|

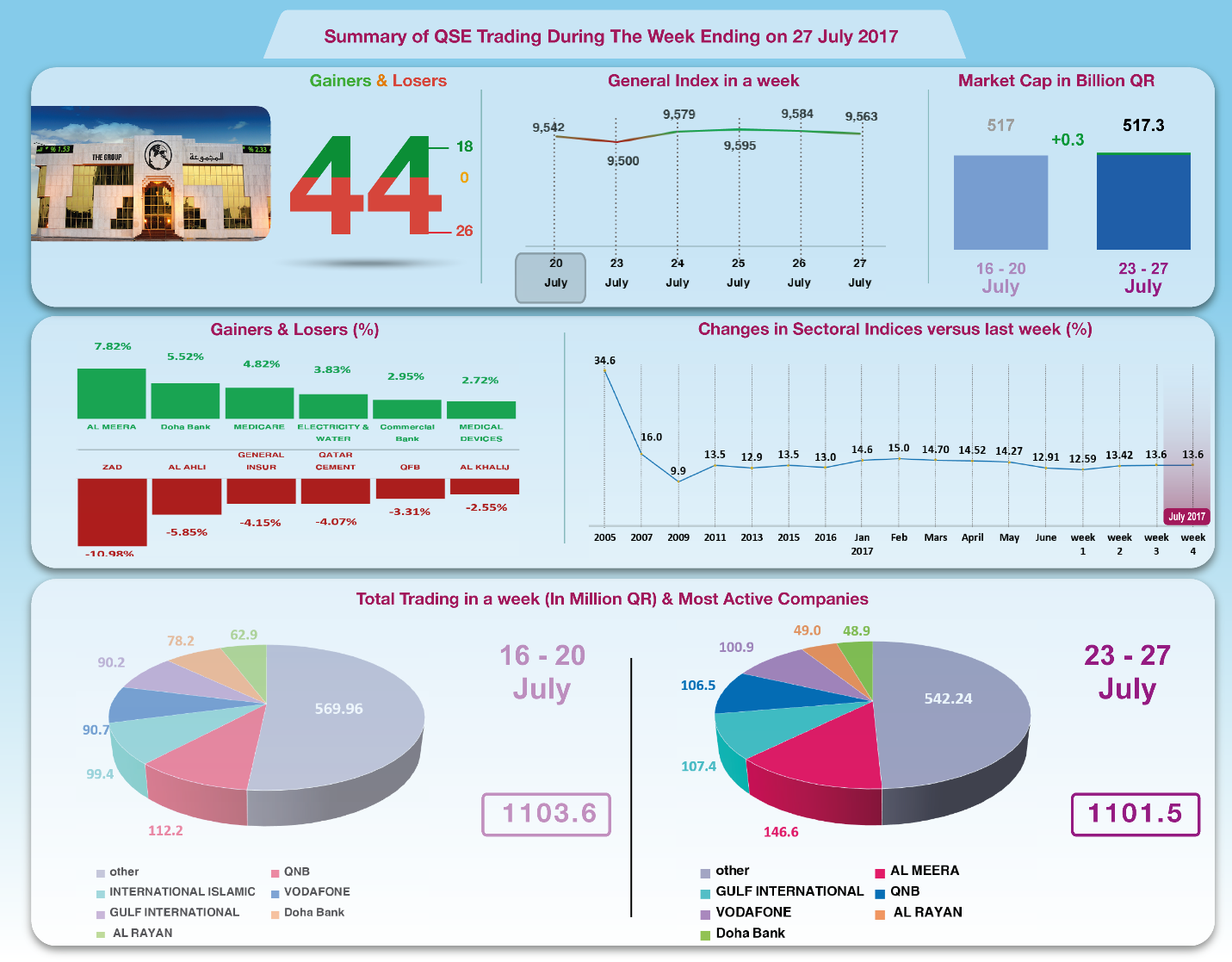

The Group Securities: Weekly Report on QSE Performance,

23-27 July 2017

Over the last week, nine companies released their financials for

the second quarter of this year. Most of the result reveal a

decline of profit compared to that of the same period last year.

