|

The Group Securities: Weekly Report on QSE

Performance, 26-30 Nov 2017

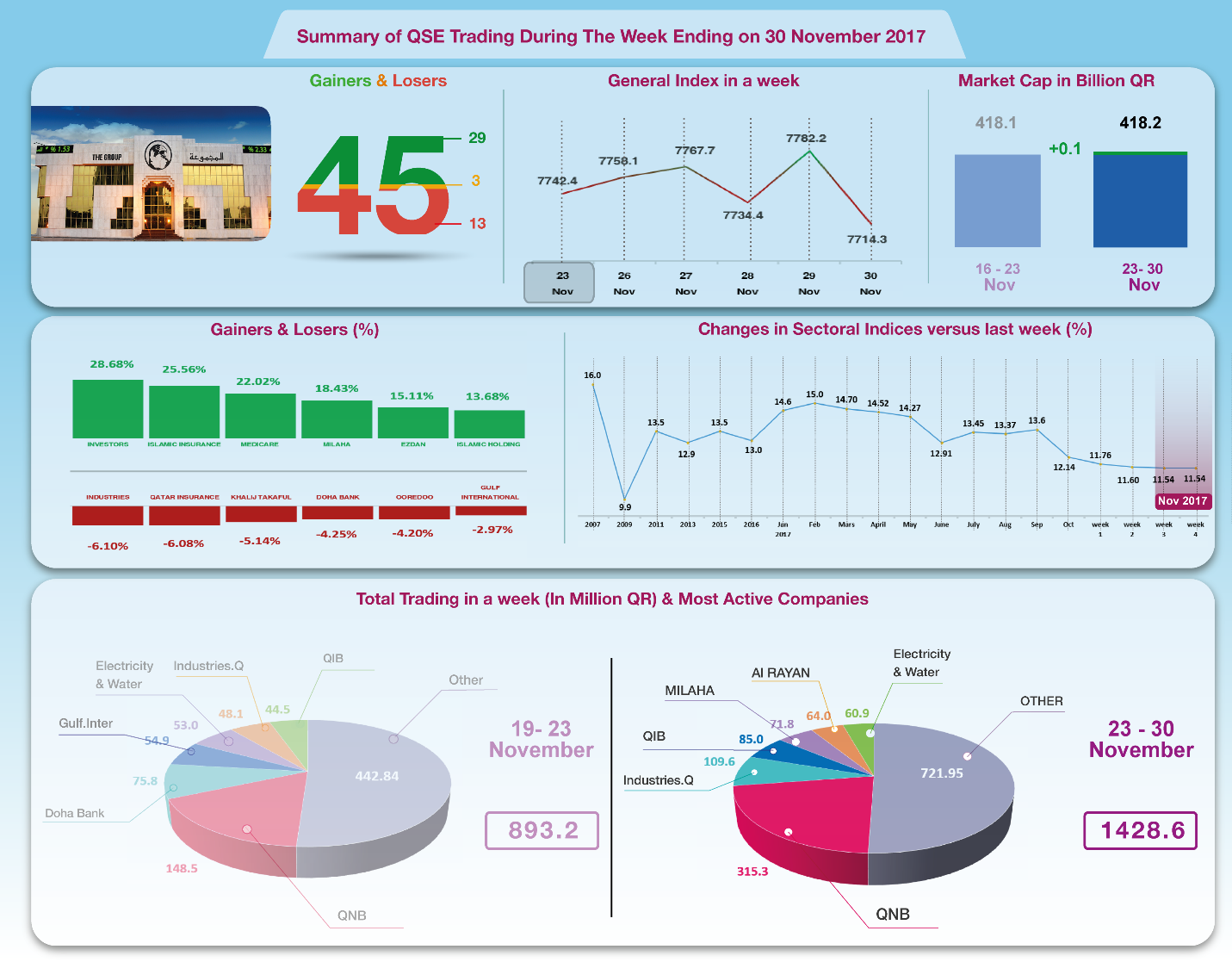

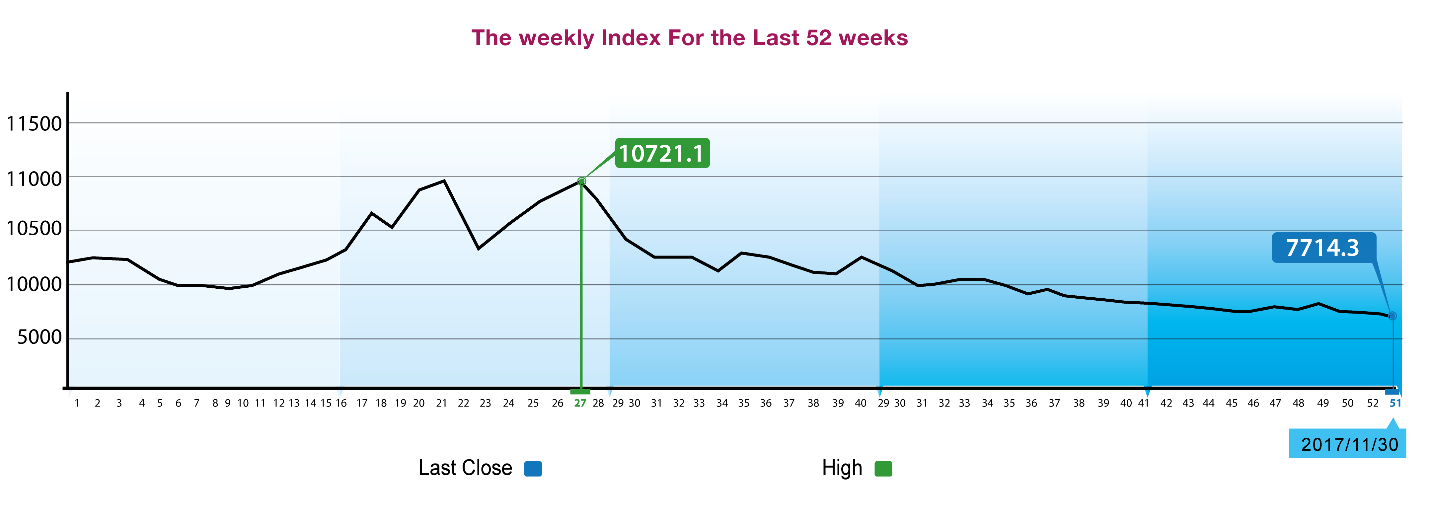

General Index

Fluctuates at Bottom with Small Decline

Last week, Qatar

Stock Exchange performance was unsteady. In fact, three trading

sessions closed up, while two others ended on negative note. The

result was a fall by 28.2 points or by 0.36% in five trading

sessions. Notably, Al Rayan index surged by 2.29% as result of

robust gains made by the shares of its companies; namely, Qatari

Investors Group, Qatar Islamic Insurance, and Medicare and Ezdan

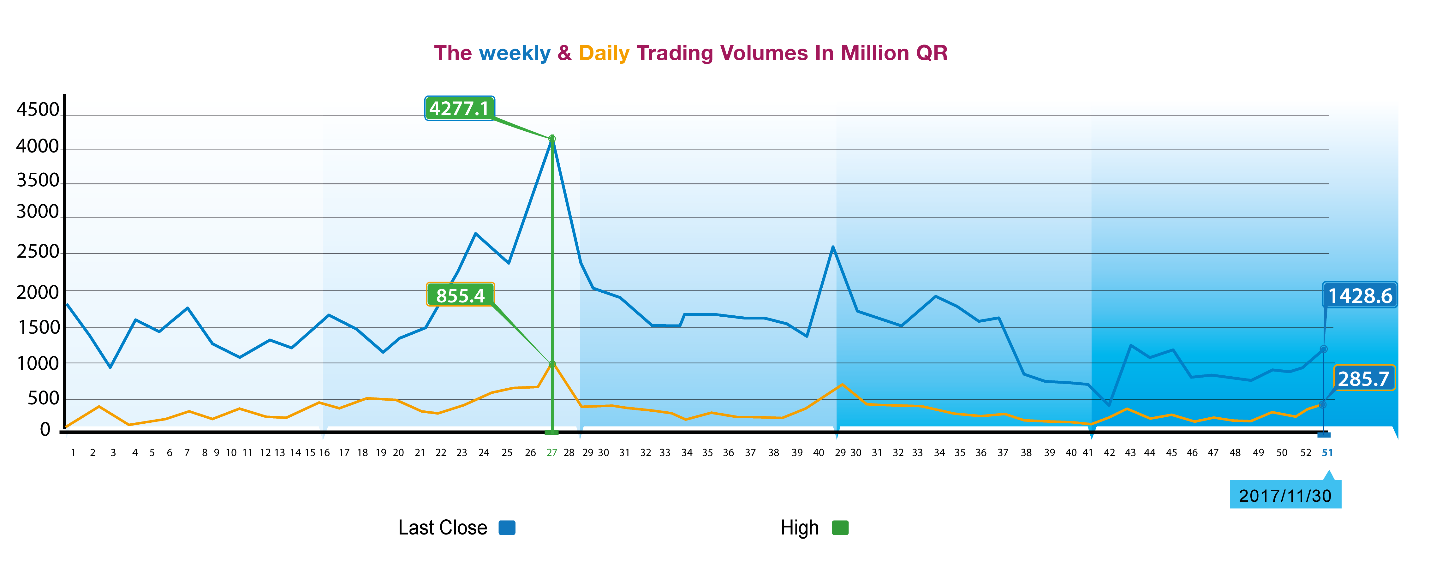

Holding Group. Moreover, total trading volume increased by 64.7%

to QR1428.7 million, with an average daily trading of QR285

million. Total

capitalization remained steady, with a marginal increase of

QR418.2 Billion. P/E

Ratio reached a 11.54 multiple, unchanged from the previous

week. Qatari individual investors continued to lead net

purchases with a volume of QR81.4 million, while non-Qatari

portfolios topped net sales with a value worth QR89 million.

The transactions of other

categories of investors remained limited. In depth, General

Index slipped by 28.2 points, or 0.36% to the level of 7714.3

points, while All Shares index rose by 0.75%.

Al Rayan Islamic Index increased by 2.29%. Four Sectoral

Indices ended low; namely, Insurance, followed by

Telecommunication, Industries, and then Banking sector. In

