|

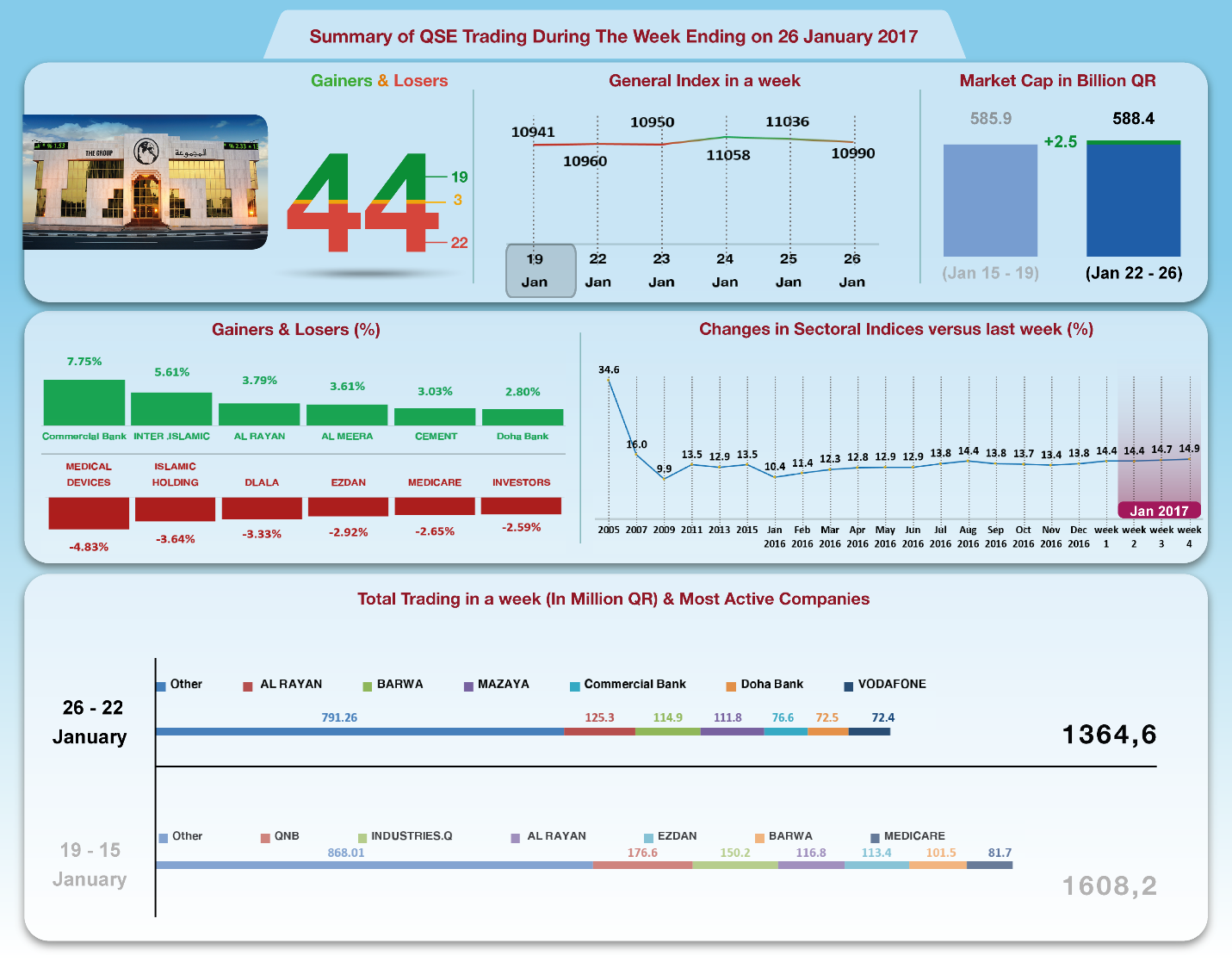

The Group Securities: Weekly Report on QSE Performance,

22-26 Jan 2017

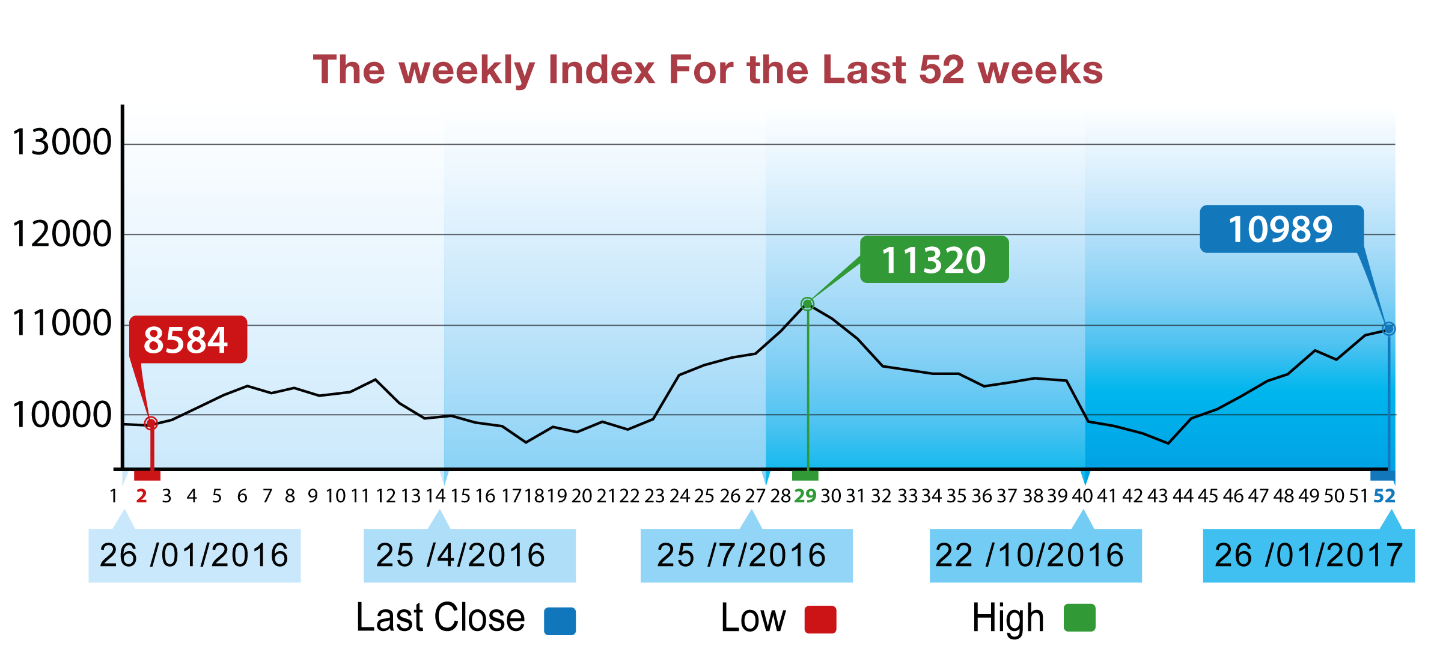

On the back of the companies release of

their financial statements for 2016, the

general index managed to break through

the barrier of 10,000 points, though it

slipped down below the same a short

while afterwards as result of the weak

results unveiled by some companies. As a

matter of fact, Al-Ijarah recommended

the distribution of QR 0.5 as cash

dividend.

