|

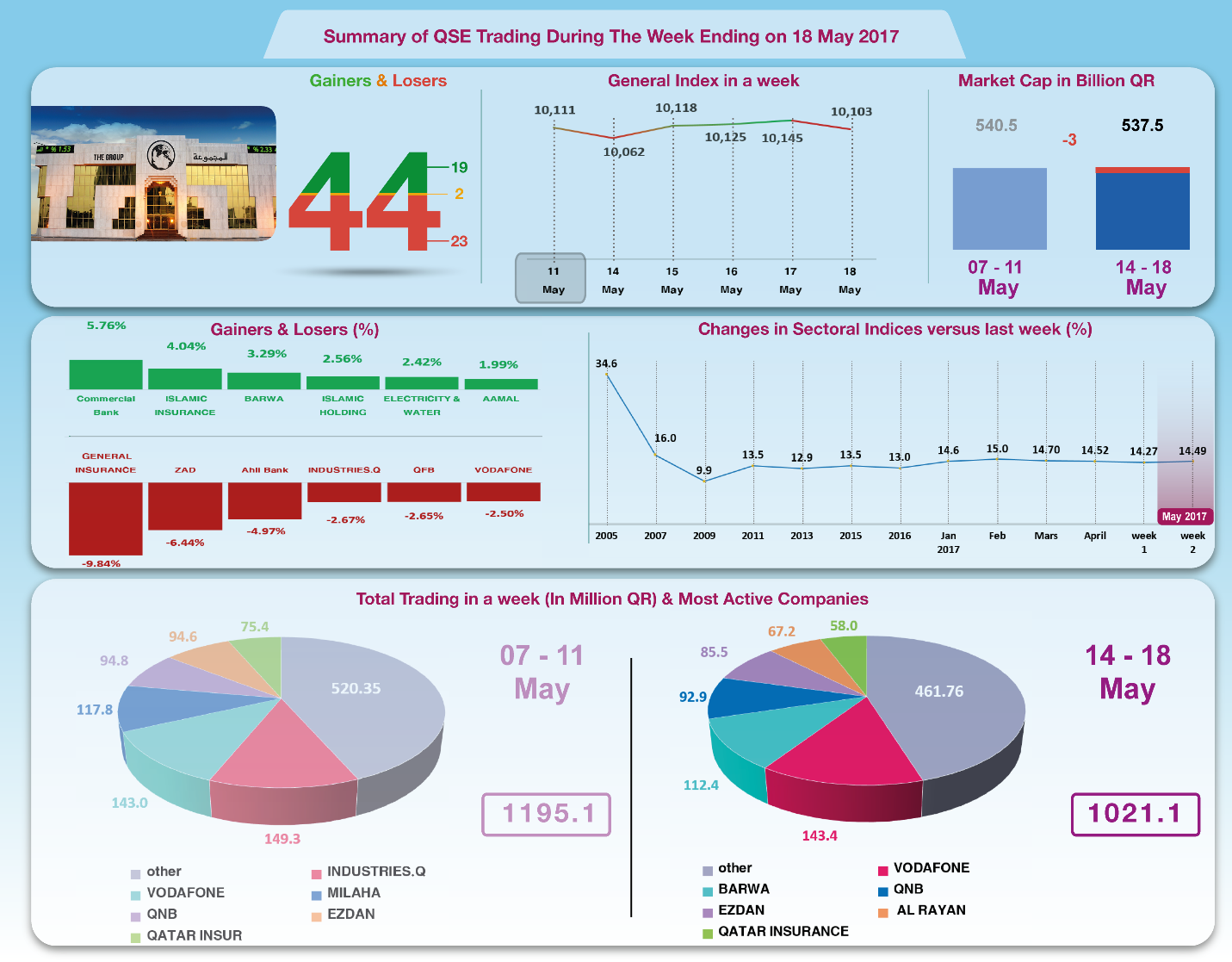

The Group Securities: Weekly Report on QSE Performance,

11-18 May 2017

Qatar Stock Exchange's key indices and others could not manage

to maintain the upward movement of the market, beyond 10100

points. Traders opted for selling to make profit out of it

sudden rise, or otherwise to cover exposure to debt.

