|

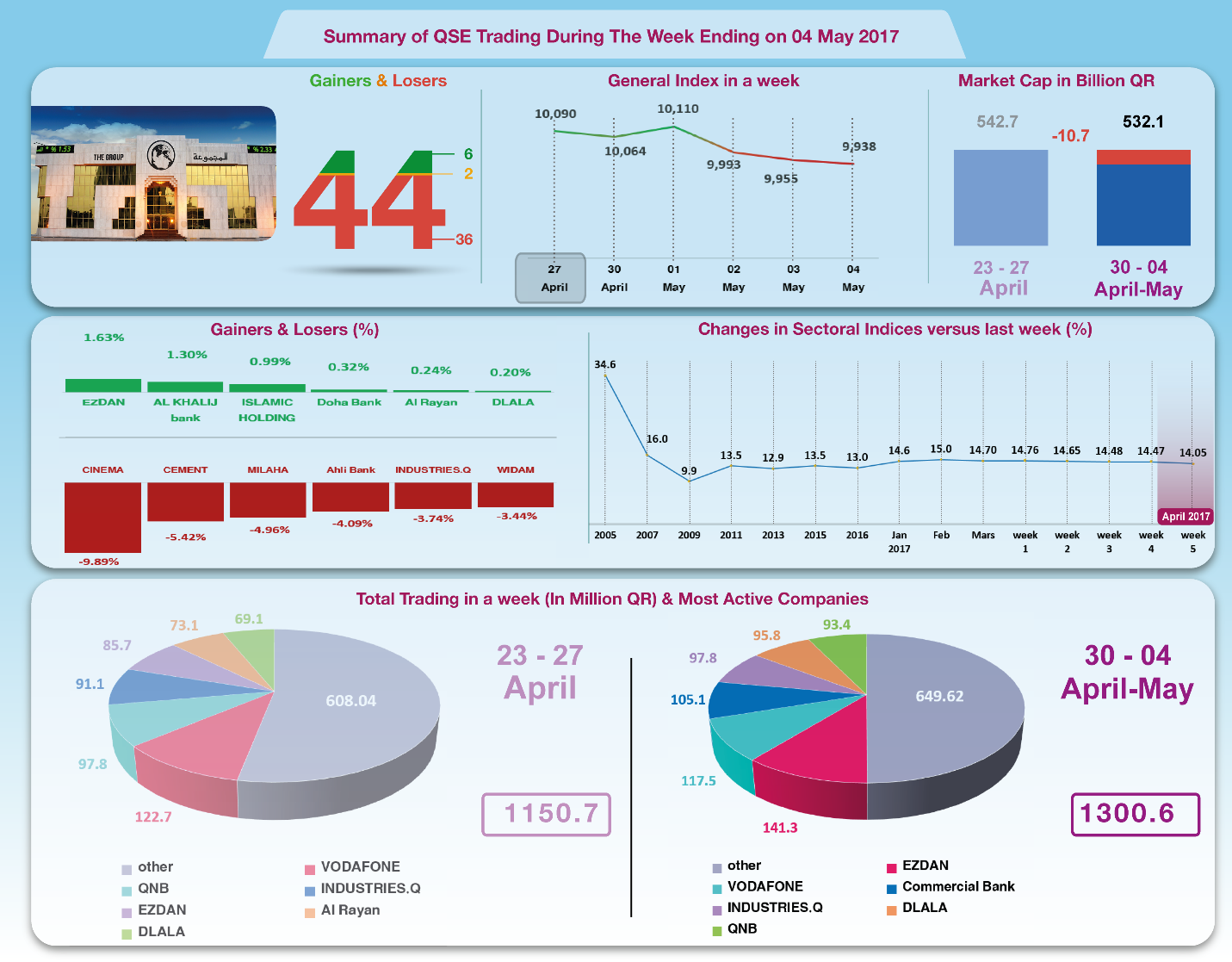

The Group Securities: Weekly Report on QSE Performance,

30 April-04 May 2017

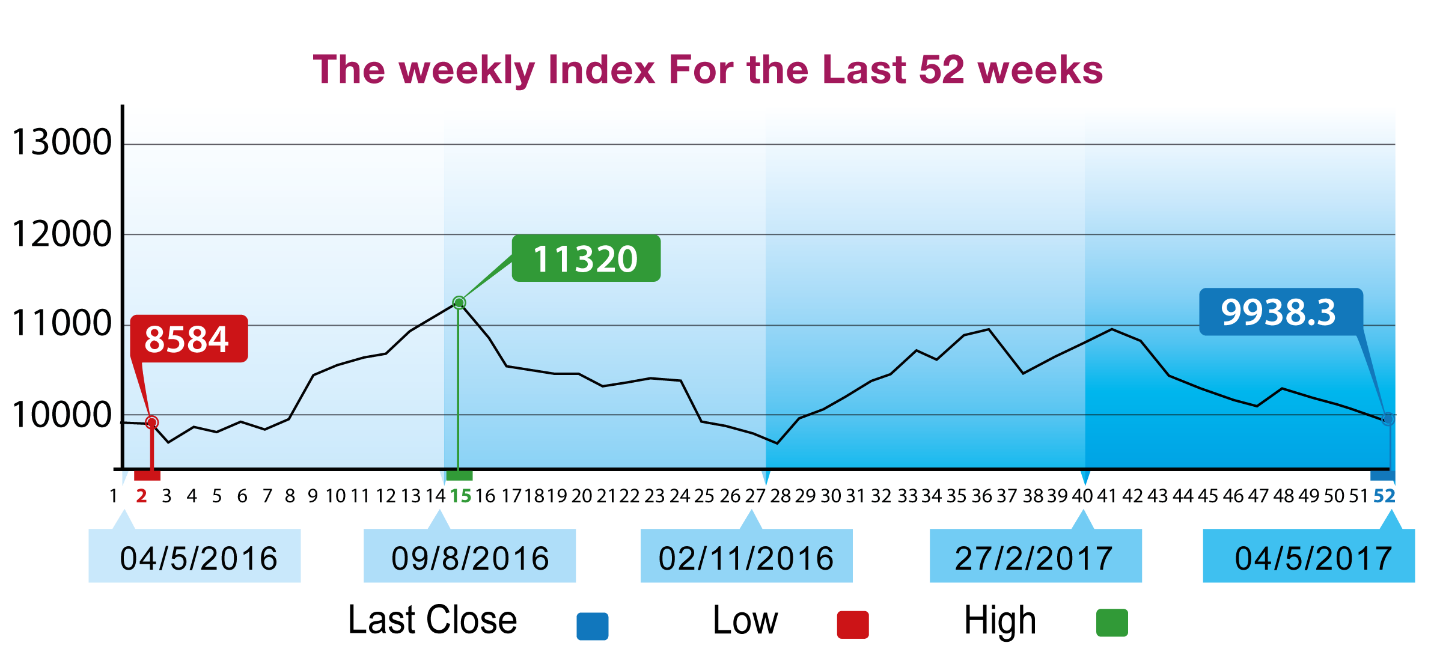

In

a week marked with adverse circumstances, the QSE indices

continued its downward movement to the level of 10,000 points

for the first time in six months. This is ascribed to the end of

the companies' financial disclosures, the falling oil prices

below 48 dollars per barrel, and Ezdan's call to hold EGM to

look into changing the company into a private shareholder

company, which would probably lead to its withdrawal from the

Stock Exchange.

