|

The Group Securities Weekly Report on QSE Performance,

7-11 May 2017

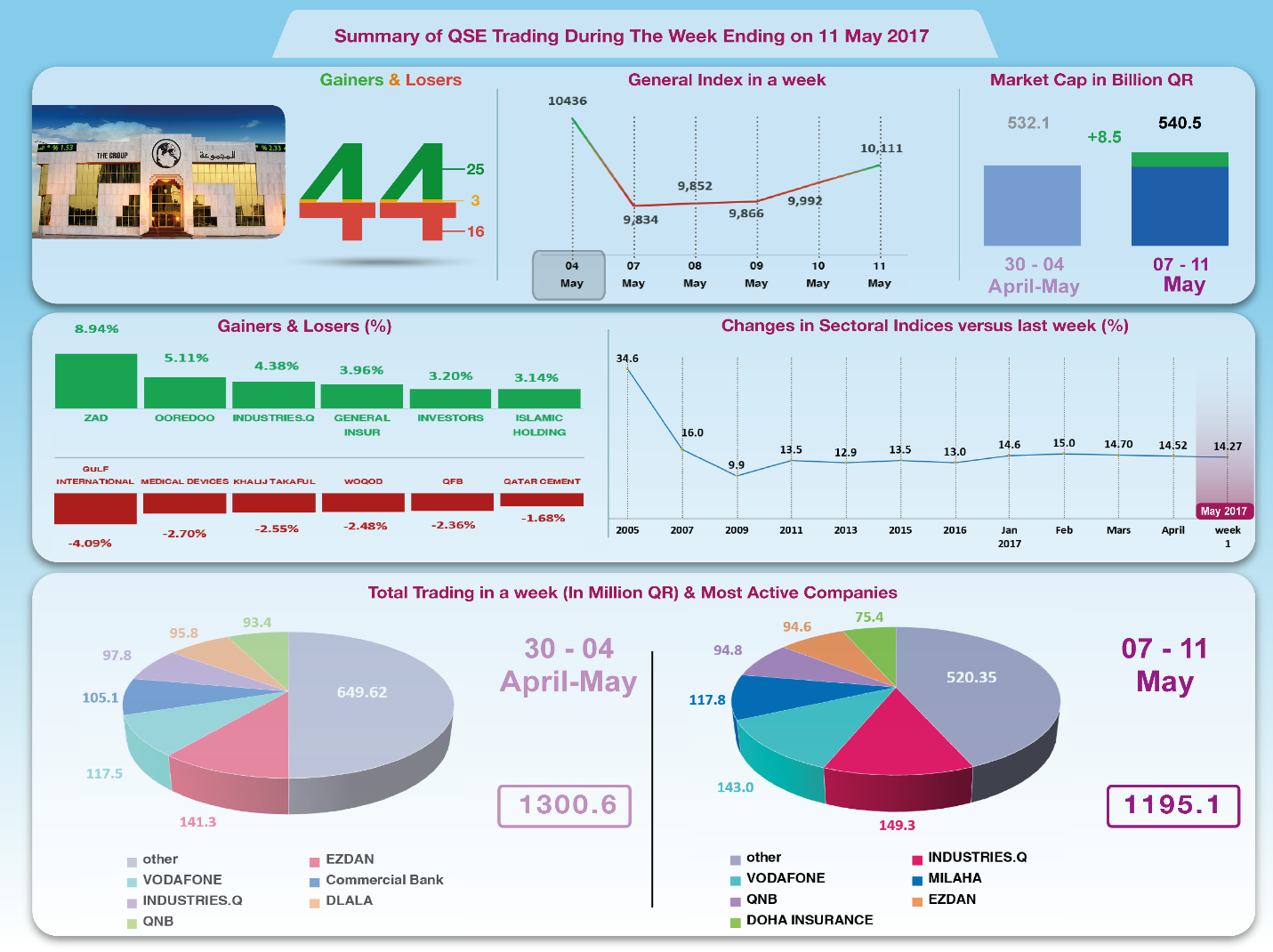

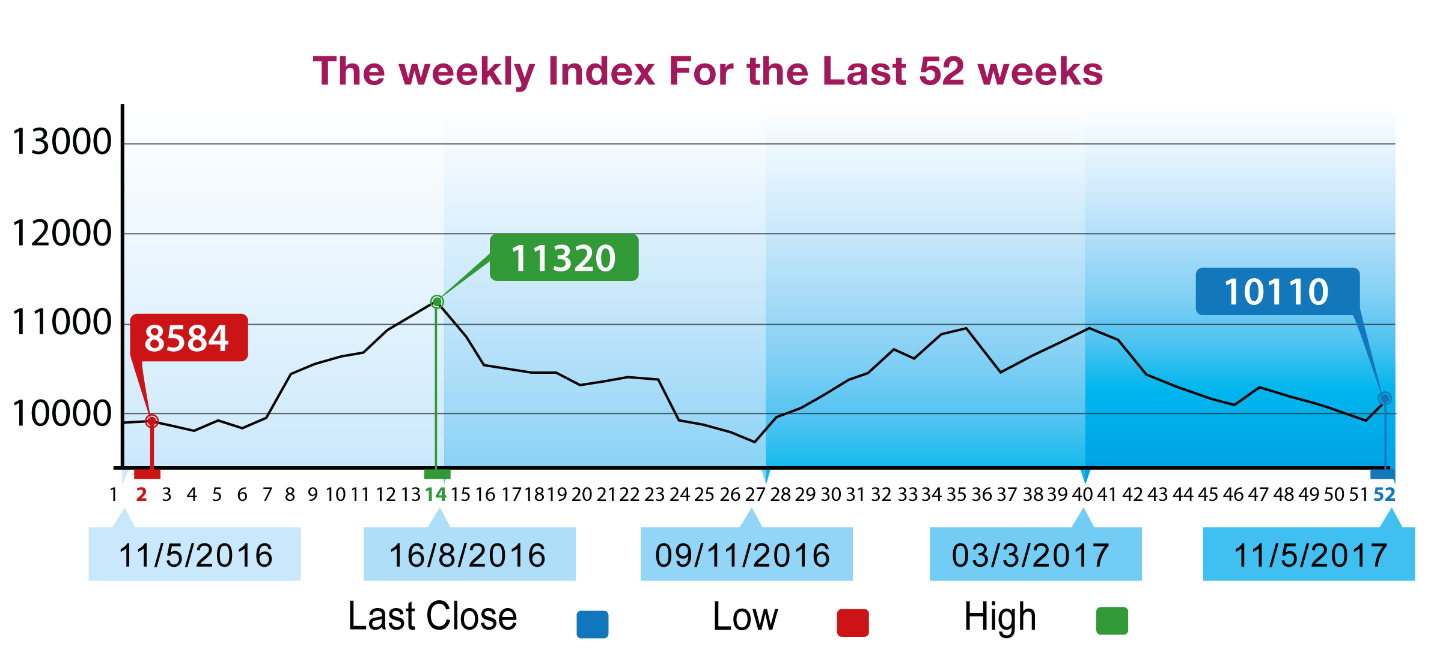

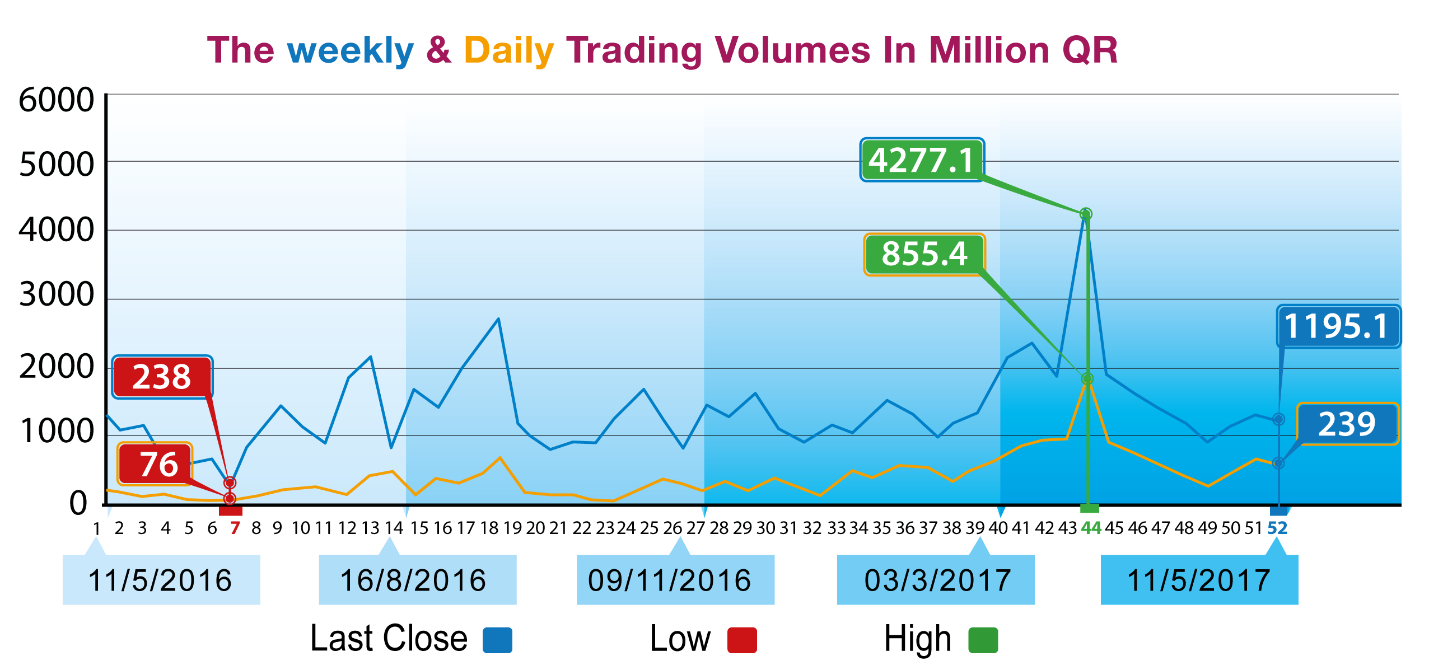

