|

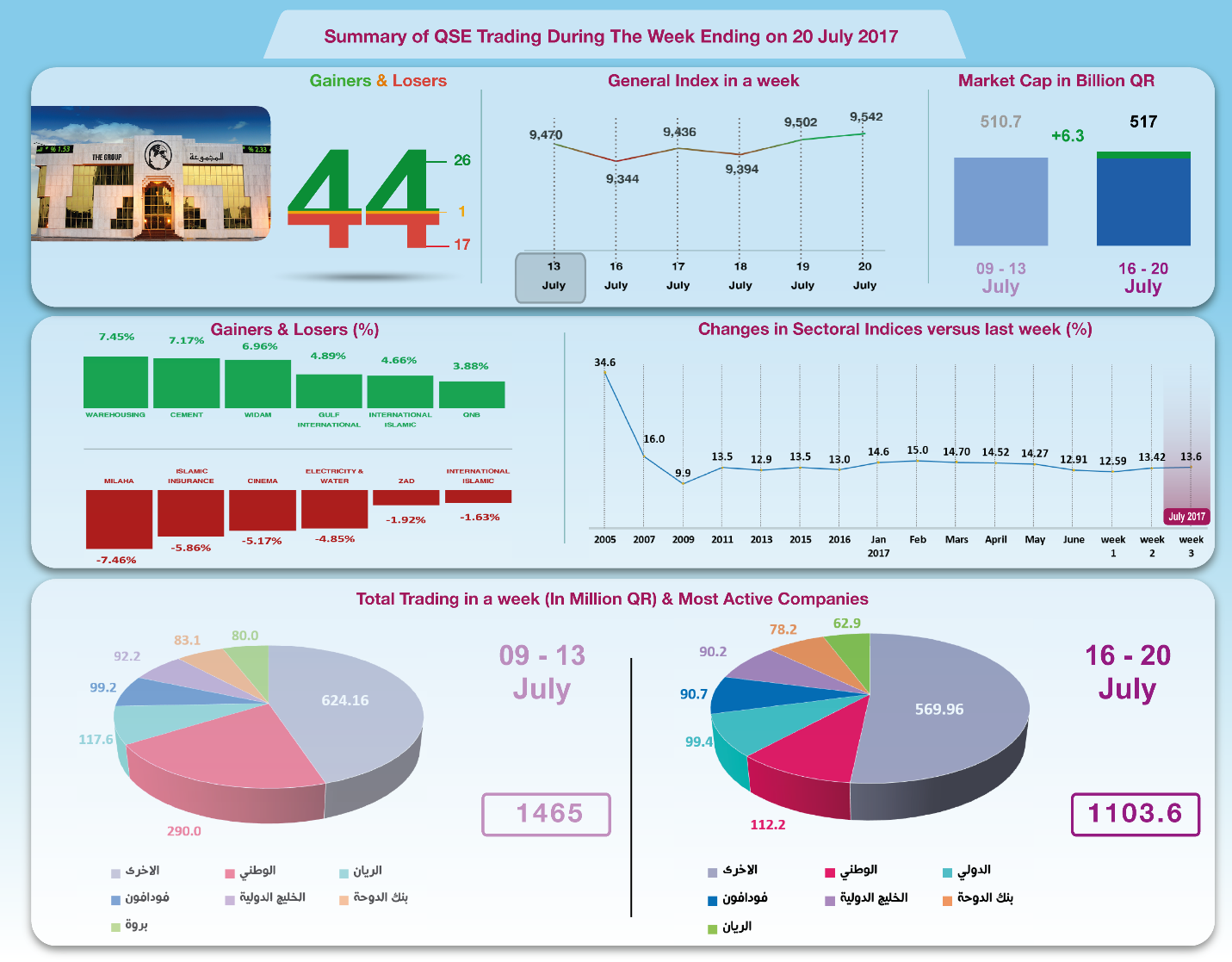

The Group Securities: Weekly Report on QSE Performance,

16-20 July 2017

QSE performance remained relatively steady over the last week,

as most prices remained with no significant change. Concerning

oil, prices marginally increased to hit 47 dollars per barrel.

