|

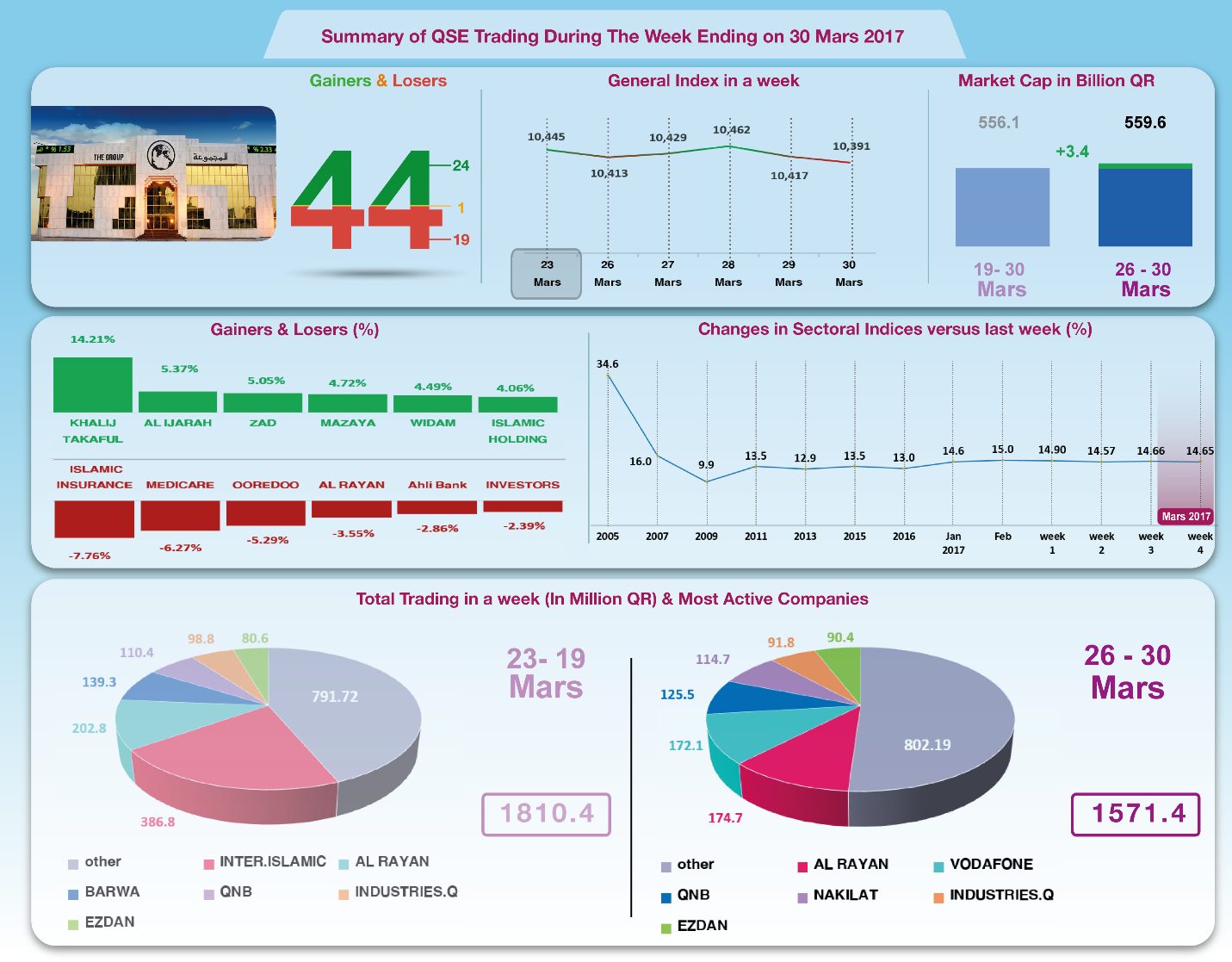

The Group Securities: Weekly Report on QSE Performance,

26-30 Mar 2017

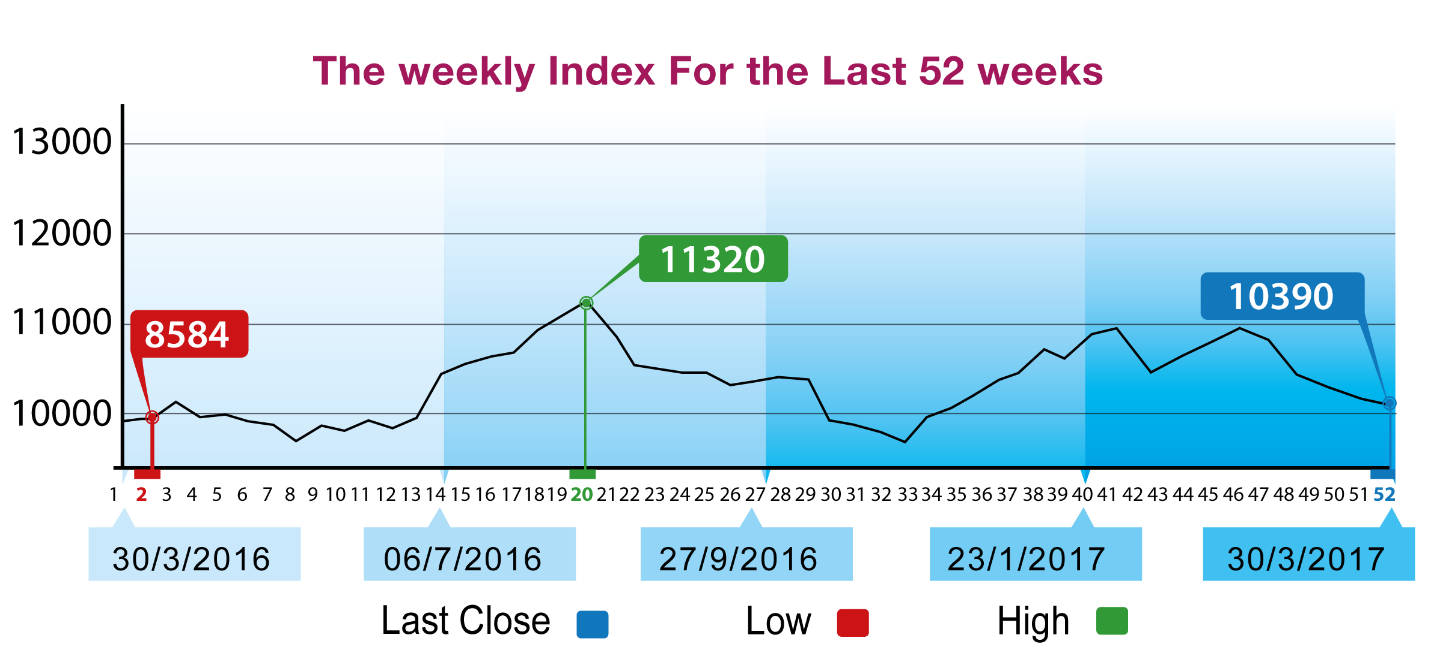

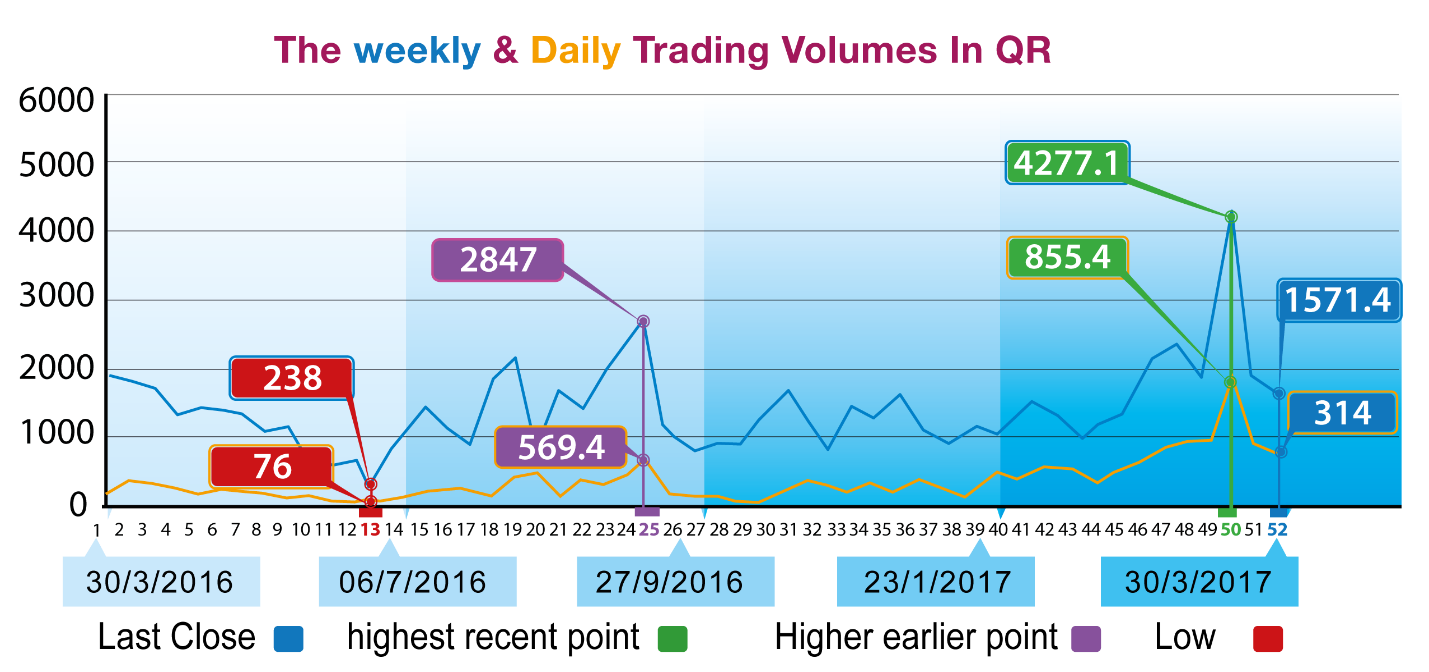

Though oil prices remained steady over the last week, with Opic

rising by the end of the week to $ 50.2 per barrel, QSE

performance remained weak at all levels. Trading volumes fell by

13.5% to QR 1.57 billion. General index failed to break through

the resistance barrier at the level of 10450 points, sliding

below 10400 points. Locally, the only significant event in this

week was the distribution of QR 3.5 cash dividend by Qatar

Islamic Insurance. Moreover, several companies announced the

dates of their disclosure of their financials for Q1 2017.

Meanwhile, Qatari portfolios and Qatari individuals sold net as

against net buy by non-Qatari portfolios and individual

investors. By the end of the week, General Index lost 55 points

to the level of 10391 points. Five sectoral indices declined;

namely telecommunications. Total capitalization fell by QR3.2

billion to QR556.4 billion, and price-earnings ratio remained

unchanged. The Group reviews QSE performance in this week with

illustrative charts combined with corporate business news, and a

list of the affecting economic factors.

