|

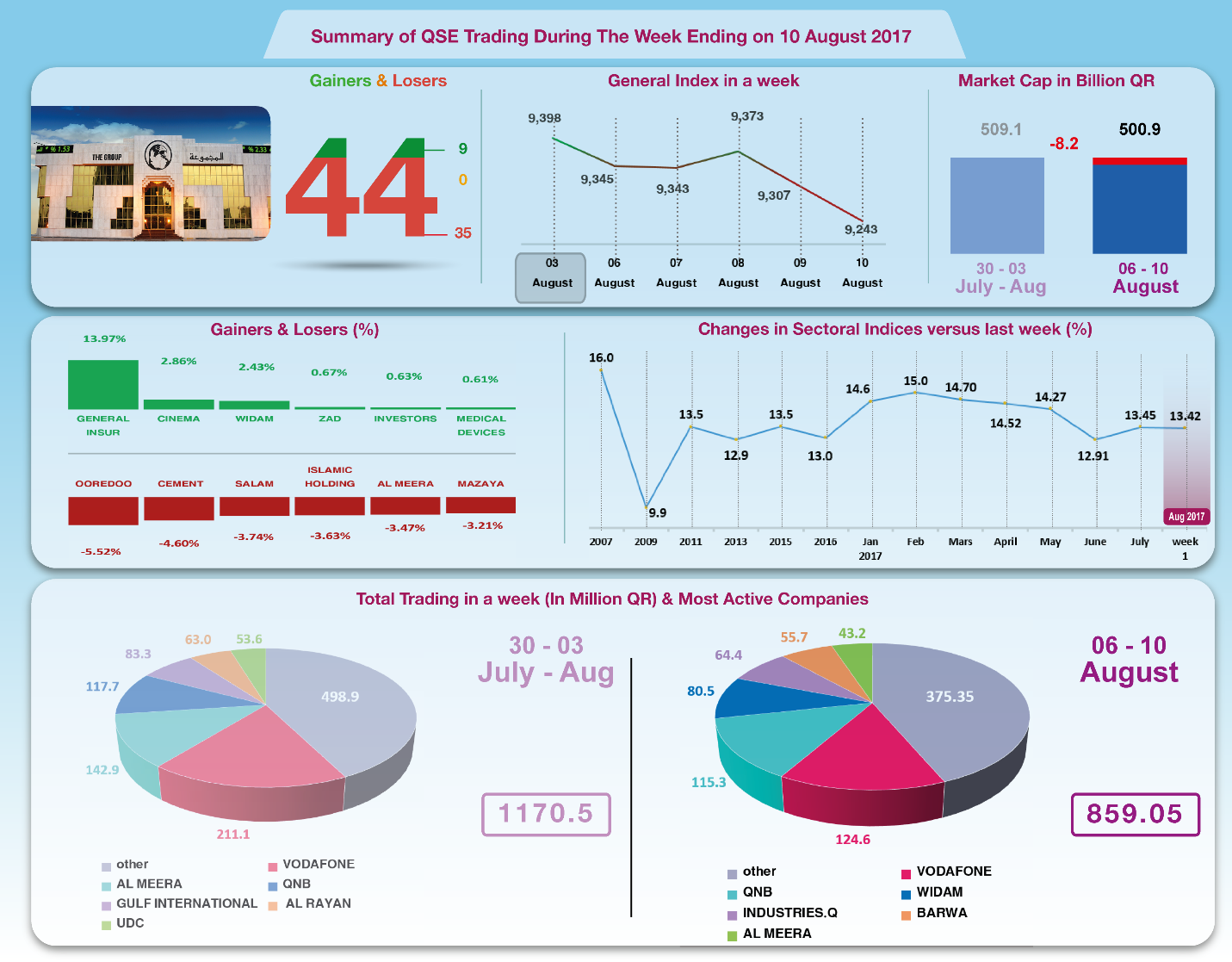

The Group Securities: Weekly Report on QSE Performance,

30 July-03 Aug 2017

Last week, trading conditions were poor in light of

scorching summer heat and the negative financials of seven

companies. Woqod, Salam, Mannai, Mesaieed, Cinema and Investment

Holding Group all had dwindling profit. Al Meera was the only

company to maintain the steadiness of profit. Consequently,

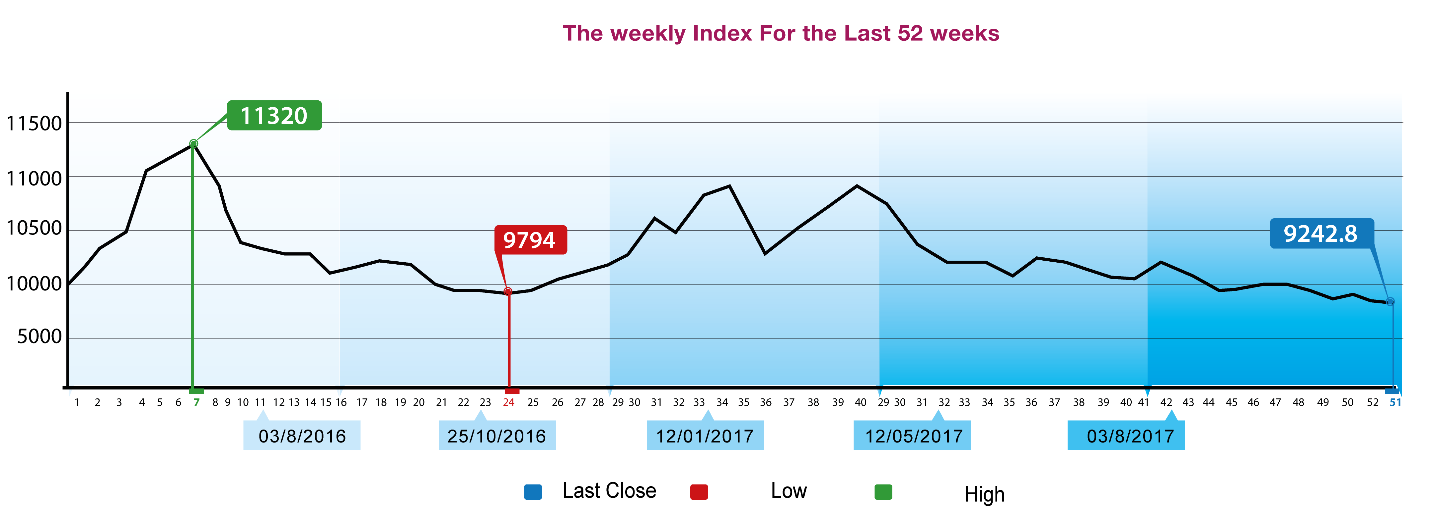

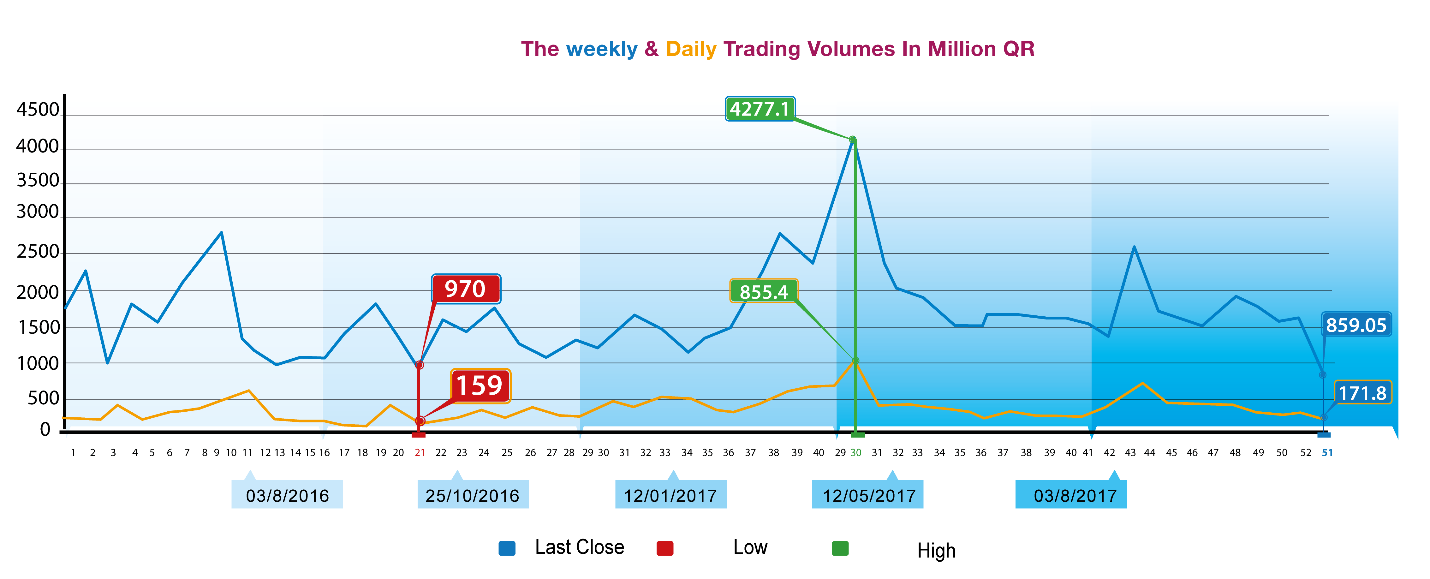

average daily trading dipped to QR 171.8 million daily. General

index slid to QR 155 points or 1.65% to QR9243 points. Except

for insurance, sectoral and other indices also fell down. Total

capitalization also decreased by QR 8.2 billion to QR 500.9

billion. It was notices that portfolios sold net, as against

individual investors, especially foreign portfolios which sold

net worth QR 61.9 million. The Group reviews QSE performance in

this week with illustrative charts combined with corporate

business news, and a list of the affecting economic factors.

