|

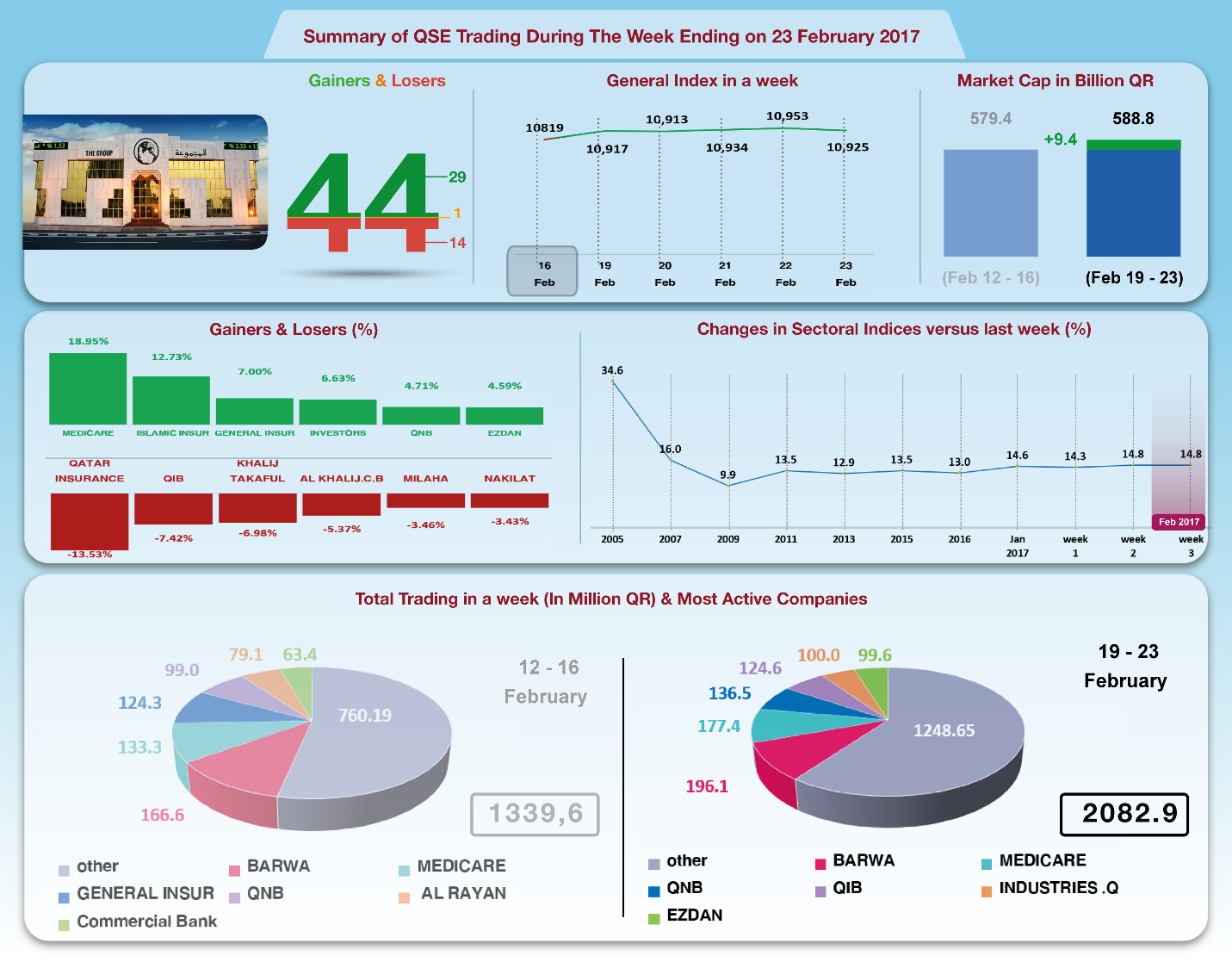

The Group Securities: Weekly Report on QSE Performance,

19-23 Feb 2017

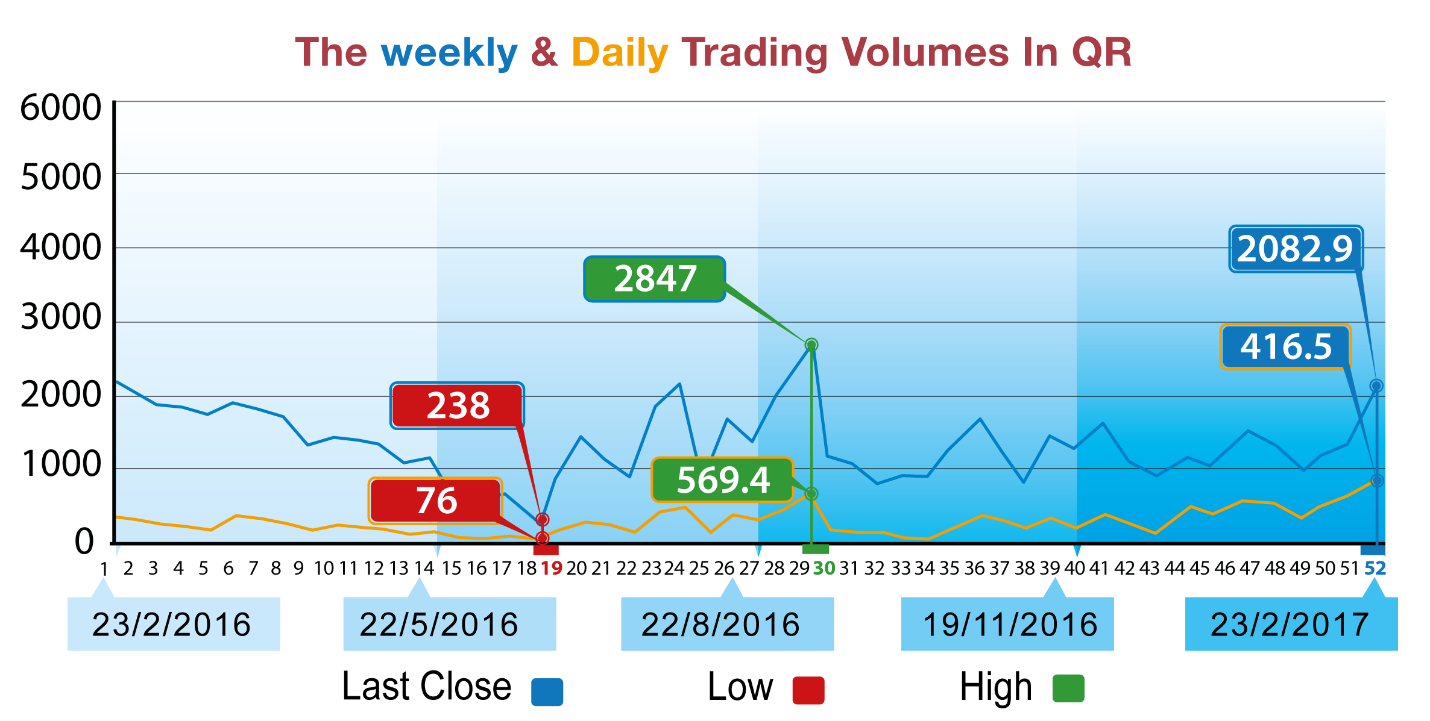

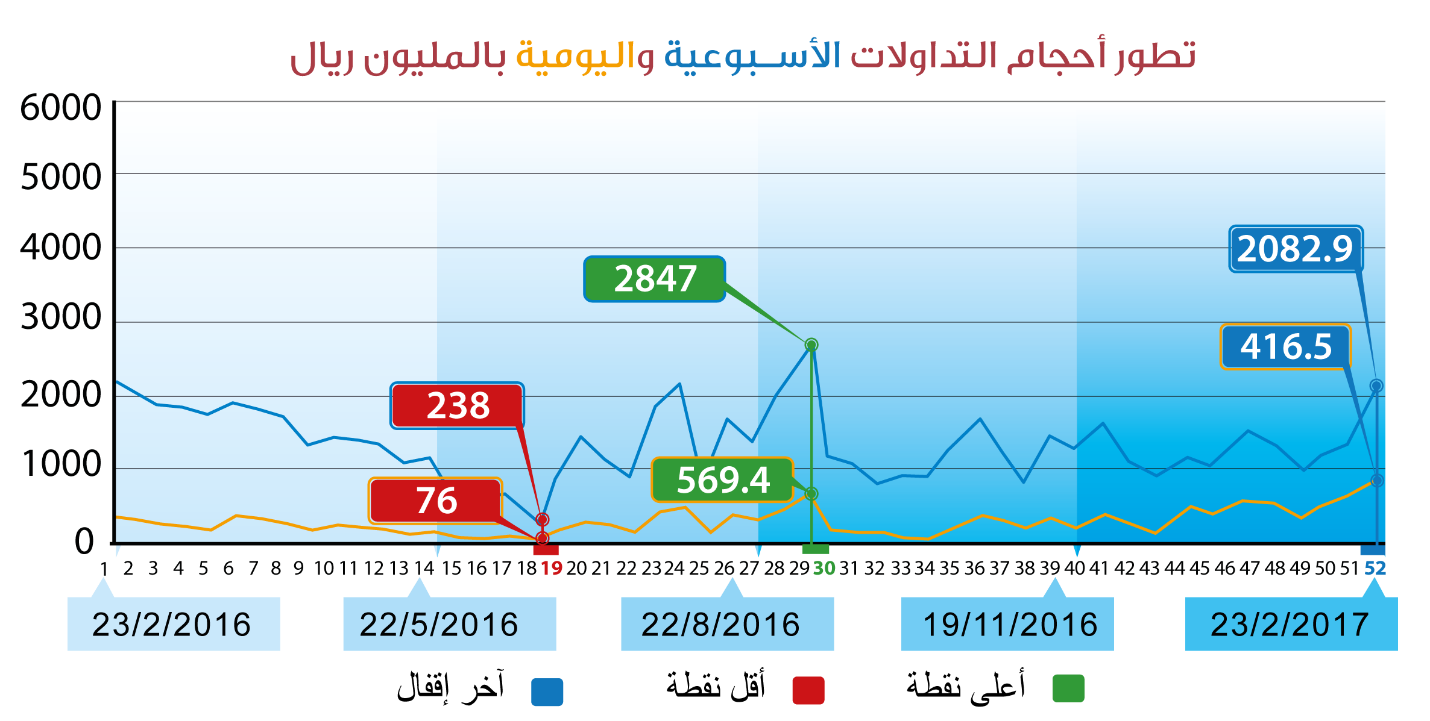

As

the release of financials continues with new five companies, the

convention of four AGMs and approval of the distribution of

dividends, the trading volume saw an upsurge, with QR 2 billion

in five sessions. This had positive impact on the price of the

companies' shares. Twenty-nine companies had their share price

up, while 14 companies ended the week down. Al Meera distributed

the highest dividend, then Woqod and Ooredoo. Qatar Commercial

Bank decided not distribute dividends. By the end of the week,

the general index settled at the level of 10925 points, slightly

up by 1% compared to last week. Other key indices also

increased; in addition to five sectoral indices, namely Real

Estates and Services. Total capitalization hiked by QR 9.7

billion to QR588.8 billion.

Non-Qatari investors dominated net buying, while Qataris

dominated net sale transactions. The Group reviews QSE

performance in this week with illustrative charts combined with

corporate business news, and a list of the affecting economic

factors.

Corporate News:

1-- Commercial Bank net operating income in 2016 declined 9% to

QR 3.59 billion, of which QR 2.34 billion

net interest income. Net loan impairment losses rose by

50.6% to QR 1.27 billion, staff costs settled slightly higher at

QR 872.3 million.

Depreciation and amortization expenses increased to QR 241.6

million. As a result, net profit attributable to shareholders

decreased 64.3% to QR 500.8 million. There was profit from the

