|

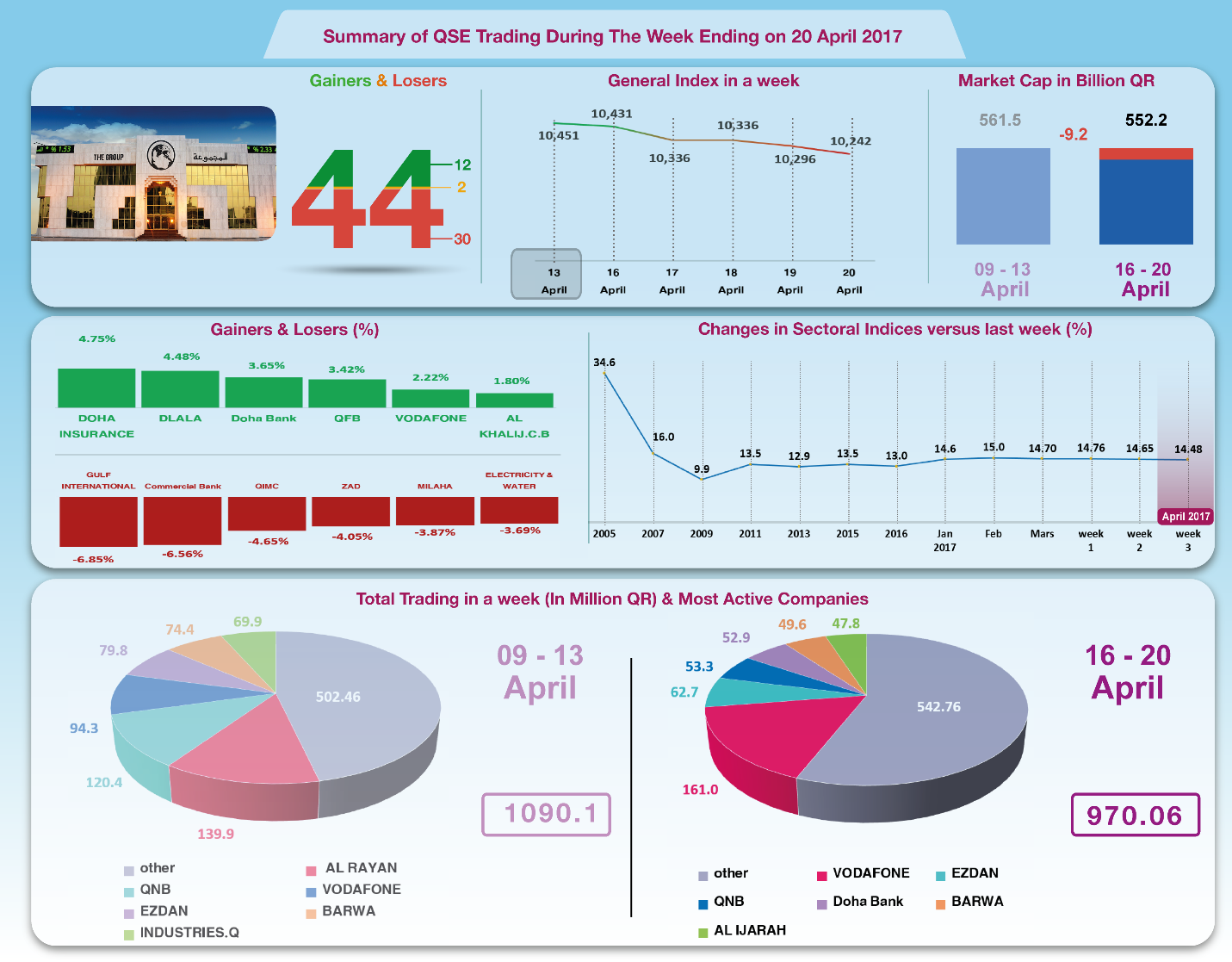

The Group Securities: Weekly Report on QSE Performance,

16-20 April 2017

Against the backdrop of financials released by ten companies,

Qatar Stock Exchange could not hold onto the level of 10450

points, sliding below in the first session. The support barrier

at the level of 10300 points was also broken in the following

sessions. Most financial disclosures did not rise to the

expectations. Commercial Bank and Gulf Internal Services saw a

decline in their revenues, much the same with UDC. Qatar Water&

Electricity's income remained flat. Al Ahli Bank and Al Khaliji

Bank posted a slight increase in their revenues. In light of

this conditions, total trading dropped by QR9.2 billion to the

level of QR 552.2 billion. The Group reviews QSE performance in

this week with illustrative charts combined with corporate

business news, and a list of the affecting economic factors.

Corporate News:

1-- Qatar Islamic Bank disclosed the interim financial statement

for the three-month period ended March 31, 2017. The financial

statements revealed a net profit of QR555 Million in comparison

to net profit QR 492 Million for the same period of the previous

year. The Earnings per Share (EPS) per share amounted to QR 2.13

As of March 31, 2017 versus EPS per share QR 1.98 of the same

period in 2016. Qatar Islamic Bank's total income increased by

16.3% to 1496.4 million in the first quarter of 2017, including

QR1325.8 million as investment and financing revenues. In

contrast, total expenses dropped by 1.6% to QR311.2 million,

including QR152.2 million as staff cost which fell by 6.5%. The

losses, incurred as result of a decline in investments and

financing, increased by 56.2% to QR176 million.

The share of unrestricted investment deposits account

holders increased by 26.4% to QR439.4 million. As result, net

profit posted in this period rose by 12.8% to QR 555.4 million.

2-- Ahli bank net profit reached QR 170.021.039, compared to QR

164.983.817 for the same period of the previous year. Earnings

per Share (EPS) amounted to QR 0.85 For the period ended March