GCC crisis has not come to an end yet, though Qatar seems in

favorable position. Meanwhile, eight companies announced their

financials for the first half of this year. Widam and QIB

increased their profit; Al Rayan, Al Khaliji and Al Ahli

maintained their profit at a stable level; while CBQ, UDCD and

General Insurance saw a decline in their profit. In light of

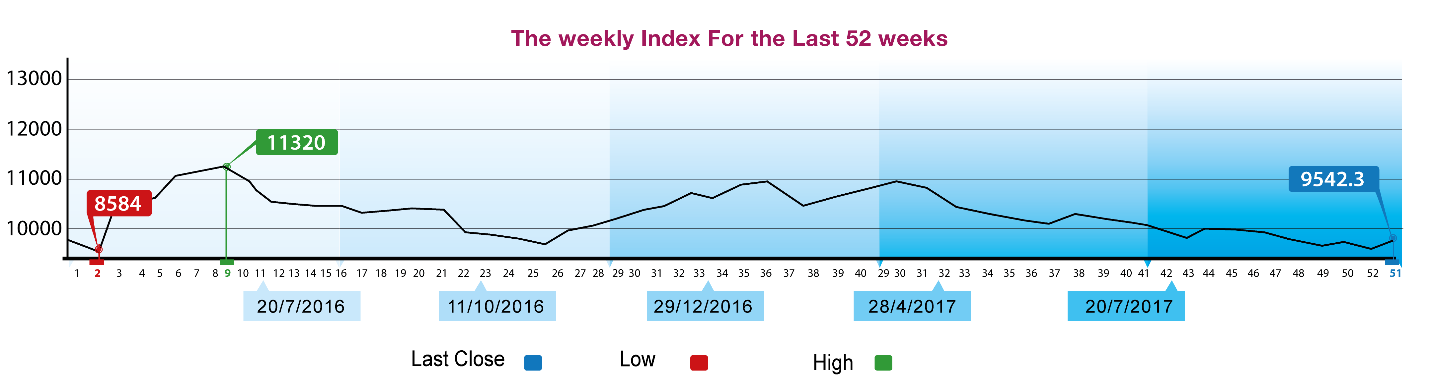

these developments, General Index rose by 72 points to the level

of 9542 points. Five sectoral indices increased, namely banking

sector by 2.12%; while transportation and industries indices

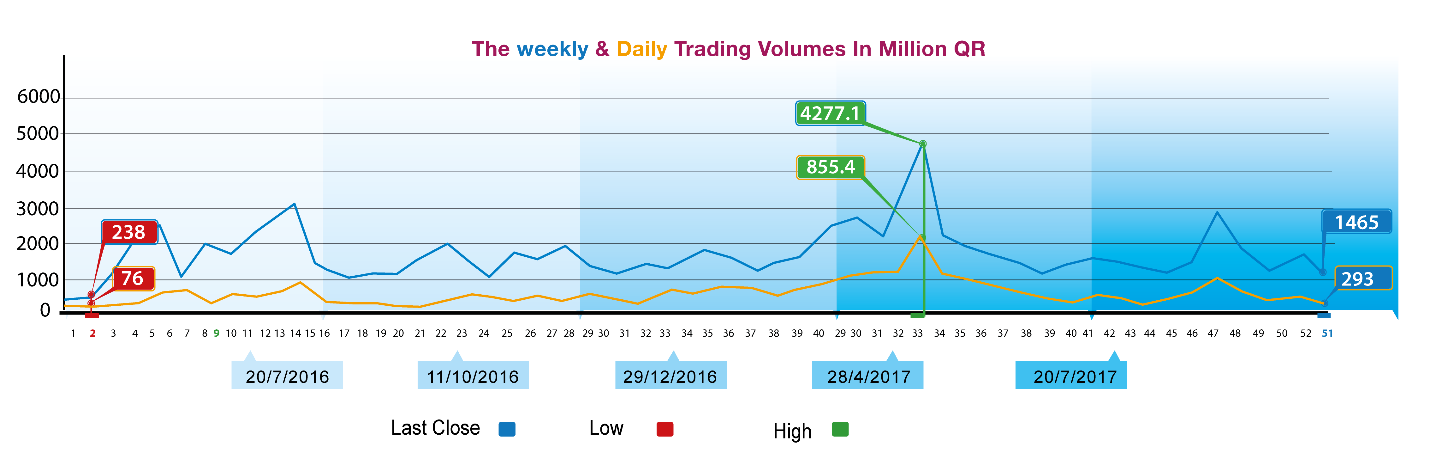

fell down. Qatari portfolios dominated net buy transactions,

while trading volumes shrunk by 24.75%. Total capitalization

increased by QR6.3 billion. The Group reviews QSE performance in

this week with illustrative charts combined with corporate

business news, and a list of the affecting economic factors.

Corporate News:

1-- Masraf Al Rayan's total income increased by 9.4% to QR2061

million, including QR 1848.5 million as investments and

financing revenues. Total expenses dropped by 13.8% to 469.9

million, including 167 million as cost of staffing.

