|

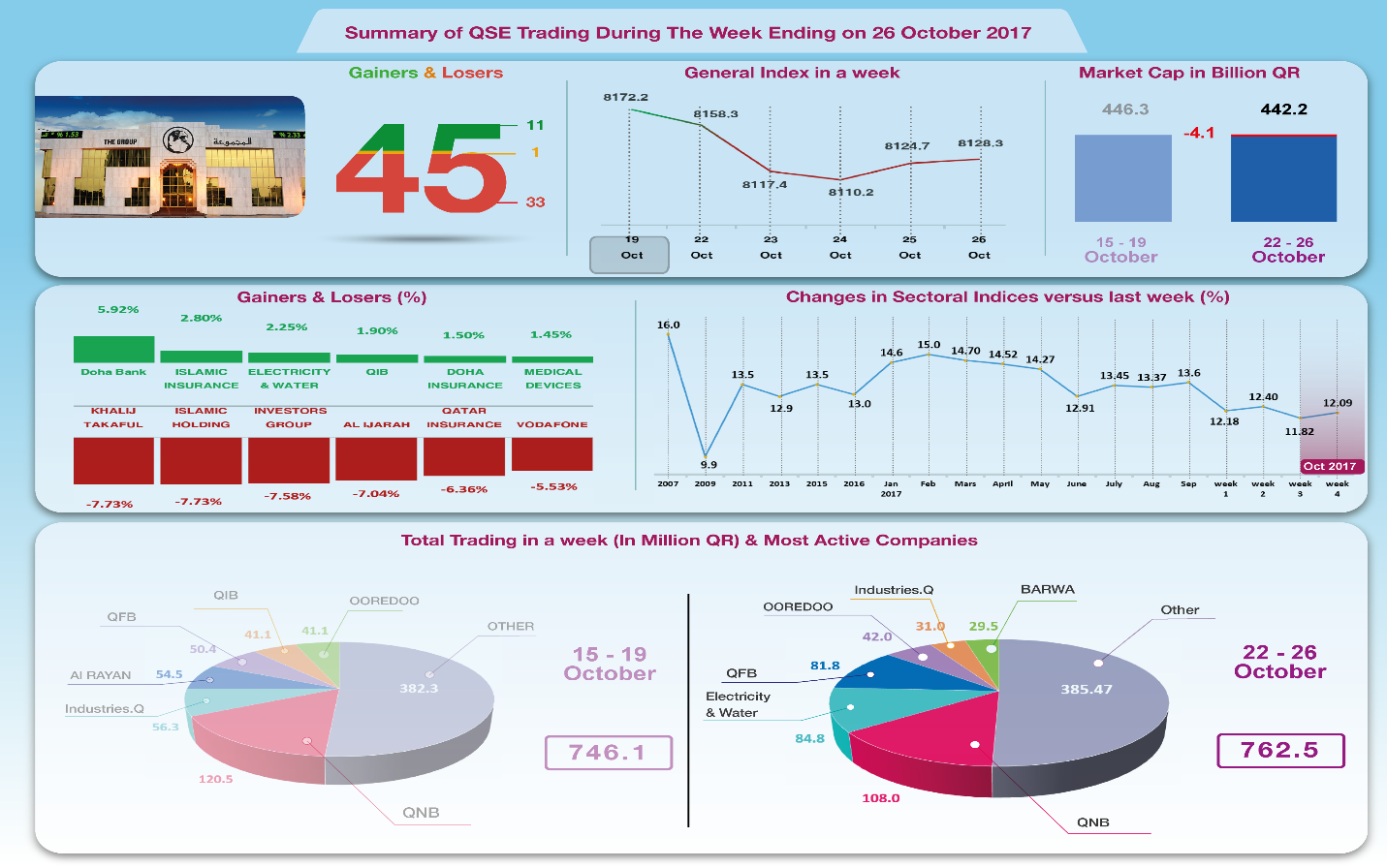

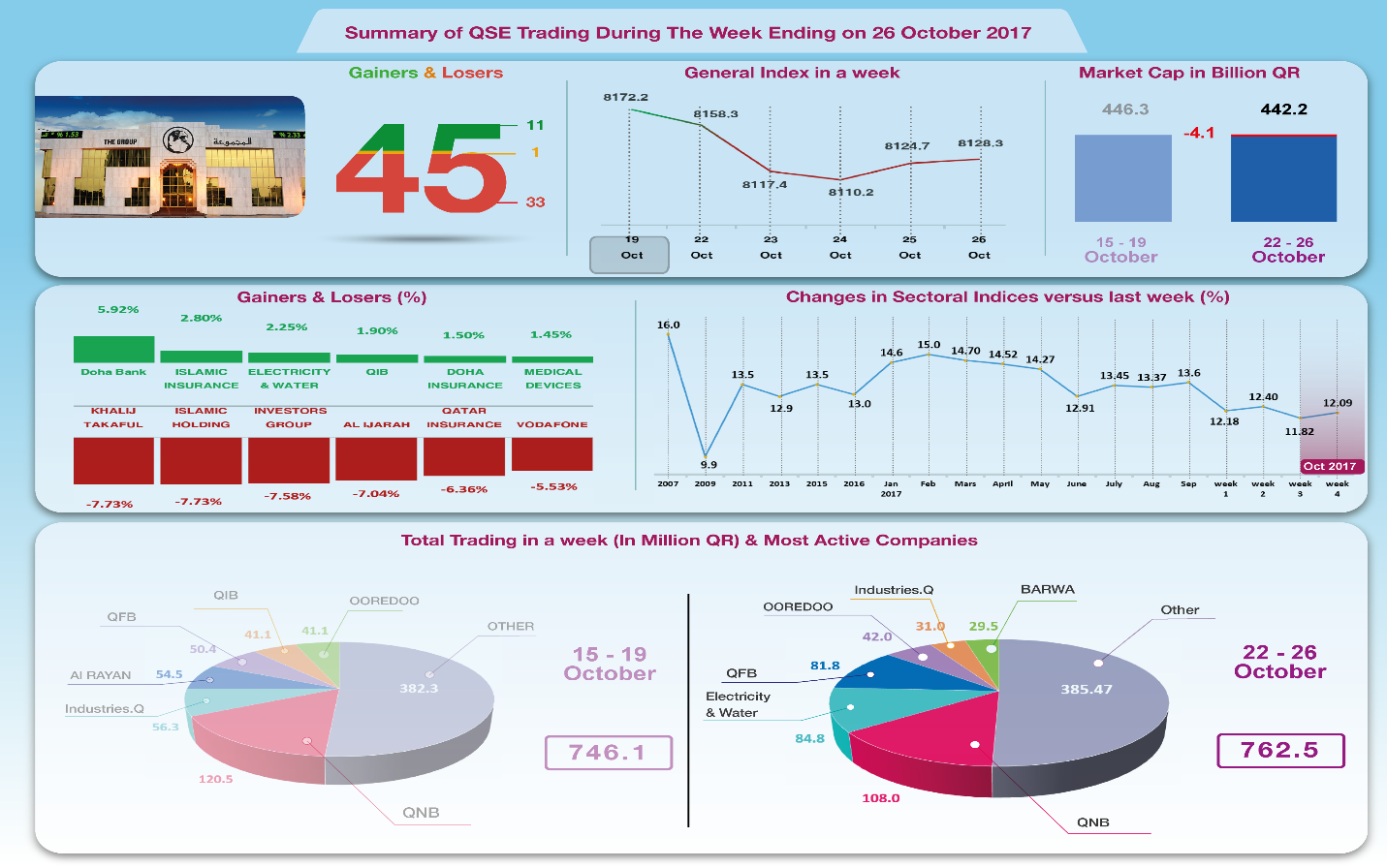

The Group Securities Weekly Report on QSE Performance, 22-26 October

2017

Despite the strong

performance of the stock market on Wednesday and Thursday and

non-occurrence of new falls, yet, the closing of the week was

not better than the previous one. The general index fell again

44 points, bringing the cumulative decline from the beginning of

the year to 22.1%. The performance was negatively affected by

the decline in the financial results of 20 companies that were

disclosed during the week with the net profit falling to QR 24.7

Billion.

The general index fell 44 points, or 0.54%, to 8128 points. All

sectoral indices fell and the most falling one was the insurance

index which dropped with the rate of 4.65% followed by transport

sector index 3.06%. The share price of

Al Khaleej Takaful Insurance

Company was

the biggest loser by the rate of 7.73%, followed by Islamic

Holding Group 7.73% then Qatari Investors Group share price

7.58%, Al-Ijarah share price 7.04% and Qatar Insurance share

6.36%. Doha Bank's share price was the most rising by the rate

of 5.92% followed by the Islamic Insurance 2.80%.

