|

The Group Securities Weekly Report

on QSE Performance, 10 – 14 September 2017

Continued decline in the stock market

indices and goods and services groups

September 17, 2017

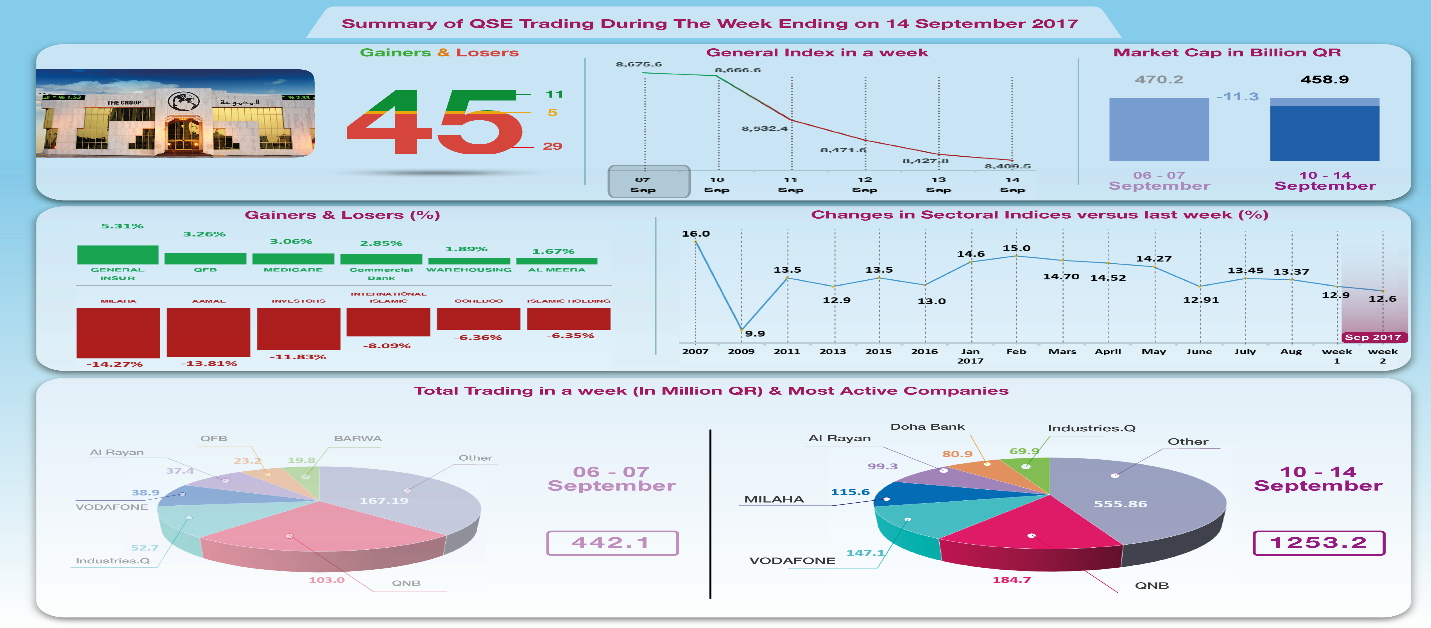

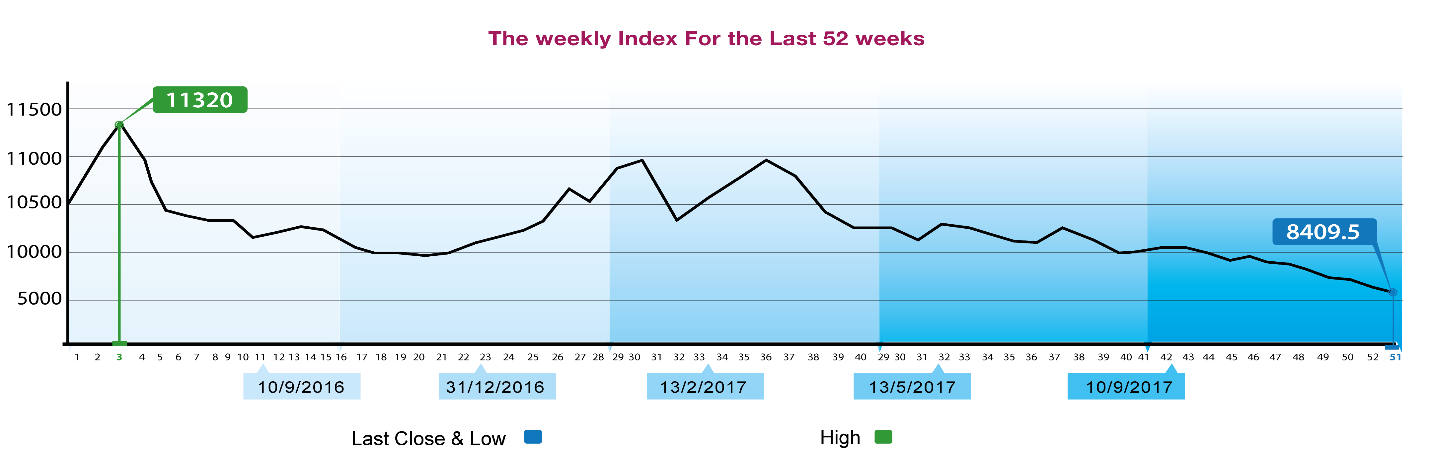

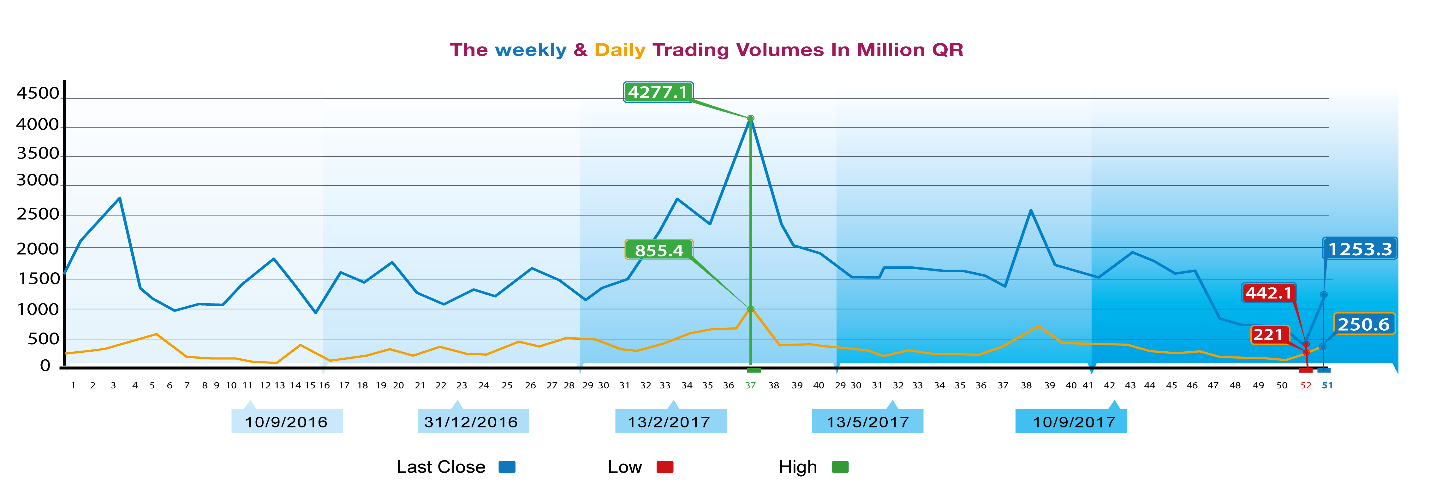

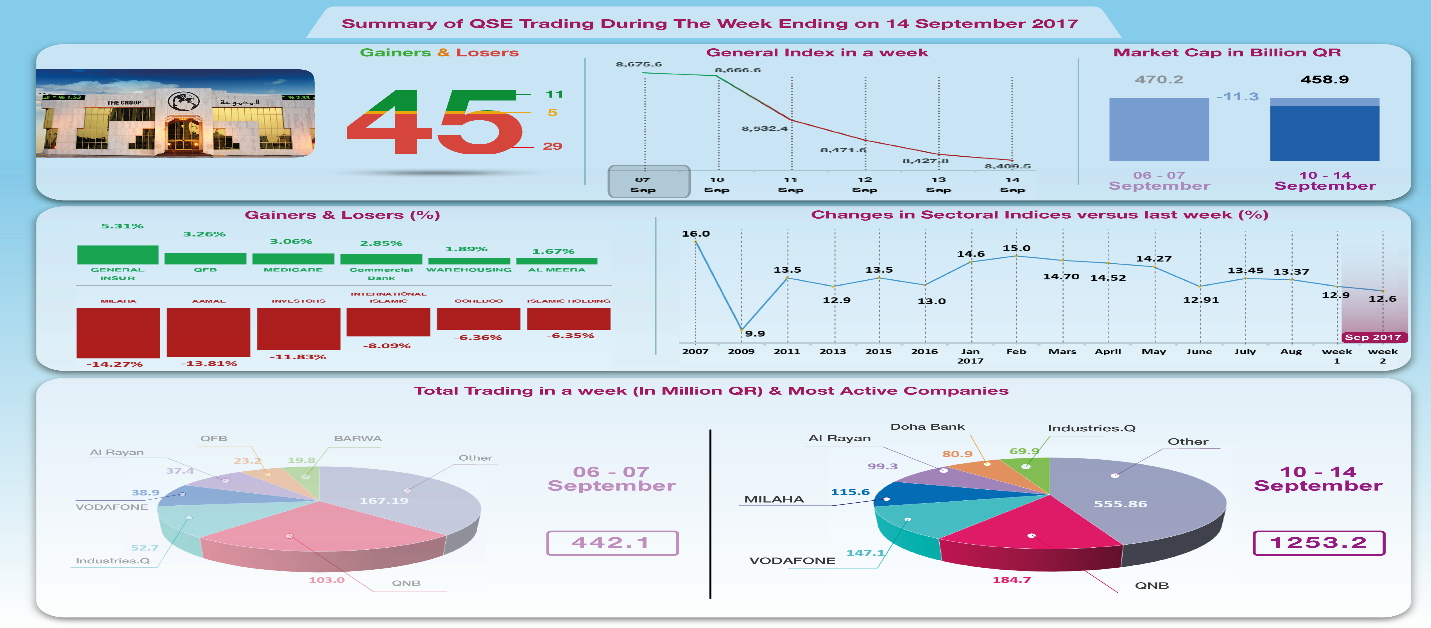

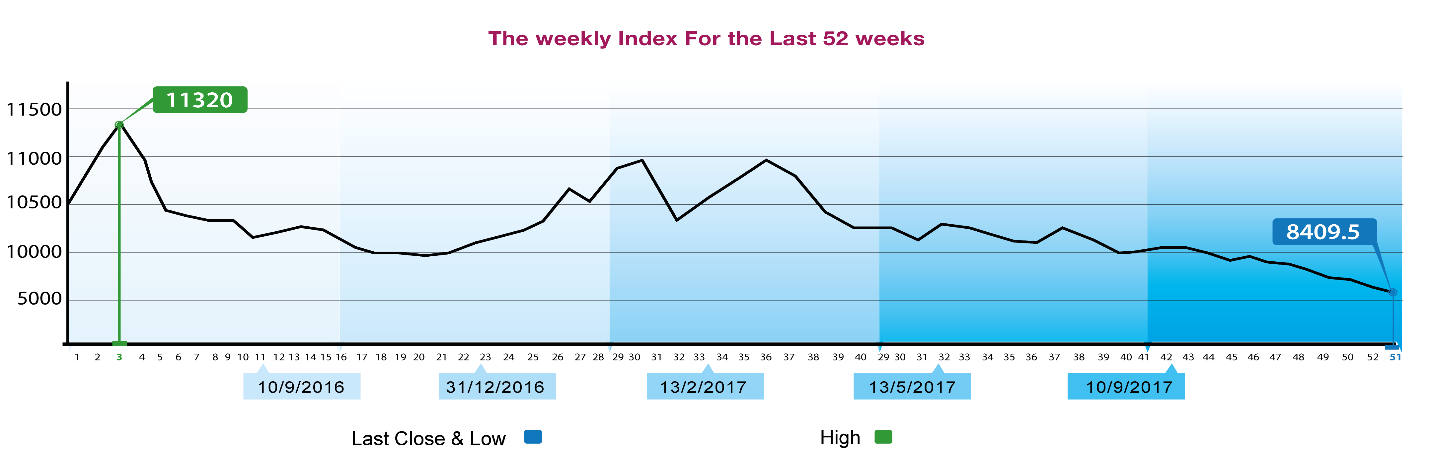

Qatar Stock Exchange performance during the

reviewed week did not differ from its performance in the

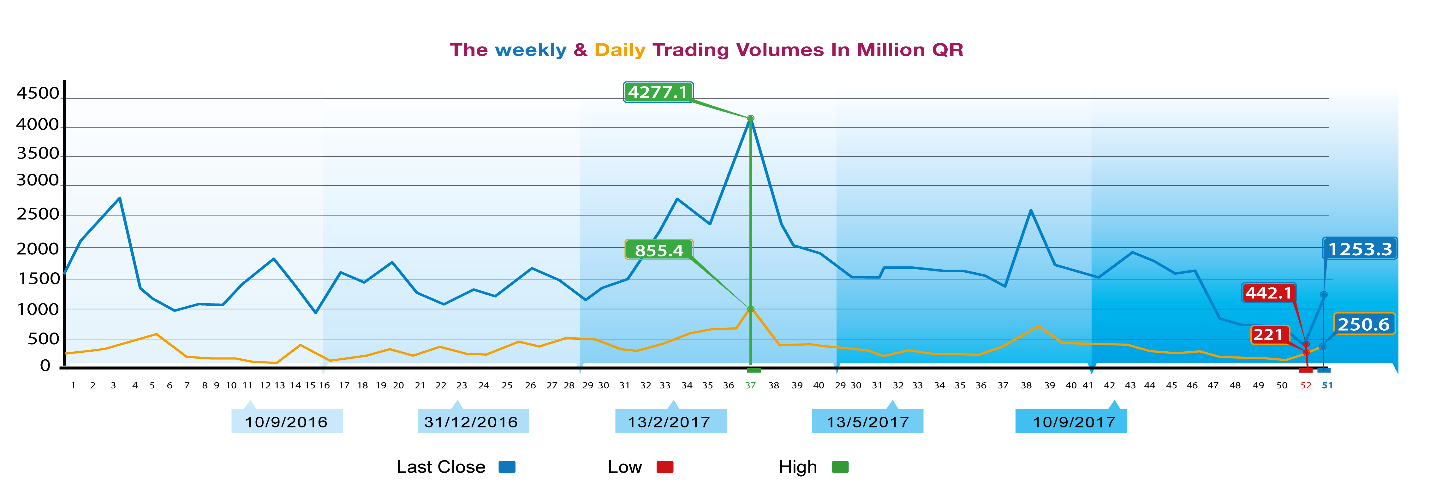

previous weeks. The single positive situation was the return of

activity to the total trading volume which benefited from

reducing the bid unit to one Dirham. The daily average rose by

13.4% to QR 250.7 million. Although oil prices improved above $

50 a barrel, traders ignored this, especially the non-Qatari

