|

The Group Securities Weekly Report

on QSE Performance, 12 – 16 November 2017

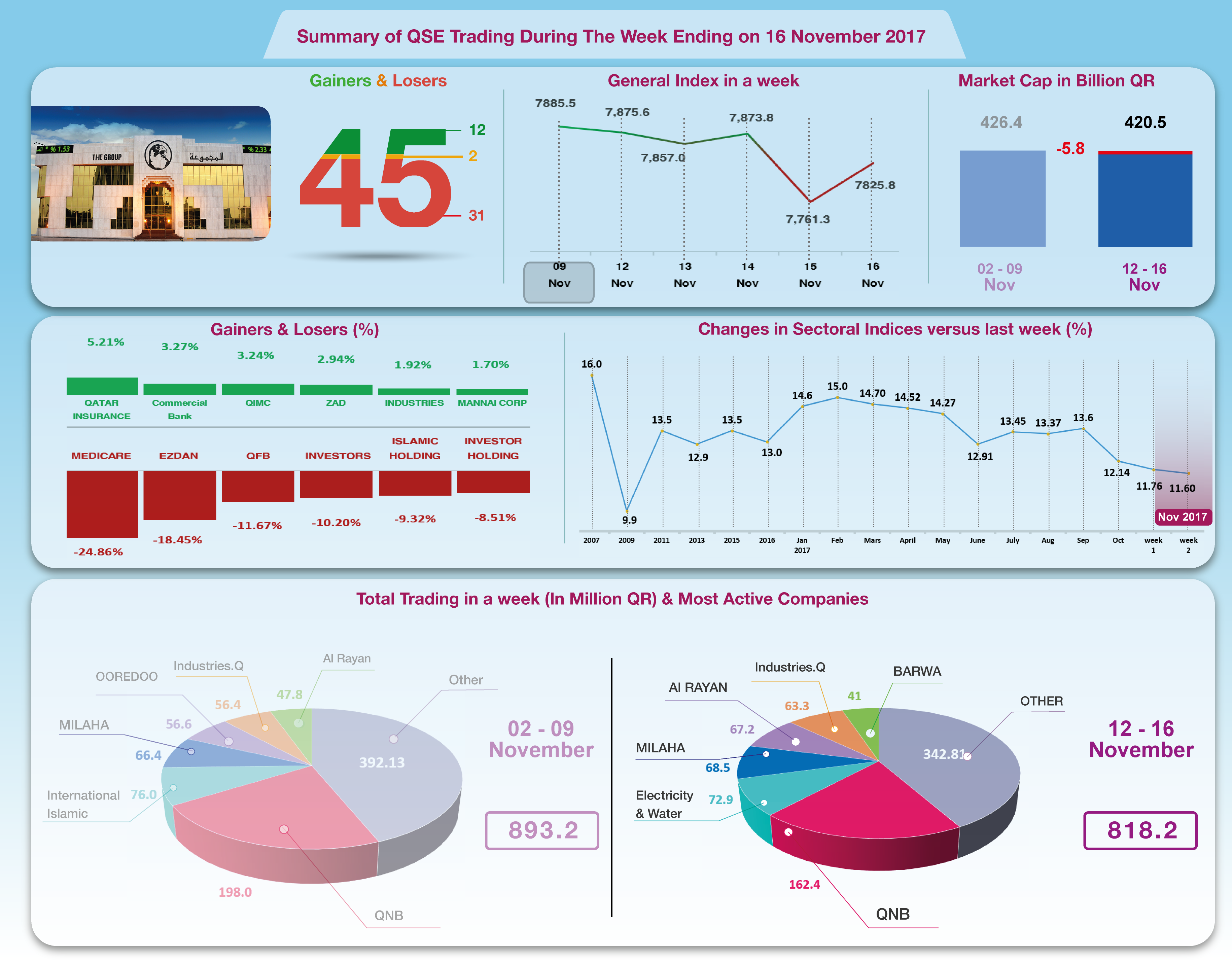

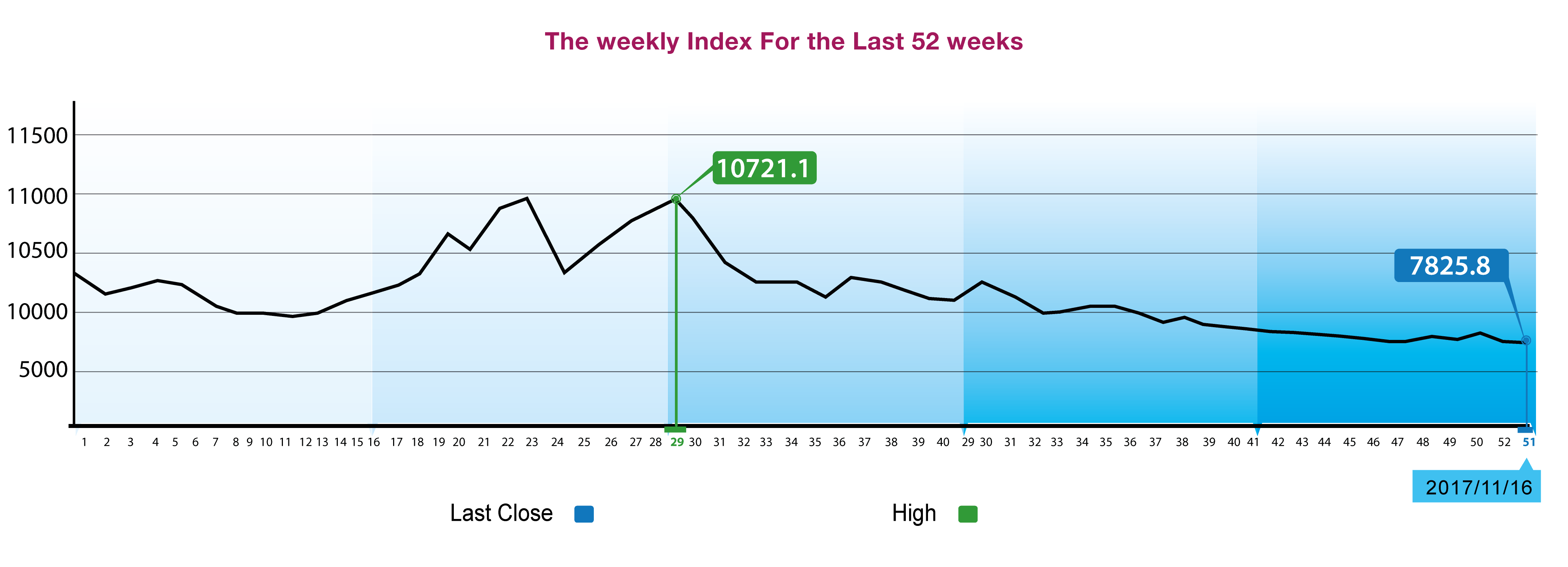

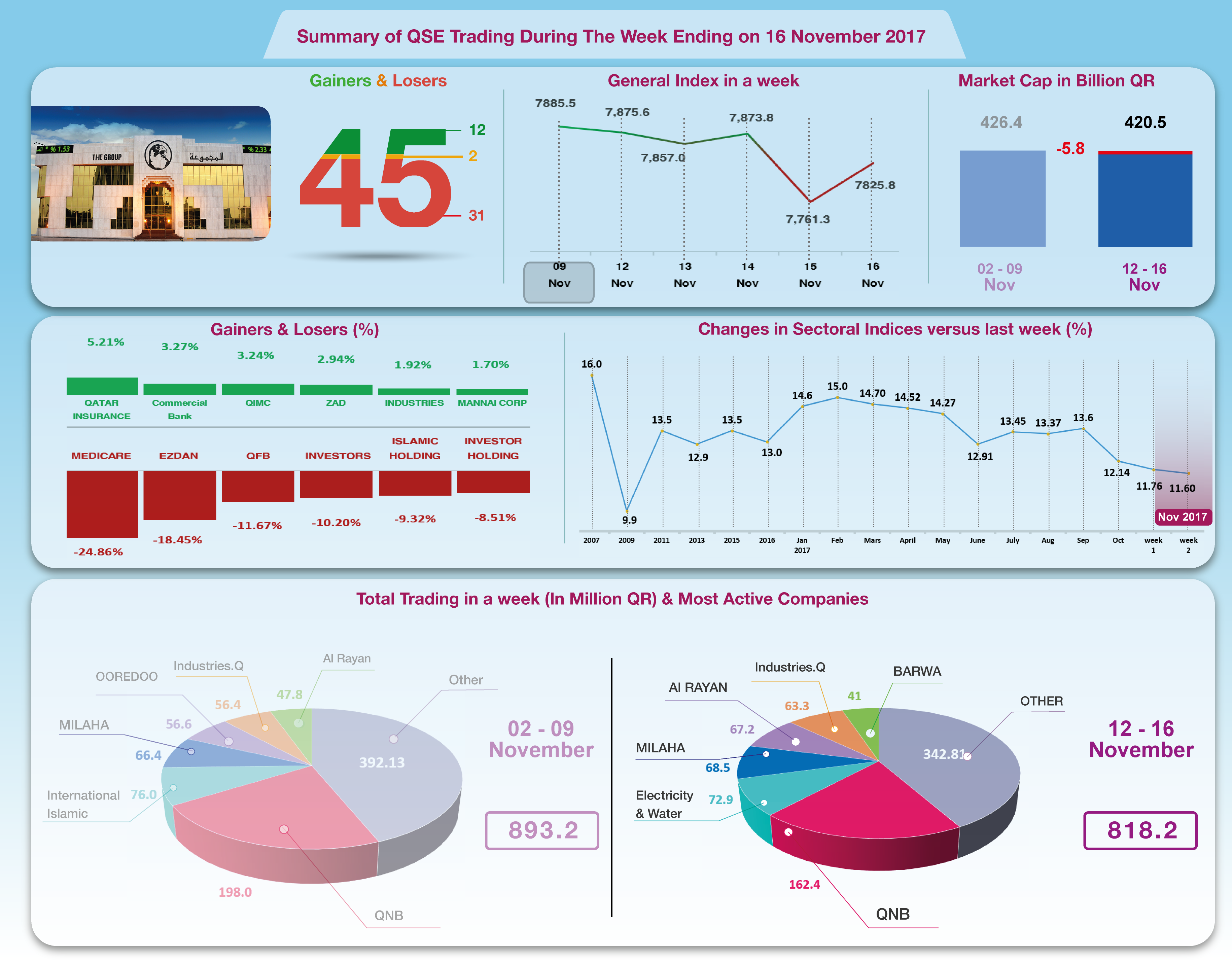

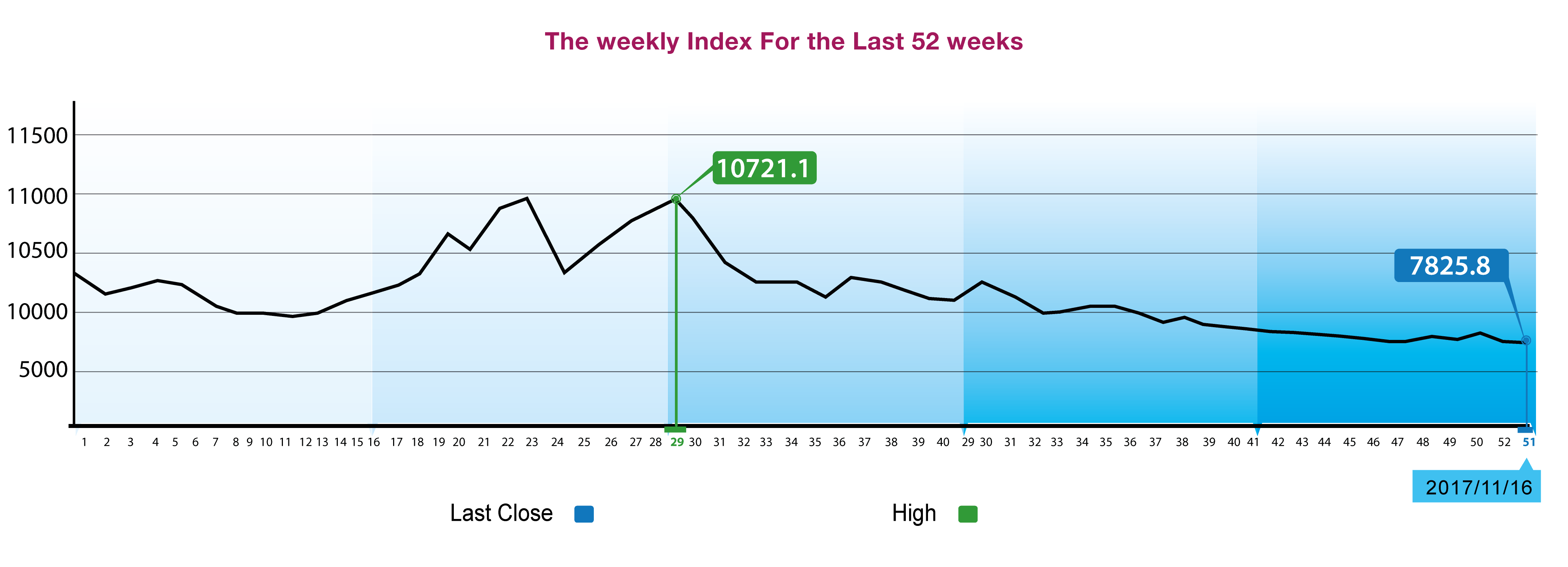

The general index continues its

decline to 7826 points

The stock market indices continued to decline

