|

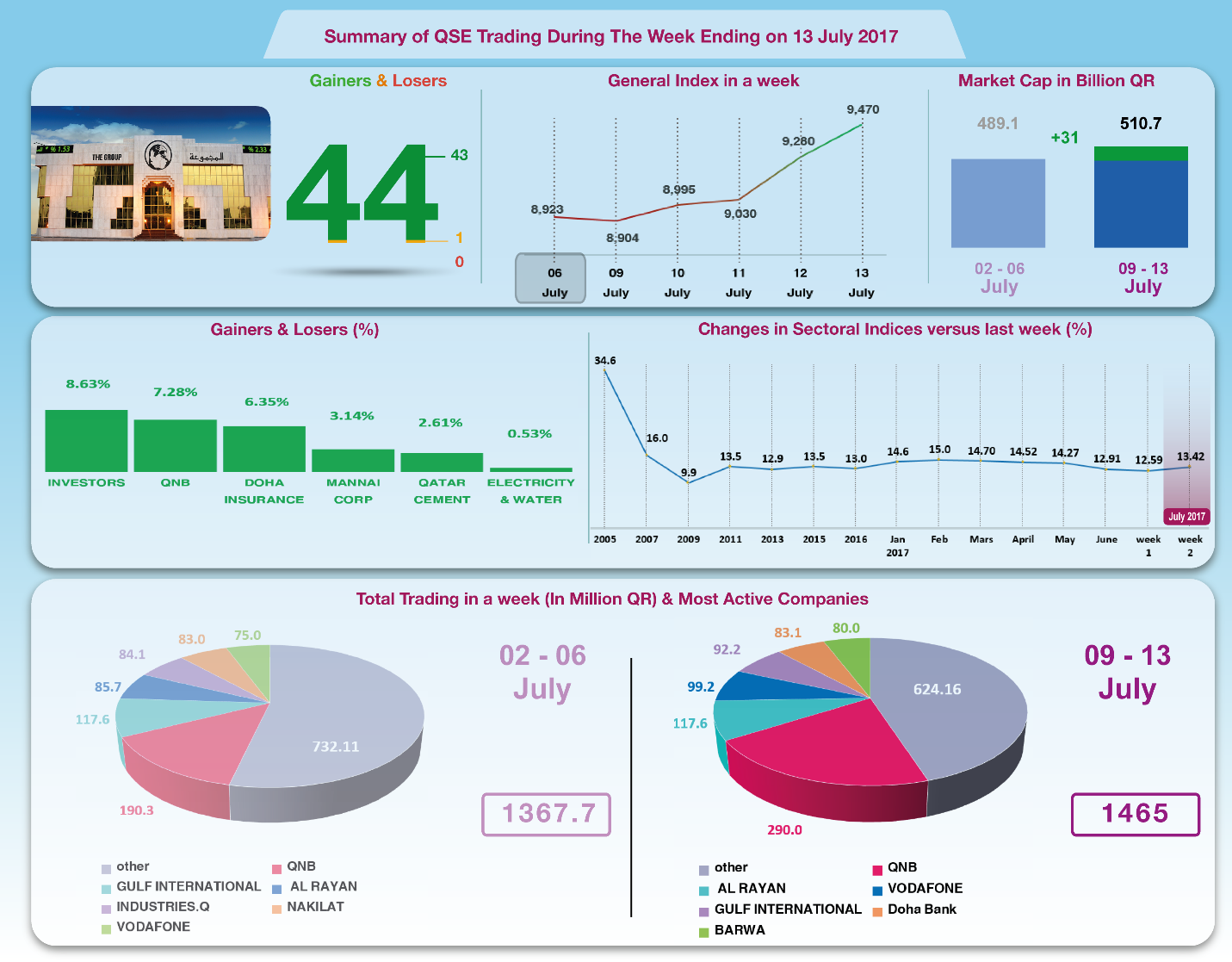

The Group Securities: Weekly Report on QSE Performance,

09-13 July 2017

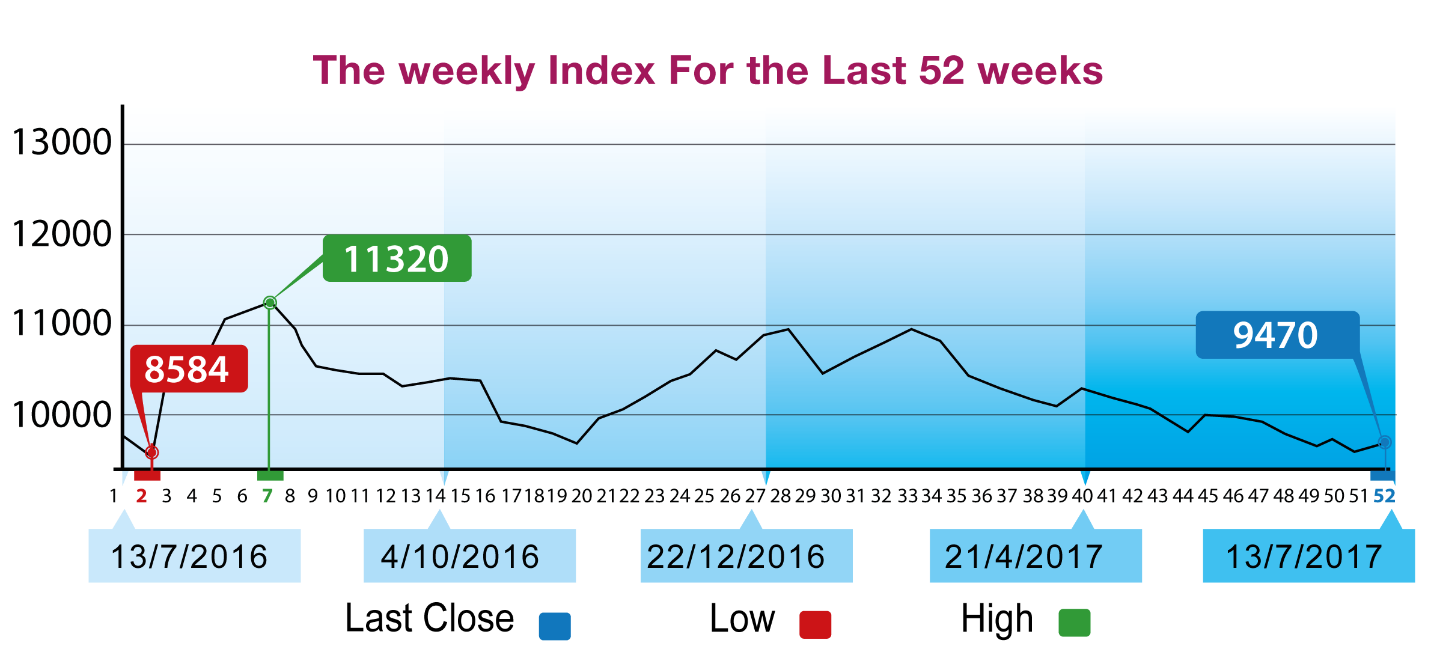

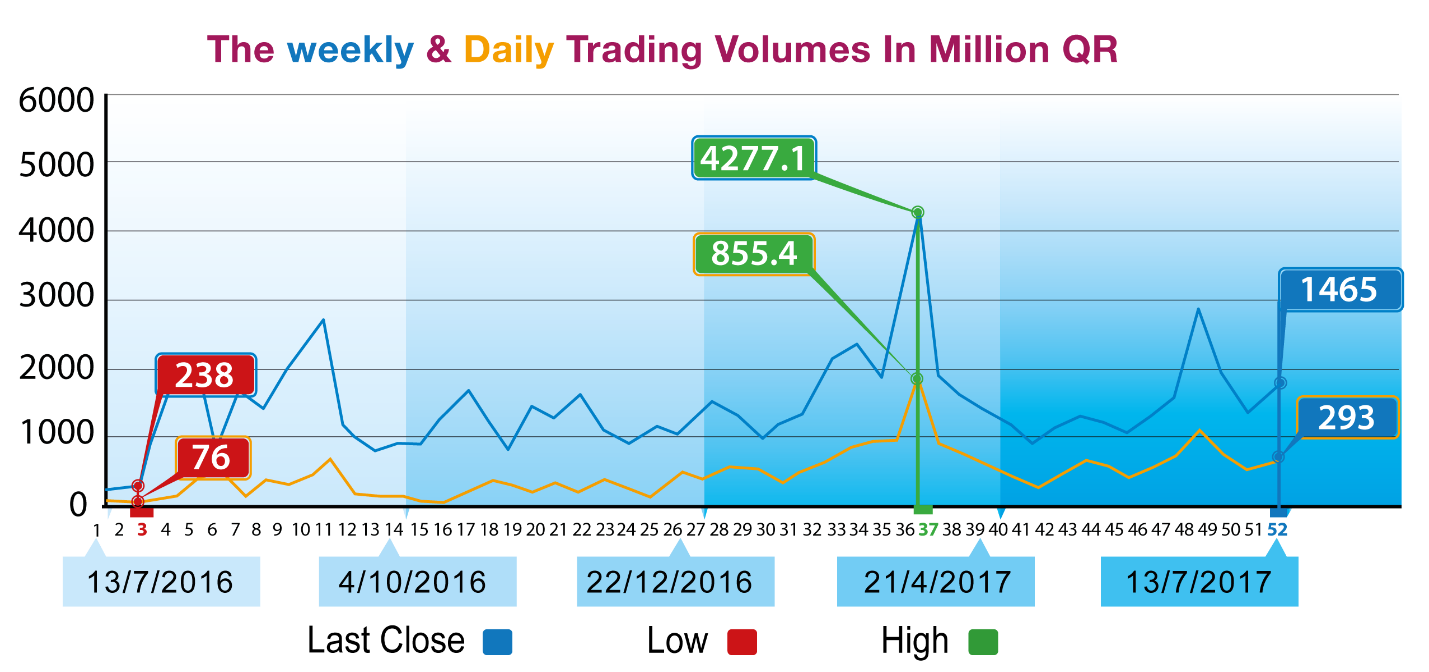

The fact that Qatar emerged victorious from the

blockade crisis, after the failure of the blockading countries

to take any further escalating measures against Qatar, had

positive impact on Qatar Stock Exchange. Trading refreshed and

the prices of most of the key stocks increased remarkably;

namely those of Qatar investors, QNB, and Al Mannai. No

company's share price declined. Hence, indices increased,

including general index which gained 547 points, or 6.13% to the

level of 9470 points. Total capitalization increased by QR 31

billion. The Group reviews QSE performance in this week with

illustrative charts combined with corporate business news, and a

list of the affecting economic factors.

Corporate News

1-- Islamic Holding Group's

income remained steady at 5.28 million in the first half of

2017, with no significant change compared to last year. The

company posted profit of QR 3.91 million from brokerage and

commissions, compared to QR 4.58 million in the same period last

year. Profit from deposits increased to QR1.3 million.

Expenses increased by 3.7% to QR 4.5 million.

Consequently, net profit dropped by 19.3% to QR 769.8 thousand.

There was a decline in the fair value worth QR 482.5 thousand,

