|

The Group Securities Weekly Report on QSE Performance,

21-25 May 2017

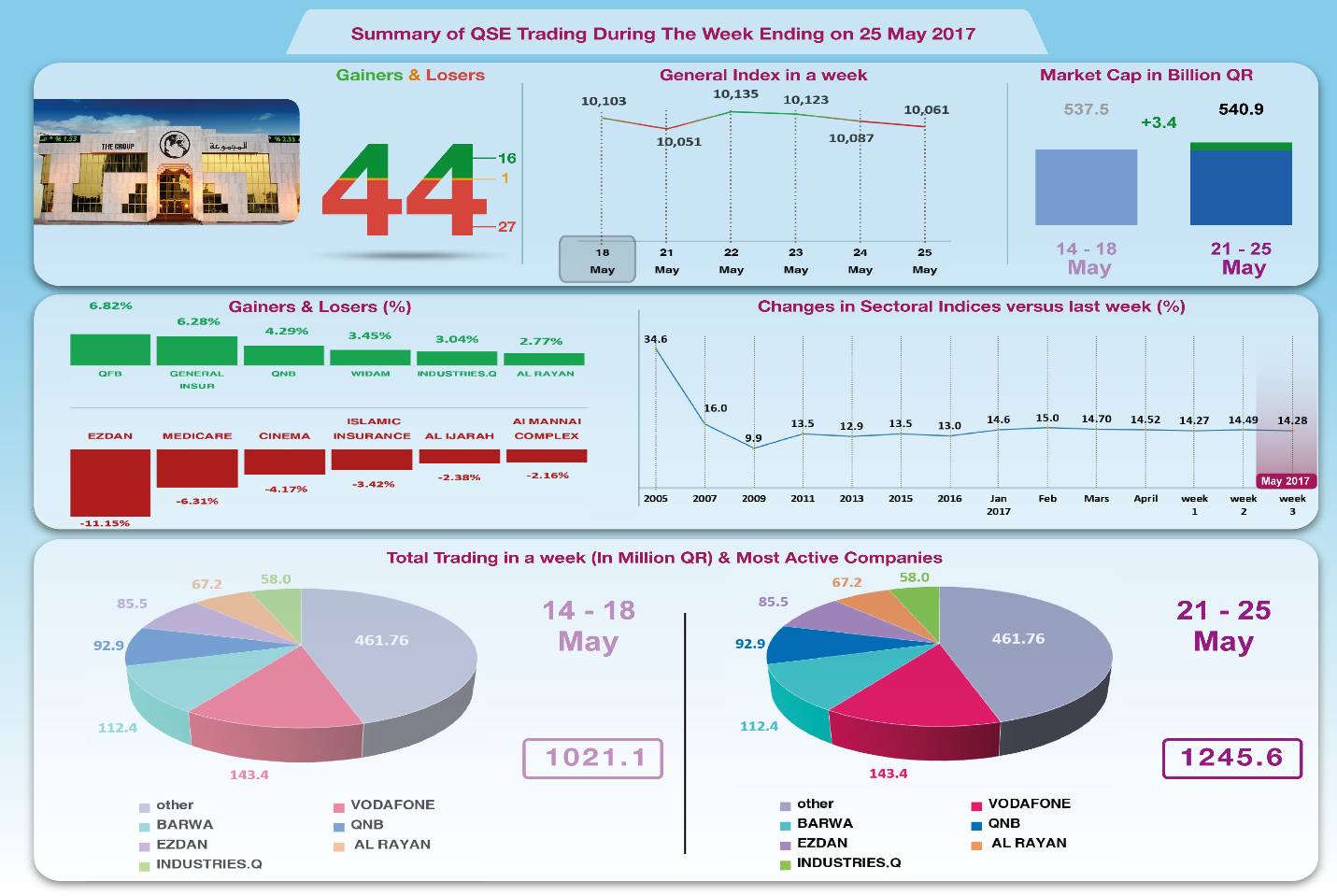

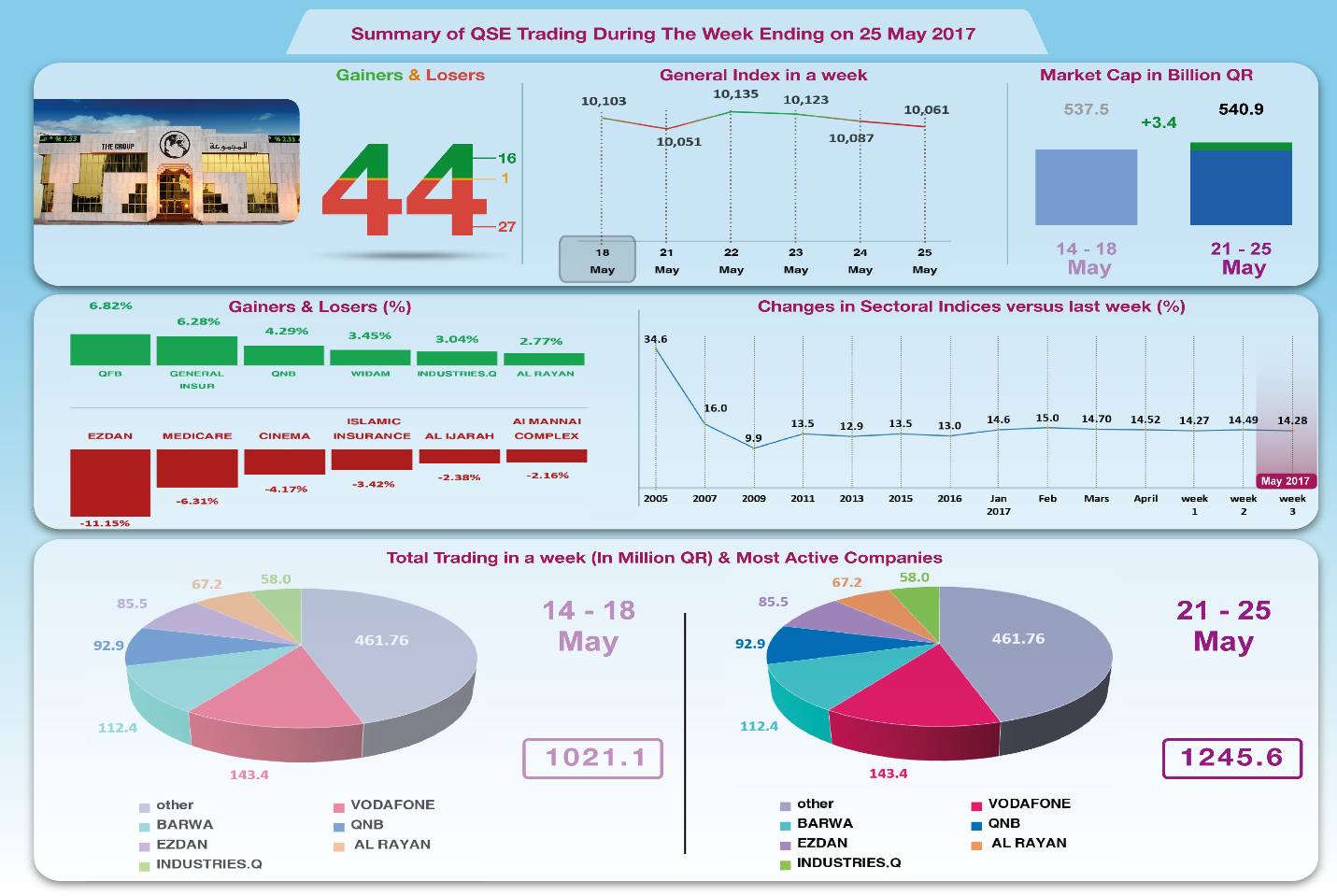

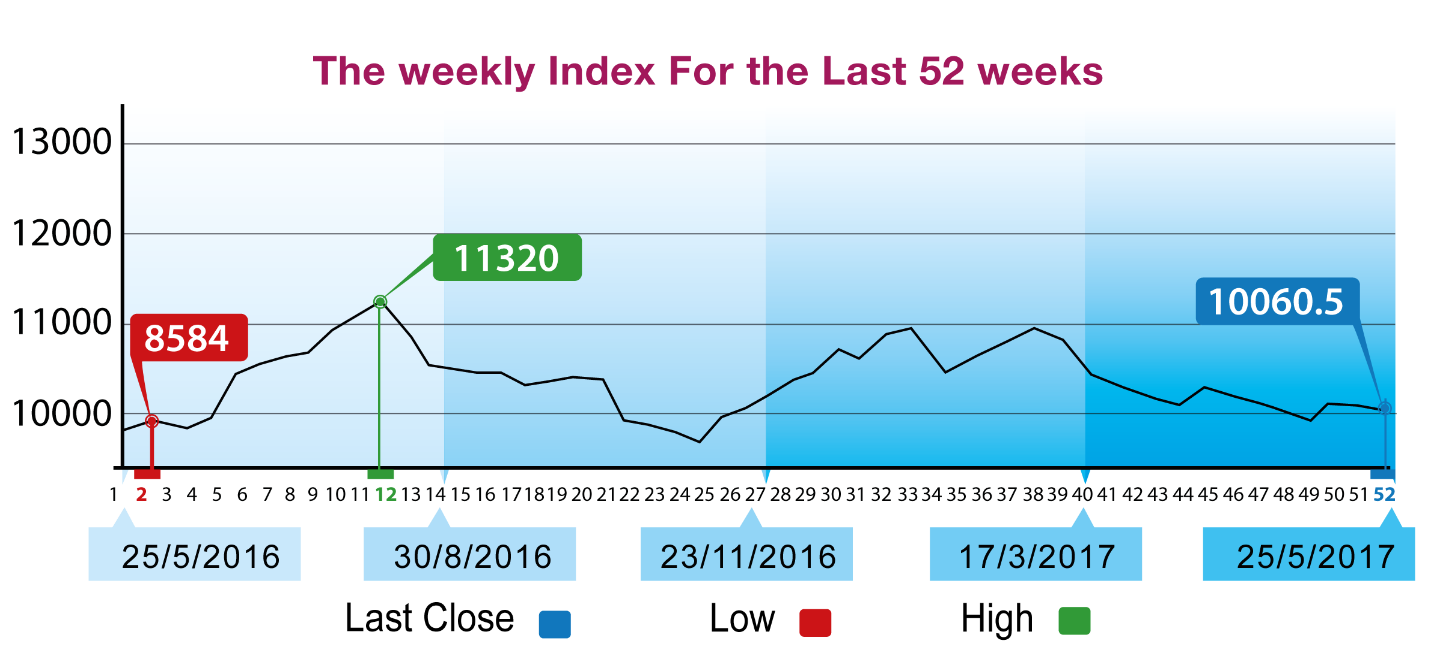

Various factors contributed to a drop in

the stock exchange indices

The decision taken by the extraordinary general

assembly meeting of Ezdan Holding Group to

convert into a private joint stock company had

a negative impact on the company's share price which fell by

more than 11% in addition to affecting the stock indices,

particularly Al Rayan Islamic Index. The other conditions were

somewhat helpful, especially the rise in the price of OPEC oil

until Thursday to $ 52 a barrel before returning to a slight