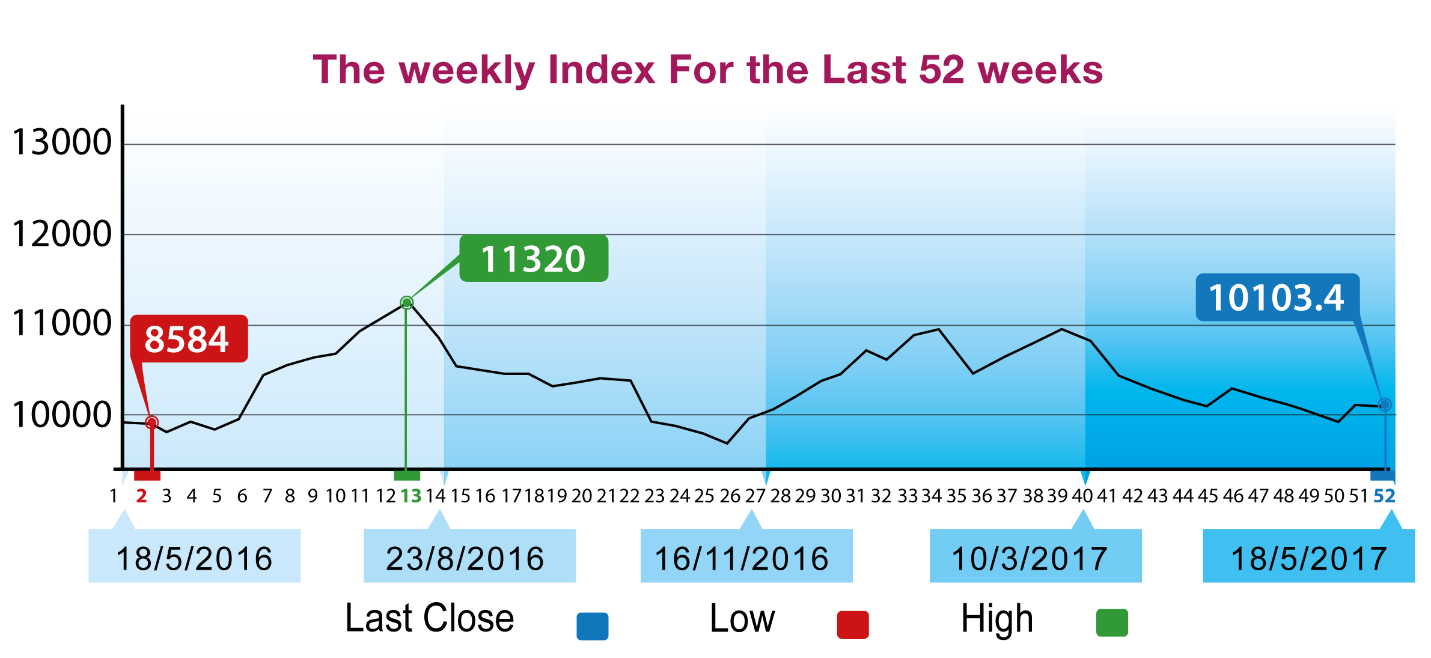

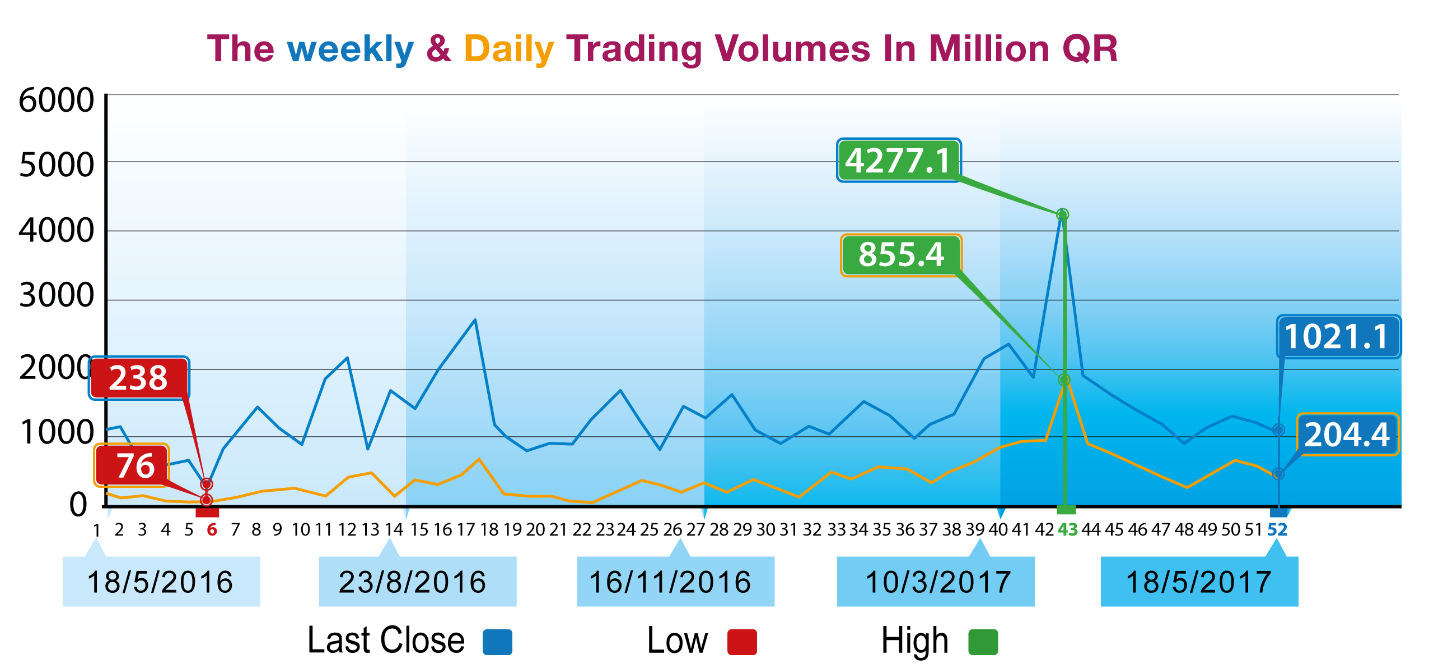

With trading volumes declining to about QR1.02 billion in

a week only, QSE benchmark declined by the end of the week to

the level of 10103 points, slightly down by 42 points compared

to last week. All other indices fell down; total capitalization

decreased by QR 3 billion. The Group reviews QSE performance in

this week with illustrative charts combined with corporate

business news, and a list of the affecting economic factors.

Corporate News:

1-- Vodafone Qatar disclosed its financial statements for the

period ended on 31/03/2017. The statements show that the net

loss is QR (269.2) million compared to net loss amounting to QR

(465.7) million for the same period of the previous year. Loss

per share amounted to QR (0.32) for the period ended on

31/03/2017 compared to loss per share amounted to QR (0.55) for

the same period of the previous year. The Board of Directors

recommended to the Annual General Assembly not to distribute

dividend in order to accelerate investment in coverage and fixed

line opportunities.

Though Vodafone's income declined by 2.85% to QR2059 million in

2016, total expenses fell by 11.4% to QR 1522 million.

Consequently, the company achieved an operational profit

worth QR 536.5 million, up by 33.8% compared to last year.

Deducting amortization and depreciation, financing cost, then

the company's loss drops by 42.2% to QR 269.2 million. Hence,

the accumulative loss incurred since incorporation increased by

11.1% to QR 3.97 billion.

2-- Qatar Islamic Bank (“QIB”), priced a highly successful USD

750 million 5-year RegS only Sukuk offering. The Sukuk was