re-evaluation of real estate worth QR 1265 million, a loss in

the fair value and

the comprehensive income achieved a profit of QR 840.5

million to reach QR 1342.8 million.

2-- Nakilat's operational income increased by 2.25% to QR3.76

million in 2016, including QR 3.07 billion as revenues of

operating ships. Total expenses increased by 4.1% to QR2.81

billion, including 718 million as expenses of operating the

ships, and QR1187.7 million as financing cost. Consequently,

this year's profit attributable to shareholders dropped by 2.9%

to QR954.2 million. The company also made profit from the

positive change in the fair value worth QR578 million, thus

causing the comprehensive income to rise to QR1532.5 million.

3-- Al Meera Consumer Goods Company net profit is QAR 199.2

million, compared to QAR 162.1 million for the same period of

the previous year. Earnings per Share (EPS) amounted to QAR 9.96

for the period ended December 31, 2016 compared to (EPS)

amounted to QAR 8.10 for the same period of the previous year.

In addition, the proposed dividend distribution is QAR 9 per

share (90% of the nominal value of each share). Al Meera's

operational income decreased by 3.4% to QR 441.7 million in

2016. Public and administrative expenses rose by 10% to QR278.2

million. Adding rent revenues; deducting depreciation

allowances, then net profit attributable to shareholders rises

by 23% to QR199.2 million.

4-- Qatar Fuel Company (Woqod) sales value in 2016 increased by

the rate of 5% to QR 13.84 billion and the cost of sales rose by

6.7% decreasing the total profit by 6.4% to QR 1589.1 million.

Other revenues decreased by 4.4% to QR 475.2 million while the

general and administrative expenses rose by 3.9% to QR 1089.2