and last week lost more points where the general index lost 60

points to reach the level of 7826 points. Thus, the index has

lost 25% of its value since the beginning of the year. The

declines in Islamic-listed stocks were sharp as Al Rayan Islamic

Index declined 2.65% versus a decline of only 0.76% for the

general index. The biggest declines were in shares Medicare,

Ezdan and Qatar First Bank. Five of the sectoral indices were

also down; the real estate sector was the most declining by the

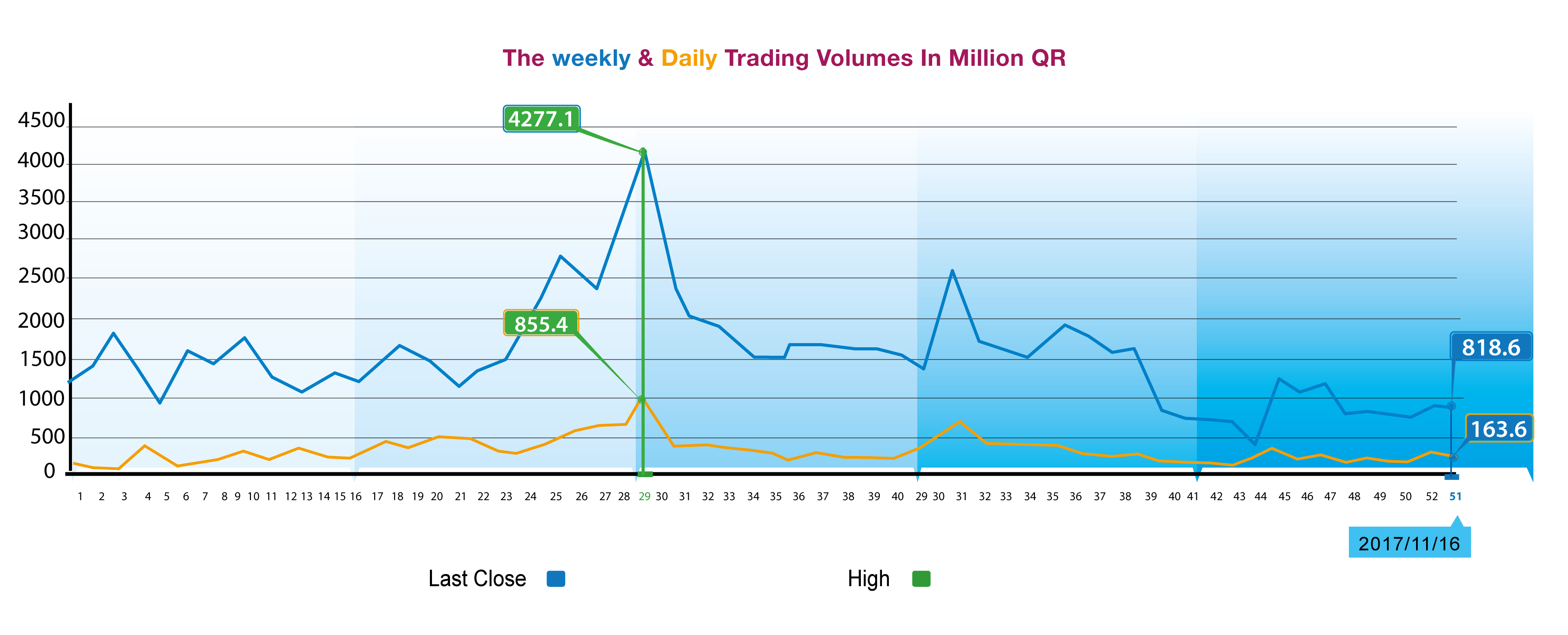

rate of 10.56%. On the other hand, the total trading decreased

by 8.4% to QR 818.2 Billion. Total capitalization decreased

QR 5.8 Billion to QR 420.5 Billion and P/E ratio

was down to 11.6, the lowest level since 2010.

The general index fell 60 points i.e.

0.76%, to 7825.8 points. All shares index decreased by

1.98% while the Islamic Rayan Index decreased by 2.65%. Five

sectoral indices, in particular real estate index followed by

transport index and services index. Medicare Group share price

was the most declining by the rate of 24.9%

followed by Ezdan share price of 18.5%, Qatar First Bank

by 11.7%, Qatari Investors Group by 10.2%

and the Islamic Holding Group share price by 9.3%. On the

other hand, Qatar Insurance Company share price rose 5.2%

followed by the Commercial Bank share 3.27%, QNB share 3.24%,

Zad share 2.94% and Industries Qatar share price 1.92%.

