|

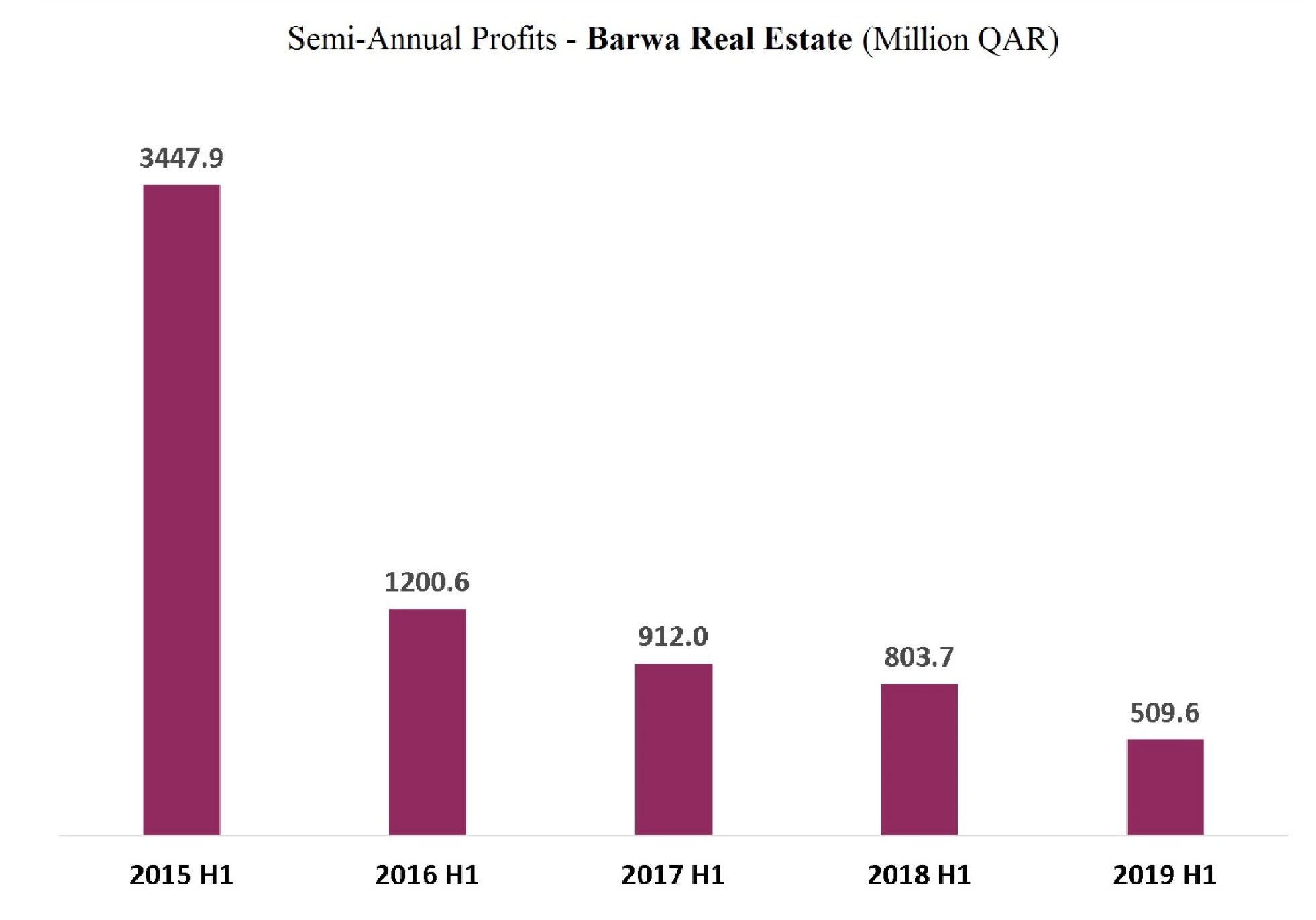

(The Group’s Comments) Barwa's Net Profit Drops to QAR

510 Million for the First Half of 2019

August 06, 2019

Profits: Barwa Real Estate’s profits

decreased by 36.6% or QR 294.1 million to reach QAR 509.6

million for the first half of 2019, compared to QAR 803.7

million for the corresponding period of 2018. This decline in

profits is due to a non-recurring income in the results of 2018

of about QAR 140 million generated from the restructuring of the

company's debts, in addition to the increase in financing costs

and amortizations during the period in conjunction with the

decrease in net rents by about QAR 38 million. The company’s

earnings per share amounted to QAR 0.13 versus QAR 0.21 for the

corresponding period last year. As for the second quarter, Barwa

posted a net profit of QAR 97.3 million, compared to QAR 401.6

million for the same quarter of 2018, a drop of 76.5%.

Comprehensive Income: Barwa recorded

an assessment profit through the statement of comprehensive

income of about QAR 2.3 million against a loss of about QAR 46.7

million for the same period in 2018.

Revenues: the net rental income and financial

leasing dropped by 8.5% to reach QAR 447.0 million, compared to

QAR 488.7 million for the same first half of 2018, due to a

decrease in the net rental income of QAR 38 million.

Operating Profit: decreased by

9.2% to QAR 681.2 million compared to QAR 750.6 million for the

corresponding first half of 2018, as real estate revaluation

profits decreased by QAR 9.0 million, and profits from

associates declined by QAR 4.0 million versus profits of about

QAR 11.4 million for the same period last year. The company also

recorded losses in the value of its investments in associate

companies of about QAR 1.2 million, versus a profit of about

17.5 million for the first half of 2018.

Financing Costs: decreased by

QAR 161 million, which had a noticeable impact on the results of

the company. As mentioned earlier, the company recorded a

non-recurring income of QAR 140 million from the restructuring

of its debt, in addition to the decline in income from Murabaha

by about QAR 20 million.

The company incurred additional financing and amortization costs

during the period as a result of the implementation of

accounting standard No. 16, therefore the amortization amounted

to QAR 20 million, compared to zero for the corresponding period

of 2018.

|