million. As a result, the net profit attributable to

shareholders decreased by 15.9% to QR 883.1 million and the

comprehensive income decreased to QR 870.1 million as a result

of a decrease in the fair value of investments worth QR 17.7

million.

5-- Ooredoo’s revenues in 2016 slightly increased to QR 32.5

billion while the company's operating, general and sales

expenses stood at QR 19.1 billion. Depreciation and amortization

expenses rose QR 0.5

billion to QR 8.4 billion. After adding the net financing

cost of QR 1.8 billion, fees estimated at QR 443.2 million and

income tax of QR 537.4 million, profit attributable to

shareholders stood at the level of QR 2192.5 million, an

increase of QR 74 million above the levels of the previous year.

There were losses resulting from currency differences and lower

fair value worth QR 842.4 million. As a result, the

comprehensive income attributable to shareholders amounted to QR

1416.9 million compared to a comprehensive loss of QR 366.7

million a year earlier.

Economic Developments

1-- Banks consolidated balance sheet for Janaury was released

showing a decline in total assets

by about QR 9.9 billion to stand at QR 1261.9 billion.

The total domestic public debt, including bonds,

decreased by about QR 16.7 billion to QR 418.8 billion, while

the total domestic private sector deposits rose by QR 2 billion

to the level of QR 440.6 billion.

2-- Last week, Opec oil prices remained steady at the level of

$ 53.48

3-- Last week, Dow Jones index gained 200 points to reach the

level of 20822 points. US Dollar exchange rate settled at the

level of 112.70 yen, and $ 1.06 per Euro. Gold price increased

by 15 dollars to the level of $ 1251 per ounce.

|