which reduced the comprehensive income to 287.3 thousand.

2-- QNB's operational income declined by 3.8% to

QR11.13 billion in the first half of 2017, including QR 8.6

billion as interests and QR1.78 billion as commission fees.

Total expenses dropped by 17.4% to QR 3.93 billion, including

QR1.67 billion for staffing. As result, net profit attributable

to shareholders increased by 6.5% to QR 6654 million.

There was a limited change in the fair value of

investment, with a loss worth QR 512.7 million, compared to QR

2427.3 million in the same period last year. Hence,

comprehensive income increased by 58.8% to QR6 billion compared

to QR 3.8 billion.

3-- Qatar International

Islamic Bank (QIIB) has announced that the international credit

rating agency Moody's has affirmed QIIB's rating for the second

consecutive year at A2, which is a sign of strength of the

bank's financial position. Moody’s decision to affirm the

ratings of QIIB reflects the resilience in the bank’s financial

performance underpinned by continued strong asset quality and

capital buffers

4-- Ooredoo announces that

Moody’s Investor Service has affirmed the A2 long-term issuer

rating of Ooredoo Q.S.P.C. (Ooredoo. Moody’s stated that the

affirmation of the A2 ratings with a stable outlook reflects

Ooredoo's robust standalone credit profile with around 70% of

EBITDA generated outside of Qatar in 2016. Moodys also noted

