|

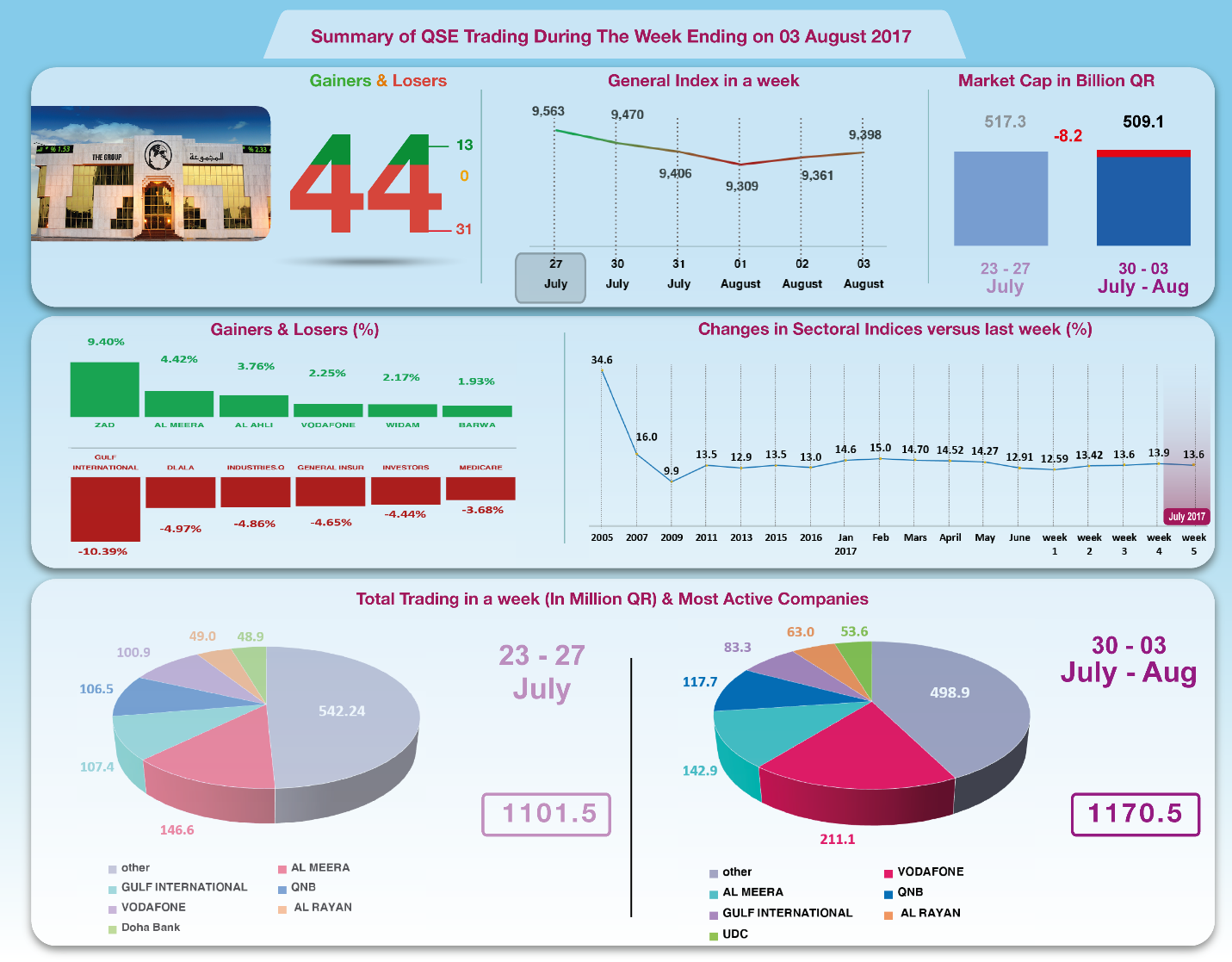

The Group Securities: Weekly Report on QSE Performance,

30 July-03 Aug 2017

Last week, OPEC oil prices increased to more than $50 per

barrel; yet, most of the companies delivered poor performance.

