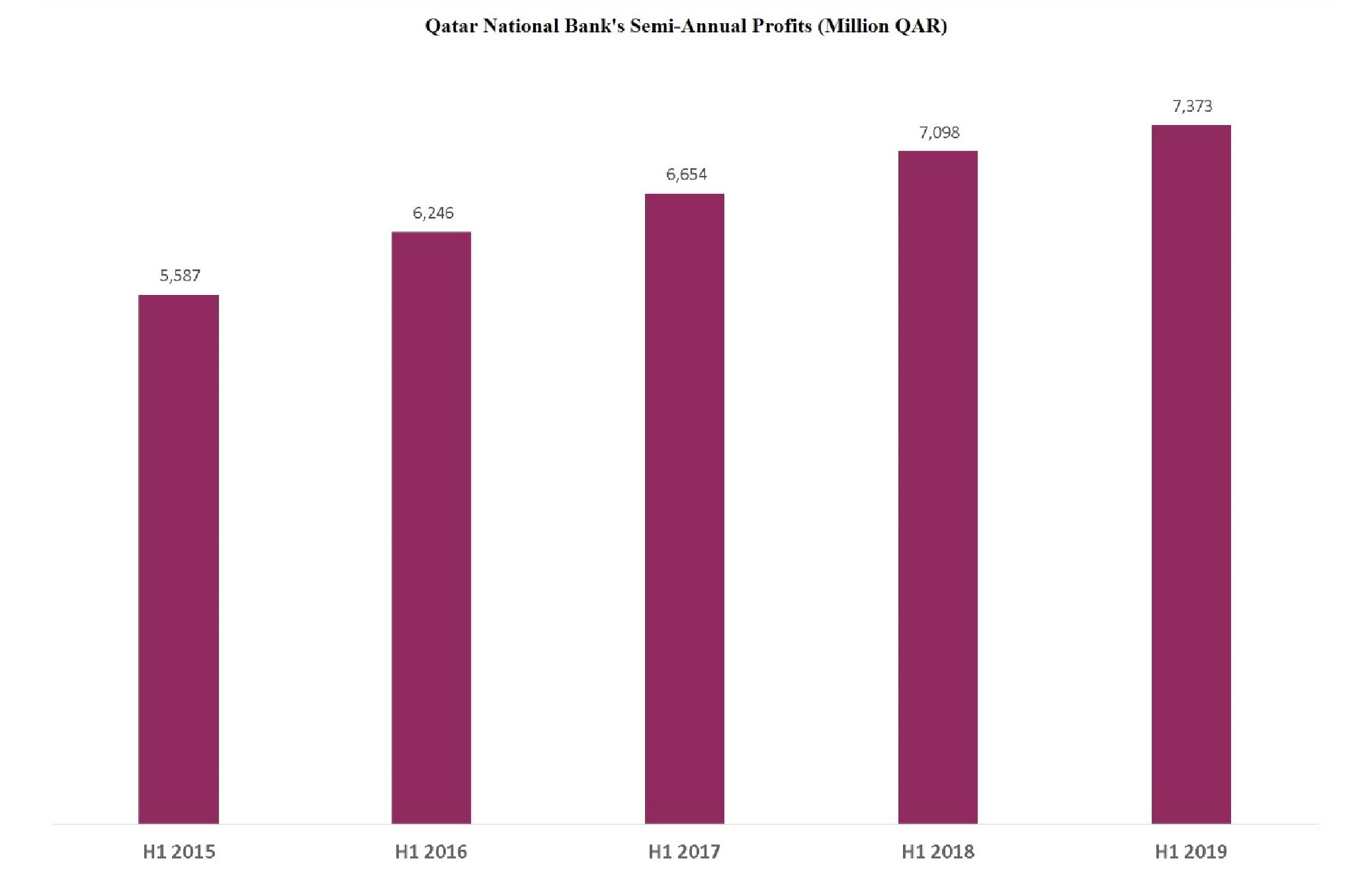

(The Group’s Comments) QNB Net Profits Up by 4% to QAR

7.4 Bn. in First Half of 2019

July 11, 2019

Net Profits: Qatar National

Bank (QNB) reported a profit growth of 3.88% for the first half

of 2019, reaching QAR 7,373 million, compared to QAR 7,098

million for the same period in 2018. The bank’s earnings per

share (EPS) amounted to QAR 0.74 in this first half, similar to

the corresponding period of 2018. This stability of EPS is due

to the increase in interest paid to additional capital. Also, in

the second half of 2018, the Bank had issued an additional

portion of its capital to support the solvency ratio by QAR 10

billion. As for QNB’s Q2 earnings, they increased by about

3.77%.

Comprehensive Income: QNB recorded an

impairment loss of QAR 1,160 million in the first half of 2019,

versus an impairment loss of QAR 1,160 million for the

corresponding period of 2018. These impairment losses are

relates to foreign exchange differences, changes in fair value

of cash hedges and valuation differences for foreign

investments.

Operating Revenues: increased by

QAR 406 million or 3.4% to reach QAR 12,328 million. This

improvement was due to the increase in the interest income and

fees by 3.22% to QAR 364 million, and the rise in foreign

exchange profits by QAR 52 million.

Operating Expenses: increased by

5.30% or QAR 234.5 million, compared to the first half of 2018.

However, increased expenses remained lower than revenues, which

resulted in improved profit for the period.

Loans & Deposits: During the

first half of 2019, the loan portfolio grew by 4.60%, which is

similar to the growth in customer deposits that increased by

4.63%. The ratio of loans to customer deposits stabilized at

98.3%. Non-performing loans accounted for 1.9% of total loans.

|