|

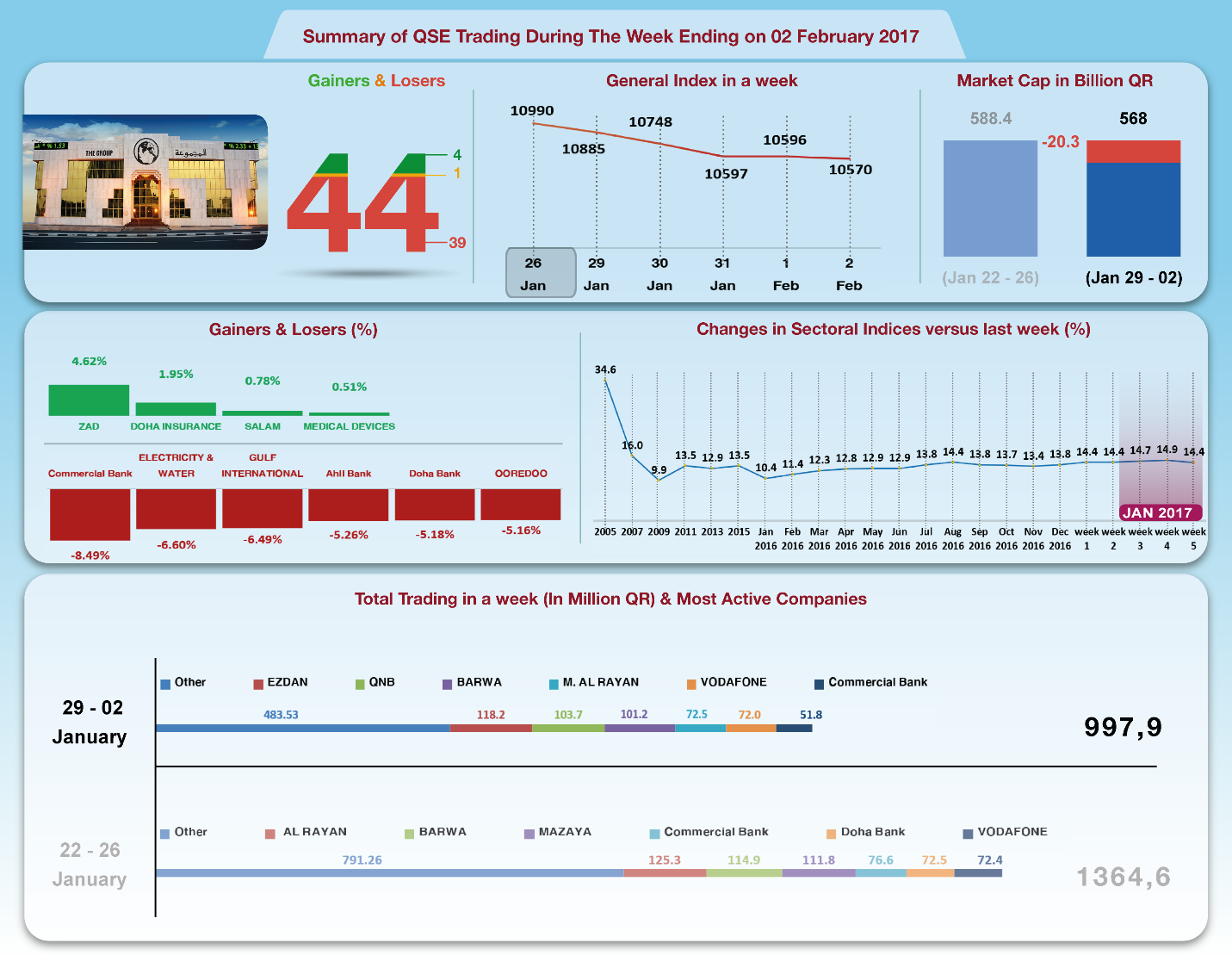

The Group Securities: Weekly Report on QSE Performance,

29 Jan-02 Feb 2017

Over the last week, six companies released

their financial results, namely Vodafone,

Doha Insurance, Widam, Water & Electricity

Company, and Qatar Industries.