decline as OPEC and Russia failed to reach an agreement to

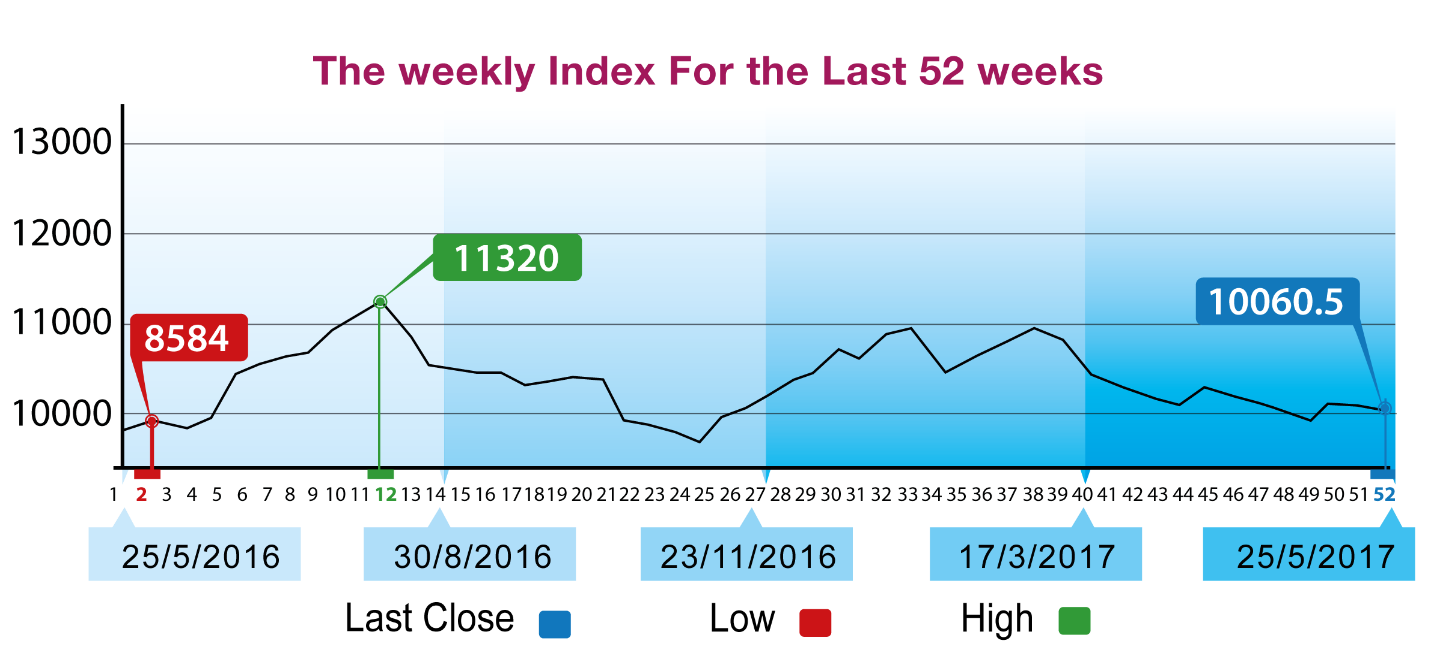

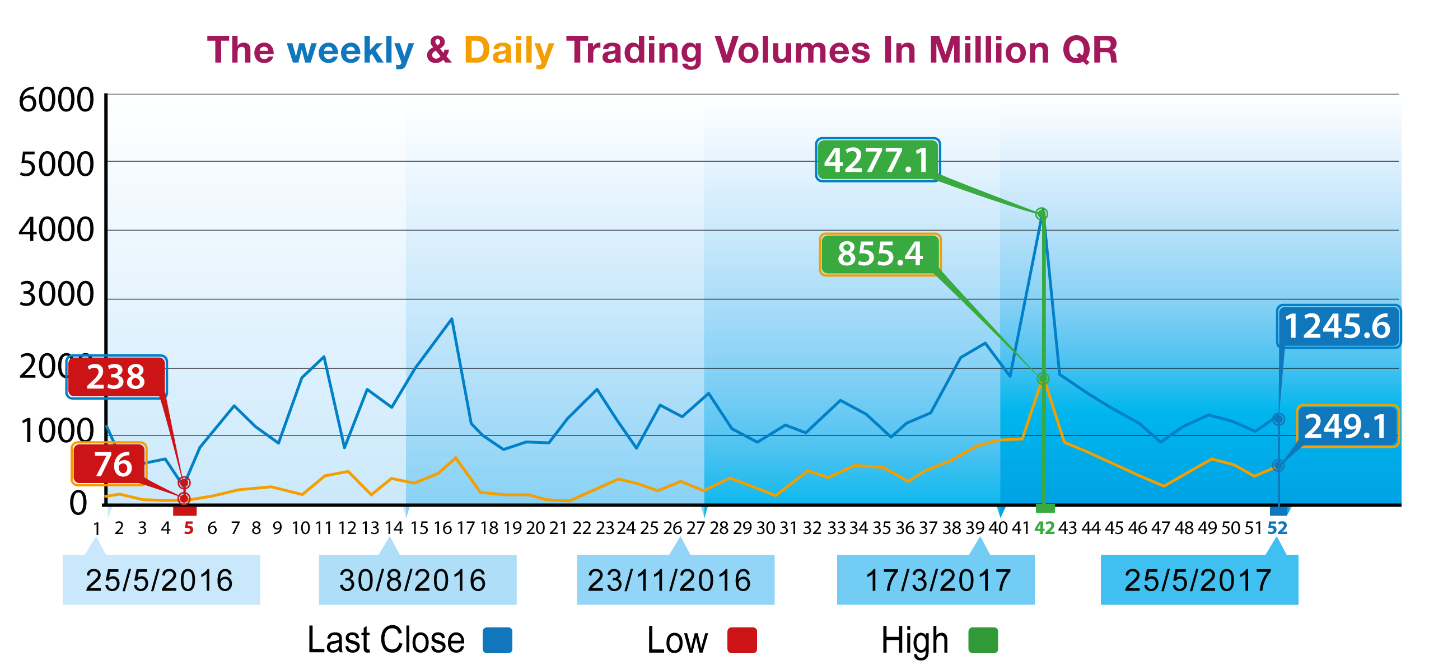

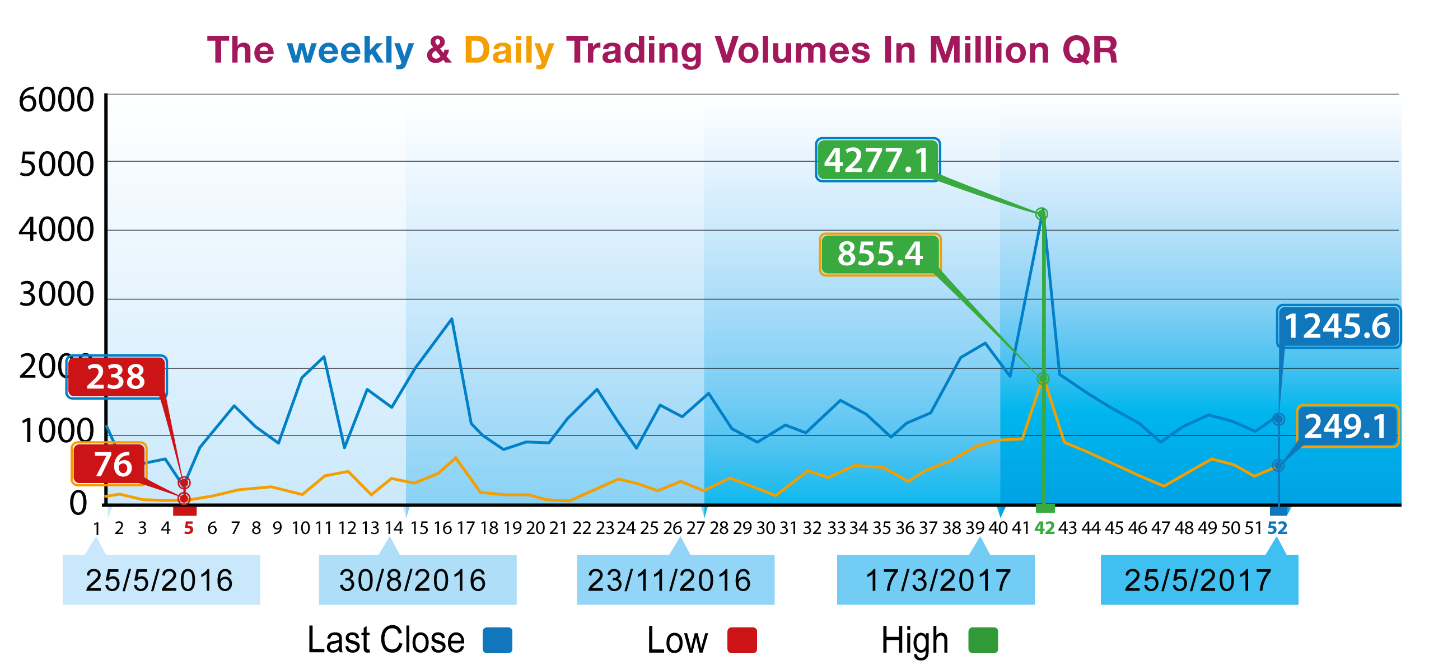

extend production cut. The rise in total trading volume in a

week by the rate of 22% to QR1.25 billion was also positive. The

benchmark index dropped to 10061 points while the sectoral

indices witnessed various situations in which the real estate

index dropped 7.8% while the banking sector index rose by 2.63%

due to the return of Masraf Al Rayan share price to rise. Total

capitalization increased QR 3.4 billion to QR 540.9 billion. It

was noted that the Qatari portfolios were the sole net buyers

versus all other categories and bought for QR 100.1 million.

