|

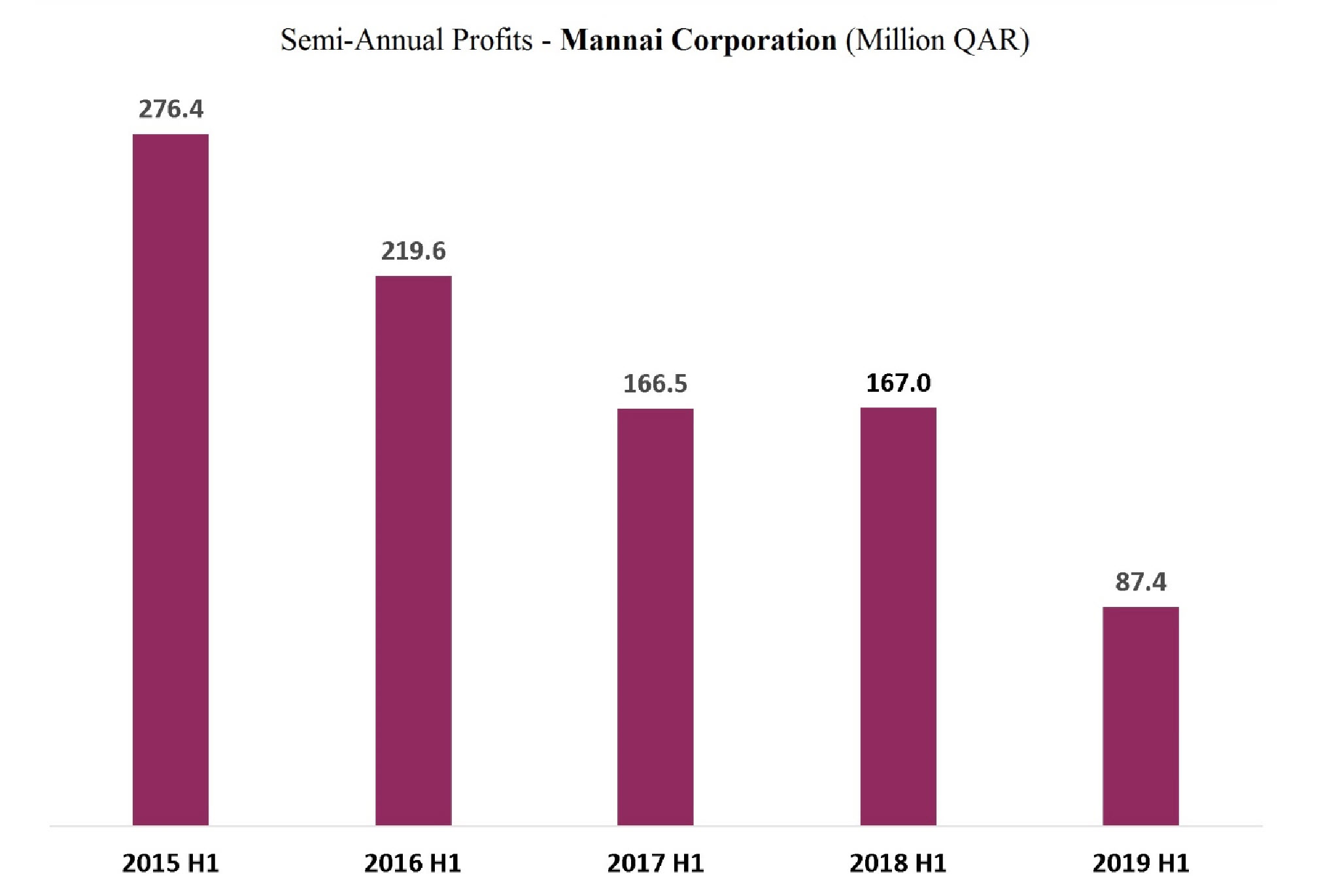

(The Group’s Comments) Mannai’s Net Profit Drops to QAR

87.4 Million for the First Half of 2019

August 07, 2019

Profits: decreased to QAR 87.4 million by the

end of the first half of this year, compared to QAR 167 million

for the same period last year, while earnings per share reached

QAR 0.19 versus QAR 0.37. This decline is due to the climb in

Financing Costs and Depreciation Expenses due to the application

of IAS 16, in addition to the increase in loans.

Comprehensive Income: Mannai

Corporation recorded a loss of QAR 13.9 million in the statement

of comprehensive income compared to a loss of QAR 50.3 million

for the first half of 2018.

Revenues: increased by 10% to reach QAR 5,700

million in the first half of the current year, compared to QAR

5,171 million for the same period of 2018. In contrast, Direct

Costs increased by 12.7%, and Gross Profit climbed to QAR

1,227.8 million, compared to QAR 1,202.9 million for the

corresponding period of 2018.

Financing Costs: As mentioned

above, Financing Costs rose significantly by QAR 75.3 million to

jump to QAR 205.1 million as the company often finances its

acquisitions through loans, which resulted in higher Financing

Costs. The implementation of accounting standard No. 16 had the

most impact on the climb of these costs, and on Depreciation and

Amortization Expenses, which rose by about QAR 90 million,

leading to the decline in profits.

|