|

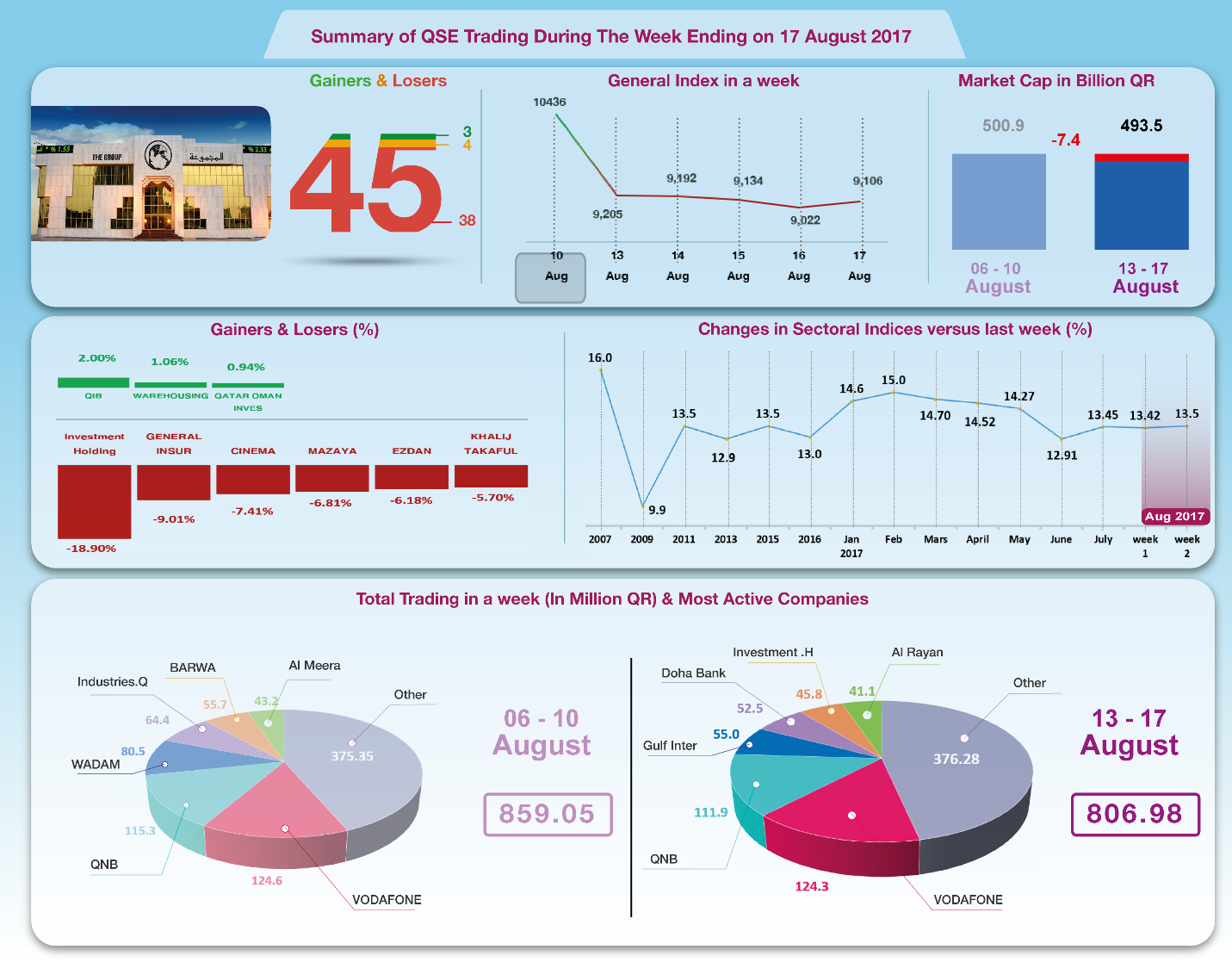

The Group Securities: Weekly Report on QSE Performance,

13-17 Aug 2017

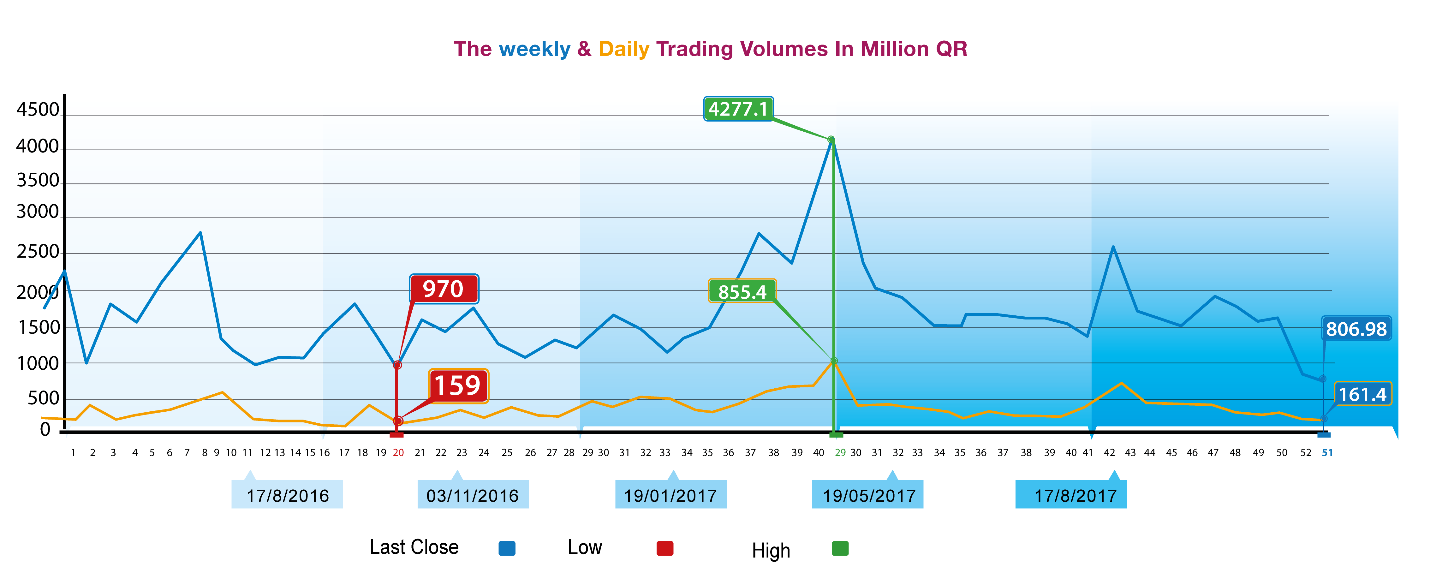

The listing of Investment Holding Group was not opportune just

as the timing of offering its shares for subscription this year

was surprising. This happened at a time when the daily average

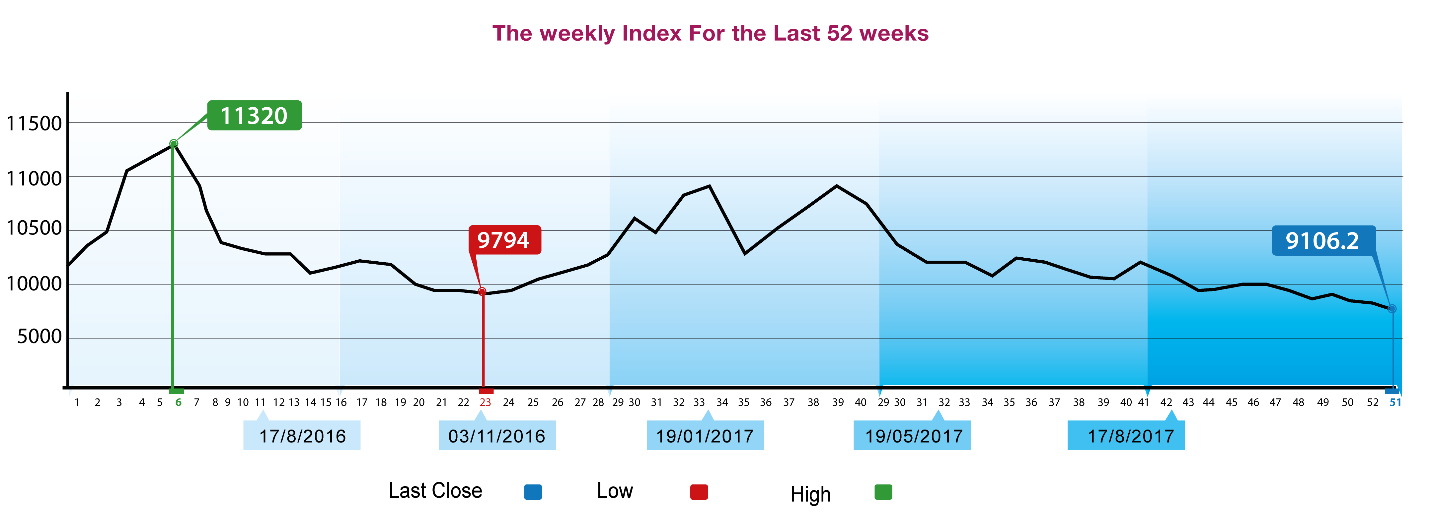

trading hit lowest in a year, that is 161 million. As the

disclosure season is drawing near conclusion, marked with the

decline of profit of 24 companies, QSE General Index continued

its decline and lost 137 points to hit the lowest level in a

year: 9106 points. All key and sectoral indices declined, and

total capitalization dropped by QR 7.4 billion to QR 493.5

billion. The share price of 38 companies declined, with the

share price of Investment Holding Group down by % 18.9 below the

nominal price. Non-Qatari investors dominated net sale worth QR

71.5 million as against other categories of investors. The Group

reviews QSE performance in this week with illustrative charts

combined with corporate business news, and a list of the

affecting economic factors.

Corporates News:

1-- On 14 August 14,2017, Investment Holding Group was listed on

Qatar Stock Exchange (QSE) to raise the number of listed

companies to 45. Meanwhile, Qatar Stock Exchange (QSE) announced