While Ezdan registered 24.4% increase, along with Islamic

Insurance and Medicare Group, four companies declined; namely

Gulf International by 90%, Milaha by 51.7%, and Alijarah with

net loss of QR 8.9 million. Vodafone reduced its loss by 42% to

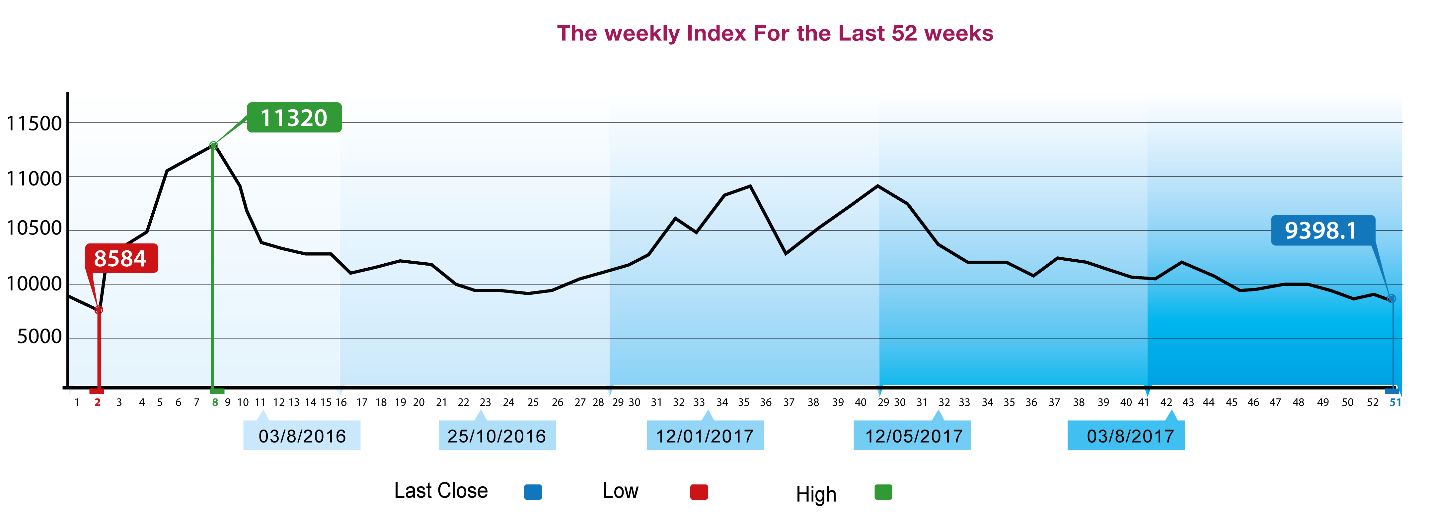

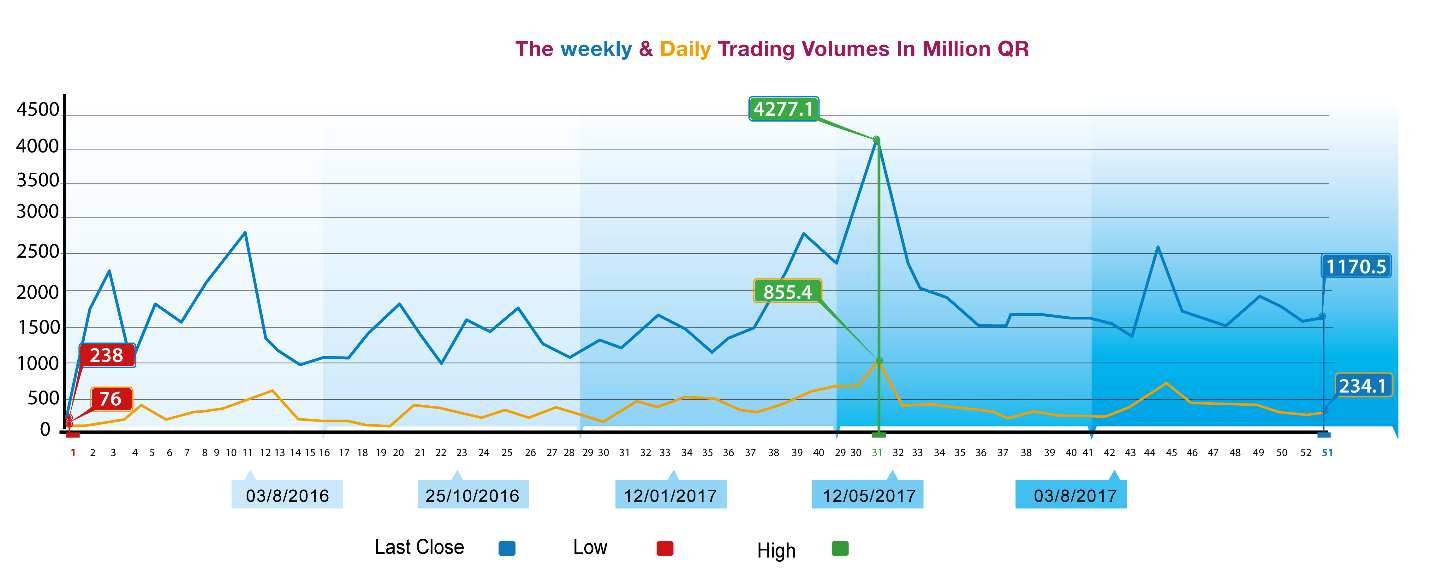

QR 57 million. In light of these results, the share price of 31

companies declined, while 13 others increased. General index

fell by 165 points to the level of 9398 points. Four sectoral

indices decreased. Total capitalization and price earnings

ratios also fell down. The Group reviews QSE performance in this

week with illustrative charts combined with corporate business

news, and a list of the affecting economic factors.

Corporates News:

1-- Gulf International's operational income dropped in the

second quarter of this year by 35% to QR 195.8 million.