issued at par with an annual profit rate of 3.251% (payable

semi-annually), representing a spread of 135bps over 5-year

mid-swaps. The transaction represents QIB’s return to the public

debt capital markets, following its USD 750mn Sukuk issuance in

October 2015. Citi, Emirates NBD Capital, HSBC, Noor Bank,

QInvest and Standard Chartered Bank acted as joint book runners

and joint lead managers on the transaction.

3-- Mannai Corporation plans to acquire an additional 29% stake

in 2017 and an additional c. 15% stake in 2018 in Gfi

Informatique from Apax France, Altamir and Boussard & Gavaudan.

Economic

Developments

1-- Banks consolidated balance sheet for March has not been

released, but that of February shows a rise in total assets by

about QR 2.5 billion to stand at QR 1264.4 billion.

The total domestic public debt, including bonds,

increased by about QR 18.1 billion to QR 436.9 billion, while

the total domestic private sector deposits fell by QR 2.1

billion to the level of QR 439 billion.

2-- The Ministry of Development Planning and Statistics (MDPS)

has released the Consumer Price Index (CPI) for the month of

March 2017. Data shows that the annual inflation rate increased

by 0.9% when compared to CPI of 0.7% in February; 1.2% in

January; 1.8% December; 2% in November and 2.2% in October 2016.

3-- Last week, OPEC oil prices recouped 1.5 dollar, closing at $

49.87 per barrel on Thursday.

4-- Last week, Dow Jones index lost 91 points to reach the level

of 20805 points. US Dollar exchange rate increased to the level

of 111.26 yen, and $ 1.12 per Euro. Gold price increased by 28

dollars to the level of $ 1256 per ounce.

|