Qatar Investors Group logged a

10% profit and order the distribution of

QR 1 cash and 5% as bonus shares. In a

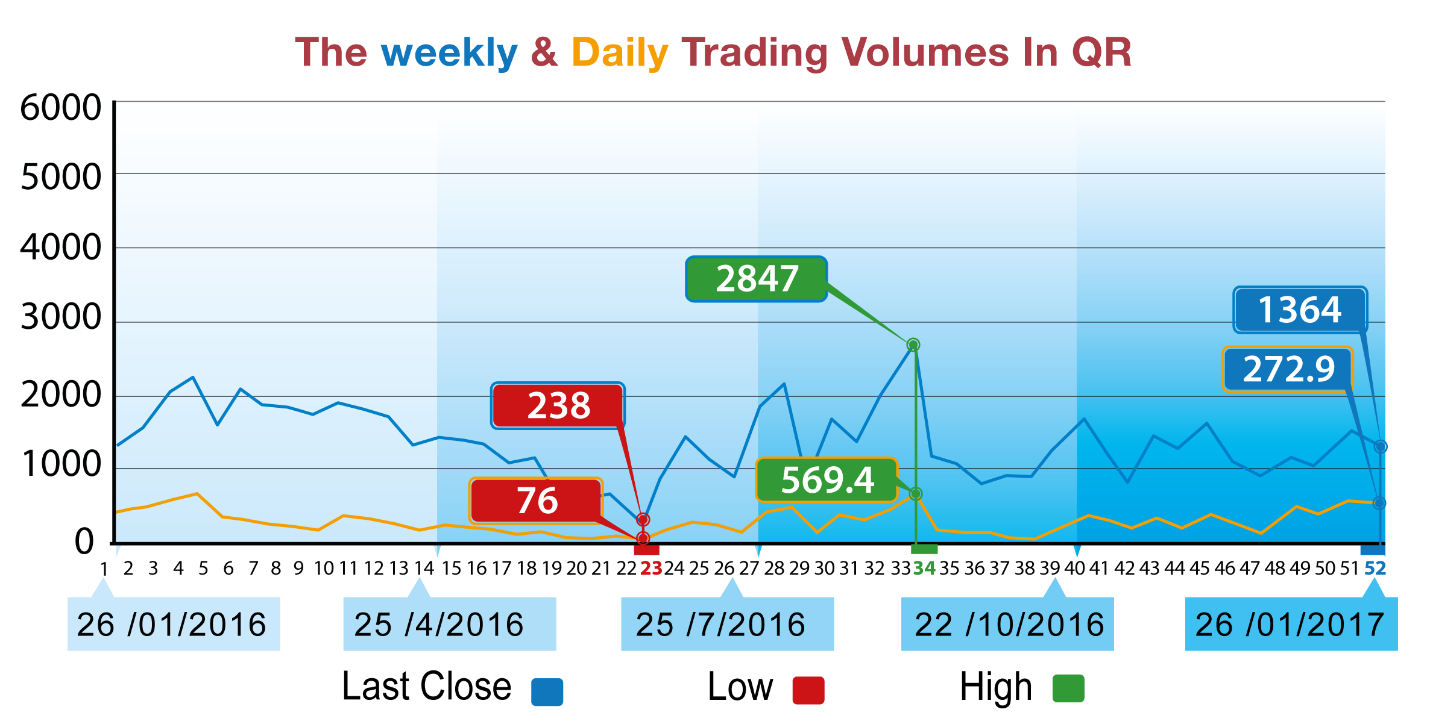

nutshell, total trading volumes declined

by 15.1% to QR1364.7 million, while

general index increased by 57 points to

the level of 1099 points.

Total capitalization hiked by

QR2.5 billion to the level of QR588.4

billion. The Group reviews QSE

performance in this week with

illustrative charts combined with

corporate business news, and a list of

the affecting economic factors.

Corporate

News:

1-- Islamic Holding Group's net

profit is QR 4.1 million compared to QR

6.1 million for the same period of the

previous year. EPS amounted to QR

0.72 compared to QR 1.53 for the same

period of the previous year. The Board

of Directors also proposed a dividend of

10% in cash per share. Islamic Holding

Group's net operational income declined

by 15.2% to QR12.8 million in 2016,

including QR 10.6 million as brokerage

fees. Expenses flatlined at the level of

QR 8.7 million, with marginal decline.

As result, the net profit posted this

year amounted to QR4.1 million, down by

33% from the previous year.

2-- Qatar National Cement's net profit

is QR 475.1 compared to QR 463.5 for the

same period of the previous year.

Earnings per Share (EPS) amounted to QR

8 against QR 7.80 for the same period of

the previous year. Qatar National

Cement's total income settled at QR473

million in 2016, slightly down compared

to the previous year; while other

sources of income increased to QR 41.9

million. Expenses went up to QR 46.5

million. Adding the company’s share of

profit from other companies worth QR 6.7

million, then the company's profit of

this year rises 2.5% to QR 475.1

million, while comprehensive income

remains at the level of QR 470.3

million.

3-- Qatar International Islamic Bank

(QIIB) disclosed its financial

statements for the period ended on

31.12.2016 the statements show that the

net profit is QR 784.8 Million Compared

to net profit amounting to QR 784.2

Million for the same period of the

previous year.

Earnings per Share (EPS) amounted to QR

5.18 for the period ended December 31,

2016 to EPS amounted to QR 5.18 for the

same period of the previous year.

The Board of Directors recommends a

dividend 40% of issued Capital (QR 4.0

per Share).

