|

(The Group’s Comment) Al Mannai Net Profits Decreases

by 63.4% to QAR 80.9 Million in the 3rd Quarter 2019

Profits: Net profits for the first 9 months of 2019 decreased to QAR 80.9

million versus QAR 221.4 million for the same period last year

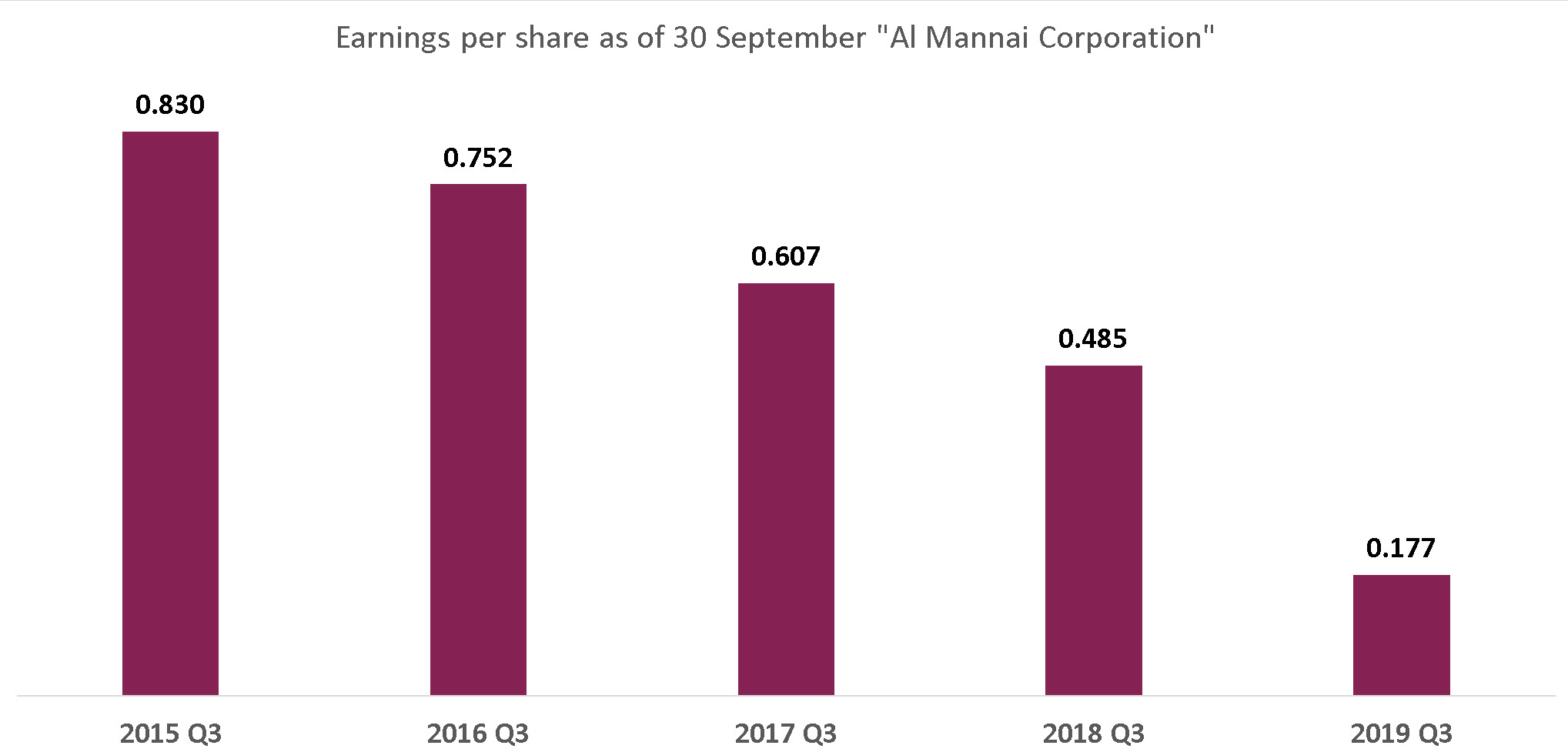

2018, a decline of 63.4%. Earnings per share mounted to QAR 0.18

versus QAR 0.49.

The 3rd. quarter’s results registered losses of QAR 6.5

million against profits of QAR 64.4 for the same quarter last

year.

Comprehensive Income: The Company’s comprehensive income

statement for the period has shown an assessment losses of QAR

48.9 million versus losses of QAR 58.9 million for the

equivalent period last year.

Revenues: Revenues for the 9

months period increased by approximately 11%, an amount of QAR

839 million to reach QAR 8525.1 million compared to QAR 7686.0

million for the equivalent period last year 2018. However, the

cost of revenues increased by 15%, an amount of QAR 887 million

the matter that impacted the total profit to reduce by QAR 47.9

million.

Operating profit before interests, taxes, depreciations and

amortization (EBITDA): This index measure the company’s

capability to generate revenues before calculating the costs of

financing, depreciation and amortization.

This items reached as of the end of the period QAR 759.2 million

versus QAR 670.6 million and increase of 13.2% and was

attributed to the reduction of the administrative and general

expenses by QAR 90.0 million along-with the sales and

distribution expenses by QAR 47.0 million. This translates that

the company is capable of generating revenues but the financing

costs and the depreciations cost are clearly stating pressure on

the profitability.

Financing and amortization costs: This item

represents a high importance to the company since it finances

most of the acquisitions operations through banking loans. The

period witnessed an increase in the financing costs by QAR 87.0

million to reach QAR 311.0 million. Further, the depreciation

and amortization expenses increased by QAR 130.0 million. This

increase is attributed to the implementation of Standard 16 in

addition to the increase in the interest-loans balance by QAR

700.0 million.

|