|

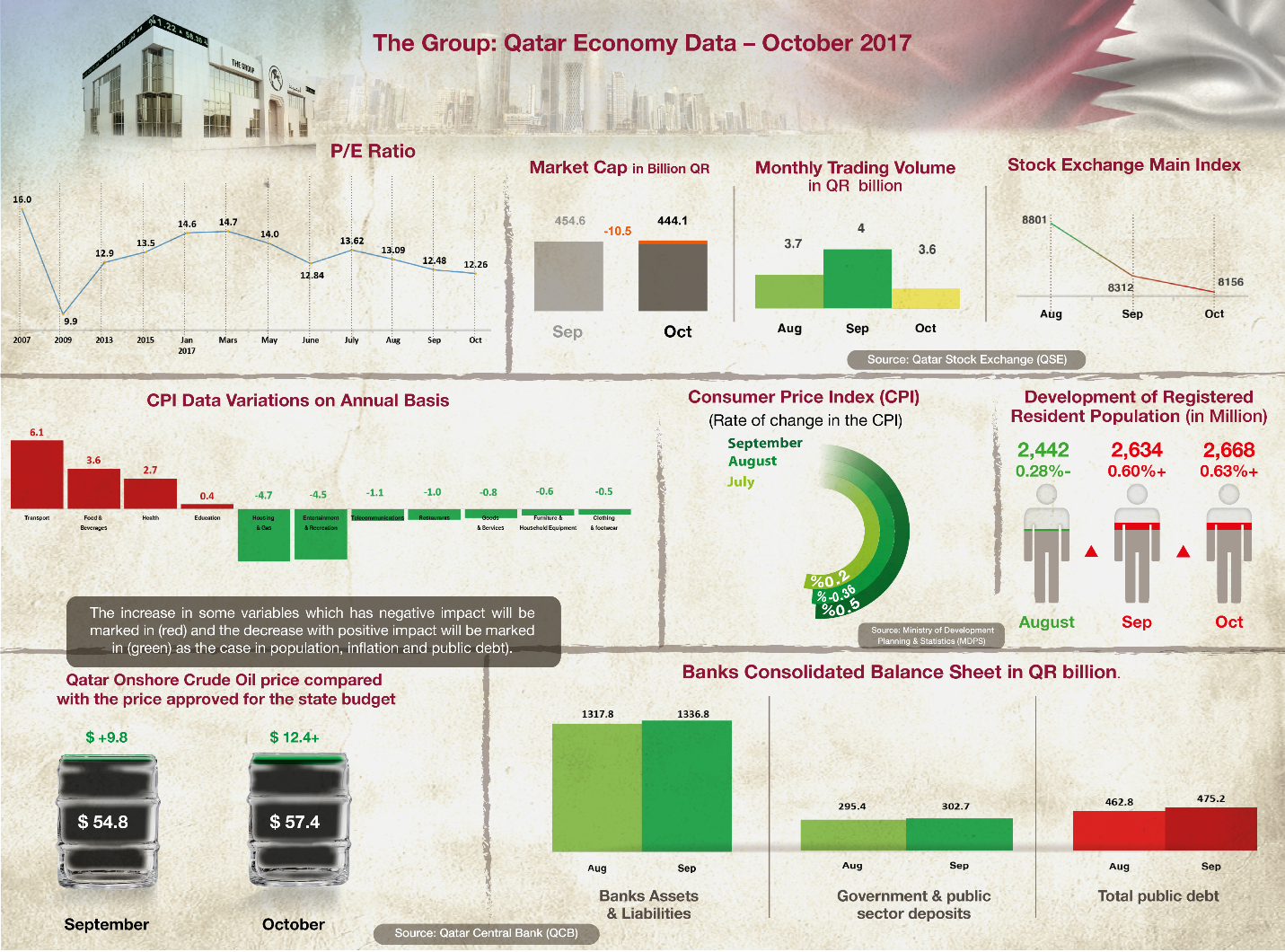

The Group Securities Review of Qatar Economy Data as at the end

of October 2017

November 08, 2017

The Group Securities Company reviews figures of Qatari economy

as reflected in data available at the end of October regarding

population count data, inflation rate, Qatar Stock Exchange

indices, oil prices and their compatibility with the price

approved in the state budget in addition to banks consolidated

balance sheet. The chart published with this report summarizes

the most important economic data that give a brief idea about

the economic situation in the country until the end

of October- except some data, which were available only in

August.

1. The total Population Count Register at the end of October

recorded an increase of about 34 thousand people, by the rate of

1.3 % to reach 2.668 million people compared to 2.634 million

people at the end of last September. Yet, it was still higher by

2.2% from what it was a year ago at the end of October 2016,

when it reached 2.610 million people.

2. Qatar Stock Exchange (QSE) benchmark index in October dropped

about 156 points by the rate of 1.9 % to the level of 8156

points, while the value of traded shares dropped 0.9 % to QR 3.6

Billion. On the other

hand, the market value of all shares of the stock market

QR 10.5 Billion by the

end of October to reach QR 444.1 Billion. P/E Ratio dropped to

12.26 by the end of the month.

3. USD together with Qatari Riyal exchange rate against the euro

at the end of October rose by the rate of 2.5 % to settle at the

level of $ 1.16 for each euro and rose against the yen by the

rate of 3.4 % to the level of 114.06 yen per dollar.

4.

Qatar Petroleum

announced that Qatar onshore oil price in October rose $ 4.6

per barrel above its price in September to reach $ 57.4 a

barrel. That means the price at the middle of October remained

$12.854 above the price of $ 45 a barrel approved in the state

budget.

5. Inflation rate data in October has not been released and

September data showed a drop in the inflation rate to 0.50 %

compared to 0.36% in August. The changes in the sub-groups of

goods and services were as follows: Decrease by the rate of 4.7%

in housing and fuel group, 4.5% in recreation and culture group,

1.1% in communication, 1% hotels and restaurants group, 0.8%

goods and service group, 0.6% furniture and 0.5 clothing and

footwear group. In

Contrast, there was an increase in inflation by the rate of 6.1%

in transport group, 3.6% increase in

food and beverage group, 0.4% increase in education, 2.7

increase in health group.

6. Figures of Qatar trade surplus in October 2017 are not

released and the figures of September showed a surplus of QR

12.5 Billion recording an increase of QR 3.7 Billion above the

figures of the corresponding period in 2016 and a decrease of QR

0.2 Billion compared to the surplus in August 2017.

|