individual dealers who were net sellers against all other

categories with the value of QR 112.8 million. The general index

fell to 8409 points, the total capitalization dropped to QR

458.9 billion and P/E Ratio fell to 12.60.

The Group reviews QSE performance in the week ending on

14th September 2017 with illustrative charts combined

with corporate business news and a list of the affecting

economic factors.

Corporate News:

1. Ooredoo

announced that it had reviewed Fitch's long-term credit rating

from "A +" to "A" with a negative outlook.

2. Minejesa Capital BV - in which Nebras Energy owns 35.5%

shares, managed on August 10, 2017 to complete a successful

financial closure of US $ 2.75 billion for a multi-source

refinancing project. Nebras Power is an international energy

company established in 2014 and headquartered in Doha, Qatar.

The company develops and manages a portfolio of strategic

investments in the energy and water sectors around the world,

outside the State of Qatar. It is a partnership between two

Qatari government bodies: Qatar Electricity and Water Company

(60%) and Qatar Holding (40%).

Economic developments:

1.

Al Meera Consumer Goods Company, Qatar First Bank and Mazaya

Qatar shares will join QE Index while Aamal and Qatar Insurance

will be removed from the index. Qatar Islamic Insurance share

will join QE Al Rayan Islamic Index. Ahli Bank share will be

removed from QE All Share Index and QE Banks and from Financial

Services Index.

2. The trade balance of the State of Qatar

during July this year showed a surplus of QR 11.9 billion,

recording a rise of QR 5.2 billion or 78.1% above the figures in

July 2016 and a decrease of QR 0.6 billion or 4.8% versus the

situation in June 2017.

3. Banks consolidated balance sheet of August has not been

released. July balance sheet showed that total assets increased

QR 18.8 billion to QR 1324.6 billion and the total government

and the public sector loans, including T-Bills, increased QR

15.1 billion to stand at QR 457.7 billion. Total private sector

debts increased QR 2.4 billion to QR 450.9 billion.

4. OPEC oil prices rose by $ 4.22 to $ 53.63 per barrel compared

to $ 49.41 a barrel in the previous week. Qatar's oil prices

were up by 6.3% last month to reach $ 50.90 a barrel compared to

a price of $ 47.80 last month.

5. The Dow Jones Index rose 471 points to 22268 points. US

Dollar exchange rate rose to $ 1.19 per euro and to 110.85 yen

per dollar. Gold price about $ 27 an ounce to $ 1323.

|