| |

The Group Securities Weekly Report on QSE Performance, 29 October to 25 2nd

November 2017

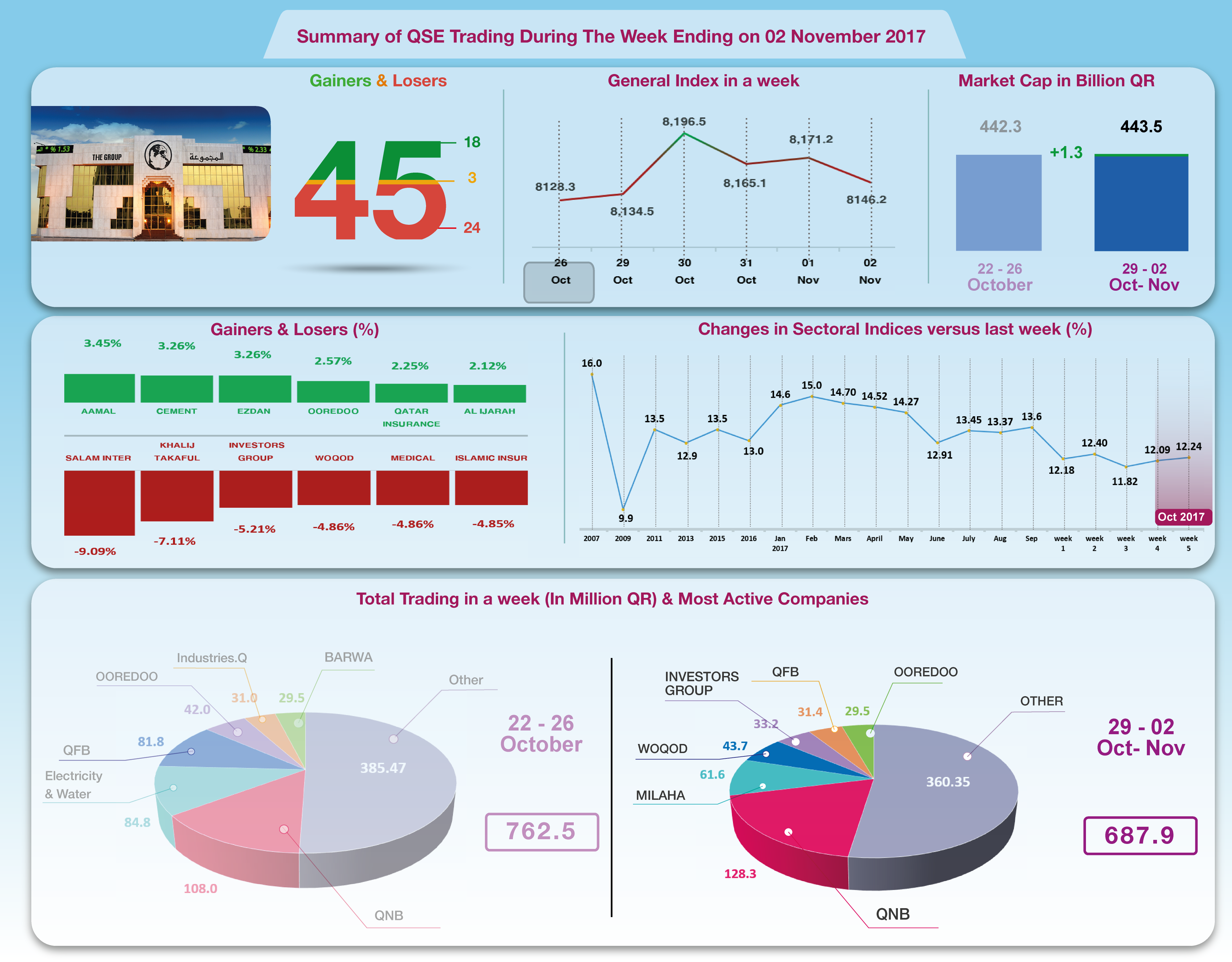

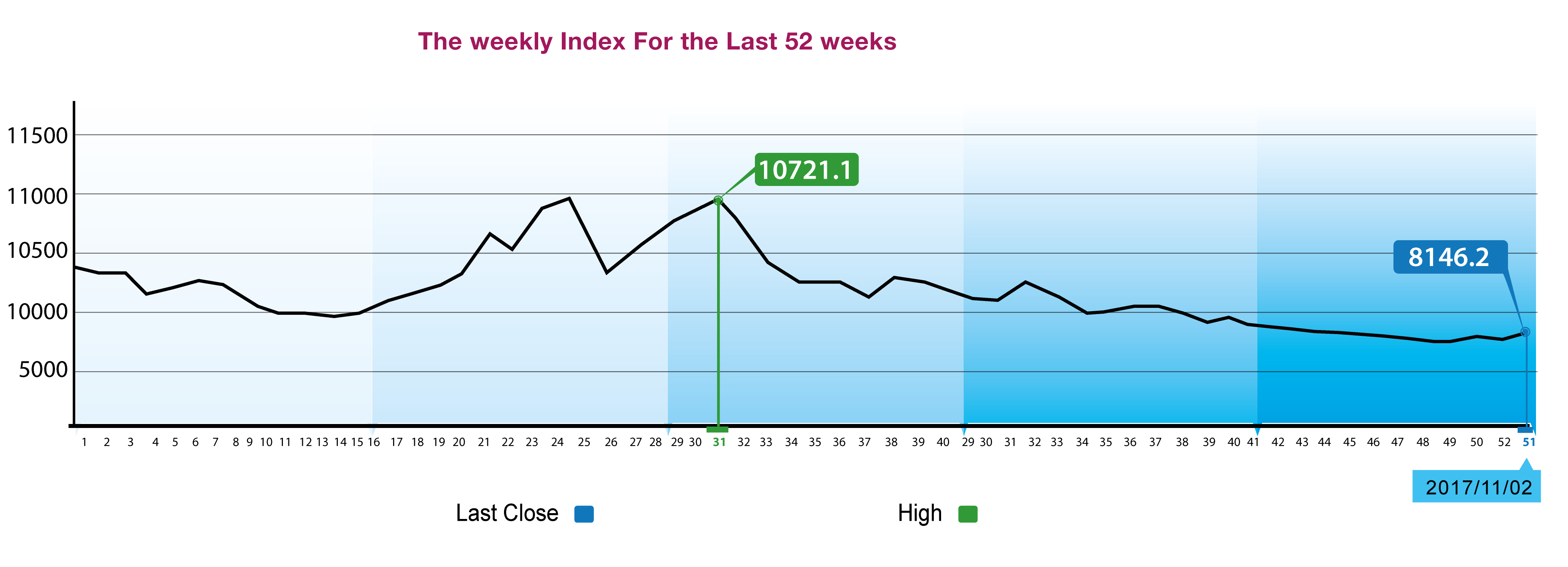

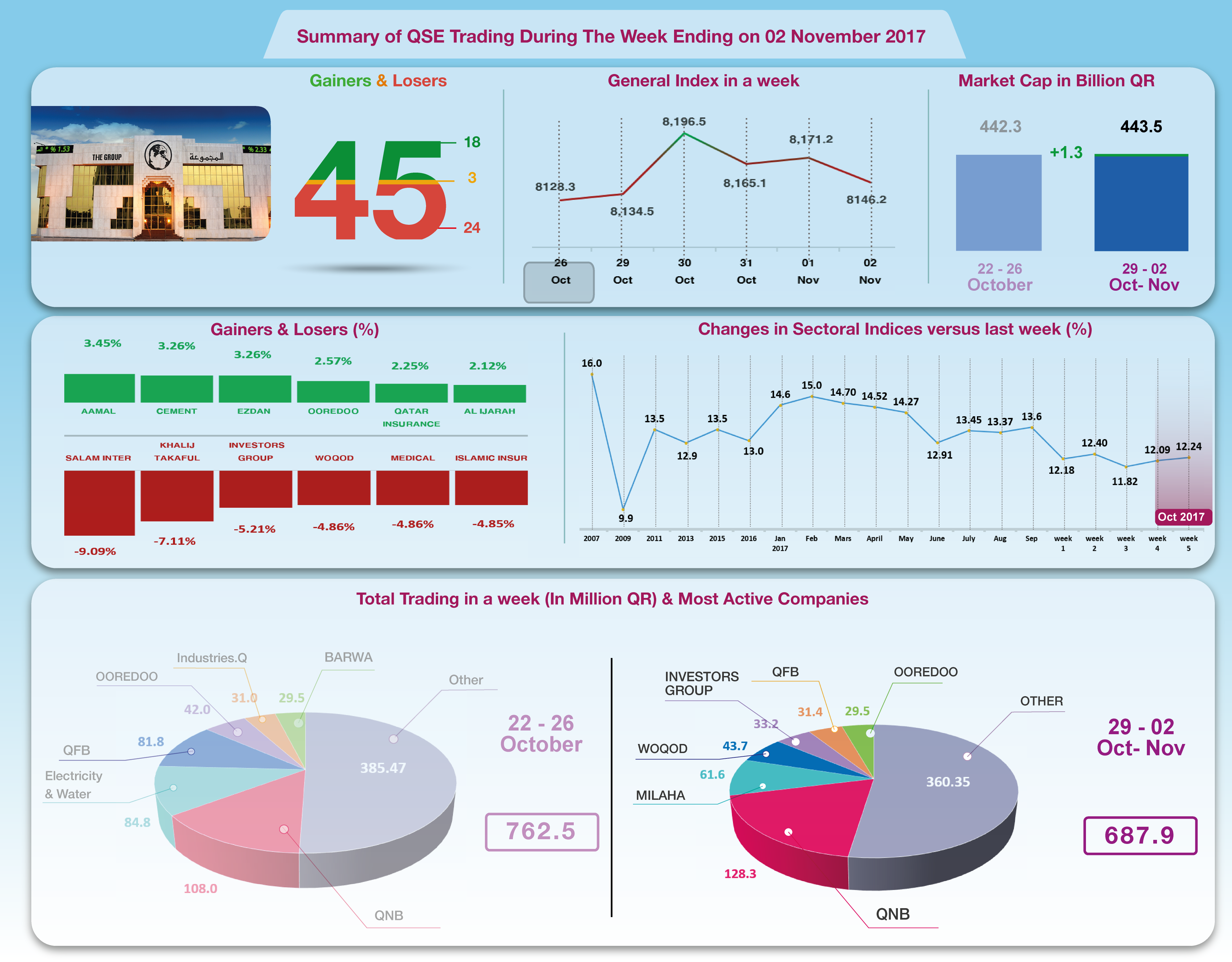

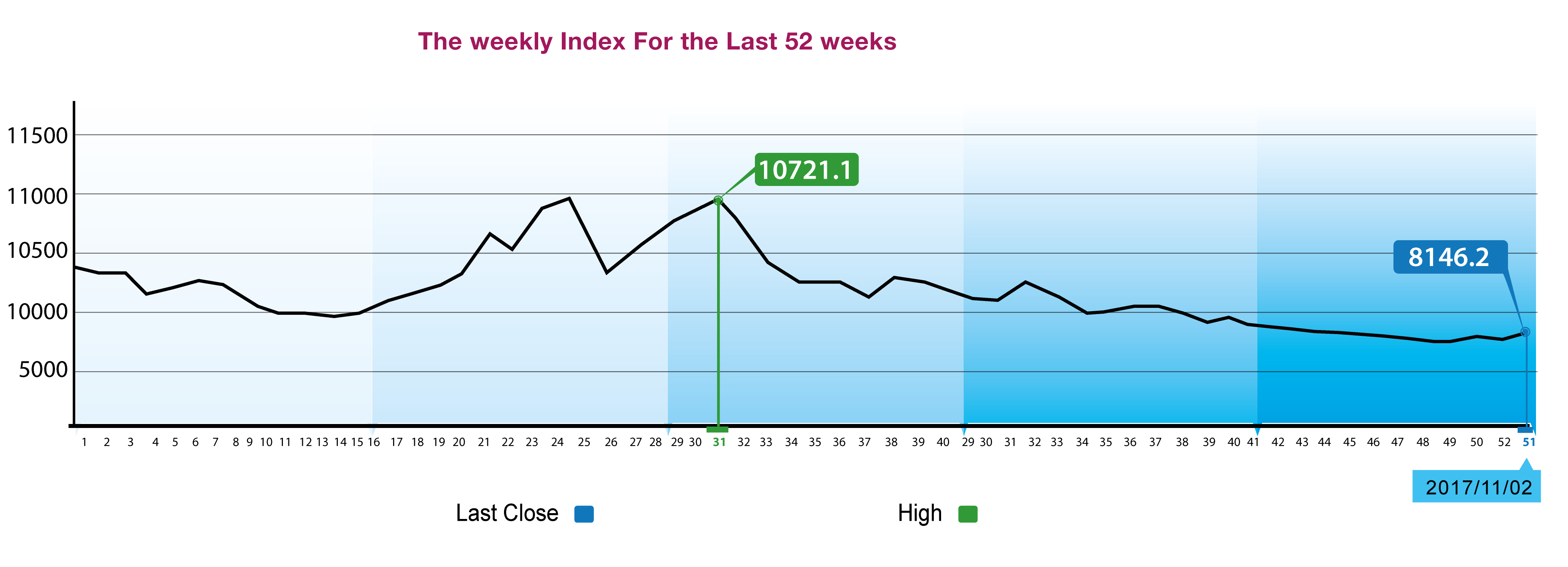

The General Index

fluctuates around 8150 points

November 5, 2017

The Qatar Stock Exchange may have benefited

last week from rising oil prices, which approached $ 60 a

barrel, its highest level this year. The stock market

performance enhanced somewhat and the indices ceased declining

but fluctuated within a narrow margin. The general index ended

the week on a limited rise of about 18 to reach the level of

8146 points. However, the total trading decreased by 9.8% to QR

688 Million with an average of QR 137.6 Million per day. Qatari

individuals and Qatari portfolios continued to sell net at a

total of QR 67 Million versus net purchases by non-Qatari

portfolios and individuals. Trading was concentrated on three

companies: QNB, Milaha and Woqood. The total capitalization

marginally increased to QR 443.5 Billion.

The general index rose by 18 points or 0.22 % to 8146 points.

All shares index rose 0.33 % while Al Rayan Islamic Index rose

0.65 %. Four sectoral indices rose: Real Estate sector index,

Telecommunication index, Insurance index, and Industrial sector

index. On the other hand, indices of services, banking and

transport sectors declined. The share price of Salam

International was the most declining by the rate of 9.1%,

followed by the share price of Khaleej Takaful Group by 7.11%,

Investment Holding Group 7.11%, Woqood share price and the

Medical Devices Company share price. On the other hand, Aamal

share price was the most rising by the rate of 3.45% followed by

National Cement, Ezdan Holding, Ooredoo, Qatar Insurance and Al

Ijarah share price.

