|

The Group Securities Review of Banks

Consolidated Balance Sheet Data of December

2016

January 23, 2017

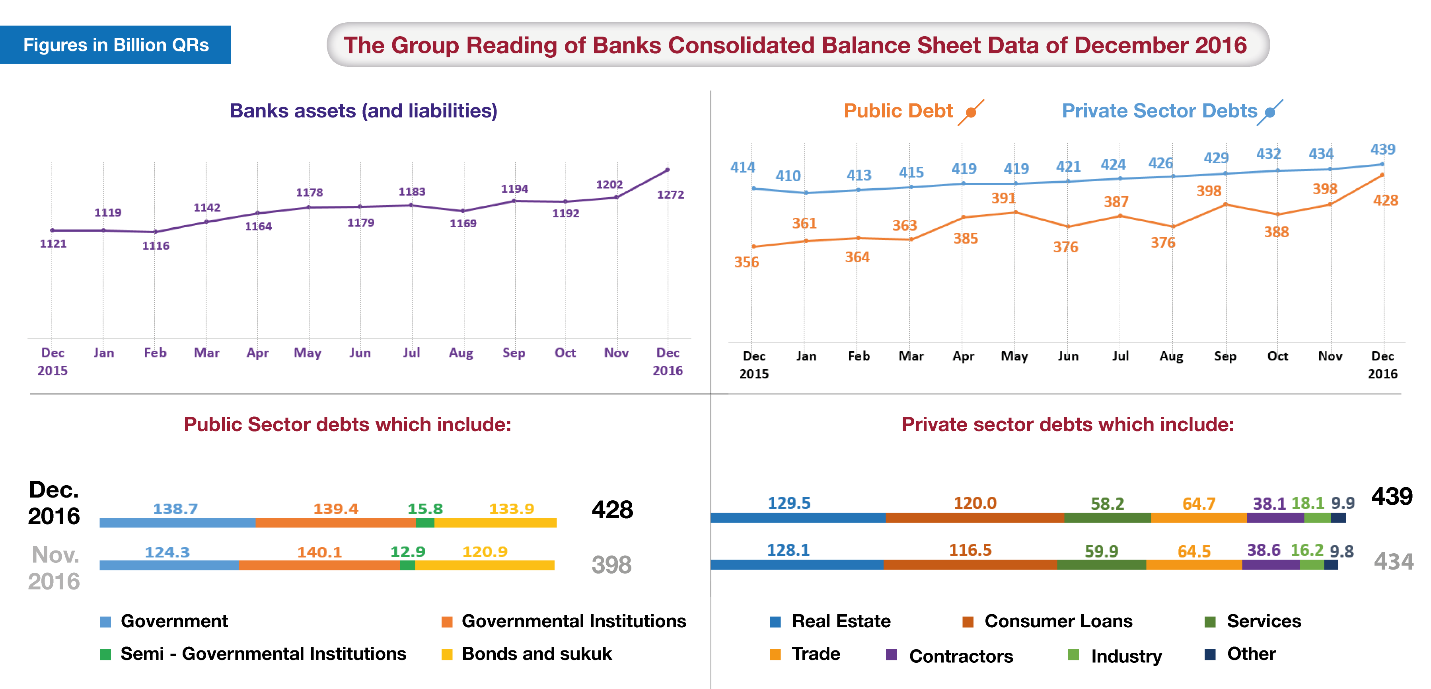

Assets (and liabilities) increase QR 69

billion to QR 127.8 billion

Government and public sector deposits

increase about QR 8.1 billion to QR 185.9

billion

Total domestic public debt rise about QR

29.6 billion to QR 427.8 billion

Domestic private sector's credit increases

by about QR 10.8 billion to QR 438.8 billion

Domestic private sector deposits increase

about QR 4 billion to reach QR 347.7 billion

The

Group Securities Company presents a detailed

reading of the changes that took place in

banks consolidated balance sheet in

December, compared to the situation at the

end of last November, as such data helps to

understand the situation of the domestic

liquidity. Figures of the consolidated

balance sheet, which have been recently

posted on Qatar Central Bank website, shows

that banks' assets (and liabilities)

increased by the end of December by QR 69

billion to reach the level of QR 1271.8

billion; compared with QR 1202.8 billion by

the end of November. In its reading, The

Group focuses on explaining changes in the

position of the key players: Qatar Central

Bank (QCB), the Government, Public Sector,

Private Sector, external sector, and the

interbank sector.

Qatar

Central Bank

Total banks' deposits at Qatar Central Bank

increased by QR 1.1 billion to the level of

QR 38.7 billion, broken down as follows:

· QR 33 billion as the obligatory

reserve balance, note that this reserve is

set by QCB at the rate of 4.75% of the total

customers' deposits at each bank. The

obligatory reserve is deposited permanently

and with no interest.

· QR 5.79 billion as banks free

balances at QCB.

Government and the Public Sector:

Government and public sector deposits

increased by around QR 8.1 billion to reach

the level of QR 185.9 billion, broken down

as follows: QR 64.3 billion for government;

QR 93.3 billion for government institutions;

and QR 28.3 billion for semi-governmental

institutions, in which government share is

less than 100% and more than 50%. On the

other hand, government and the public

sector's total loans increased to reach QR

293.9 billion, broken down as follows:

· Government: QR 138.7 billion, up by

QR 14.5 billion;

· Governmental institutions: QR 139.4

with a decrease of QR 0.7 billion;

· Semi - Governmental institutions: QR

15.8 billion, with an increase of QR 2.9

billion.

In

addition to the foregoing; the balance of

Qatar Government bonds and bills with banks

increased about QR 13 billion to reach the

level of QR 133.9 billion. The total

domestic public debt (government, government

institutions, quasi-governmental

institutions, bills and bonds) increased QR

29.7 billion to reach the level of QR 427.8

billion, as shown in the above infographic.

The

Private Sector:

The

total domestic private sector deposits at

local banks, by the end of December,

increased by QR 4 billion to reach the level

of QR 347.7 billion; in addition to deposits

worth QR 10 billion by non-banking financial

institutions. Total domestic loans and

credit facilities provided by banks to the

local private sector increased by QR 10.8

billion to reach QR 488.6 billion; out of

which QR 129.5 billion for real estate’s

sector, QR 120 billion for individual’s

consumer loans and QR 64.7 billion for

trade. There were also loans and facilities

worth QR 16.2 billion for the non-banking

financial, sector as shown in the above

infographic.

Foreign Sector:

Banks investments in securities outside

Qatar settled at the level of QR 18.5

billion, broken down as follows: QR 14.7

billion bonds and Sukuk, QR3.8 billion

shares and others. Local banks assets at

banks outside Qatar increased by QR 32.1

billion to reach QR 114.1 billion. Bank

loans to foreign parties increased QR 1.4

billion to reach the level of QR 95.4

billion and banks investments in foreign

companies increased QR 0.9 billion to QR 40

billion. In contrast, foreign banks

liabilities on banks in Qatar increased QR

415.8 billion to reach the level of QR 192.5

billion. While the indebtedness of local

banks to foreign parties, in form of bonds

and certificates of deposit, increased QR0.3

billion to the level of QR 49.1 billion. The

balance of foreign deposits at Qatari banks

increased QR 36.4 billion to QR 183.2

billion. By reconciling assets at home and

abroad with liabilities, we find that

banking sector's debt to the outside world

has increased QR 2.3 billion above the level

of debts in November to reach QR 156.8

billion in December.

|