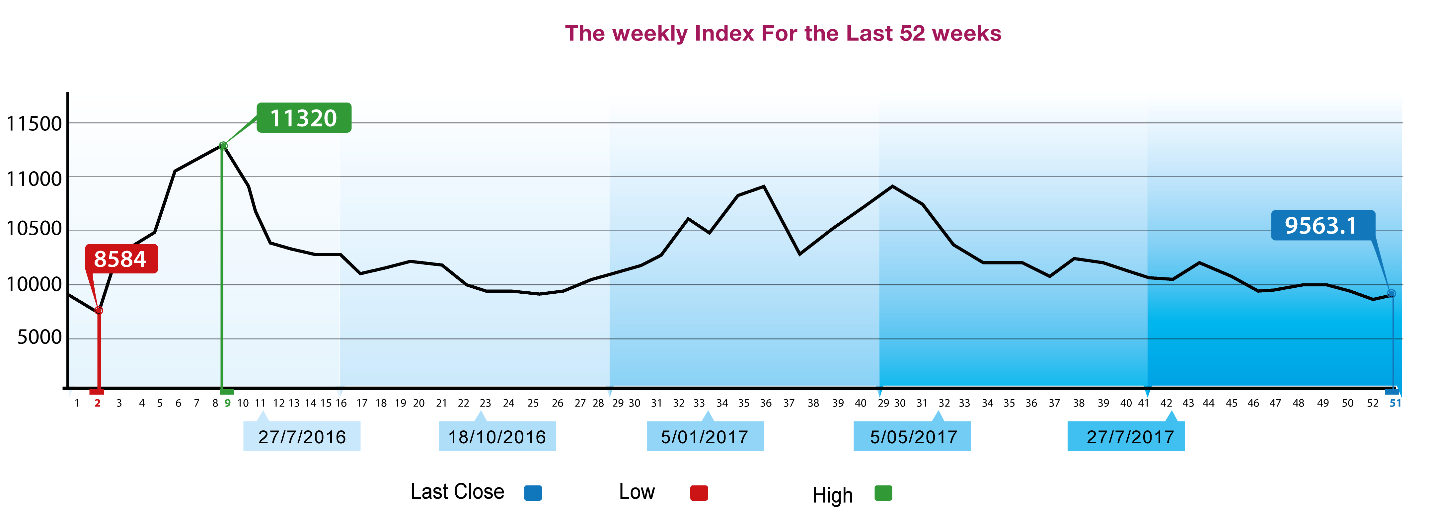

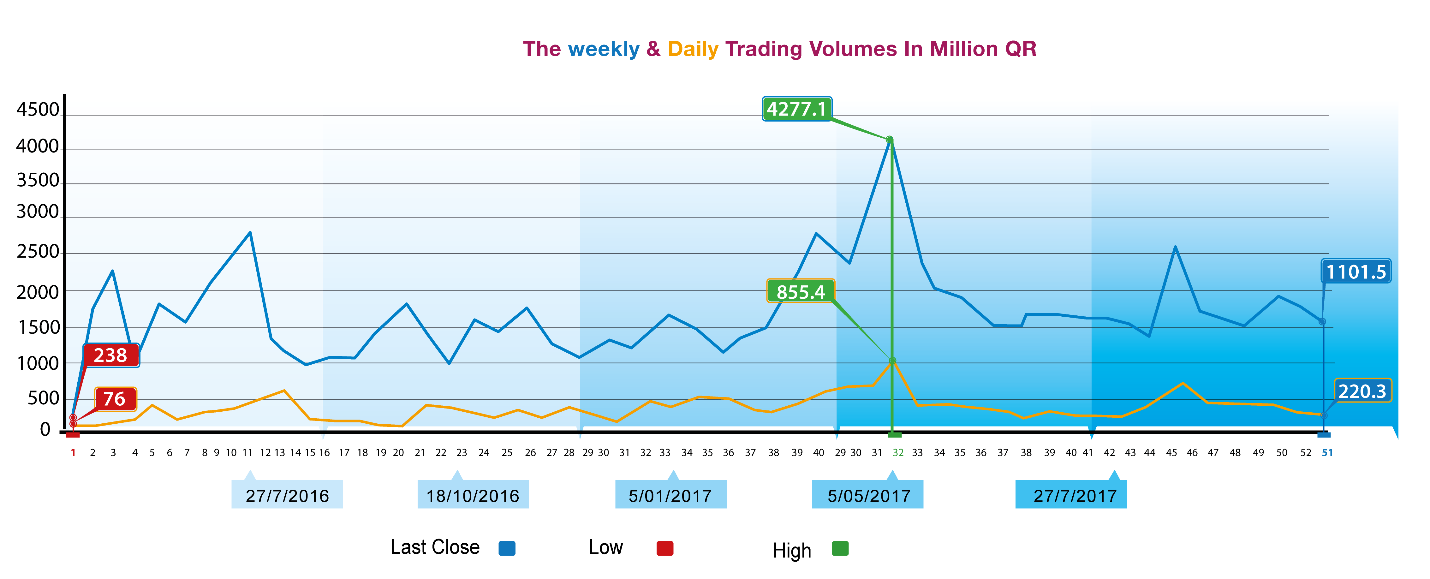

Average daily trading stood at the level of QR200 million, thus

pushing the General Index up by 21 points to the level of QR

9563 points; while four sectoral indices increased and three

others declined. Qatar portfolios exclusively dominated net buy

transactions. Individual investors, namely Qataris, exclusively

carried out net sale transactions.

As result, total capitalization of the market stood at

the level of QR 517.3 billion, slightly up. The Group reviews

QSE performance in this week with illustrative charts combined

with corporate business news, and a list of the affecting

economic factors.

Corporate News:

1-- Qatar Industrial Manufacturing Company Sales in the first

half of the year shrank by 60.8%, accordingly the total revenue

from the company's sales decreased by 37.1% to QR 50.8 million.

In contrast Sales cost and general expenses rose by 29.5% to QR

34.2 million and the operating income decreased by 41.2% to QR

23.9 million. However, the company's share in the profits of its

associates quadrupled to QR 89 million. The net profit for the

period increased 16% to QR 113.4 million. However, with fair

value losses, the comprehensive income decreased to QR 90.7

million.

2-- The company's total revenue in the first half of the year

declined by 3.5%, despite the stable revenues of vessels at QR

1.52 billion as the company's share of profits in joint venture