Broadly speaking, the results were

weak and dividends were less than the

expectations. This fact spurred the share

prices to go down for all sectors. Total

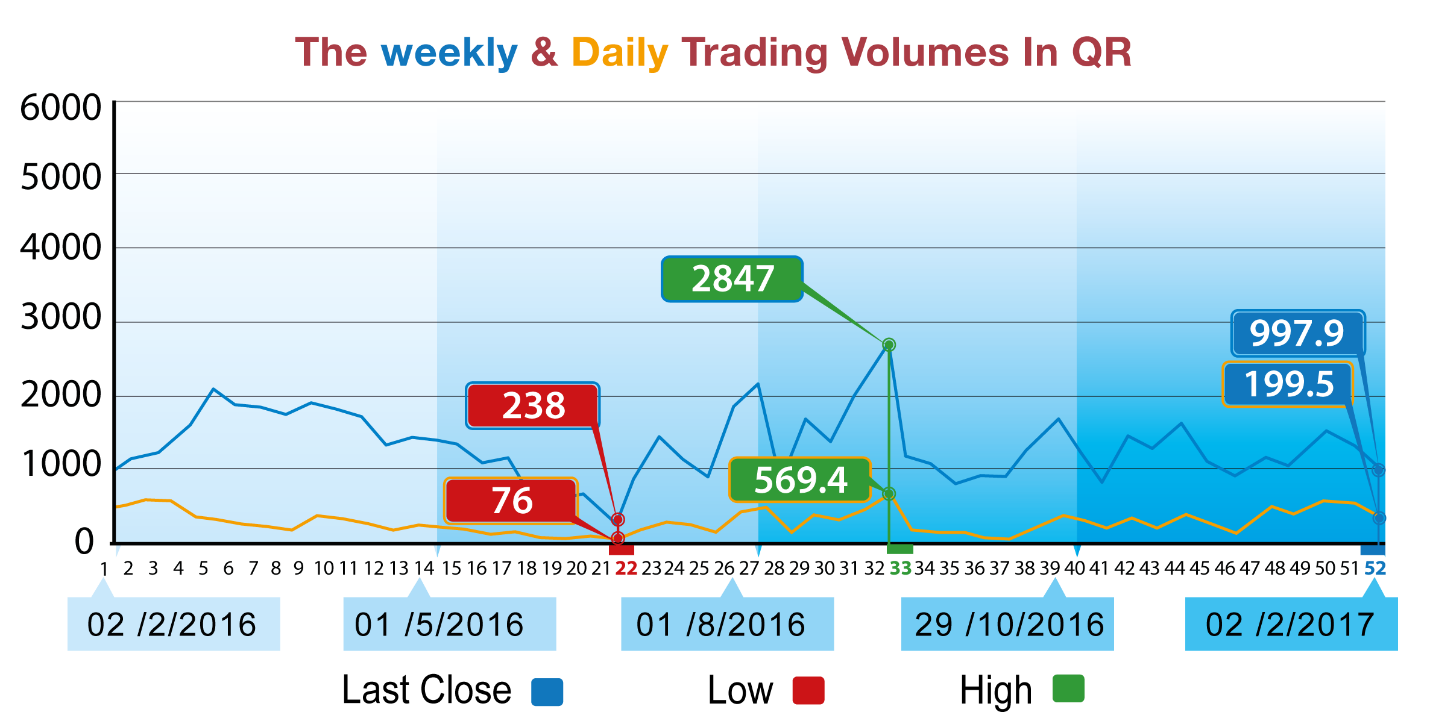

trading volume dropped by 26.9% to the level

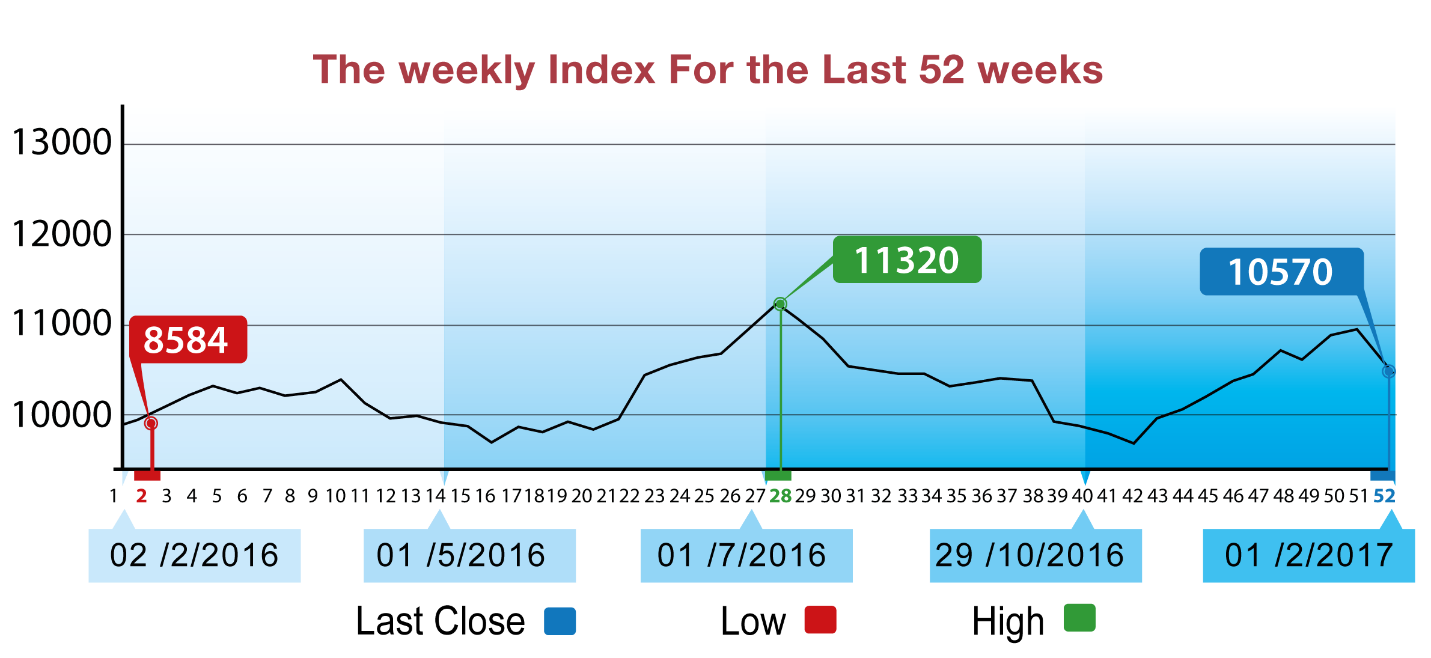

of QR 997.9 million. General index declined

by 419 points or 3.82% to the level of 10570

points. All sectors indices declined, namely

telecommunications, insurance, banks, real

estates. Total capitalization dropped by

20.4 million to the level of QR568 billion.

Earnings per share ratio fell to 14.38.

During this week, 39 companies had their

share price down, as against 4 companies

whose share price remained up. Foreign

portfolios exclusively dominated the net

sale transactions, against all other

categories of investors. The Group reviews

QSE performance in this week with

illustrative charts combined with corporate

business news, and a list of the affecting

economic factors.

Corporate News:

1--Dlala Brokerage and Investment Holding's

net profit hit QR 3.8 Million compared to

net loss amounting to QR 41.97 million for

the same period of the previous year. EPS

amounted to QR 0.13 compared to QR 1.48 loss

for the same period of the previous year.

Dlala's net operational income dropped by

1.3% to QR 27.4 million in 2016, including

QR 21.5 million as net brokerage revenues

and commissions, and QR 4.3 million as

properties revenues.

Public and administrative expenses

dropped by 8% to QR 24.2 million. As result,

the company posted a net profit worth QR3.8

million, compared to net loss worth 41.97

million in 2015. The company incurred losses

as result of a negative change in the fair

value of investments available for sales,

thus turning the comprehensive income into a

total loss worth QR 6.2 million, compared to

total loss worth QR 29.2 million in the

previous year.

2-- Vodafone Qatar net loss in the nine

months amounted to QR 195 million compared

to a net loss of QR 285.7 million in the

corresponding period last year. Loss per

share stood at QR 0.23 versus QR 0.3 in the

corresponding period of the previous year.