Corporates News:

1-- The company's total revenues, after subtracting

operating costs, decreased by 8.4% to QR 359.3 million and the

revenues are mostly from its operations. Total expenses

including salaries, general and administrative expenses,

financing costs, management incentives and depreciation

increased by 11.7% to QR 337.9 million. Net profit attributable

to shareholders decreased by 62.8% to QR 17.7 million compared

to QR 47.6 million in the corresponding period. The fair value

of available-for-sale investments decreased by QR 5.7 million

and accordingly the comprehensive income decreased to QR 12.06

million.

2-- Gulf International's operational income dropped

in the second quarter of this year by 35% to QR 195.8 million.

Administrative and public expenses increased by 14.3% to QR128.5

million. Net financing cost increased by 42.5% to 61 million.

Adding other items, including losses incurred as result of

depreciation worth QR 10.9 million, then net profit falls by 90%

to QR 15.8 million. Hence, comprehensive income fell by QR 4.2

million as result of the decline of its items by 11 million.

3--

Although insurance revenues in the first half of

the year increased by 25.2% to QR 99.8 million, yet, net

insurance revenues decreased by 22.4% to QR 37.5 million.

Investment revenues doubled several times to QR 28.5 million

compared to QR 6.4 million in the corresponding period last

year. As a result, net profit increased 62.2% to QR 33.9

million. On the other hand, the fair value losses on

available-for-sale investments doubled to QR 51.8 million

turning the company's profit to a comprehensive loss of QR 5.4

million compared to a profit of QR 23.4 million in the

corresponding period in 2016.

4--

Mesaieed Petrochemicals total income from its different factories droped by

4.3% to QR 433.9 million.

Public and administrative expenses fell slightly by QR8

million. Adding some tax returns worth QR 42.8 million, net

profit drops by 4.3% to QR 468.6 million. Comprehensive income

seems on par with net profit.

5--

Al Meera's total income from sales increased by 9.8% to QR 236.6

million. Other sources of income settled at QR 48.5 million. In

contrast, total expenses increased by 13.55 to QR 182.2 million,

including QR 151.9 million of public and administrative

expenses. As result, net profit stood at QR 102.36 million.

There was a decline in the fair value of some investment worth

QR 11.6 million, which lowered the comprehensive income to QR

90.87 million.

6--

Mannai Corporation's total income from sales dropped 9.5% to QR

549.7 million in the second quarter of this year. Other sources

of income and dividends also fell by 31.5% to QR 88.1 million.

Total expenses fell by 9% to QR 471.4 million, including 200.8

million as public and administrative expenses; QR 154 million

distribution expenses, and QR 116.6 million as financing and

depreciation expenses. As result, net profit dropped by 1.8% to

QR 166.5 million. The exchange rate of currencies yielded QR

151.5 million, thus bringing the comprehensive income up to QR

318 million.

7-- Mannai Corporation's total income from sales dropped 9.5% to

QR 549.7 million in the second quarter of this year. Other

sources of income and dividends also fell by 31.5% to QR 88.1

million. Total expenses fell by 9% to QR 471.4 million,

including 200.8 million as public and administrative expenses;

QR 154 million distribution expenses, and QR 116.6 million as

financing and depreciation expenses. As result, net profit

dropped by 1.8% to QR 166.5 million. The exchange rate of

currencies yielded QR 151.5 million, thus bringing the

comprehensive income up to QR 318 million.

8-- Woqod's total profit

from fuel sales increased by 35 to QR 615.3 million in the

second quarter of this year. Other sources of income declined by

3.1% to QR 551.6 million. In contrast, total expenses increased

by 25% to QR 726.7 million. As result, total profit fell by 31%

to QR 373 million.

There was a negative change in the fair value of assets worth QR

193.5 million. Hence, comprehensive income dropped by 59% to QR

186 million.

Economic Developments

1-- Banks consolidated balance sheet for July has

not been released yet, but that of June shows a rise in total

assets by about 7.7 billion to around QR1305.8 billion.

The total domestic public debt, including bonds,

decreased by about QR 15.1 billion to QR 442.6 billion, while

the total domestic private sector deposits increased by QR 6.9

billion to the level of QR 448.5 billion.

2-- Last week, OPEC oil prices recouped 0.46

dollar, closing at $ 50.70 per barrel on Thursday.

3-- Last week, Dow Jones index lost 5135 points to

reach the level of 21858 points. US Dollar exchange rate stood

at the level of 109.20yen, and $ 1.18 per Euro. Gold price

increased by 31 dollars to the level of $ 1295 per ounce.

|