contrast, Real Estate, Transport and Commodities recorded strong

gains. The share price of Qatar Investors hit the highest level,

notching a 28.8% increase, followed by Qatar Islamic Insurance

by 25.6%, Medicare Group by 22%, MILAHA, and Ezdan Holding

Group. In contrast, the share price of Qatar Industries fell by

6.1%, Qatar Insurance by 6.08%,

Al Khaleej Takaful by 5.14%, Doha Bank by 4.25%, and

Ooredoo by 4.20% Total trading

volume increased by 64.7% in the space of one week to QR1428.7

million, while the average daily trading

rose to QR285.7 million.

QNB’s share dominated the trading with a volume of QR315.3

million, followed by Industries Qatar with QR109.6 million, QIB

with QR85 million, MILAHA with QR71.8 million, and Masraf Al

Rayan with QR64 million. It should be noted that Qatari

individuals dominated net purchases with a volume of QR81.4

million, compared to non-Qatari portfolios that recorded net

sales of QR89 million. Consequently, the QSE's total

capitalization rose by QR0.1 Billion, reaching QR418.2 Billion.

P/E Ratio stood at a multiple of 11.54, similar to the previous

week.

1.

Qatar Oman Investment Company

(QOIC) announced the opening of the candidacy to the Board’s

membership in its new 3- years tenure(2018-2020). Six members

will be elected to the Board in the process that will take place

starting the morning of Thursday 30/11/2017 throughout

14/12/2017.

2.

Al Khaleej Bank’s ordinary

general assembly has approved the nomination and election list

