|

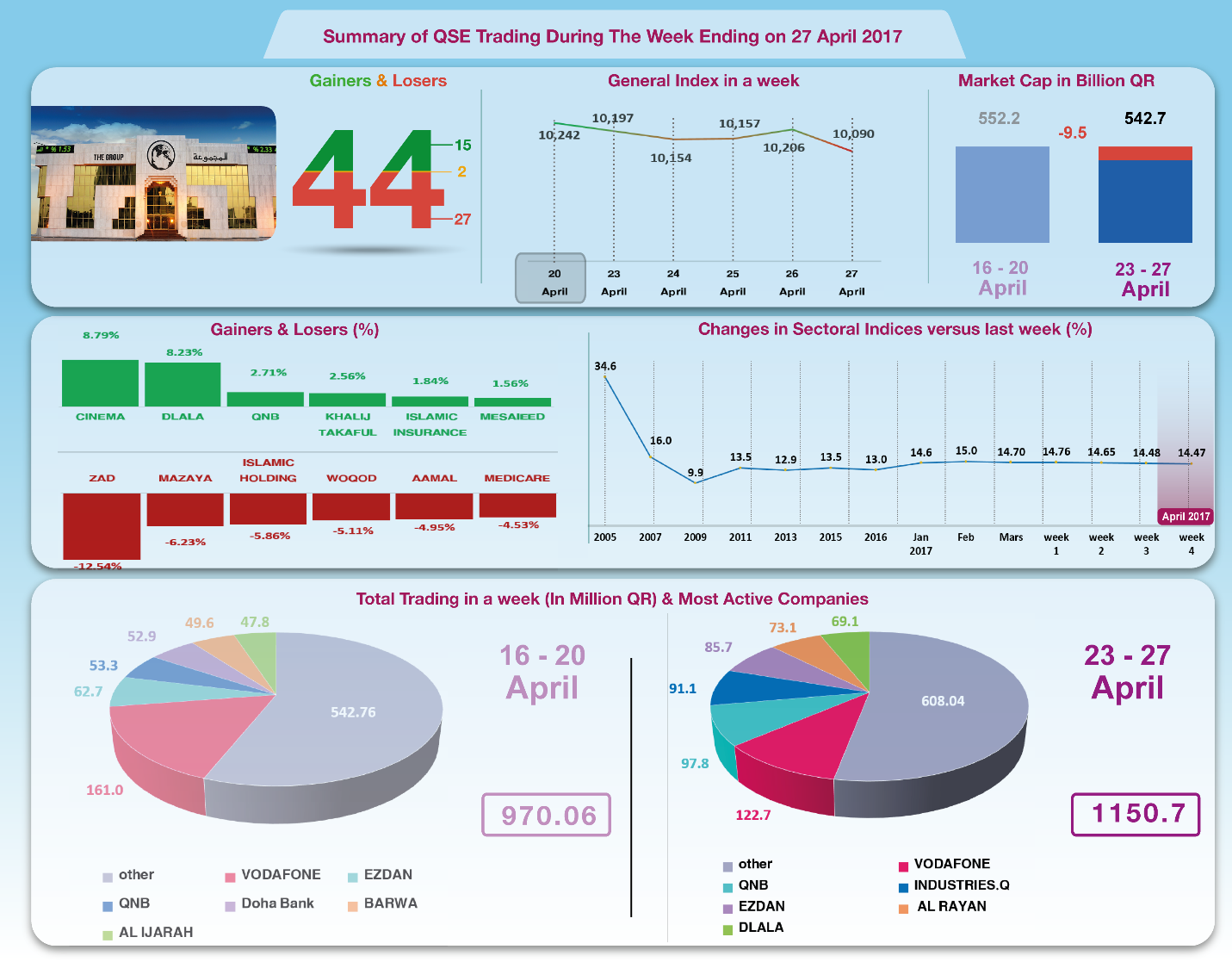

The Group Securities: Weekly Report on QSE Performance,

23-27 April 2017

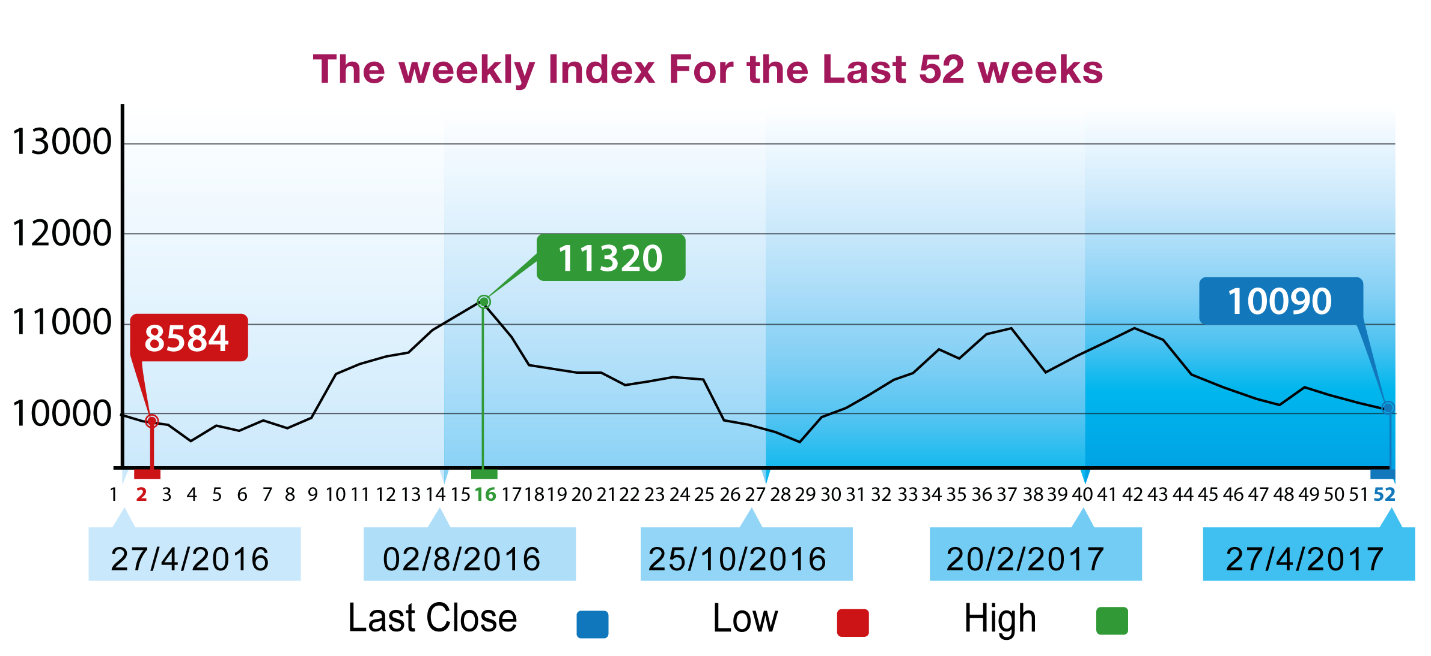

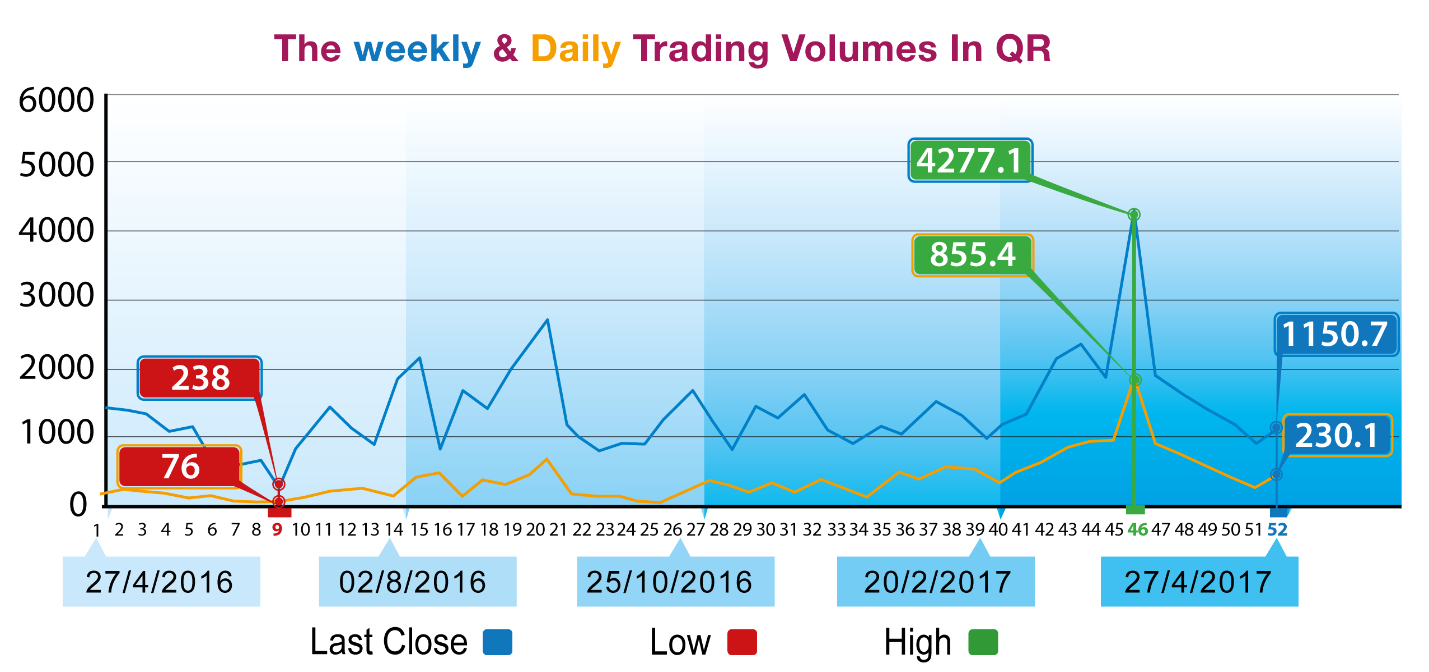

This week marked the end of the release of the Q1 financials of

2017. In fact, 36 companies disclosed their financials, 18 of

which disclosed their results during this week. Most of the

results were negative and marked a remarkable decline in profit

compared to the same period last year. Except for a few

companies, like Qatari Investors and Medicare, the result of 36

companies showed a decline of 4.65% to QR 9.4 billion. In light

of these conditions-- with oil prices sliding to 48.90 dollar--

the limited recovery of the market trading volume failed to hold

up the fall of prices and indices. General Index dropped by 152

points to the level of 10090 points. The Group reviews QSE

performance in this week with illustrative charts combined with

corporate business news, and a list of the affecting economic

factors.

Corporate News:

1--Qatari Investors Group net profit in the first quarter of

2017 rose 9.3% to QR 115.7 million. Expenditure stood at QR 25.9

