|

(The Group’s Comments) Doha Bank's Net Profit Rises 11%

to QAR 818.52 Million in Q3 2019

Ø

Profits: amounted to QAR 818.5 million for this period, an increase of 11 %,

compared to QAR 737.5 million for the same period last year,

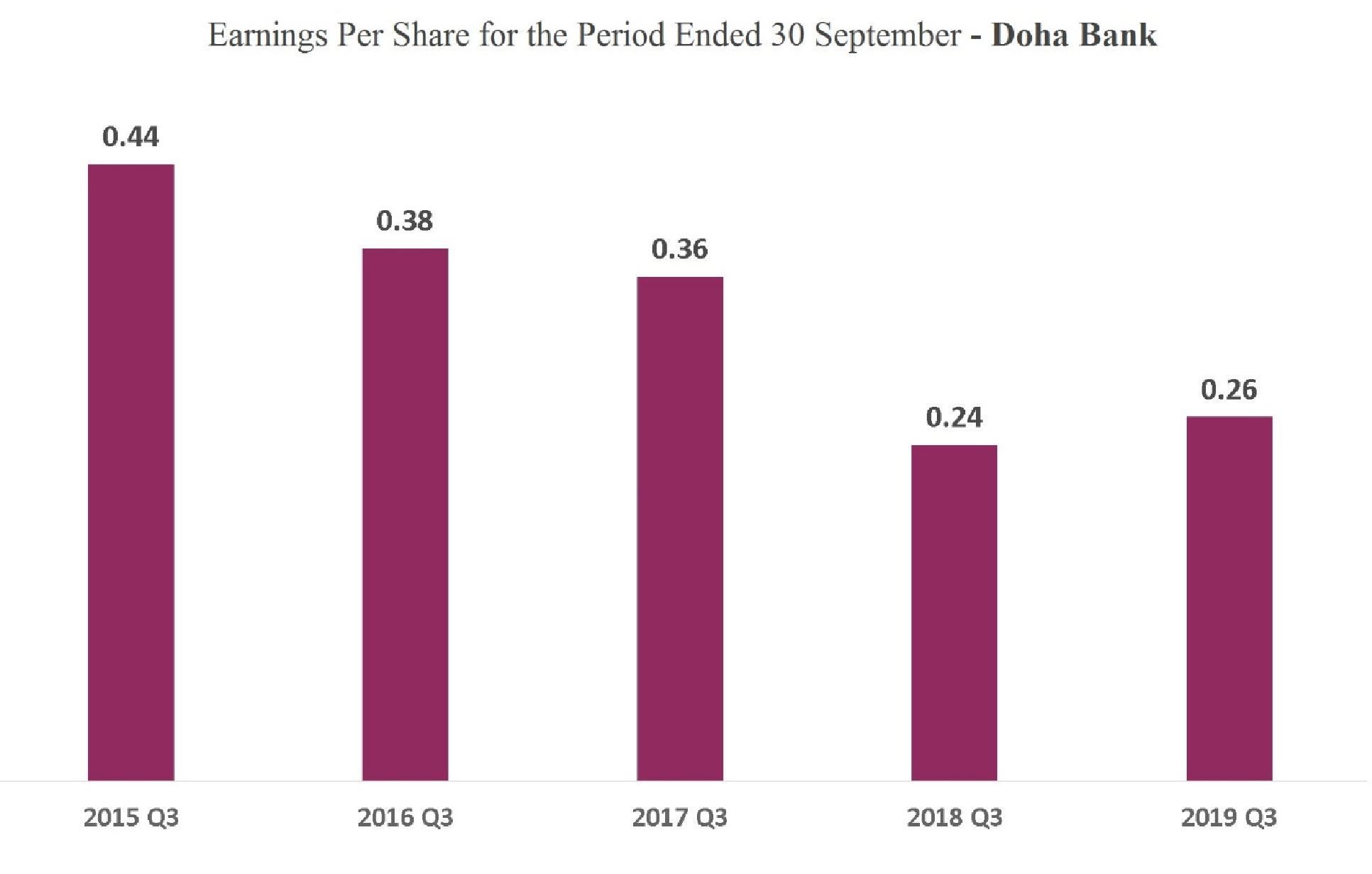

while the bank’s earnings per share reached QAR 0.26 versus QAR

0.24 for the same period in 2018. As for the third quarter, the

bank posted a profit of about QAR 300.0 million, compared to QAR

266.8 million in the corresponding period of the previous year.

Ø

Comprehensive Income: Doha Bank recorded an assessment profit of QAR 213.5 million,

compared to QAR 202.7 million for the same period in 2018.

Ø

Insurance Activity: recorded a loss of QAR 58.3 million in this period, compared to a

profit in the corresponding period of 2018 amounting to QAR 7.11

million due to the increase in insurance claims.

Ø

Operating Income: improved by 2.4% to QAR 2079.7 million, compared to QAR 2,030.0

million in the same period of 2018. This improvement in

revenues, and consequently in profits was due to a QAR 191.7

million increase in income, generated by investment in

securities, in addition to QAR 13.1 million generated by other

income, which offset the drop of QAR 107.4 million in the net

interest income as a result of higher interest receivable than

payable during this period.

Ø

Operating Expenses: decreased during this period by 10% to settle at QAR 802.6 million,

compared to QAR 890.8 million in the same period of 2018, due to

the reduction in staff costs by QAR 22.8 million, and a QAR 31.6

million decrease in allocations to QAR 416.8 million, compared

to QAR 448.4 million for the corresponding period of 2018. It

should also be noted that the item of other expenses witnessed a

drop of QAR 27 million.

Ø

Loans & Advances: rose by 9.8% compared to the same period in 2018 to reach QAR 65

billion, while deposits increased by 12.9% to QAR 58.9 billion.

The loans to deposits ratio stood at about 110.4%, as for

non-performing loans, they reached 5.65% of the total loans.

|