31, 2017 to EPS / amounted to QR 0.82 for the same period of the

previous year. Ahli Bank's total operational income increased by

3.5% to 253.7 million in the first quarter of 2017, including QR

202.3 million as net interest revenues. In contrast, total

expenses rose by 4.5% to QR 83.7 million. As result, the profit

made in this period amounted to QR170 million, or 3% increase.

3-- Qatar Electricity & Water Company net profit reached QR 350

Million, compared to QR 347 Million for the same period of the

previous year. The Earnings per Share (EPS) amounted to QR 3.18,

compared to EPS amounted to QR 3.16 for the same period of the

previous year. Qatar Electricity & Water

Company's net operational income dropped by 14.6% to QR 276

million in the first quarter of 2017, as result of a significant

rise in the operating cost. Public and administrative expenses

increased by 4.9% to QR 51 million.

Net financing cost amounted to QR 38.3 million. Adding

other sources of income worth QR41.8 million, its share from

other joint ventures worth QR 128.4 million, then the profit

posted in this quarter stands at QR 356.1 million, without

change. The company registered a comprehensive income of QR

147.6 million-- compared to losses incurred in the same period

last year. The total income attributable to shareholders

increased by 47.5% to QR 497.9 million.

4-- The Commercial Bank net profit stood at QR 91.226 million,

compared to QR 288.115 million for the same period of the

previous year. Earnings per Share (EPS) amounted to QR 0.24

compared to QR 0.85 for the same period of the previous year.

Commercial Bank's operational income dropped by 4.2% to QR885.5

million in the first quarter of 2017, including QR598.6 million

of interests.

Expenses rose by 20.7% to 840.2 million, including QR 189.3

million as staff cost, down by 17%. The bank lost QR484.8

million as result of decline of loans and financial investments.

Adding its share of profit in other joint projects,

deducting taxes, then profit attributable to shareholders falls

by 68.3% to 91.2 million. Comprehensive income fell to 181.9

million, compared to QR 418.9 million in the same period last

year.