million. Net operating profit increased by 11.4% to QR 91.6

million. After subtracting the net financing cost, which fell

18.3% to QR10.7 million, and adding a stake of other companies'

profits, the company's net profit rose 13.4% to QR 84.9 million.

2-- Qatar Gas Transport total income increased by 3.1% to QR

877.5 million in the first quarter of 2017, including QR 752.6

million as revenues of ship operations, and QR 83.8 million from

joint projects.

Total expenses increased by 3.2% to QR 686.2 million, including

170.8 million as operational expenses; QR 189.6 provision of

depreciation; QR 293.1 million as financing cost.

As result, the profit posted in this period dropped by

20.4% to 191 million. Comprehensive income stood at QR 194.7

million, compared to total loss in the same period last year

worth QR 455.1 million.

3-- Masraf Al Rayan's total revenue in the first quarter

increased by 8.1% to QR 1013.7 million, of which QR 896.8

million was income from finance and investment. Expenses rose by

9.1% to QR 227 million, of which QR 82.4 million was staff

expense. Depositors' share of profits rose by 45.1% to QR 273.7

million, noting that the balance of deposits rose by 11.8% to QR

55.7 billion in the same period. As a result, net profit for the

period decreased by 6.5% to QR 510.3 million.

4-- Milaha operating income for the first quarter decreased by

15.6% to QR 648 million while expenses decreased by 9.5% to QR

463 million. As a result, operating profit decreased by 26.6% to

QR 185 million. After adding profits from other companies and

deducting the net financing cost, the net profit is down 33% to

QR 236.2 million. Total losses on available investments shrank

to QR 49.5 million compared to QR 389.1 million in the

corresponding period last year making the overall income improve

to a profit of QR 186.8 million compared to a comprehensive loss

of QR 37.2 million in the corresponding period in 2016.

5-- Qatar Cement's total income from cement sales dropped by

27.2% to QR83.9 million as result of sales decline and rise of

production cost. Adding other sources of income, deducting

routine expenses worth QR 10.8 million, then net profit falls by

31.5% to QR 84.8 million. Comprehensive income declined to 78.3

million.