that Ooredoo's credit profile continues to benefit from the

support and rating uplift offered by the Government of Qatar,

which owns 68.6% of the company through direct and indirect

holdings.

5-- Barwa Real Estate Group

has announced the signing of the leasing contract for its

project; Mustawdaat in Umm Shahrain area, with Mohammed Hayil

Group for Trading and Contracting WLL. The contract is for a

period of 10 years and a half starting from the first of October

2017, with a total rental value of QR 755 million over the

duration of the contract. The Tenant shall operate, maintain and

lease the project during the contract term.

Economic

Developments

1-- Banks consolidated

balance sheet for May has been released. The data shows a rise

in total assets by about QR 5.4 billion to stand at QR 1313.5

billion. The total

domestic public debt, including bonds, decreased by about QR 6.8

billion to QR 457.6 billion, while the total domestic private

sector deposits increased by QR 2.5 billion to the level of QR

441.6 billion.

2-- OPEC oil prices

decreased again and settled at the level of 46.66 dollars by the

end of week, down by 0.86 dollars.

3-- Last week, Dow Jones

index gained 224 points to reach the level of 21638 points. US

Dollar exchange rate decreased to the level of 112.54 yen, and $

1.15 per Euro. Gold price decreased by 16 dollars to the level

of $ 1228 per ounce.

|