of the board of directors which has been prepared to comply with

the applicable laws of good governance. The next election of the

Board of Directors will be structured around these approved

regulations. Furthermore, the Bank’s extraordinary general

assembly approved the proposed amendments to the statute

Economic

Developments:

1.

Banks’ consolidated balance sheet

for October has been released showing a fall in bank

assets/liabilities worth QR18.1 Billion, down to QR1318.7

Billion. Government and public sector deposits were affected as

well, recording a fall of QR4.3 Billion, sitting at QR298.4

Billion. As for Government and public sector loans, they reached

QR328.9 Billion, a decline of QR5 Billion, while bonds and

treasury bonds dropped by QR5.7 Billion to QR140.6

Billion, whereas the private sector loans increased by QR4.8

Billion to QR458.7 Billion.

2.

Qatar’s Trade Balance recorded a

surplus of QR8.7 Billion for October 2017, a hike of QR1 Billion

or 12% compared to the same period from the previous year.

However, equated to the previous September of 2017, the Trade

Balance decreased by 30.9% a fall worth QR3.9 Billion.

3.

OPEC oil price remained stable at

$61.06 until past Thursday, compared to $61.14 a barrel in the

previous week.

4.

Dow Jones reached a new record

height to mark 24,231 points. The US dollar exchange rate

remained put at $1.19 per euro, and had seen a slight push up

against the yen marking ¥112.10 per dollar. Gold price on the

other hand dropped marginally to $1,283 per ounce.

|