6-- Qatar General Insurance & Reinsurance's total income

increased by 4.2% to QR145.9 million in the first quarter of

2017. Other sources of income increased to 100.9 million, while

net premiums dropped slightly to 45 million. Total expense

increased by 22.4% to 106.5 million, including QR29.5 million

net claims, QR 43.7 million as public and administrative

expenses. As result, net profit posted in this period fell by

50% to QR43 million. Comprehensive income loss shrunk by half in

respect of investment available for sale and currencies exchange

rate; comprehensive income increased by 28.9% to 25.4 million.

7-- Ooredoo's revenues reached QR8 billion in the first quarter

of 2017, compared to QR 7.9 billion in the same period last

year. Total income hit QR 7.18 billion, including QR 2.95

billion operational expenses, QR 1.7 billion sale expenses, QR

2.1 billion depreciation expenses, QR 433 million net financing

cost. Adding other sources of income worth QR71 million, shares

from associate companies worth QR11.3 million, deducting taxes

worth QR 148.3 million, then profit attributable to shareholders

drops by third to QR 584 million. There was a positive change in

the currencies exchange rate which pushed the comprehensive

income attributable to shareholders to QR 872.5 million, though

still below that of the same period last year at QR 1397.6

million.

8-- Qatar German Medical Devices' total income from its business

and other sources dropped by 33% to QR 880.200 in the first

quarter of 2017.

Total expense dropped by 8.6% to QR 2.08 million. Financing cost

fell slightly to QR 1.01 million. As result, net loss increased

by 7.5% to 2.20 million.

9-- Widam Food Company's loss on meat sales dropped by 21.8% to

QR40.6 million. The government subsidy fell by 7.6% to QR74.6

million. In contrast, public and administrative expenses

increased by 37.2% to QR 12.9 million. As result, net profit

posted in this period rose by 16% to QR 22.95 million.

10-- Mazaya Qatar profit from building dropped in the first

quarter 2017 to QR 10.3 million shrinking its total revenue by

the rate of 54.4% to QR 17 million. The company’s expenses rose

by 20% to QR 3.6 million

and the cost of financing increased by 16% to QR 8.4

million. As a result, net profit shrank to less than a fifth,

reaching to about QR 5.02 million.

11-- Qatar First Bank

revenue in the first quarter 2017 fell 8.1% to QR 121.5 million,

of which QR 89.7 million was non-bank income. Total expenses

decreased by 12.9% to QR 129.2 million, of which QR 89.3 were

non-banking expenses, QR 17.8 million were for employees and QR

13.4 million were other operating expenses. As a result, net

loss in the first quarter decreased by 51.2% to QR 9.56 million.

12-- Total profit for Woqod from its direct activity in the

first quarter decreased by 7.7% to QR 293.1 million. The

decrease resulted from higher cost than sales value. Other

income rose by 10.4% to QR 301.4 million, while expenses rose by

20% to QR 389.7 million. As a result, net profit attributable to

shareholders decreased by 27.3% to QR 176.5 million

13-- Dlala Brokerage and Investment Holding disclosed its

reviewed financial statements for the period ended on

31.03.2017. The statements shows that the net profit is QR 10.1

million compared to net profit amounting to QR 445 thousand for

the same period of the previous year. The Earnings per Share

(EPS) amounted to QR 0.36 for the period ended March 31, 2017 to

EPS amounted to QR 0.02 for the same period of the previous

year.

14-- Al Meera Consumer Goods Company disclosed the interim

financial statement for the three months ended 31 March 2017.

The statements show that the net profit is QR 40,516,263

compared to net profit amounting to QR 49,403,900 For the same

period of the previous year.

The Earnings per Share (EPS) amounted to QR 2.03 For the period

ended 31 March 2017 to EPS amounted to QR 2.47 for the same

period of the previous year.

Economic

Developments

1-- Banks consolidated balance sheet for March has been

released; it shows a rise in total assets by about QR 18.1

billion to stand at QR 1282.5 billion.

The total domestic public debt, including bonds,

decreased by about QR 13 billion to QR 423.9 billion, while the

total domestic private sector deposits increased by QR 0.5

billion to the level of QR 439 billion.

2-- Last week, Opec oil prices lost around 1.58 dollars and

closed at $ 48.90 per barrel on Thursday.

3-- Last week, Dow Jones index gained 393 points to reach the

level of 20941 points. US Dollar exchange rate increased to the

level of 111.52 yen, and $ 1.09 per Euro. Gold price decreased

by 18 dollars to the level of $ 1269.5 per ounce.

|