companies decreased by 23.1% to QR 185.6 million. Total expenses

increased by 2.1% to QR 1.37 billion, of which QR 339.9 million

were operating expenses, QR 582.1 million financing costs, QR

381.6 million equipment depreciation and QR 67.8 million general

and administrative expenses. Net profit for the period decreased

by 18.4% to QR 408.9 million. There was a positive change in

fair value raising the comprehensive income to QR 427.3 million.

3-- Operating income in the first half of the year decreased by

5% to QR 556.7 million and the operating cost increased by 10.8%

to QR 386.5 million. Accordingly, the total operating profit

decreased by 28% to QR 170.3 million. Total general,

administrative and distribution expenses increased by 40.4% to

QR 23.3 million. After adding other income, the profit for the

period decreased by 33.2% to QR 168.1 million. There was a

decline in the fair value of investments amounting to QR 33.9

million decreasing the comprehensive income to QR 134.1 million

compared to QR 246.4 million in the corresponding period last

year.

4-- QIIB total income in the first half of 2017 increased by

11.4% to QR 910 million, of which QR 820.9 million was profit

from financing and investment activities. Total expenses

increased by 16% to QR 236.9 million, of which QR 75.7 million

were for staff, QR 81 million for financing cost and QR 70.3

million other costs. The share of holders of unrestricted

deposits increased 20.9% to QR 205.3 million. Net profit

increased 5% to QR 465.3 million.

