|

(The Group’s Comment) Qatar

First Bank Net Losses Reduced to QAR 299.79 Million in the 3rd

Quarter 2019

Ø

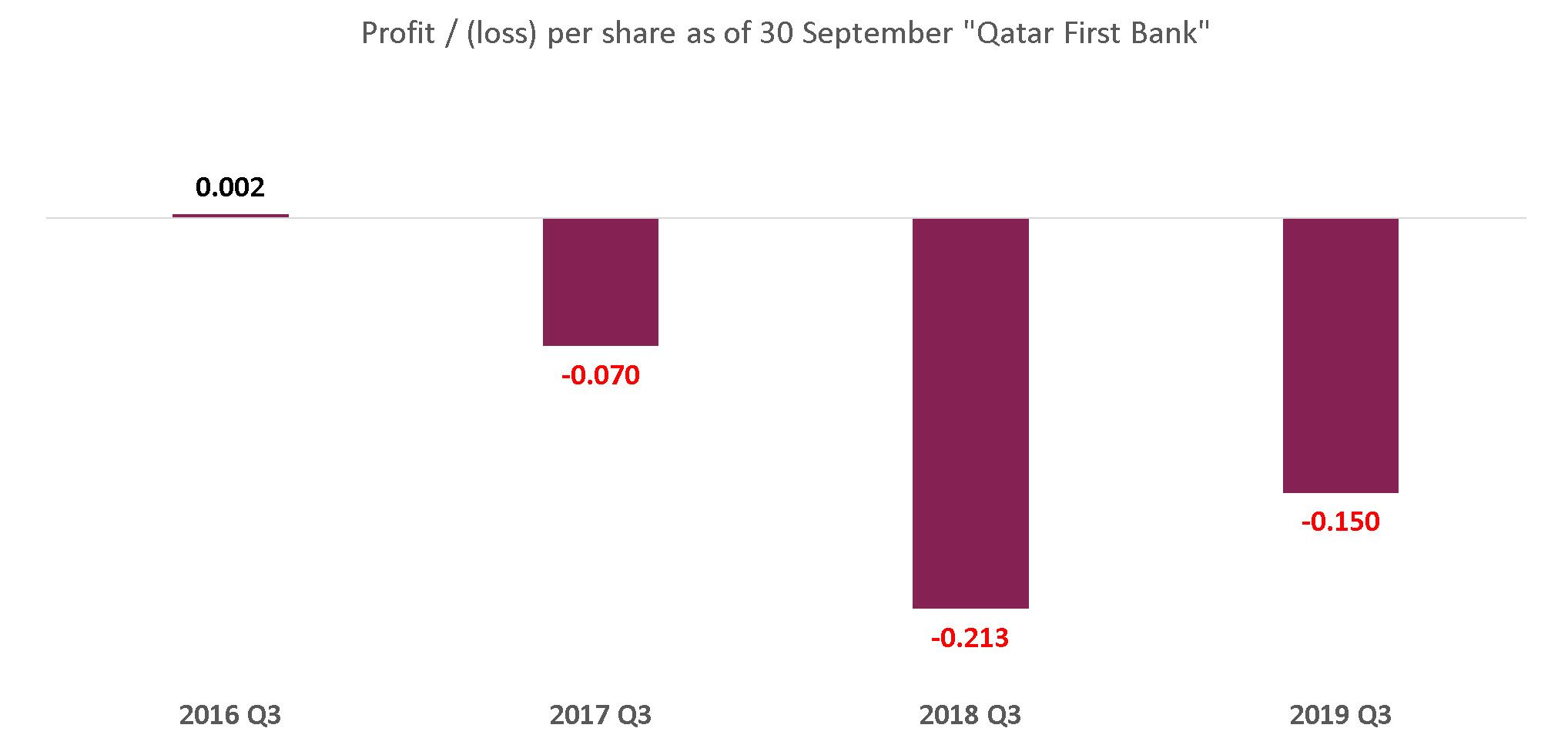

Profits/Losses: The Bank recorded losses of QAR

299.79 million for the 9 months ended 30 September 2019 compared

to losses of QAR 425.54 million for the equivalent period last

year 2018 reflecting a reduction in the losses by 29.5%. Losses

per share amounted QAR 0.150 versus QAR 0.213 losses per share

for the equivalent period last year. The Bank, in the 3rd

quarter 2019 recorded a profit of QAR 1.55 million versus loss

of QAR 71.67 million for the similar quarter 2018. The

achievement of profits in the 3rd quarter is mainly

attributed to the reversal of QAR 13.0 million provision

associated with financing assets to revenues compared to a

provision avoided for the same item of equivalent period

revenues of QAR 8.5 million.

Ø

Total Income: amounted at the end of the period

QAR 29.97 million compared to negative deficit of QAR 242.9

million for the equivalent period last year 2018. The financial

statements of the equivalent period included losses from

valuation of financial investments of QAR 198.0 million where

such losses were reduced in this period to QAR 47.0 million.

Moreover, the losses from sale of investments were reduced to

QAR 0.8 million compared to losses of QAR 111.0 million for the

same period 2018.

Ø

Provision against the decline of the financing assets: This

item represents the anticipated losses in the irregular

financing assets which is an expense avoided from the profits of

period. The bank has provisioned QAR 173.51 million to meet the

losses from the decline of the financing assets versus QAR 43.97

million of the same period last year. The Bank has further

avoided an additional provision of QAR 29.97 million assigned to

meet the decline in the financial assets. The bank recorded

additional losses of QAR 41.7 and listed them under excluded

transactions.

Ø

Cumulated losses: Article#295 of the Qatari Corporate Law of 2018 stated the

following “In the event, a company’s losses reached half of its

capital, the Board of Directors must invite for an Assembly

General Meeting to decide on the continuity of the company of

dissolving it before its term stated in the article of

associations”. Consequently, the Bank’s Assembly General Meeting

decided in last September to reduce the share capital by 65% to

amortize the losses.

Losses amounted

QAR 1.298 billion, a 64.9% of the share capital and the share

book value declined to QAR 0.35.

|