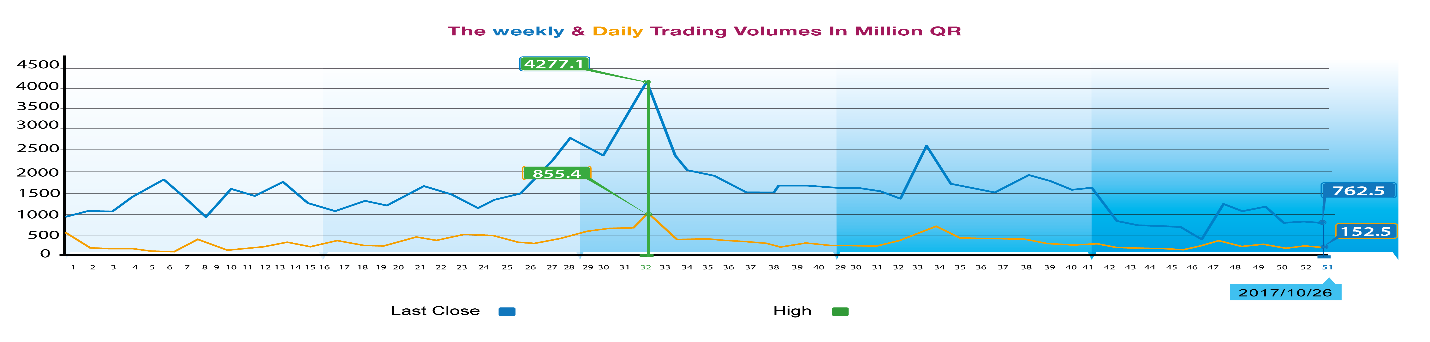

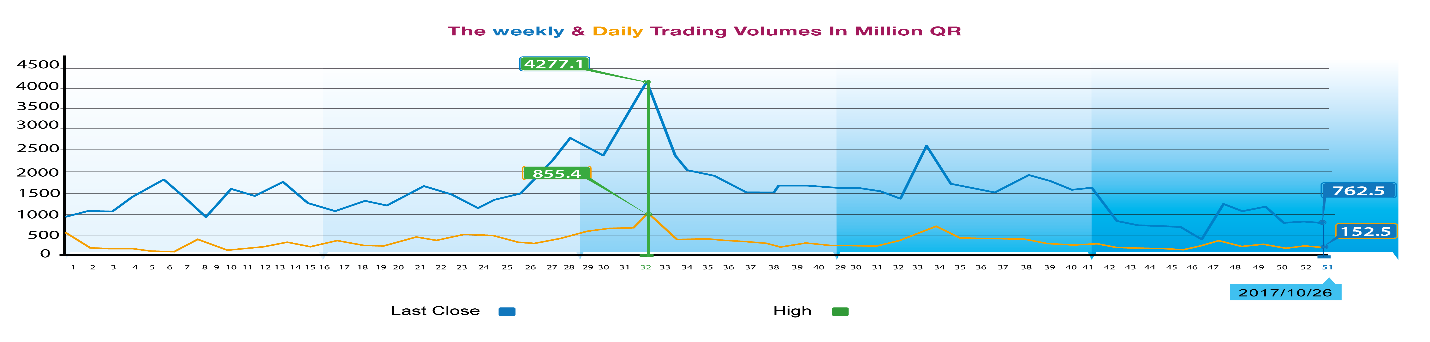

The total volume of trading in a week rose by 2.21% to the level

of QR 762.6 Million, the daily average rose to QR152.5 Million.

Trading on QNB share took the lead with the value of QR 108

Million, followed by Qatar Electricity and Water Company share

worth QR 84.8 Million. Then Qatar First Bank share valued at QR

81.8 Million. Foreign portfolios bought net worth QR 114.6

Million while Qatari portfolios sold net worth QR 84.9 Million.

Qatari individuals amounted to QR 26.7 Million and non-Qatari

individuals sold net worth QR 3 Million. As a result, the total

capitalization of the stock market shares declined QR 4.1

Billion to QR 442.2 Billion, but P/E ratio rose to 12.09 from

11.82 a week earlier.

Corporate News:

20

companies disclosed their financial statements for the period of

9 months, bringing the number of companies which disclosed to 37

and only 8 companies remain. The total profit recorded for all

these companies amounted to about QR 24.7 Billion, down by 6.5%

compared to the situation in the corresponding period last year.

Interested parties can view on The Group website all the

financial results and The Group Company’s comments on them.

Economic Developments:

1. Banks consolidated balance sheet for the month of September

was released during the week showing a rise in bank assets /

liabilities worth QR 19 Billion to reach QR 1336.8 Billion.

Government and public sector deposits rose QR 7.3 Billion to QR

302.7 Billion and the government and public sector loans

declined by about QR 5 Billion to QR328.9 Billion. Total bonds

and T-bills rose QR 17.5 Billion to QR146.3 Billion

while the private sector loans marginally increased to QR

453.9 Billion.

2. OPEC oil price rose by $ 0.93 a barrel to $ 56.52 a barrel,

compared to $ 55.52 a barrel last week.

3. The Dow Jones rose 105 points to a historic high of 23434

points. US dollar exchange rate rose to $ 1.16 per euro and

settled at 113.67 yen per dollar. Gold price

fell $ 8 per ounce to $ 1274.

|