|

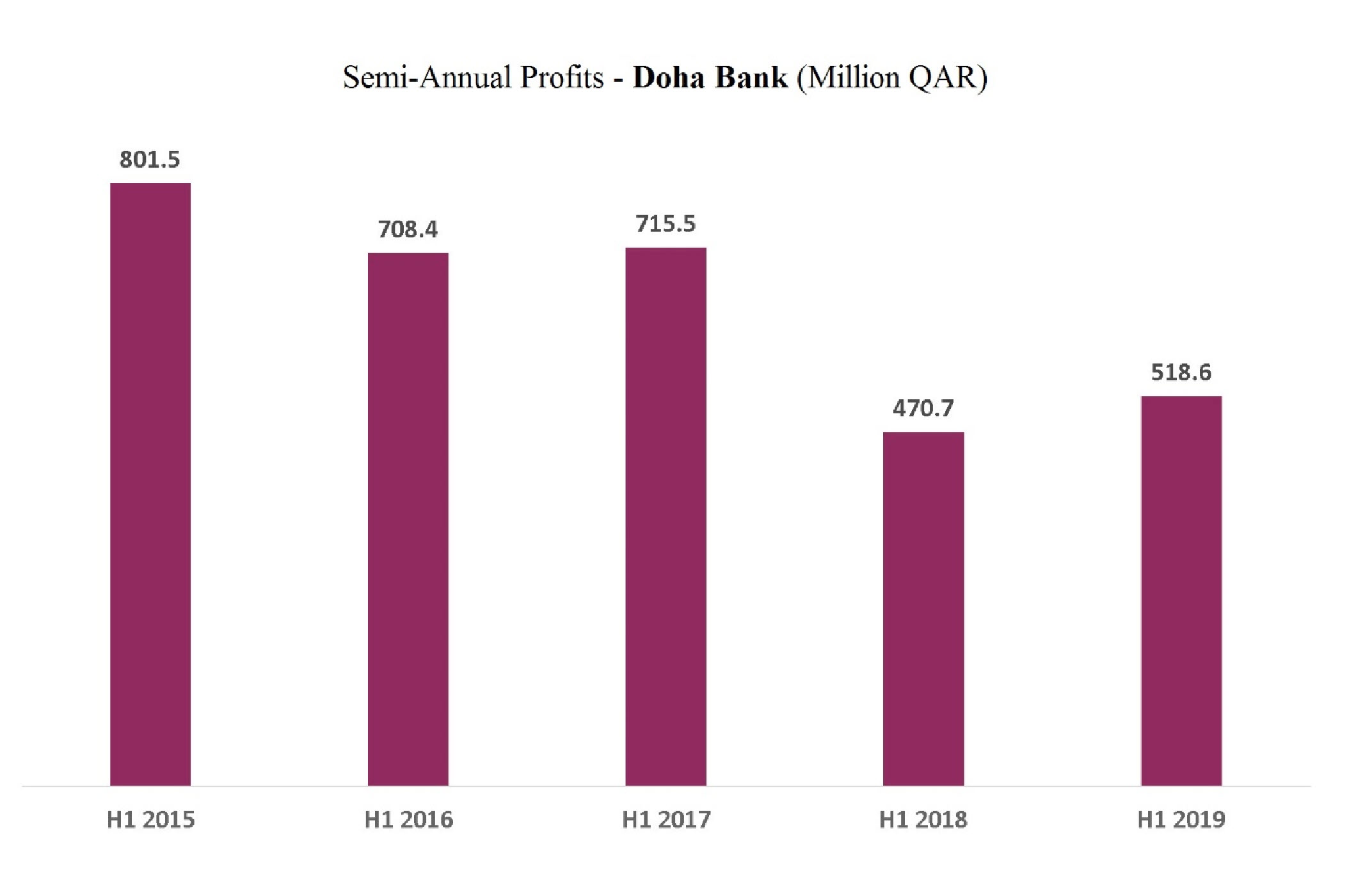

(The Group’s Comments) Doha Bank's Net Profit Climbs to

QAR 519 Million for the First Half of 2019

July 25, 2019

Profit: amounted to QAR 518.6 million in the

first half of 2019, compared to QAR 470.7 million for the same

period last year, a rise of 10%, while the bank’s earnings per

share reached QAR 0.167 versus QAR 0.152 for the corresponding

period of 2018.

Comprehensive Income: Doha Bank

posted an estimated profit of QAR 316.7 million in this first

half, compared to a loss of QAR 37.3 million for the same period

of 2018.

Insurance Activity: recorded a loss

of QAR 26.07 million, compared to last year’s first half when

the bank made a profit of QAR 5.4 million due to an increase in

insurance claims.

Operating Income: decreased by

5.4% to QAR 1,291.5 million in this first half, compared to QAR

1,365.3 million for several reasons:

The drop of the net interest income (interest payable - receivable)

by 11.1% or QAR 120.3 million due to higher interest rates

(deposit and borrowing costs) than the increase of interest

income. In this first half, the net interest income amounted to

QAR 961.9 million, compared to QAR 1,082.2 million for the

corresponding period of 2018.

The bank’s insurance activity losses and the turning a loss affected

the revenues by about QAR 31.5 million during the first half of

2019.

On the other hand, the bank's results showed a profit of about QAR

99.4 million from investments and other income (explanation was

not provided), compared to QAR 30.2 million for the same period

of 2018, which diminished the impact of the drop in revenues.

Operating Expenses: decreased by

10% to QAR 802.6 million during this year’s first half, compared

to QAR 890.8 million recorded during the same period of 2018,

due to a cut in staff costs by QAR 22.8 million, and a reduction

of QAR 31.6 million in other allocations to QAR 416.8 million

instead of QAR 448.4 million for corresponding period of 2018.

It should also be noted that the item of Other Expenses

decreased by QAR 27 million.

Loans & Advances: increased by

1.67% compared to the end of 2018 to reach QAR 60.92 billion.

Deposits stabilized at QAR 55.6 billion, and the ratio of loans

to deposits reached 109.6%. In terms of non-performing loans,

they stood at 5.83% of the total loans.

|