5-- Ooredoo disclosed its reviewed financial statements for the

period ended on June 30, 2017. The statements show that the net

profit is QR 1,097 million Compared to net profit amounting to

QR 1,462 million for the same period of the previous year. The

Earnings per Share (EPS) amounted to QR 3.42 For the period

ended June 30, 2017 to EPS amounted to QR 4.56 for the same

period of the previous year.

6-- Qatar Insurance Company's total income dropped by 8.6% to QR

858.8 million in the second quarter of 2017, including QR262.8

million as net income from insurance, and QR 563 million net

investment income. Total administrative and operational expenses

increased by 2.5% to QR 331 million. As result, net profit

attributable to shareholders increased by 16.2% to QR 504.9

million. The company incurred loss as result of negative change

in the fair value of investments worth QR 223.9 million, which

reduced the comprehensive income attributable to shareholders by

QR 47.2% to 298.4 million.

7-- Barwa Real Estate's total income dropped by QR20.3 million

to QR 497.6 million in the second quarter of this year. This

decline is attributed to a decline in leasing revenues by QR82.8

million to QR 30.6 million, coupled with rise in the rentals

worth QR63.5 million to QR 467 million. The company's share from

associate companies increased to QR54.9 million, while public

and administrative expenses fell marginally to QR 108.8 million.

Net financing cost increased by 20% to QR40.1 million. The

important actor that affected the result was the net profit

posted from the positive change in the real value of real estate

investments, which amounted to QR 469 million, compared to 630.2

million in the same period last year. As result, net profit

dropped by 24.2% to QR 917.9 million. Comprehensive income

amounted to QR 903 million.

8-- Vodafone's total revenue increased by 3.1% to QR 515.8

million and its total expenses decreased by 5.8% to QR 377.1

million, including QR 182.3 million interconnection expenses,

QR 136.2 network and rental expenses and QR 58.6 million

operating expenses. Depreciation and amortization provisions

decreased by 30% to QR 128.3 million. After deducting QR 7.4

million in financing costs, net loss decreased by 42.7% to QR

57.1 million compared to QR 99.6 million in the corresponding

period last year.

9-- Dalal's net operational income increased by 78.75 to QR29.1

million in the second quarter of 2017, including QR20.3 million

net income from commissions and brokerage. Total expenses

increased by 18.65 to QR15.3 million. As result, net profit

jumped to QR13.96 million, compared to 1.25 million in the same

period last year. The company incurred a great loss as result of

a negative change in the fair value of investments worth 26.36

million. Net profit turned into a comprehensive loss worth 12.65

million.

10-- Total operating revenues of the company decreased by 5.8%

to QR 660.5 million in the first half. Total general and

administrative expenses increased by 7.2% to QR 99.7 million.

After adding a share in the profits of sister companies worth QR

286.6 million (compared to QR 185.8 million in the corresponding

period last year) and deducting the cost of financing which

increased by 10.8% to QR 89 million, the net profit for the

period increased by 2.4% to QR 810.6 million. There was a

decline in the fair value of investments amounting to QR 168.8

million compared to a decrease of QR 86.6 million in the

corresponding period in 2016. The comprehensive income decreased

by 9% to QR 641.7 million compared to QR 704.7 million in the

corresponding period last year.

Economic Developments

1-- Banks consolidated balance sheet for June has been released

and data shows a rise in total assets by about 7.7 billion to

around QR1305.8 billion.

The total domestic public debt, including bonds,

decreased by about QR 15.1 billion to QR 442.6 billion, while

the total domestic private sector deposits increased by QR 6.9

billion to the level of QR 448.5 billion.

2-- Last week, OPEC oil prices recouped 1.40 dollar, closing at

$ 48.88 per barrel on Thursday.

3-- Last week, Dow Jones index lost 58 points to reach the level

of 21580 points. US Dollar exchange rate decreased to the level

of 111.16 yen, and $ 1.17 per Euro. Gold price increased by 27

dollars to the level of $ 1255 per ounce.

|