5-- United Development Company's net profit amounted to QR 231

million in compared to QR 259 million for the same period of the

previous year. The Earnings per Share (EPS) amounted to QR 0.65 As of

March 31, 2017 versus EPS per share QR 0.73 of the same period

in 2017. UDC's operating income dropped by 7.7% to QR267.9

million in the first quarter of 2017, including QR 288.6 million

from its core business.

Public and administrative expenses dropped by 5.1% to QR

83.2 million. Adding other sources of income, deducting net

financing cost, then the profit of this quarter declines by

10.9% to QR 230.8 million. Comprehensive income amounted to QR

226.8 million.

6-- Doha Bank's net profit settled at QR 364 million, compared

to QR 354 million for the same period of the previous year.

Earnings per Share (EPS) amounted to QR 1.41, compared to QR

1.37 for the same period of the previous year. Doha Bank's net

income from insurance increased by 51.8% to QR25.8 million in

the first quarter of 2017, while it dropped from investments and

other sources by 22% to QR 17.8 million. Expenses settled at QR

16.8, slightly up. As result, the bank's net profit increased by

22.8% to QR 27.4 million.

7-- Al Khaliji's net profit stood at QR 160.9M, compared to QR

156.2M for the same period of the previous year. The Earnings

per Share (EPS) amounted to QR 0.45 compared to QR 0.43 for the

same period of the previous year. Al Khaliji's net operational

income increased by 5.1% to QR 312.1 million in the first

quarter of 2017, including QR 230.9 million as interest and QR

62.1 million as commissions.

Total expenses increased by 12% to QR148.2 million,

including QR 51.9 million as staff cost; QR64 million as

impaired loans; QR 25 million as other losses. As result, net

profit rose by 3% to QR160.9 million. There was a positive

change in the fair value of investment worth QR92.5 million,

thus causing the comprehensive income to rise to QR 253.5

million, compared to QR 94 million in the same period last year.

8-- Gulf International Services' net income from core business

dropped by 36.2% to QR87.8 million in the first quarter of 2017,

including revenues from investments and other sources worth

QR17.9 million. Total expenses increased by 8.6% to QR 61.6

million, in addition to net financing cost worth QR29 million.

As result, the company's profit declined by 81% to QR 15.1

million.

9-- Doha Bank's net profit is QR 364 million, compared to QR 354

million for the same period of the previous year. Earnings per

Share (EPS) amounted to QR 1.41 compared to QR 1.37 for the same

period of the previous year. Doha Bank's net income from

insurance increased by 51.8% to QR25.8 million in the first

quarter of 2017, while it dropped from investments and other

sources by 22% to QR 17.8 million. Expenses settled at QR 16.8,

slightly up. As result, the bank's net profit increased by 22.8%

to QR 27.4 million.

10-- Islamic Holding net profit amounted to QR 1.309.809

compared to QR226.857 for the same period of the previous year. The Earnings per Share (EPS) per

share amounted to QR 0 .23 compared to QR 0.04 of the same

period in 2017. Islamic Holding Group's net operational income

increased by 43.2% to QR 3.4 million, including QR 2.8 million

net income from commission and brokerage. Expenses dropped by

4.5% to QR 1.91 million. As result, the profit posted in this

quarter amounted to QR 1.31 million, including QR 226,000 in the

same period last year.

Economic

Developments

1-- Banks consolidated balance sheet for March has

been released; it shows a rise in total assets by about QR 17.9

billion to stand at QR 1264.4 billion.

The total domestic public debt, including bonds,

increased by about QR 0.3 billion to QR 437.2 billion, while the

total domestic private sector deposits increased by QR 0.5

billion to the level of QR 439 billion.

2-- Last week, Opec oil

prices went down again by 3.19 dollars and closed at $ 50. 48

per barrel on Thursday.

3-- Last week, Dow Jones index gained 95 points to reach the

level of 20548 points. US Dollar exchange rate increased to the

level of 109.22 yen, and $ 1.07 per Euro. Gold price decreased

by 3 dollars to the level of $ 1287 per ounce.

|