Profit attributable to unrestricted investment deposits

account holders

increased by 42.2% to 564.2 million. As result, net profit

attributable to shareholders dropped by 3% to 1020 million.

2-- Al khaliji's net operational income increased by 3.4% to QR

609.8 million in the first half of this year, including QR 496.2

million as interests and commissions.

Staffing cost amounted to QR 103.9 million. The bank

incurred a loss worth QR 114.6 million as result of an increase

in non-performing loans.

Other expenses dropped to QR 54.2 million.

As result, the profit posted in this period amounted to

QR 319.8, slightly down compared to the same period last year.

There was a negative change in the fair value worth QR11

million. Hence, comprehensive income dropped to 308.6 million,

compared to 281.1 in the same period last year.

3-- Ahli bank's operational income increased by 7.6% to QR 512.8

million in the first half of 2017, including QR 412.9 million as

net interest, and QR 85.5 million as net fees and commissions.

Total expenses increased by 18.2% to QR175.6 million,

including QR 88.9 million as cost of staff.

As result, the net profit posted in this period increased

by 2.9% to QR 342.2 million. Comprehensive income increased

after deducting the losses incurred as result of a change in the

fair value worth QR 334.9 million, compared to QR 325.1 million

in the same period last year.

4-- Widam Food Company total operational loss in the first half

of the year increased by 10% to QR 122 million. The Government

subsidies for meat consumption increased by 12.7% to QR 199.2

million. On the other hand, total expenses increased by 12.3% to

QR 27.4 million. As a result, the net profit for the period

increased by 22.3% to QR 54.1 million. The comprehensive income

increased to QR 53.5 million.

5-- The Commercial Bank net operating income in the first half

2017 decreased by 3% to QR 1.77 billion, of which QR 1.23

billion was net interest income. Total expenses increased by

13.4% to QR 1.67 billion, of which QR 366.8 million were staff

costs and QR 961.5 million were loans and investments impairment

losses. As a result, the net profit for the period attributable

to shareholders decreased by 64.1% to QR 179.6 million. The

comprehensive income amounted to QR 332.5 million due to

positive changes of QR 152.9 million in investments fair value.

6-- United Development Company total operating profit in the

first half of the year decreased by 1% to QR 472.2 million.

Total expenses of all types decreased by 3.4% to QR 163 million.

Operating profit decreased by 5% to QR 368.8 million. After

adding and subtracting other items, including other income and

net financing cost, the profit attributable to the shareholders

decreased by 14.4% to QR 283.9 million. The comprehensive income

attributable to the shareholders stood at QR 278.3 million.

7-- Moody’s, the international credit rating agency, announced

last week that it has affirmed Doha Bank’s A2/Prime-1 deposit

ratings and baa3 baseline credit assessment (BCA) of Doha Bank

Q.S.C.

9-- Qatar General Insurance & Reinsurance Company revenues for

the first half of the year decreased by 9.3% to QR 236.4

million, of which QR 91.7 million net premiums and QR 129.5

million investment income. Net claims on the company increased

by 11.6% to QR 66.2 million. Total expenses increased by 14.6%

to QR 203.1 million, of which QR 83.1 million was operating and

administrative expenses. As a result, the net profit for the

period decreased by 53.8% to QR 39.6 million. There was a fair

value loss on financial assets of QR 113.7 million, resulting in

a comprehensive loss of QR 50.1 million versus a profit of QR

19.6 million in the corresponding period last year.

10-- Vodafone Qatar said it experienced a major network outage

with their Home Location Register (HLR) a key hardware component

of their core network. HLR failure directly impacts the ability

to make and receive calls and data sessions. The equipment

failure took place during a network upgrade and extended to the

network back-up and redundancy systems.

Economic

Developments

1-- Banks consolidated balance sheet for June has not been

released, but that of May shows a rise in total assets by about

QR 5.4 billion to stand at QR 1313.5 billion.

The total domestic public debt, including bonds,

decreased by about QR 6.8 billion to QR 457.6 billion, while the

total domestic private sector deposits increased by QR 2.5

billion to the level of QR 441.6 billion.

2-- Last week, OPEC oil prices recouped 1.82 dollar, closing at

$ 47.48 per barrel on Thursday.

3-- Last week, Dow Jones index lost 58 points to reach the level

of 21580 points. US Dollar exchange rate decreased to the level

of 111.16 yen, and $ 1.17 per Euro. Gold price increased by 27

dollars to the level of $ 1255 per ounce.

|