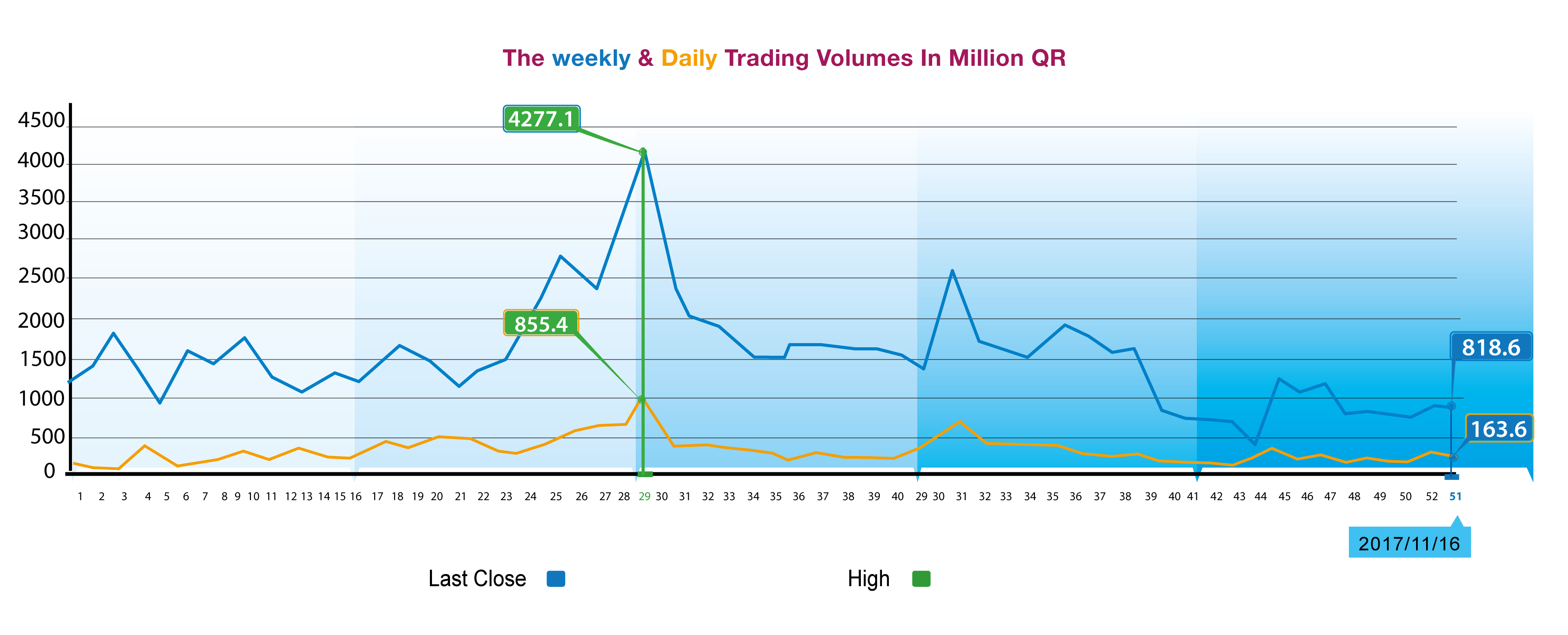

The total trading volume fell by 8.4% to QR 818.2 Million and

the daily average dropped to QR 163.6 Million. Trading on shares

of QNB topped valued at QR162.4 Million followed by Electricity

& Water shares worth QR 72.9 Million then Milaha shares QR68.5

Million and Masraf Al Rayan share QR 67.2 Million. Qatari

individuals were the sole net sellers of QR 38.9 Million versus

net purchases of QR 23.7 Million by non-Qatari portfolios and

QR15.2 Million by Qatari portfolios. As a result, the total

capitalization of the stock exchange shares declined by QR 5.8

Billion to QR 420.5 Billion and P/E ratio dropped to 11.60 from

11.76 a week ago.

Corporate News:

1 - Widam Food

Company announced that it received a copy of the

Court of Cassation - Civil Court ruling in the Appeal No.

314/201and rejected the appeal raised by the Ministry of

Municipality and Environment. Thus, Widam Food Company won the

case obtaining QR 11,939,369 Million as compensation from the

Ministry of Municipality and Environment.

2. The Board of Directors of Mannai Corporation has announced

holding the Extraordinary General Assembly Meeting scheduled for

Sunday, December 03, 2017.

3.

Qatar First Bank announced that the Astro AD Cayman Ltd, a fully

owned subsidiary of Qatar First Bank founded in Cayman Islands,

CR No CT 239044 (hereinafter referred to as “Subsidiary”) has

sold all its shares in Amanat Holding, founded in UAE and listed

in Dubai Financial Market. The sale amount is UAE Dirhams

150,000,000 (Only One Hundred Fifty Million UAE Dirhams). The

deal amount does not represent more than 10% of the total assets

of the bank. Moreover, conclusion of this deal will not

negatively affect in any way on financial position of the bank,

and the deal was concluded in full accordance with the standard

common commercial practices.

Economic Developments:

1. Banks consolidated

balance sheet for October has not been released and the data for

September showed

a rise in bank assets / liabilities worth QR 19 Billion to reach

QR 1336.8 Billion. Government and public sector deposits rose QR

7.3 Billion to QR 302.7 Billion and the government and public

sector loans declined by about QR 5 Billion to QR328.9 Billion.

Total bonds and T-bills rose QR 17.5 Billion to QR146.3

Billion while the private sector loans marginally increased to

QR 453.9 Billion.

2. The consumer price index for October 2017

rose by 0.2% to 108.7 points compared to the figures of October

2016. As a result, the inflation rate reached 0.2% compared with

5% in September 2017

3. OPEC oil price until last Thursday rose by $ 1.63 a barrel to

$ 59.98 per barrel compared to $ 61.61 a barrel in the previous

week.

4. The Dow Jones fell nearly 64 points to 23,358 points. US

dollar exchange rate rose to $ 1.18 per euro, falling to 112.07

yen per dollar. Gold price rose $ 18 per ounce to $ 1294.

|