|

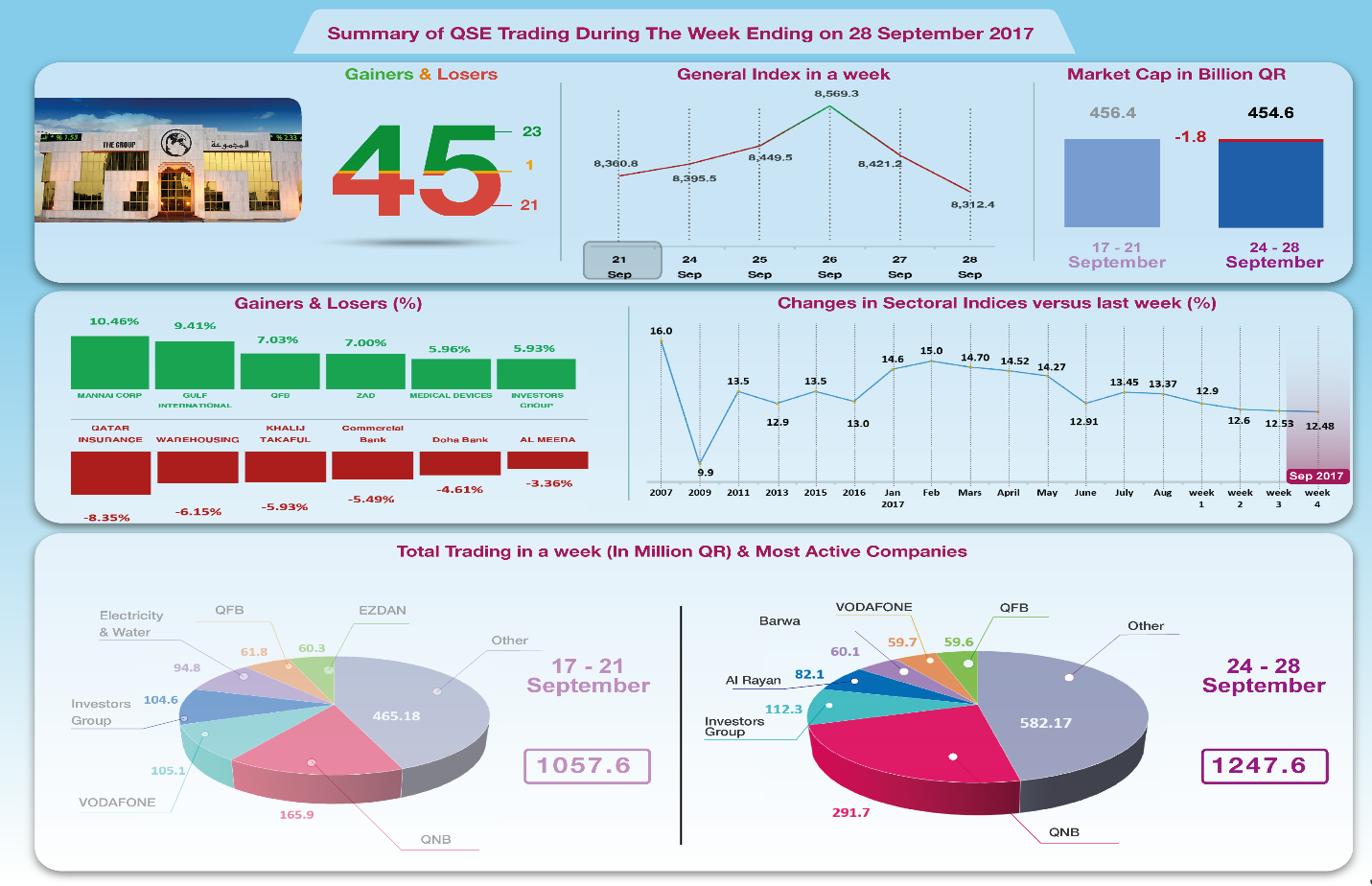

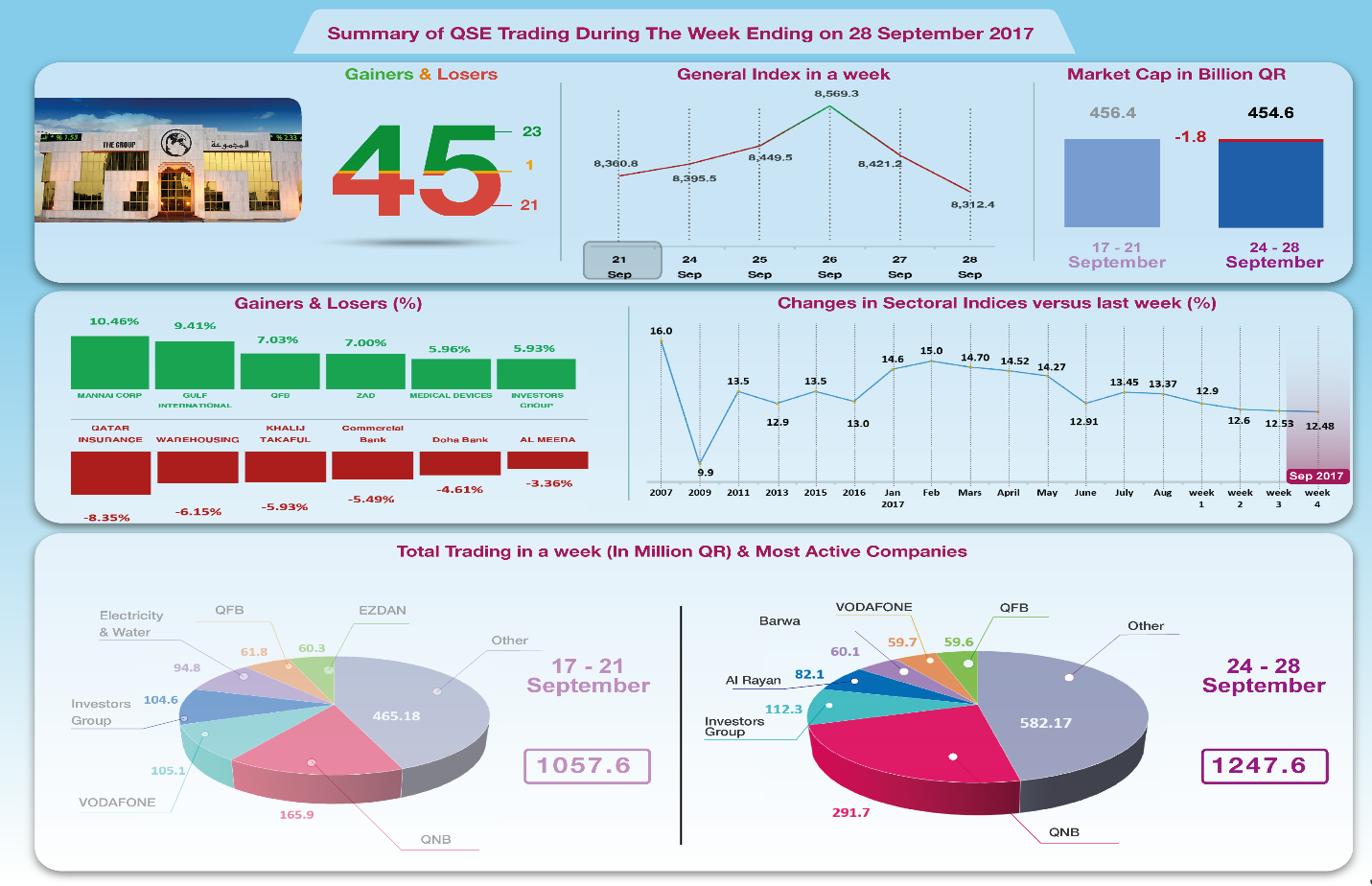

The Group Securities Weekly Report on QSE Performance, 24-28

September 2017

Do foreign portfolios manipulate the

market?