The Group reviews QSE performance in the week ending 25th

May with illustrative charts combined with corporate news and a

list of the affecting economic developments.

Corporate News:

1. The Extraordinary General Meeting of Ezdan Holding Group

approved the conversion of the company from a public joint stock

company to a private joint stock company with more than 75% of

the attendees. The meeting was attended by 2.51 billion shares

representing 94.96% of the company's capital. The Board of

Directors has authorized the appointment of an evaluator to

arrange a financial statement of the Company's assets,

liabilities and the approximate value thereof together with the

fair value of the share as at 30/4/2017 to be presented to the

shareholders at a subsequent meeting for approval. The Board of

Directors has also been authorized to prepare a draft amendment

to the Company's Articles of Association to conform to its

proposed type of private joint stock company to be presented to

shareholders at a subsequent meeting for approval. The

shareholders who object to the transfer decision shall apply for

the withdrawal within a period of no more than 60 days from the

date of the initial approval of the decision to transform the

company into a private joint stock company.

2- Barwa Real Estate Company announced

signing of contract for the construction of phase 2 of

Madinat Al Mawater with INSHA Co.-W.L. L that has also developed

phase one of the project. The contract value amounts to

QR112,500,000 and with a construction duration of 12 months so

as to meet the growing leasing demands on the project.

3.

Qatar Islamic Bank (QIB), announced the opening of a new branch

at one Doha Festival City. The new branch will have extended

working hours throughout the week and will operate from Saturday

to Thursday from 9:00 am to 2:30 pm, from 3:30 pm to 9:00 pm and

from 4:00 pm to 9:00 pm on Friday.

4 -

Al

Meera Consumer Goods Company has opened the doors to its new

Community Shopping Mall in Leaibab. The launch marks the

inauguration of one of the largest Al Meera supermarkets in

Qatar and it is the last shopping center to launch in the

Company’s five-store phase of its 14-branch expansion plan.

Economic Developments

1. Banks Consolidated Balance Sheet of April has been released

showing a rise in total assets / liabilities by QR 25.6 billion

to QR 1308.1 billion and a rise of QR 40.5 billion in total

domestic public debt, including bonds, to reach QR 464.4

billion. The private sector credit rose QR 0.1 billion to stand

at QR 439.1 billion.

2. Last week, OPEC crude oil returned to rise and gained $ 1.37

closing at $ 51.24 a barrel on Thursday.

3. Last week, the Dow Jones rose 275 points to 21080 points. USD

exchange rate stood at 111.33 yen per $1 and $ 1.12 per euro.

Gold price rose about $ 10 to $ 1266 per ounce.

|