Administrative and public expenses increased by 14.3% to QR128.5

million. Net financing cost increased by 42.5% to 61 million.

Adding other items, including losses incurred as result of

depreciation worth QR 10.9 million, then net profit falls by 90%

to QR 15.8 million. Hence, comprehensive income fell by QR 4.2

million as result of the decline of its items by 11 million.

2-- Qatar Oman Investment's total income declined to QR 13.4

million in the second quarter, compared to QR 15.1 million in

the same period last year. Total expenses increased by QR2.97

million. As result, net profit posted in this period increased

by 18.1 % to QR10.55 million. In contrast, the bank incurred

losses as result of a negative change in the fair value of

investments worth QR 13.2 million, which turned net profit into

a comprehensive loss worth QR 2.6 million.

3--Aamal Company's net operational income declined by 13.8% to

QR 306.2 million. Total expenses stood at QR78.1 million,

slightly up. The company earned QR 25 million from its share in

investment companies, and profit worth QR 22.2 million as result

of a positive change in the fair value of investments; as well

as other sources of income worth QR3.6 million, as against

financing cost worth QR 11.8 million. As result, net profit

attributable to shareholders declined by 5.5% to QR 240.4

million.

4-- Qatar Navigation's

operational income decreased by 17.4% to QR1145.8 million in the

second quarter of this year. Total expenses decreased by 6.3% to

QR 945.4 million, QR 456.1 million as cost of operations and

supply, and 262.4 million as public and administrative expenses.

As result, net profit dropped by 55% to QR170.4 million. Adding

and deducting other items, including a loss worth QR128.8

million as result of negative returns from associate companies;

net financing cost worth QR16.5 million, net profit drops by

51.7% to QR 267.3 million. The company incurred a loss as result

of change in the value of its financial assets worth 502.7

million, compared QR 163.9 million last year. Hence, net profit

turned into a total loss worth QR 208.6.

5-- Financial data show that the company surplus from its

insurance in the second quarter of this year increased by QR2.5

million to QR18.9 million.

Total income amounted to QR 54.1 million, down by 2.4

million compared to the same period last year. Most of the

income came from the agency fees worth QR 40.3 million and

rentals worth QR 4.6 million, shares of profit from associate

companies worth QR 3.5 million. Total expenses amounted to QR 18

million, down by QR 2.8 million. As result, net profit increased

by QR 400,000 to QR 36.1 million.

6-- Ezdan's operational income

increased by 37.6% to QR2.17 billion in 2016, including 1.6

billion as rental revenues and QR756 million net sale of assets

available for sale.

Net operational expenses increased by 25% to QR 370.6 million.

As result, the operational income increased by 35.6% to QR1.6

billion. Adding

profit earned from associate companies and from joint ventures;

deducting expenses worth QR303.3 million as public and

administrative expenses, QR623.3 million as financing cost, then

net profit attributable to the shareholders rises by 9.1% to

QR1812.5 million.

The company also incurred losses as result of negative change in

the value of assets available for sale worth QR 276 million,

which reduced the comprehensive income to QR 1536.5 million.

7-- Alijarah Holding disclosed

its reviewed financial statements for the period ended on

30.06.2017. The statements show that the net loss is QR

8,964,649 Compared to net profit amounting to QR 3,928,460 for

the same period of the previous year. Loss per share amounted to

QR 0.18 for the period ended June 30, 2017 compared to earnings

per share amounted to QR 0.08 for the same period of the

previous year.

8-- Vodafone's

total revenue increased by 3.1% to QR 515.8 million and its

total expenses decreased by 5.8% to QR 377.1 million, including

QR 182.3 million interconnection expenses, QR 136.2 network and

rental expenses and QR 58.6 million operating expenses.

Depreciation and amortization provisions decreased by 30% to QR

128.3 million. After deducting QR 7.4 million in financing

costs, net loss decreased by 42.7% to QR 57.1 million compared

to QR 99.6 million in the corresponding period last year.

10--Medicare Group disclosed its

reviewed financial statements for the period ended on

30.06.2017. The statements show that the net profit is QR

32,589,187 Compared to net profit amounting to QR 30,693,468 for

the same period of the previous year. The Earnings per Share

(EPS) amounted to QR 1.16 for the period ended June 30, 2017

against EPS amounted to QR 1.09 for the same period of the

previous year.

Economic Developments

1--Three weeks ago, banks consolidated balance sheet

for was released and data shows a rise in total assets by about

7.7 billion to around QR1305.8 billion.

The total domestic public debt, including bonds,

decreased by about QR 15.1 billion to QR 442.6 billion, while

the total domestic private sector deposits increased by QR 6.9

billion to the level of QR 448.5 billion.

2-- Oil prices continued its rise for the third week in raw,

with OPEC gaining $ 1.36 dollars to close at $ 50.24 per barrel

on Thursday.

3-- Last week, Dow Jones index gained 263 points to reach the

level of 22093 points. US Dollar exchange rate stood at the

level of 110.69 yen, and $ 1.18 per Euro. Gold price increased

by 5 dollars to the level of $ 1264 per ounce.

|