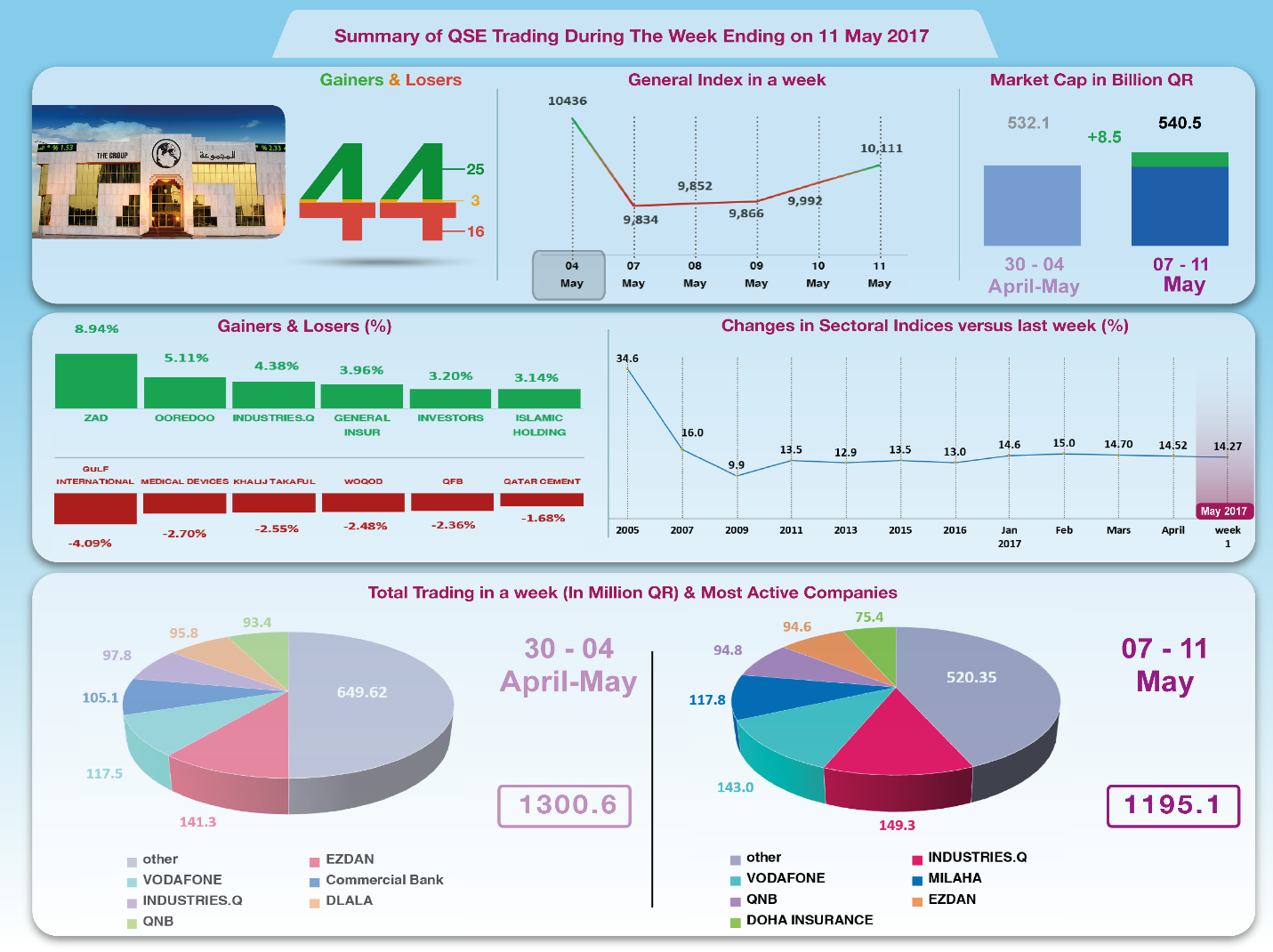

The stock market rebounded on the back of improved oil

prices

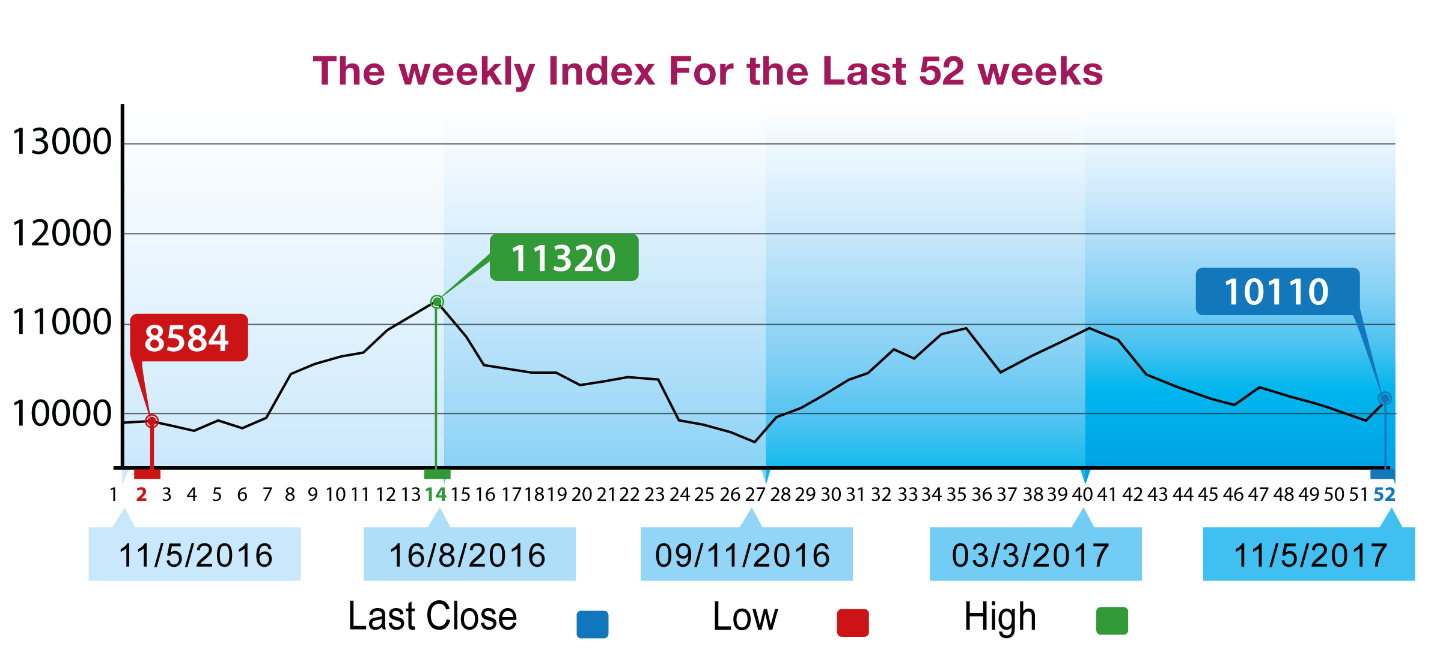

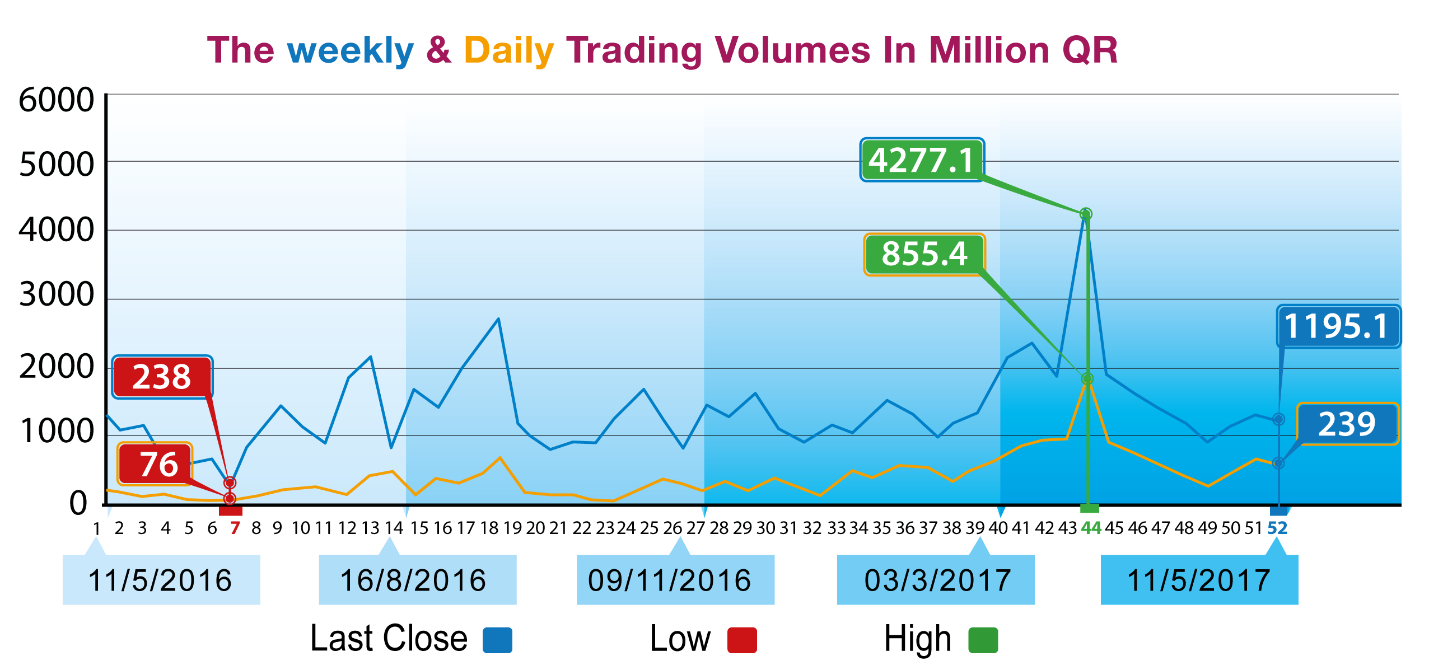

After the stock exchange benchmark index had fallen to below

9900 points last week, it recovered the previous week's losses

and gained 173 points to stand at 10111 points taking advantage

of low-level buying opportunities. The indices also benefited

from the rise in oil prices after US data showed a decline in

oil inventories in the previous week. The rise in the stock

indexes was driven by higher prices of some leading shares such

as Ooredoo and Industries Qatar. At the end of the week, the

market total capitalization increased QR 8.5 billion.

