|

(The Group’s Comments) Commercial Bank's Net Profit

Rises 11% to QAR 1.50 Billion in Q3 2019

Ø

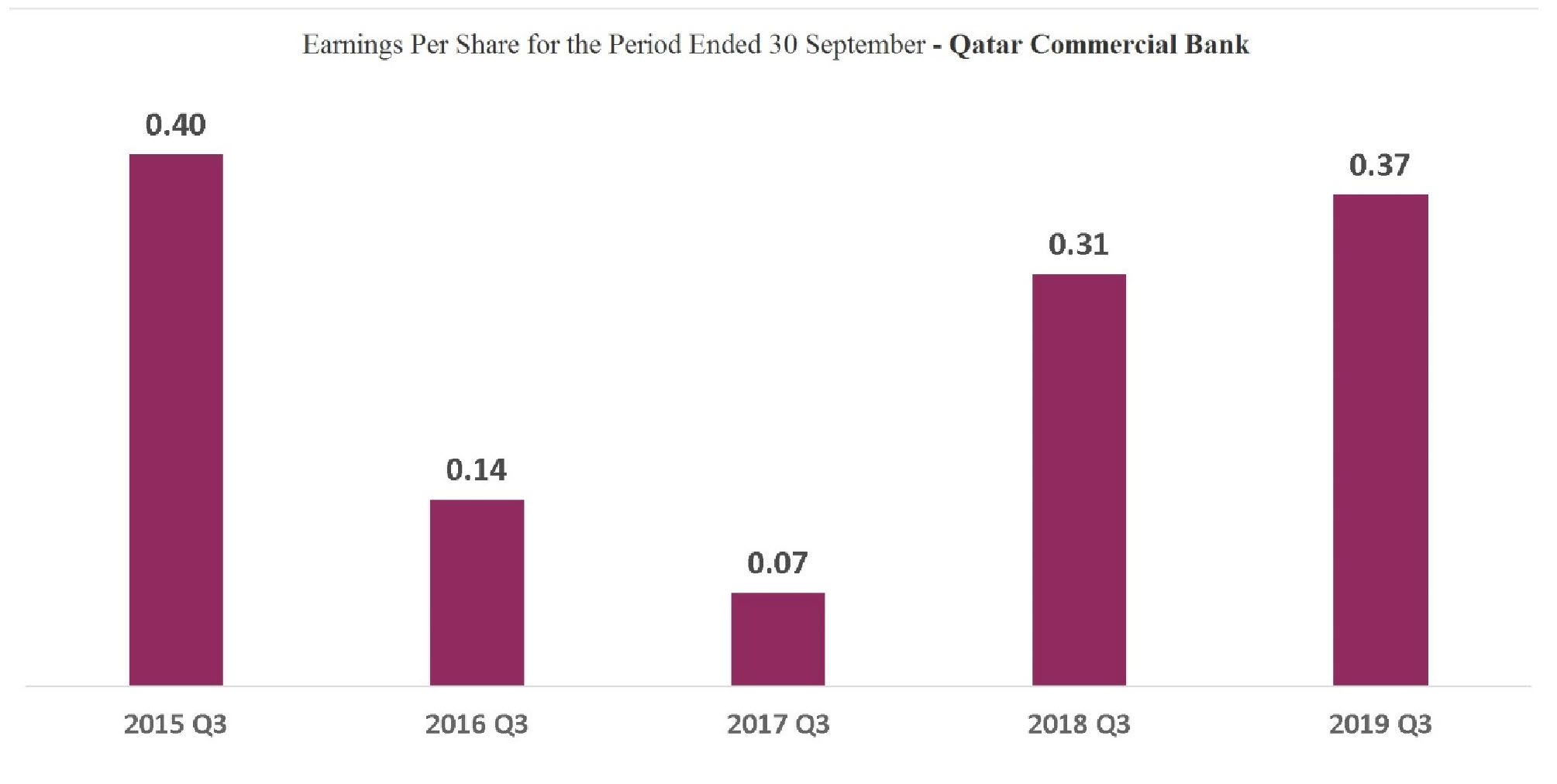

Profits: increased by 19.4% to QAR 1503.96 million for the period ended 30

September 2019, compared to QAR 1259.62 million for the same

period in 2018, while the company’s earnings per share reached

QAR 0.37, versus QAR 0.31 for the corresponding period. As for

the third quarter, the bank posted a profit of about QAR 569.9

million, compared to QAR 404.6 million for the corresponding

period of 2018. The following items contributed to the

improvement of the bank's profit:

1.

Increase in net interest income by QAR 30 million.

2.

Increase in net commission and fee income by QAR 52.6 million.

3.

Increase in foreign currency profits by QAR 61.7 million.

4.

Improved profits of financial investments by QAR 59.0 million.

5.

Decrease in impairment losses of customers loans and advances by

about QAR 31 million.

6.

Other

expenses decreased by QAR 77.0 million.

Ø

Comprehensive Income: The bank recorded an assessment profit of QAR 540.4 million

compared to a loss of QAR 594.2 for the same period in 2018.

Ø

Operating Income: improved by 7.10% to reach QAR 2,853.0 million, compared to QAR

2,663.4 million for the same period in 2018, an increase of QAR

189.6 million.

Ø

Operating Expenses: decreased by 4.86% to QAR 1448.9 million compared to QAR 1522.9

million for the corresponding period of 2018 due to the drop in

other expenses by QAR 77 million, as well as staff costs by QAR

11.15 million, and a decrease in customer loans and advances by

QAR 31 million.

Regarding asset quality, non-performing loans amounted to 4.9% of

the total loan portfolio compared to 5.6% at the end of 2018.

Ø

Assets:

Loans and advances decreased by 3.8% compared to the same period in

2018 as a result of the increase in deposits by 1.35%.The ratio

of loans to customer deposits is about 119.92%, while the return

on equity for this period amounted to 8.58%, versus 8.02% for

the corresponding period of 2018. The book value of the bank

stood at QAR 4.33 per share.

|