|

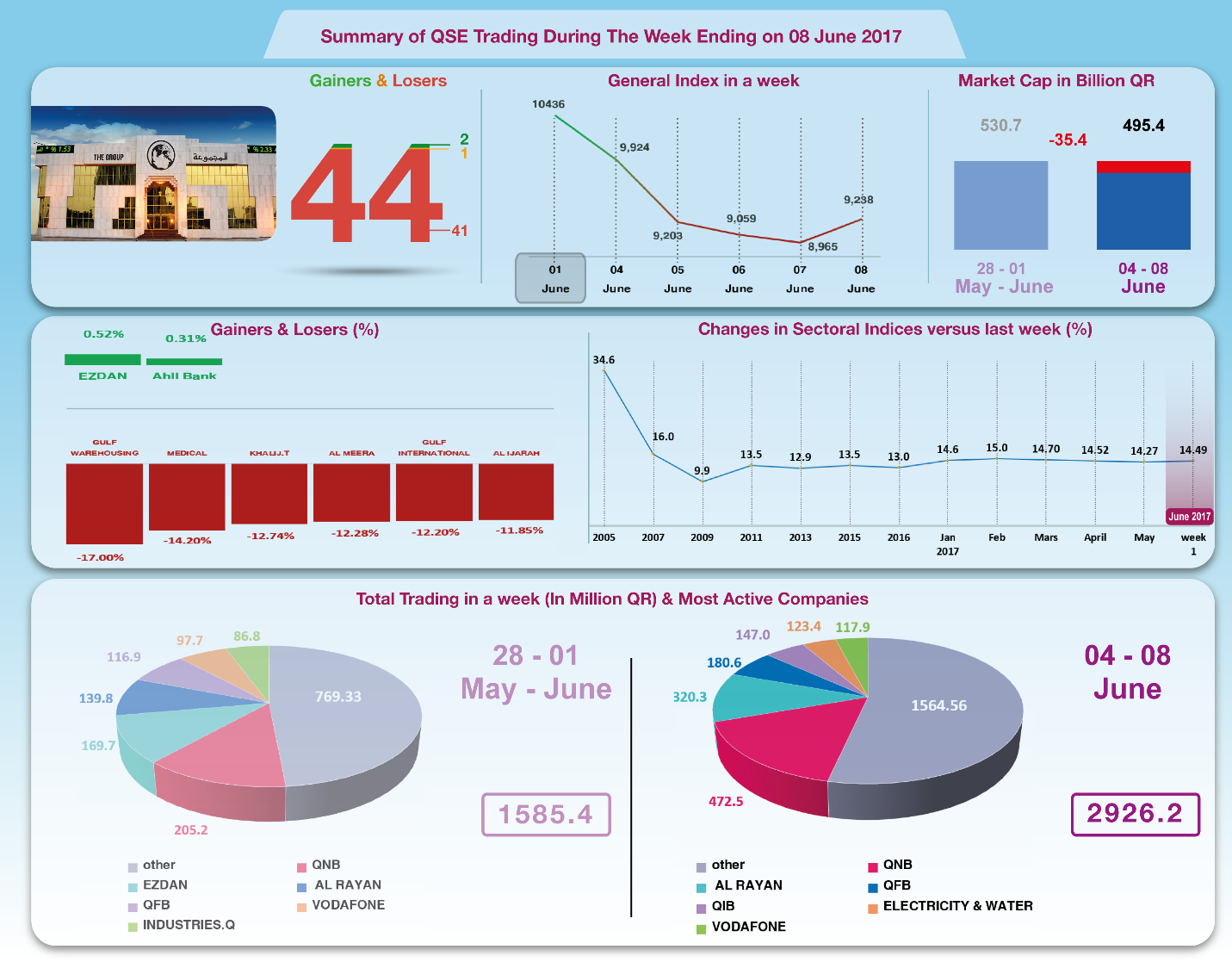

The Group Securities: Weekly Report on QSE Performance,

04-08 June 2017

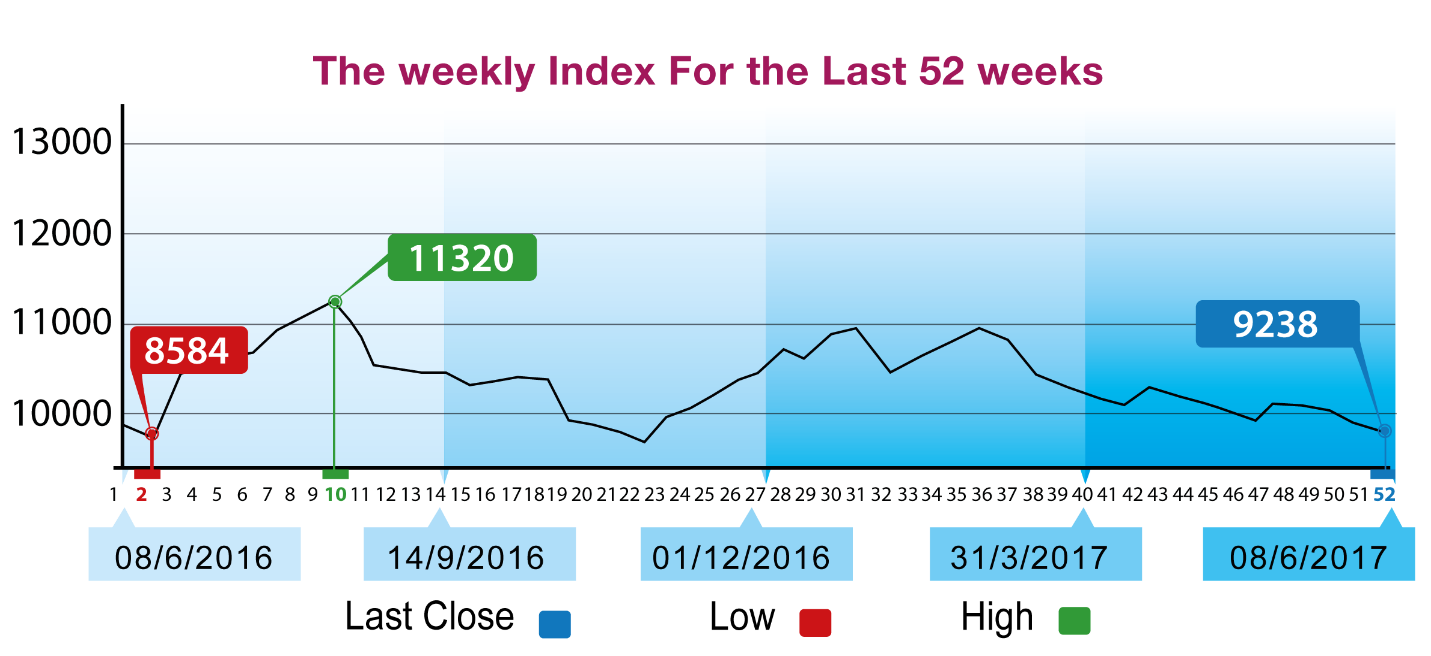

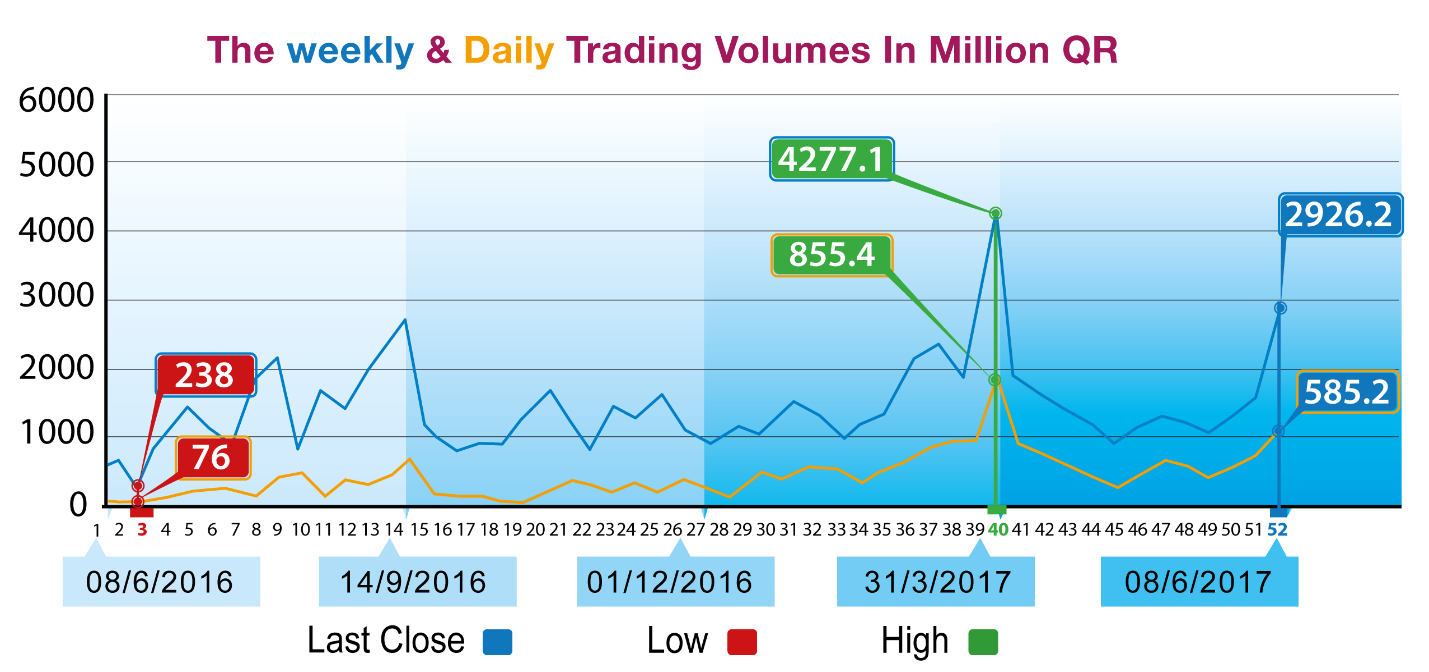

In

light of extraordinary circumstances, QSE's indices fluctuated

vehemently over the last week, namely because of the political

spat between Gulf countries and Qatar, as well as the decline of

oil prices. Oil prices fell by 2 dollars to the level of 46

dollars per barrel, though politics was the factor that strongly

affected QSE trading. Stock prices slid sharply at the beginning

of the week, over two days, before recovering in the following

days. Foreign portfolios dominated sale transactions with a

total of QR 653 million, as against net buy by Qatari

portfolios. As result total trading increased by QR3 billion.

General index lost around 702 points. Other sectoral indices

also declined. Total capitalization lost around QR 35.4 billion.

Price-earnings ratio fell 13.04 times the original price.

The Group reviews QSE performance in this week with illustrative

charts combined with corporate business news, and a list of the

affecting economic factors.

Corporate News:

1-- Qatar Stock Exchange announces trading suspension on Qatar

Fuel Company (WOQOD) on Tuesday, 06 June 2017 due to its EGM