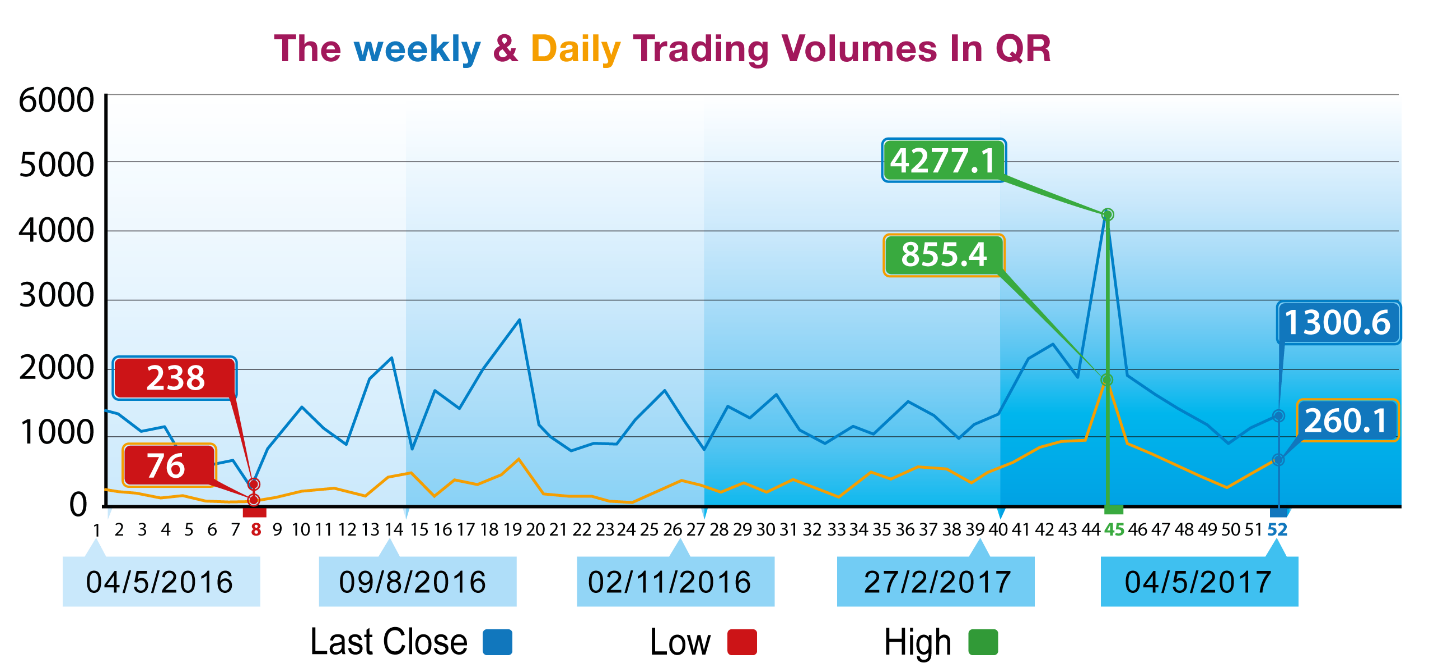

Though trading volumes increased by 13% to the level of 1301

million, it was not enough to support the trading.

Qatari portfolios exclusively dominated net buy

transactions, as against other categories of investors. By the

end of the week, QSE general index had declined the level of

9938 points. Total capitalization dropped by QR10 billion to QR

532.1 million. Price-earnings ratio (P/E Ratio) fell down to the

level of 14.05 points. The Group reviews QSE performance in this

week with illustrative charts combined with corporate business

news, and a list of the affecting economic factors.

Corporate

News:

1-- Ezdan Holding Group announces that the Board of Directors of

Ezdan met on Thursday 27/4/2017 at 7:00 pm to consider the

request of a shareholder who owns more than 25% of the shares of

the group, which includes the request to convene an

extraordinary General Assembly To discuss the "conversion of

Ezdan Holding Group from a public shareholding company to a

limited liability company or a private shareholder".

2-- Mesaieed's share of profit in joint projects increased by

1.1% to QR 191.3 million in the first quarter of 2017.

Adding other sources of income worth QR7.4 million,

deducting public and administrative expenses worth QR4.4

million; and adding tax returns worth QR18 million, then net

profit made in this period settles at QR 212.3 million.

3-- Qatar Industrial Manufacturing Company's total profit on

sales stood at QR 31.2 million in the first quarter of 2017,

despite a decline in the sales in this quarter.

There were other sources of income worth QR 6.3 million;

a share of profit on investment in another company worth 39

million, investment returns worth QR4.5 million. Deducting

expenses worth QR18.2 million, then net profit made in this

quarter increased by 8.1% to QR 62.5 million. Comprehensive

income amounted to QR 53.9 million.

4-- Alijarah Holding total revenues in the first quarter

decreased by 30.4% to QR 38.7 million and the total expenses

decreased by 22.1% to QR 44.94 million. As a result, net

operating loss doubled to QR 6.2 million. The company achieved a

net profit of QR 6.96 million. As a result, net profit for the

period decreased by 66.1% to QR 712 thousand.

5-- Zad Holding Company total operating income in the first

quarter decreased by 34.4% to QR 265.4 million, of which QR

241.9 million was operating income and QR 23.5 million was

government support. Operating cost decreased by 42.3% to QR

185.5 million and the total profit declined by 3.4% to QR 79.9

million. After adding other income and subtracting general

expenses, which increased by 8.8% to QR 32 million, and

subtracting the cost of funding QR 2.8 million, net profit for

the period decreased by 4.7% to QR 49.3 million.

6-- The total income for Khaleej Takaful Group shareholders in

the first quarter stood at QR 23.1 million and the total

expenses stood at QR 9.2 million. As a result, net profit

attributable to shareholders decreased by 2.3% to QR 13.9

million but the comprehensive income increased to QR 9.8 million

up from QR 4.6 million in the corresponding period last year.

Economic Developments

2-- Ezdan Holding Group announces that the Board of Directors of

Ezdan met on Thursday 27/4/2017 at 7:00 pm to consider the

request of a shareholder who owns more than 25% of the shares of

the group, which includes the request to convene an

extraordinary General Assembly To discuss the "conversion of

Ezdan Holding Group from a public shareholding company to a

limited liability company or a private shareholder".

1-- Banks consolidated balance sheet for March has not been

released, but that of February shows a rise in total assets by

about QR 2.5 billion to stand at QR 1264.4 billion.

The total domestic public debt, including bonds,

increased by about QR 18.1 billion to QR 436.9 billion, while

the total domestic private sector deposits fell by QR 2.1

billion to the level of QR 439 billion.

2-- Qatar's trade balance registered a surplus of QR 9.9 billion

in March 2017, a 4.1-percent increase from a year ago and a

1.6-percent decline from February, 2017.

3-- Last week, OPEC oil prices continued its decline and lost

around 1.56 dollar, closing at $ 47.44 per barrel on Thursday.

4-- Last week, Dow Jones index lost 66 points to reach the level

of 21007 points. US Dollar exchange rate increased to the level

of 112.73 yen, and $ 1.10 per Euro. Gold price decreased by 41

dollars to the level of $ 1228 per ounce.

|