the change of the tick size of all listed stocks to one dirham

as of the opening of the trading session on Sunday, August 27,

2017. The decision was taken after obtaining QFMA’s approval

thereon.

3-- Forty-five companies announced their financials for the

period ended on 30 June 2017. The total profit of these

companies amounted to QR20 billion compared to QR 21.7 billion

for the same period in the last year, down by 7.8%.

4-- Mazaya Qatar Real Estate Development Company revenues in the

first half of the year decreased by 53.8% to QR 39.3 million

including QR 13.5 million from other income and QR 25.9 million

from its activity. Total expenses increased by 4.7% to QR 25.9

million, of which QR 17.6 million was finance cost. As a result,

net profit decreased 77.8% to QR 13.45 million.

5-- Total revenues of Qatari German Company for Medical Devices

in the first half of the year decreased by 18% to QR 1.84

million, of which QR 1.37 million was other income. Total

expenses including cost of finance increased 5.6% to QR6.62

million. Net loss rose 8.2% to QR4.3 million.

6-- Zad Holding's total income from sales dropped 3% to QR 146.4

million. Other sources of income declined by QR 900,000 to QR

41.6 million. In contrast, total expenses increased by 8.4% to

QR 73.3 million, including QR 4.9 million financing cost. As

result, net profit increased marginally by 0.8% to QR 114.7

