|

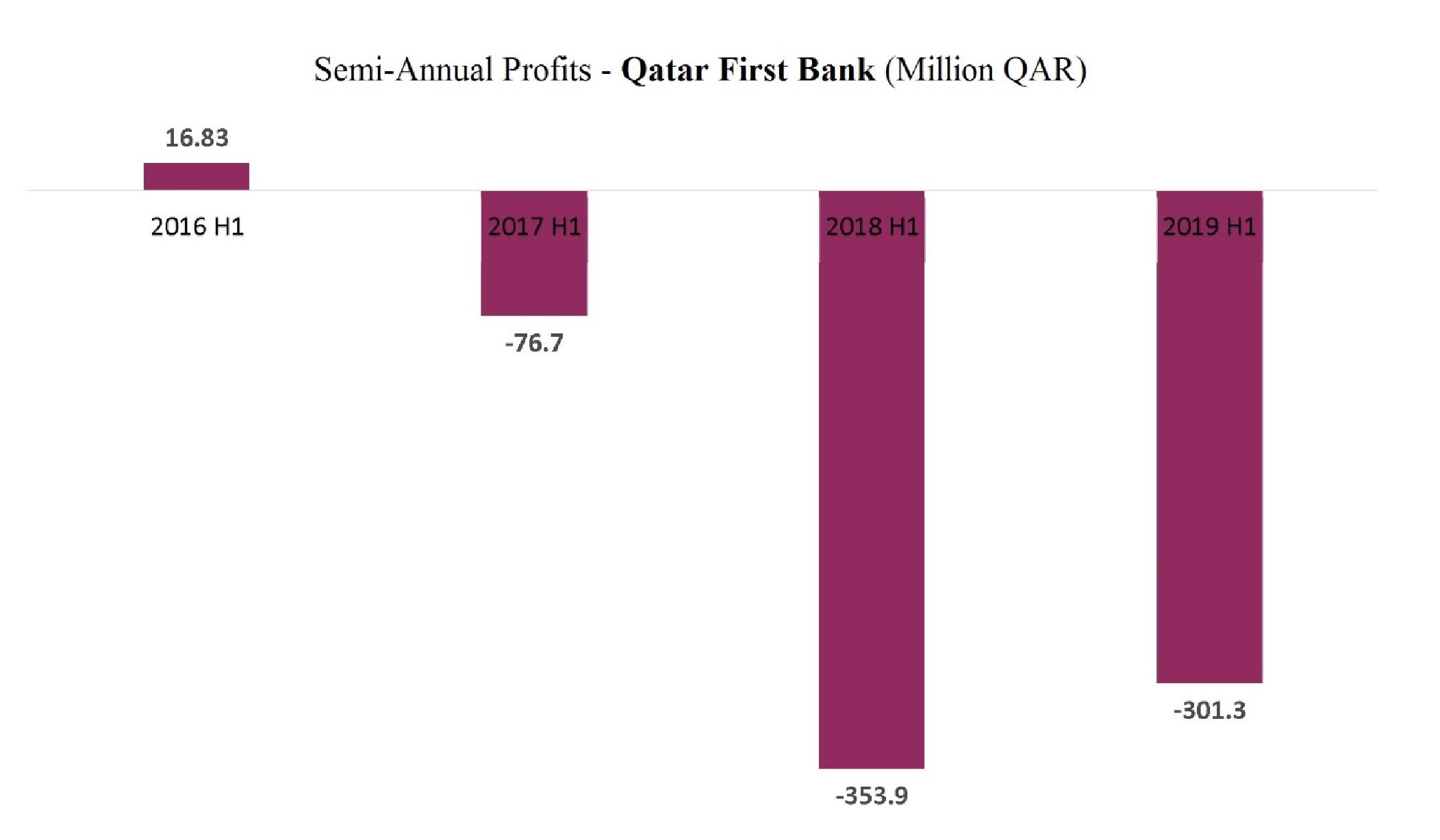

(The Group's Comments) Qatar First Bank’s Net Loss

Drops to QAR 301.33 Million for the First Half of 2019

July 29, 2019

Losses: the bank recorded losses of about

QAR 301.3 million for the first half of 2019, compared to a loss

of QAR 353.9 million for the same period in 2018, while its

losses per share amounted to QAR 0.15 versus QAR 0.18 in the

corresponding first half of 2018. As on a quarterly basis, the

bank posted a profit of QAR 3.2 million for first quarter of

2019, which means that the following second quarter witnessed a

loss of QAR 304.5 million.

Gross Income: amounted to QAR

13.8 million by the end of the first half, compared to a

negative deficit of QAR 243 million for the first half of 2018.

The data of the corresponding period included a loss of an

investment valuation of QAR 290.5 million, which reduced the

losses of this first half to QAR 39.6 million.

Impairment of Financial Assets: This

item represents the expected loss on non-performing financial

assets which is an expense deducted from the profit of the first

half. The bank deducted QAR 186.5 million to offset the

impairment losses on financing assets compared to QAR 36.5

million for the same period last year. The bank recorded an

additional provision for impairment of financial assets

amounting to QAR 32 million. The total provisions deducted for

this period, plus the losses of the valuation of investments,

amounted to QAR 258.1 million. The bank also recorded additional

losses included in discontinued operations amounting to QAR 42.9

million.

Accumulated Losses: Article 295 of

the Qatari Companies Law of 2018 states the following: "If the

losses of a joint stock company are half the capital, members of

the Board of Directors shall call the Extraordinary General

Assembly to consider the continuation or dissolution of the

company prior to the term specified in its regulations." The

bank's general assembly last April decided to reduce capital to

extinguish the losses but has not yet done so.

The accumulated losses amounted to about QAR 1.30 billion with 65%

of the capital and the book value of the share decreased to QAR

0.35.

|