|

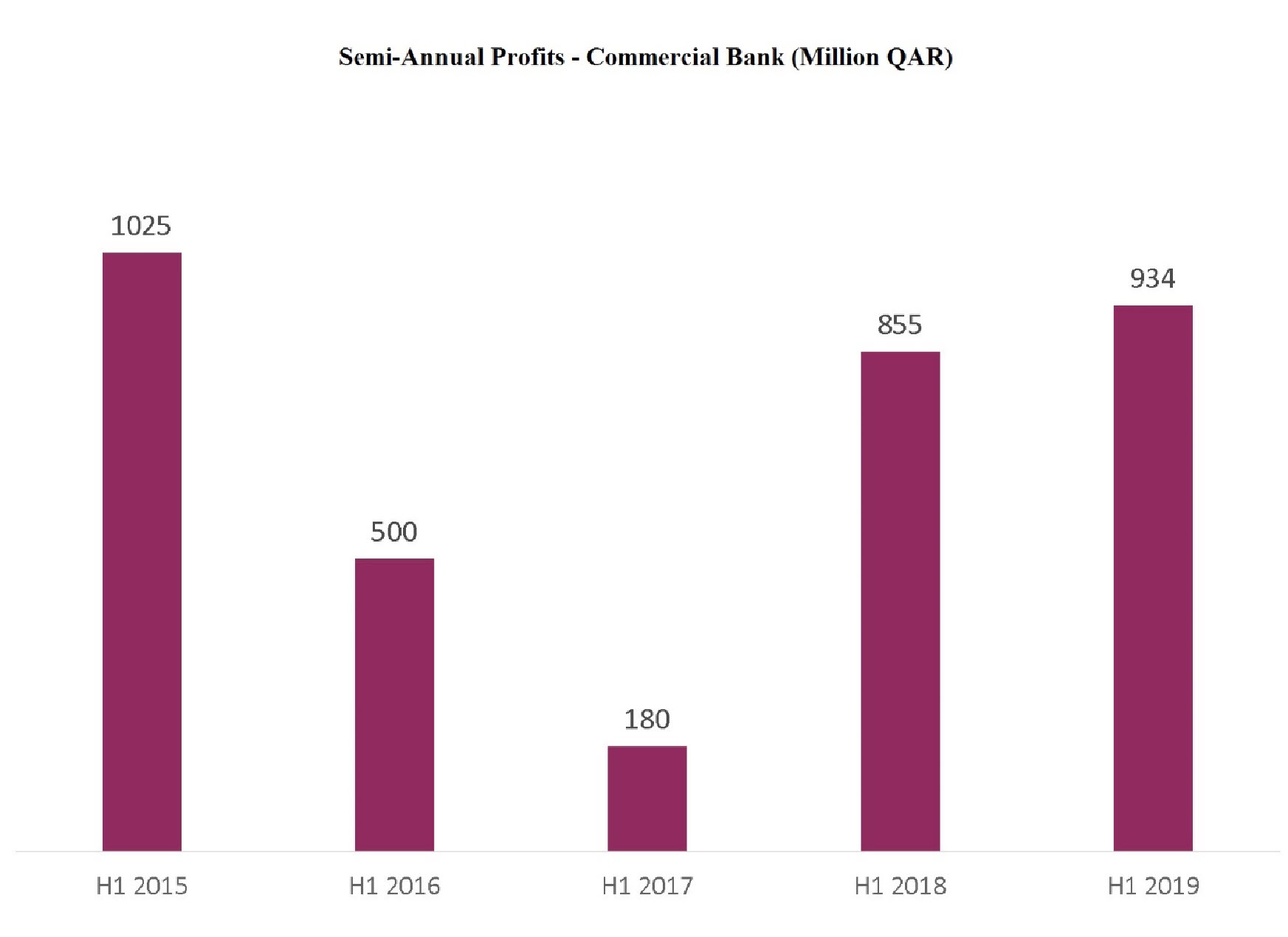

(The Group’s Comments) The Net Profit of

Commercial Bank Rises to QAR 934.08 Million in the First Half of

2019

July 17, 2019

·

Profits: increased by 9.2% to QAR 934.1 million in the first half of 2019,

compared to QAR 855.1 million for the same period in 2018, while

the bank’s earnings per share amounted to QAR 0.23 versus QAR

0.21 for the corresponding period of 2018. The second quarter

profits on the other hand reached QAR 503 million, compared to

QAR 450 million for the same period of 2018. The bank's profits

improved mainly due to a decrease of QAR 61 million in Other

Expenses.

·

Comprehensive Income: Commercial Bank recorded a first quarter valuation profits of QAR

252.4 million, versus a loss of QAR 532 for the same period of

2018.

·

Operating Income: improved marginally by 0.76% by the end of the first half to reach

QAR 1,846.6 million, versus to QAR 1,832.6 million for the same

period of 2018. It was also noted that the net interest income

decreased by 8.3%, but the increase in foreign exchange profits

and the net commissions compensated for this decrease.

Additionally, the reason behind this decrease in the net

interest income (the bank’s primary source of profits) was a 26%

drop in the Turkish lira during this period; it should be

mentioned that the Commercial Bank owns the Turkish bank

Alternatif, and therefore both financial statements are

consolidated.

·

Operating Expenses: decreased by 26% to QAR 980 million in this half, compared to QAR

1,056 million for the corresponding period of 2018 due to the

drop of QAR 61 million in Other Expenses and the decrease of

Employee Costs by QAR 18.7 million.

·

In terms of asset quality,

non-performing loans accounted for 4.9% of the total loan

portfolio. The rate of coverage, which measures the provisions

deducted to meet the decline in the value of these loans, is

about 96.2%.

·

Assets: Loans and advances decreased by 2.7% in this half, compared to the

same period of 2018, due to the decline of the Turkish currency,

as explained above. In contrast, deposits increased by 2.4%, as

the ratio of loans to customer deposits reached 110.3%. In this

half, the return on shareholders' equity stood at 5.63%, versus

5.57% for the corresponding period of last year, and the book

value of the bank amounted to QAR 4.10 per share.

·

Commercial Bank owns a 34.9% stake

in National Bank of Oman (NBO), which posted steady profits at

the end of the first half that amounted to OMR 25 million.

Meanwhile, the profits of the bank's wholly-owned Turkish Bank

Alternatif fell by QR62 million, as for Emirates based

United Arab Bank (UAB), the Commercial Bank is still considering

selling its stake in it.

|