|

(The Group’s Comment) Qatar International

Islamic Bank Net Profit Rises by 6% to QAR 777 million in the 3rd.

Quarter 2019

Ø

Profits:

The bank achieved a growth in its net profit of QAR 777.01 million

for the first 9 months of 2019 versus QAR 735.13 million for the

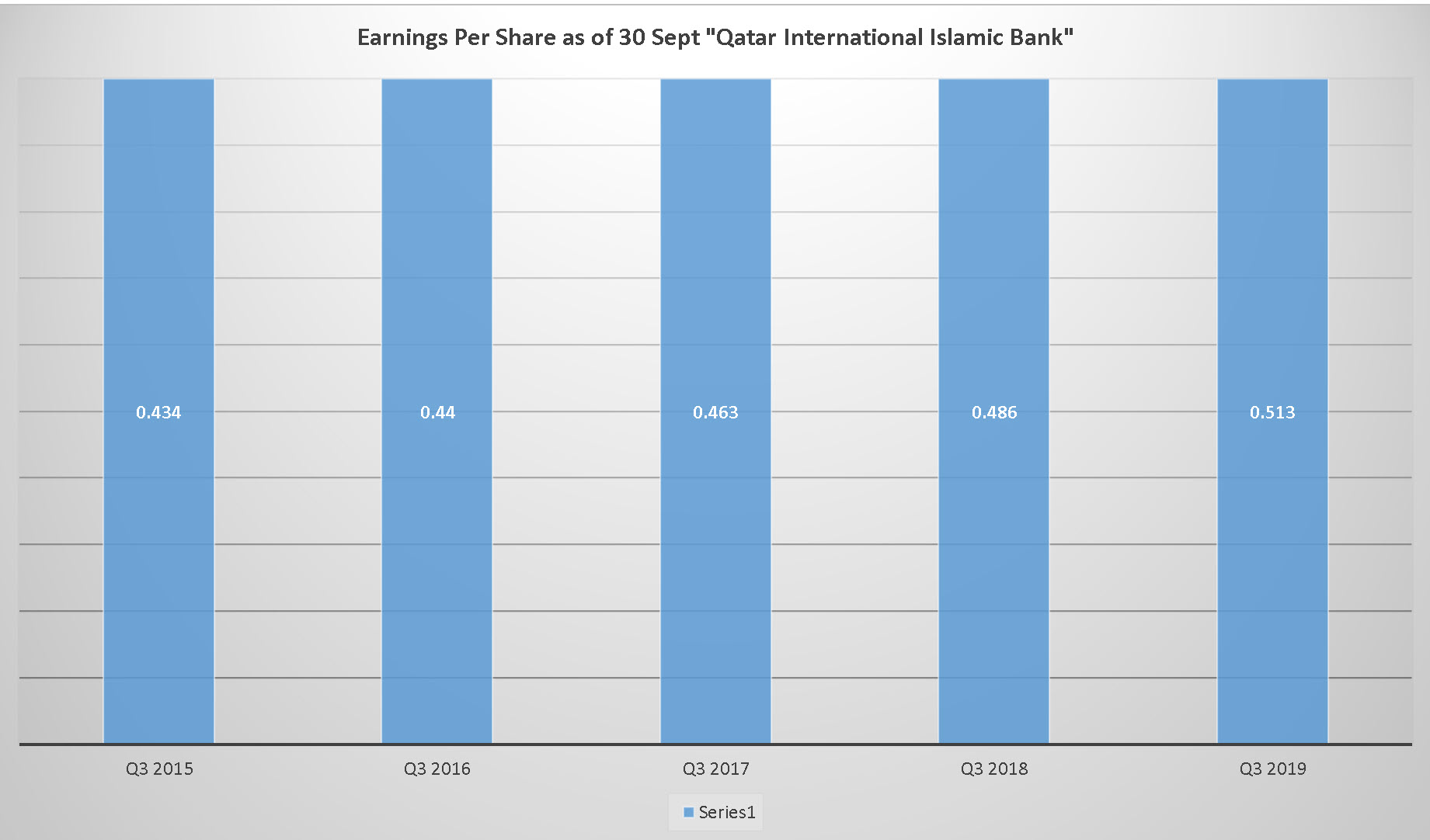

same period last year, a growth of 5.7%. Earnings per share

amounted QAR 0.513 versus QAR 0.486. The 3rd quarter

profit amounted to QAR 266.43 million compared to QAR 251.16

million for the same quarter last year 2018.

Ø

Total Income: Total income increased by 11.4% to

record QAR 1757.6 million as a result of the increase in the net

revenues of financing and investment businesses by QAR 202.27

million, an increase of 13.9% compensating the decrease in of

the income from foreign currencies business by QAR 19.3 million

along with the increased losses of the investments in associated

companies of QAR 21.40 million. Such losses resulted from the

Bank’s investment in Omnia Bank, Morocco (40% ownership).

Ø

Expenses: Expenses Increased by 31.8% at the end of the period and recorded

QAR 496.4 million versus QAR 376.5 million as a result of the

increase in the financing expenses.

Ø

During the period, the Bank reversed provisions of QR 1.94 million

and refunded them to revenues, which impacted them by QAR 4.0

million. The deducted provisions assigned to meet the decline in

financing and financial investments recorded a decrease of QAR

22.8 million and positively impacted profits.

Ø

Financing Assets:

amount QAR 31,944 million at the end

of the period a growth of 11.6% compared to the same period last

year 2018. Total financing assets to deposits reached nearly

107%. Regarding the quality of assets,

the percentage of the

irregular debts to the total financing reached 1.86% versus

2.10% for the same period last year. Provisions percentage to

irregular debts reached nearly 89%.

|