million. It is worth noting that the result of same period in

the last year included a decline in the value of securities

worth QR 12.1 million, which is not the case this year.

7-- Investment Holding Group's income dropped by 16.6% to QR

78.4 million in the second quarter of this year. Total expenses

fell by 5% to QR 46.2 million. Last year, the company made

income worth QR 28.3 million from discontinued operations, which

is not the case this quarter. Consequently, net profit dropped

by 53.7% to QR 32.2 million. The shareholder's profit amounted

to QR21 million, down by 24.7% compare to the same period last

year.

Economic Developments:

1-- Banks

consolidated balance sheet for July has been released and data

shows a rise in total assets by about 18.8 billion to around

QR1324.6 billion.

The total domestic public debt, including bonds, increased by

about QR 15.1 billion to QR 457.7 billion, while the total

domestic private sector deposits increased by QR 2.4 billion to

the level of QR 450.9 billion.

2-- Oil prices have fallen again with OPEC losing $ 1.33 dollars

to close at $ 49.37 per barrel on Thursday.

3-- Last week, Dow Jones index lost 183 points to reach the

level of 21675 points. US Dollar exchange rate stood at the

level of 109.18 yen, and $ 1.18 per Euro. Gold price increased

by 5 dollars to the level of $ 1290 per ounce.

|