Vodafone Qatar revenue in the nine months

fell 3.9% to QR 1541 million and operating

expenses amounted to QR 1135.3 million and

the net operating income rose 18.3% to QR

405.7 million. After deducting depreciation

and amortization expenses worth QR 581.4

million, the company's operating loss

reduced by 35.3% to QR 175.8 million. After

the addition of other items, the loss rises

to QR 195 million, down 31.7% of loss in the

corresponding period of the previous year.

3-- Doha Insurance net profit reached QR72.2

million for the fiscal year 2016, compared

to QR 111 million in

2015. EPS amounted to QR 1.44

compared to QR 2.22 for the period last

year. The Board of Directors has also

proposed a cash dividend of QR 0.60 per

share. Doha Insurance's net revenues from

insurance subscription increased by 2% to QR

86.5 million in 2016. Investments revenues

and other sources dropped by 46.2% to QR62.4

million. In contrast, total expenses

declined by 11% to QR75.9 million. As

result, the company's net profit dropped by

35% to QR72.2 million. The company incurred

losses worth QR21.5 million; hence the

comprehensive income dropped to QR50.8

million.

4-- Widam Food Company net profit in 2016

amounted to about QR 91.29 million compared

to QR

69.14 million in the corresponding

period last year.

Earnings per share stood at QR 5.07

versus QR 3.84 in the corresponding period

in 2015. The Board of Directors proposed a

cash dividend of QR 3.5 per share. Widam

Food Company operating losses in 2016

decreased 22% to QR 209.8 million and it

obtained

Government support of QR 341 million

in meat price, down 8.5% from government

support provided last year.

General and administrative expenses

increased by 14.3% to QR 41.6 million. As a

result, net profit for the year rose by

32.1% to QR 91.3 million and the

comprehensive income amounted to QR 85.4

million due to currency differences losses.

5-- Qatar Electricity and Water Company's

net profit is QR 1,542 million compared to

QR1,501million for the same period of the

previous year. EPS amounted to QR 14

compared to QR 13.64 for the same period of

the previous year. The Board recommended the

distribution of QR 7.5 cash dividends to

shareholders. Qatar Electricity and Water

Company's net operational income increased

by 7.7% to QR1.4 billion in 2016. Total

expenses rose by 15.9% to QR105 million.

Adding the company's share of profit

from associate companies, deducting

financing cost, then the company’s net

profit rises by 2.5% to QR1573.3 million.

There was a positive change in the fair

value worth QR 246.5 million, thus pushing

comprehensive income up to QR 1819.9

million.

6-- Industries Qatar net profit amounted to

QR2,955.0 million compared to QR4,468.7

million for the same period of the previous

year.

Earnings per Share(EPS) amounted to QR4.88

for the period ended December 31, 2016

compared to EPS amounted to QR7.39 for the

same period of the previous year. The Board of Directors of the company recommended a

dividend of QR 4 per share for the period.

Economic

Developments

1--In December 2016, the foreign merchandise

trade balance, which represents the

difference between total exports and

imports, showed a surplus of QR10.7bn, an

increase of about QR1.9bn or 21.7 percent

compared to December 2015; and increased by

nearly QR1.0bn or 10.7 percent compared to

November 2016.

2-- Banks consolidated balance sheet for

December was released showing a rise in

total assets compared to November by about

QR 70 billion to stand at QR 1271 billion.

The total domestic public debt,

including bonds, increased by about QR 30

billion to QR 428 billion while the total

domestic private sector deposits rose by QR

4.5 billion to the level of QR 438 billion.

3-- Last week, Opec oil prices hovered

around $ 52 per barrel until Thursday when

it hit $ 52.67.

4—As far as US economy, nonfarm payrolls

grew by 227,000 in January2017, while the

unemployment rate edged higher to 4.8

percent. Dow Jones index lost 210 points to

reach the level of 19885 points. US Dollar

exchange rate remained steady at the level

of 115.13 yen, and $ 1.08 per Euro. Gold

price increased by 25 dollars to the level

of $ 1216 per ounce.

|