The Group reviews QSE performance in the week ending 11th

May with illustrative charts combined with corporate news and a

list of the affecting economic developments.

Corporate News:

1.

Qatar Islamic Bank (QIB), announced that Moody’s Investors

Service, (“Moody’s”) has assigned a first time rating of A1 with

stable outlook to QIB’s local and foreign currency deposit.

Moody’s cited that the bank has solid asset quality, sound

capital buffers, good profitability, underpinned by its

established and growing retail and corporate Islamic banking

franchise. QIB was able to maintain the ratio of non-performing

financing assets lower than the local market average and total

Capital adequacy of the Bank is higher than the regulatory

minimum requirements prescribed by Qatar Central Bank and Basel

Committee.

2. Qatar Islamic Bank has announced signing of a

Sharia-compliant financing agreement of US $ 925 million

(equivalent to QR 3.4 billion) with Gulf Drilling International

Limited. The Company will use these financing facilities to

improve and develop its financing strategy.

3- Ezdan Holding

Group announced a date change for Extraordinary General Assembly

Meeting. The new scheduled date will be Wednesday, 24/5/2017

instead of 23/5/2017. The meeting will take place at 4:00 pm at

the Ezdan Hotel Towers in Dafna. In the event of an absence of

quorum, it shall be re scheduled on Tuesday 31/5/2017 at the

same place and timing as a second date of the meeting after

obtaining the necessary approvals from the competent authority

on the specific time and place.

4. Doha Bank, in its capacity as the Founder, has announced that

it has reached the final stages of

filing its application

for listing approval for the proposed launch of the QE Index ETF

(QETF). The QETF will invest and replicate the Qatar Index

largest 20 companies in terms of market capitalization and

liquid listings - The crown jewels of Q-Inc. The fund will

replicate the index in performance, net of fees. The fees or

‘Total Expense Ratio’ to be 0.50%; one of the lowest in Emerging

Markets offerings. The fund will pay an annual dividend, net of

fees, similar to the index; which currently carries a yield of

3.80%. The offering will enjoy easy access, as the investor

needs only an investor number and broker and the ETF will be

easily traded in the secondary market like other current

listings. The Fund also has on boarded a dedicated ‘Liquidity

Provider’ to ensure secondary market liquidity. The fund enjoys

full support from local government and regulators and currently

the bank is raising seed capital to be invested along with the

bank pre-listing.

5. The Constitutive General Assembly

of Investment Holding Group approved the founders' report

on the initial public offering and the procedures for converting

from a limited liability company to a Qatari public shareholding

company and the expenses of such procedures. The company’s

founding was announced and the items of the meeting agenda were

approved. In the founders' report, Mr. Khalid Bin Ghanem, Vice

Chairman of the Board of Directors stated that the shares of

Investment Holding Group will be listed for trading within less

than two weeks from the date of

the Constitutive General Assembly.

Economic Developments:

1. Banks consolidated balance sheet for March were released

showing an increase in total assets / liabilities by QR 18.1

billion to reach QR 1,282.5 billion and a decrease in total

domestic public debt by around QR 13 billion to stand at QR

423.9 billion. Local private sector’s total credit rose by about

half a billion Riyals to reach the level of QR 439 billion.

2. Oil prices rose more than 3% after data from the US Energy

Information Administration showed on Wednesday that crude oil

inventories in the United States last week recorded the biggest

weekly drop since last December. The price of OPEC crude oil

returned to rise at the end of last week and recovered about a

dollar from its losses and closed on Thursday at $ 48.37 a

barrel.

3. Last week, Dow Jones fell 111 points to stand at 20896

points. US Dollar exchange rate against the yen rose to 113.38

yen per dollar and rose to 1.09 dollars per euro. Gold price

settled at $ 1228 an ounce unchanged from the previous week.

|