4--

Qatar Insurance Company's net profit

amounted to QR 1.03 billion compared to

QR 1.04 billion registered last year.The

board recommended Cash Dividends )%15)

from the share par value, i.e. after

obtaining the necessary approvals from

respective governing bodies. QIC's total

income declined 3.3% to QR1.75 billion

in 2016, including QR 843.7 million as

net outcome of subscription to the

company's shares, QR 811.5 million as

investment revenues. Operational and

administrative expenses fell by 6.3% to

QR 684.9 million. As result, profit

attributable to shareholders fell by 1 %

to QR 1034 million.

5-- Doha Bank net profit of QR. 1,054

million compared QR. 1,354 million in

the previous year. Earnings per Share

(EPS) amounted to QR 3.23 compared to

QR. 4.58 in the previous year. The Board

of Directors is recommending to the

Ordinary General Assembly to distribute

cash dividends to the shareholders for

QR 3.0 per share. Doha Bank's net

operational income declined by 2.3% to

QR 2.75 billion in 2016, including

QR2.07 billion as interests and QR 459.8

million as net fees and commission.

Expenses and losses increased by

16.8% to QR1.7 billion, including

QR516.3 million as staff costs, QR 480.2

million lost as result of negative

change in the value of investments, and

QR468 million as loan loss. As result,

net income declined by 22.1% to QR1052.8

million. Comprehensive income increased

to 1214.9 million as result of a

positive change in the fair value.

6-- Net profit for Alijarah Holding in

2016 amounted to QR 5.17 million

compared to a net loss of QR 88.15

million in the previous year.

Earnings per share reached QR

0.10 versus a loss of QR 1.87 per share

in 2015. The Board of Directors

recommended distributing dividend of

half Riyal per share. Total revenues of

Alijarah Holding in 2016 increased by

13.9% to QR 206.1 million, of which QR

205.4 million from its main activities.

Total expenses decreased by QR 19.7% to

QR 224.3 million. As a result, the

company recorded an operating loss of QR

18.1 million compared to a loss of QR

98.3 million in the previous year. There

was a net finance revenue of QR 23.3

million turning the loss into a net

profit of QR 5.2 million.

7-- Qatari Investors Group net profit in

2016 amounted to about QR 277 million

compared to a net profit of QR 251.95

million in the previous year.

Earnings per share stood at QR

2.23 versus QR 2.03 in 2015. The Board

of Directors recommended distributing a

dividend of one Riyal per share.Total

income of Qatari Investors Group in 2016

rose

9.5% to QR 444.7 million, of

which QR 403 million

profit from its main activity.

The general and administrative expenses

dropped 15% to QR 71.8 million

while the funding costs decreased

by 9.1% to QR 50.6 million and

distribution expenses stabilized at QR

9.1 million with a limited decline.

However, there were losses in the fair

value worth QR 36.3 million. As a

result, the net profit amounted to QR

277 million by an increase of 9.9% above

profits of the previous year.

8-- Qatar Cinema & Film posted net

profit of QR 4.30 million compared 14.33

for the same period of the previous

year. E/P amounted to QR 0.68 compared

to QR 2.28 for the same period of the

previous year. Qatar Cinema's

operational loss hit QR 880.000 in 2016,

compared to one million profit

registered last year. Others sources of

income settled at QR 19.1 million,

including QR17.4 million as rental

revenues. Public and administrative

expenses slightly declined to QR4.1

million. The company incurred losses as

result of the depreciation of properties

and investments amounted to QR4.48

million, QR 4.5 million loss as result

of decline in the available for sale

securities, and financing cost worth QR

906.000. As result, this year's net

profit amounted to QR 4.3 million,

compared to QR 1.43 million last year;

and comprehensive income increased to QR

9.7 million as result of reevaluation of

the fair value of investments.

Economic

Developments

1-- Banks consolidated balance sheet for

December was released showing a rise in

total assets compared to November by

about QR 70 billion to stand at QR 1271

billion.

The total domestic public debt,

including bonds, increased by about QR

30 billion to QR 428 billion while the

total domestic private sector deposits

rose by QR 4.5 billion to the level of

QR 438 billion.

2--Last week, Opec oil prices declined

by 1.46 to $ 52.91 per barrel.

3-- Last week, Dow Jones index gained

167 points to reach the level of 20094

points. US Dollar exchange rate fell to

the level of 115.13 yen, and $ 0.7 per

Euro. Gold price decreased by 19 dollars

to the level of $ 1191 per ounce.

|