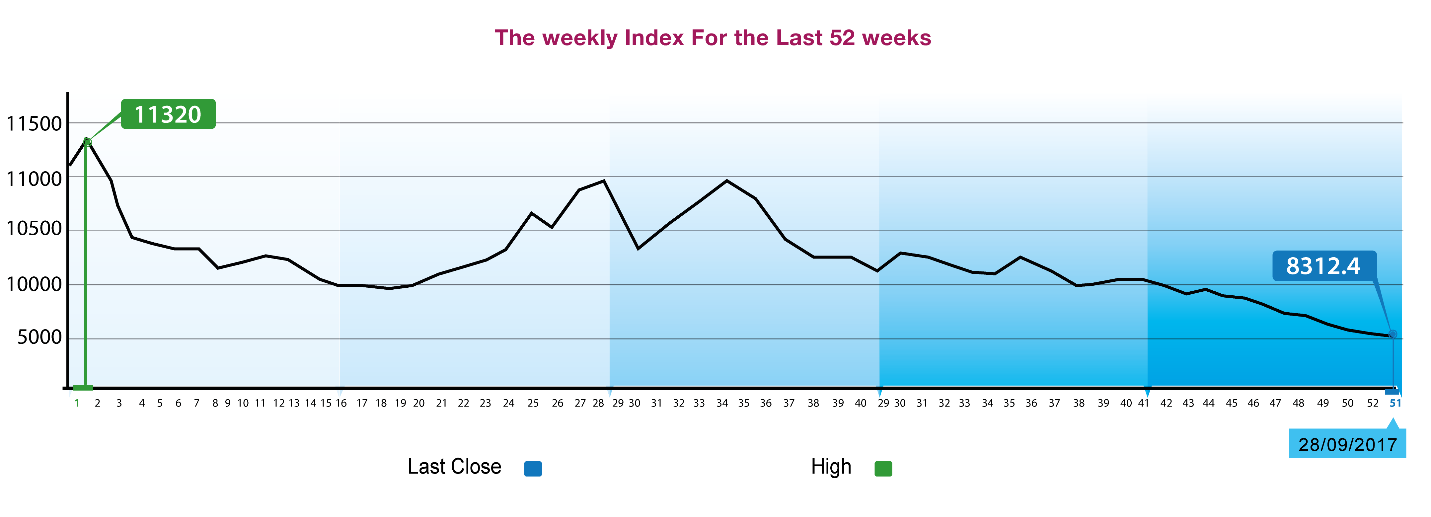

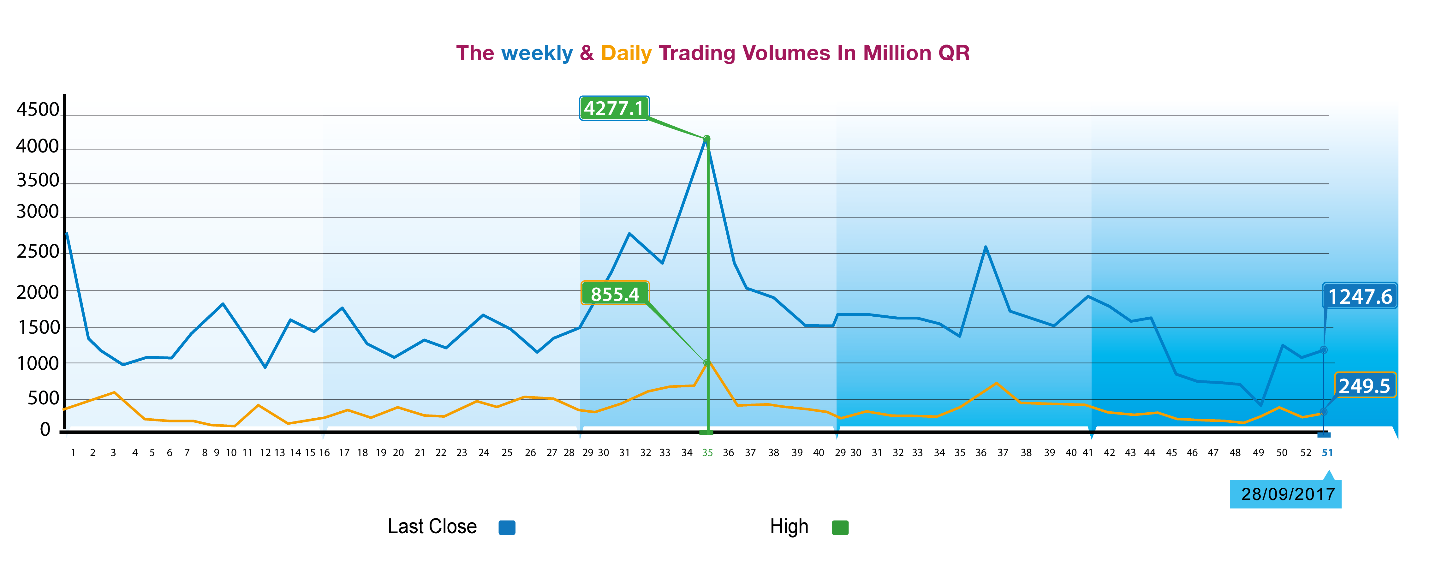

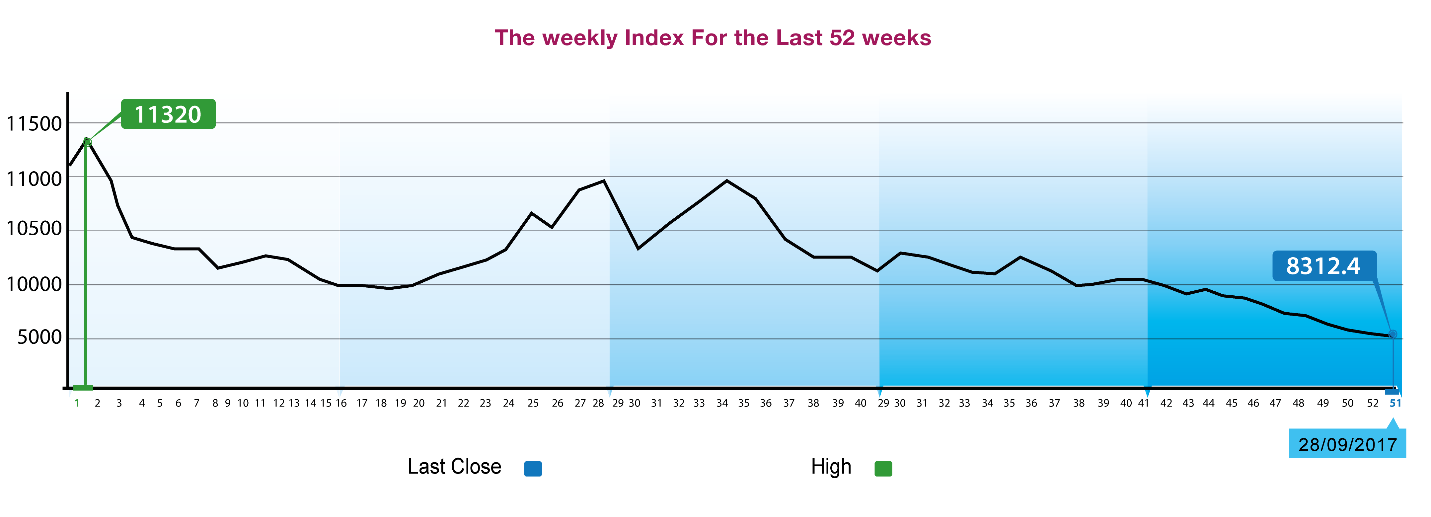

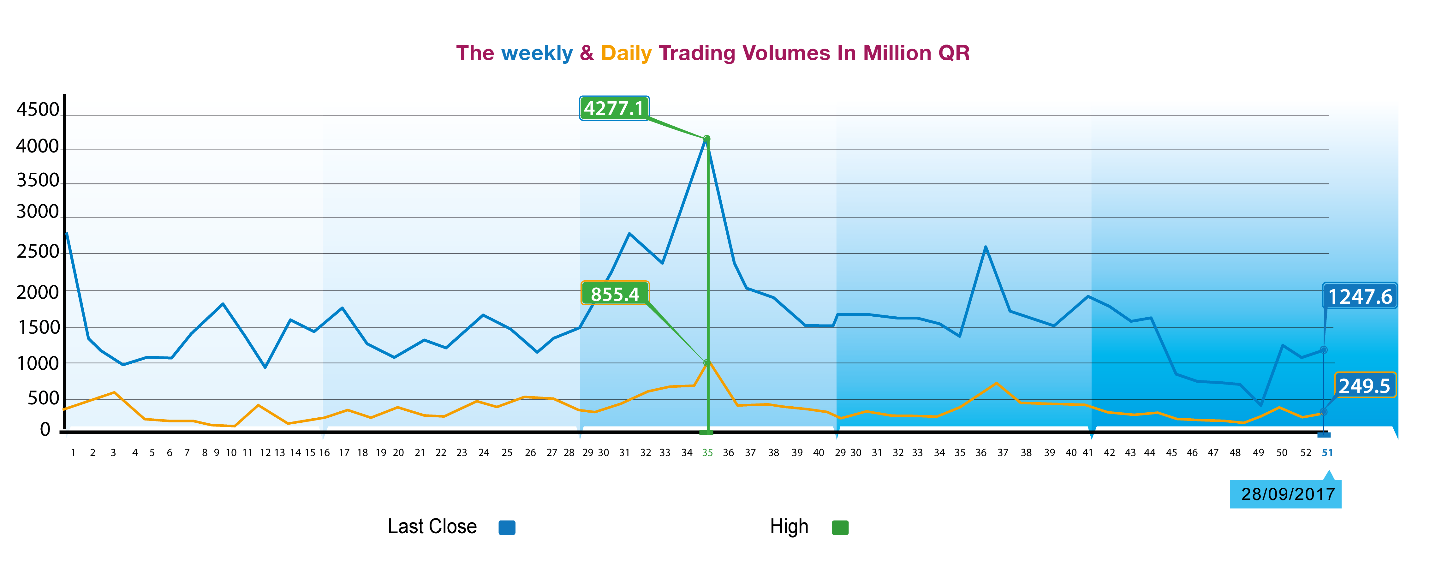

After a rise that extended to several sessions in the last two

weeks, a strong setback took place in the stock market indices

on Wednesday and Thursday, as a result of intensive selling led

by non-Qatari portfolios with a net value of QR 86.4 million. As

a result, the general index lost about 48 new points with the

benchmark index falling to 8312 points, which represented a

cumulative loss by the rate of 20.35% since the beginning of the

year. This decline in Qatar Stock Market took place despite the

fact that oil price continued to rise during the week and

reached its highest level this year and despite the dividend

distribution season is approaching with the beginning of the

fourth quarter. However, the situation in the stock market is no

longer favorable and attractive, a matter that requires changing