Corporate News:

1-- Capital

Intelligence Ratings (CI Ratings or CI), the international

credit rating agency, announced last week that it has affirmed

Doha Bank’s (DB) Financial Strength Rating (FSR) at ‘A’. The

principal supporting factors are the Bank’s good capital base

(currently being further augmented by a rights issue) and good

overall asset quality. While the NPL ratio is above average for

the peer group, so is the more than full loan-loss reserve

coverage, and taken together, the asset quality position is seen

as being sound.

2-- Qatar Islamic Insurance approved of the recommendation made

by the Board of Directors to distribute cash dividends equaling

35 % of the shares nominal value i.e. QR 3,5 per share for the

Year Ended 31.12.2016. The board also approved election nine

winners for the Board of Directors for the next three years

starting from 2017.

3-- Qatar German Medical Devices Company announced that it will

not be able to disclose the financial statements for the

financial year ended 31 December 2016 on Wednesday 29/03/2017

due to lack of quorum as the Chairman of the Board of Directors

travelled with the Prime Minister's delegation to the Investment

Forum held in the United Kingdom and as the Vice Chairman is

also abroad due to the health conditions of his family.

Accordingly, the disclosure deadline will be extended to

02/04/2017 until the Board members return.

4-- Several companies announced that the disclosure of their

financial results for Q1 2017 will be in the second half of

April; namely Al Rayan, Al Khaliji, Al Ahli, Water& Electricity

Company, and Al Khaleej Takaful Group.

Economic

Developments

1-- Banks consolidated balance sheet for February has been

released; it shows a rise in total assets by about QR 2.5

billion to stand at QR 1264.4 billion.

The total domestic public debt, including bonds,

increased by about QR 18.1 billion to QR 436.9 billion, while

the total domestic private sector deposits fell by QR 2.1

billion to the level of QR 438.5 billion. 2—

Qatar's trade balance registered a surplus of QR12.3 billion in

February 2017, an impressive 74-percent increase from a year ago

and a 12.1-percent hike from January, 2017.

3-- Last week, Opec oil prices gained around 0.5 dollars and

closed at $ 50.20 per barrel on Thursday.

4-- Last week, Dow Jones index gained 252 points to reach the

level of 20663 points. US Dollar exchange rate decreased to the

level of 111.38 yen, and $ 1.07 per Euro. Gold price increased

by 19 dollars to the level of $ 1247 per ounce.

|