being held on that day. The company approved exempting the state

of Qatar, Qatar Foundation for Education, Science and Community

Development, Qatar Investment Authority and Qatar Holding

Company from the requirement for maximum limit of company shares

ownership, provided for by Article (9-1) of the Articles of

Associations, specifying the maximum ownership limit at 0.000333

of the share capital, currently equaling (33.140) shares. he

amendments included increasing the membership of the Board of

Directors from 7 members to 9 members, by giving the National

Retirement & Social Insurance Fund the right to appoint 2 more

Board members, maintaining Qatar Petroleum right to appoint 3

members including the Chairman and the Vice Chairman, and also

the General Assembly right to elect 4 members.

3-- Mannai Corporation and Woqod announced the results of their

Board of Directors’ (BOD) meeting held on 6 June, 2017 and

discussed administrative and financial matters relating to

operations of the Companies.

4-- Qatari Investors Group discloses the judgment in favor of

the Company for Case No. 394/2017, filed by Shatea Al Nile

Company (Ezdan Holding) against Qatari Investors Group, request

to approve the plaintiff as a second spare Board Member of the

Board of Directors of the defendant’s company in the Board

Elections held on 7/11/2016 for the three years (2017, 2018,

2019) and compel the defendant to pay the expenses for the

reasons stated in the lawsuit.

Economic

Developments

1--

Qatar's central bank announced the result of the

Treasury Bills auction held on 1 June 2017. All of the three-,

six- and nine-month bills on offer were sold, with bids totaling

QR 690 million riyals.

2-- Banks Consolidated Balance Sheet of April has been released

showing a rise in total assets / liabilities by QR 25.6 billion

to QR 1308.1 billion and a rise of QR 40.5 billion in total

domestic public debt, including bonds, to reach QR 464.4

billion. The private sector credit rose QR 0.1 billion to stand

at QR 439.1 billion.

3-- Last week, oil prices fell by 4% after US data revealed an

increase in its crude oil stockpile, which spurred fears about

the ability of OPEC members' agreement to cut the gut. OPEC oil

continued its decline, losing 3.6 dollars per barrel, and closed

on Thursday at the level of QR 45.78 dollars per barrel.

4-- Last week, Dow Jones index gained 66 points to reach the

level of 21272 points. US Dollar exchange rate stood at the

level of 110.36 yen, and $ 1.12 per Euro. Gold price increased

by 12 dollars to the level of $ 1269 per ounce.

|