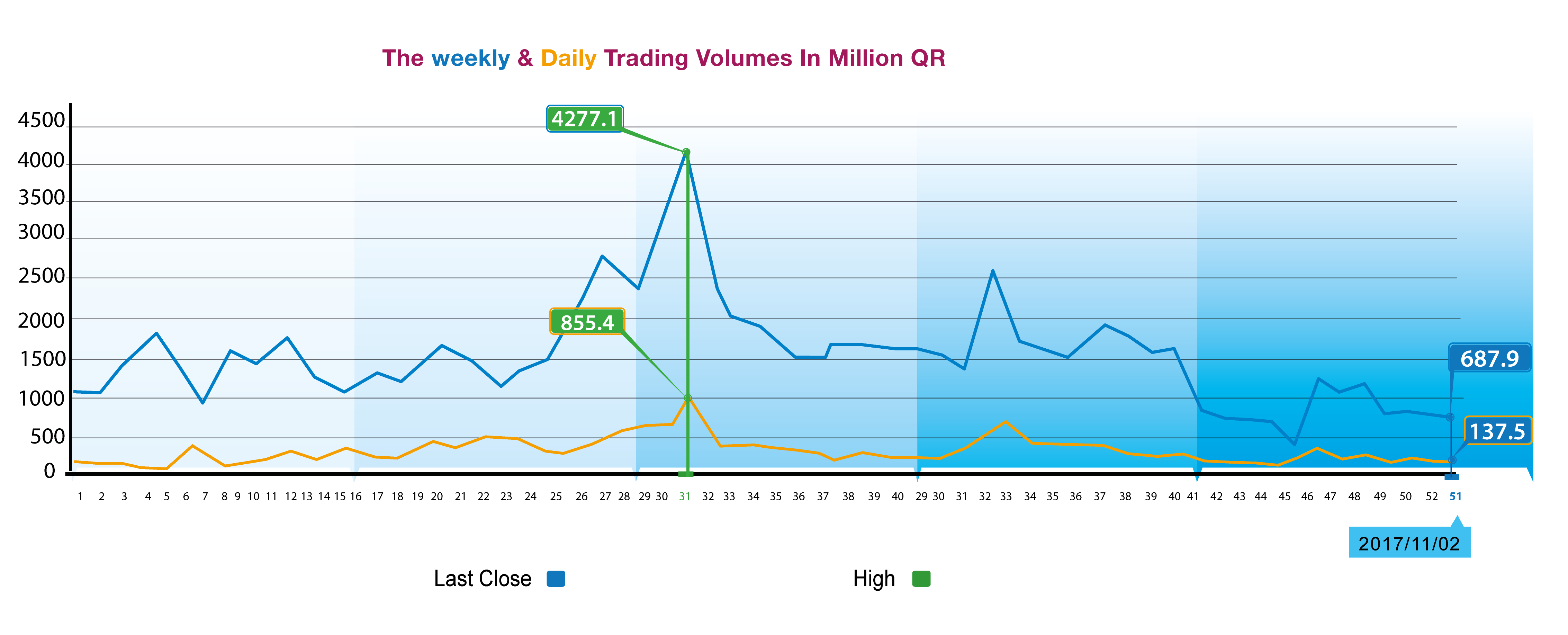

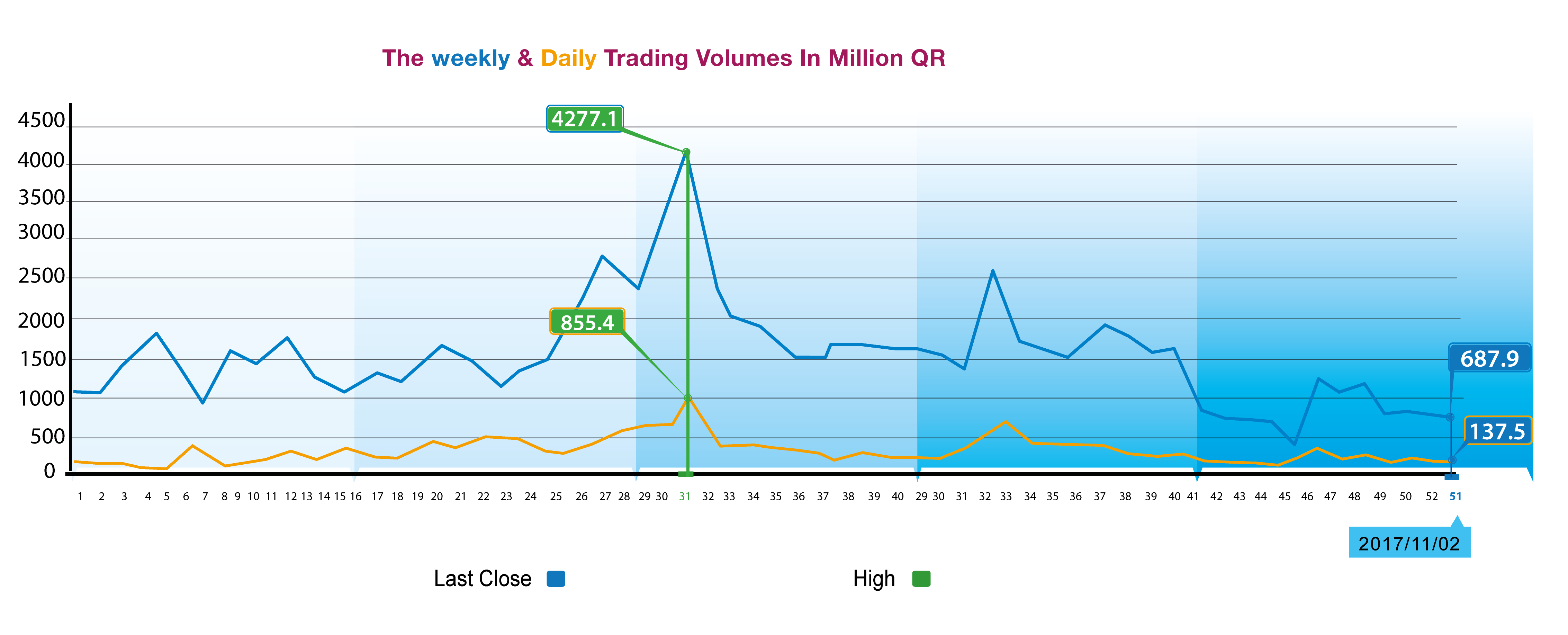

The total volume of trading in the week fell by 9.79% to QR 688

Million and the daily average fell to QR 137.6 Million. QNB

share topped the list of trading gaining QR128.3 Million

followed by Milaha share QR 61.6 Million, Wogood share QR43.7

Million. Qatari portfolios sold net worth QR 33.8 Million while

foreign portfolios bought net worth QR 56.5 Million. Qatari

individuals sold net worth QR 33.2 Million while non-Qatari

individuals bought net worth QR 10.5 Million. As a result, the

total capitalization of the stock market rose by QR 1.3 Billion

to reach QR 443.5 Billion. P/E ratio rose to 12.24 from 12.09 a

week earlier.

Corporate News:

44 out of the 45 listed companies at Qatar Stock

Exchange (QSE) have announced their financial statements results

for the nine months period ended September 30, 2017., The

combined net profit of all companies as of September 30, 2017

amounted to QR 29.3 Billion versus QR 31.1 Billion for the

corresponding period in 2016, an decrease of 6%. Ooredoo, Mesaieed, Salam International, Ezdan,

Zad, Al-Mana Corp and Gulf International Service were the last

companies to disclose. The Group followed up all disclosures and

published comments on its website.

Economic developments:

1. Banks consolidated balance sheet

for the month of September was released during the week showing

a rise in bank assets / liabilities worth QR 19 Billion to reach

QR 1336.8 Billion. Government and public sector deposits rose QR

7.3 Billion to QR 302.7 Billion and the government and public

sector loans declined by about QR 5 Billion to QR328.9 Billion.

Total bonds and T-bills rose QR 17.5 Billion to QR146.3

Billion while the private sector loans marginally increased to

QR 453.9 Billion.

2. OPEC

oil price rose by $ 1.97 a barrel to $ 58.49 a barrel compared

to $ 56.52 a barrel in the previous week.

3. The Dow Jones Index rose 210 points to a historic high of

23539 points. US dollar exchange rate rose to $ 1.16 per euro

and settled at 114.06 yen per dollar. Gold price fell around $

12 per ounce to reach $ 1270.

|