the pattern of thinking in addressing the weaknesses that have

been prevailing for years.

The Group reviews QSE performance in the week ending 28 September

with illustrative charts combined with corporate news and a list

of the affecting economic developments.

Corporate News:

1.

In order to achieve standard levels

of data security and for ensuring data flow speed while

maintaining continuity, a contract has been signed between The

Group and Qatar National Broadband Network (Qnbn) for

establishing a private fiber optic network to connect four sites

including Qatar Stock Exchange.

2. QNB Group has announced

its intention to disclose its financial statements for the third

quarter of 2017 on October 11, 2017. Other companies that have

also announced dates for disclosure include: Doha Bank, Medicare

Group, Salam International, Al Ahli,

Al Khaleej Takaful Group, Masraf Al Rayan,

Al Khalij Commercial Bank (al khaliji), Dalala and QIB.

Economic Developments:

1. Banks consolidated

balance sheet for August was released before two weeks showing

an increase of QR 14.9 billion to reach QR 1317.8 billion and

the total government and public sector debts, including T-Bills,

increased QR 5.1 billion to stand at QR 462.8 billion. Private

sector debts also increased about QR 3.4 billion to reach the

level of QR 453.5 billion.

2. The trade balance of the State of Qatar during

August achieved a surplus of QR 12.6 billion, recording

an increase of QR 3.9 billion or 45.4% compared to the

corresponding month last year and a rise of approximately QR 0.6

billion compared to the situation in July 2017.

3. OPEC oil prices rose to $ 55.59 a barrel from $ 54.59 a

barrel in the previous week.

4. Dow Jones Index recorded its highest quarterly gain in 20

years, rising 55 points to a historic high of 22405 points. US

Dollar exchange rate rose to $ 1.18 per euro and 112.46 yen per

dollar. Gold price fell about $ 18 an ounce to the level of

1282.5 dollars.

|