|

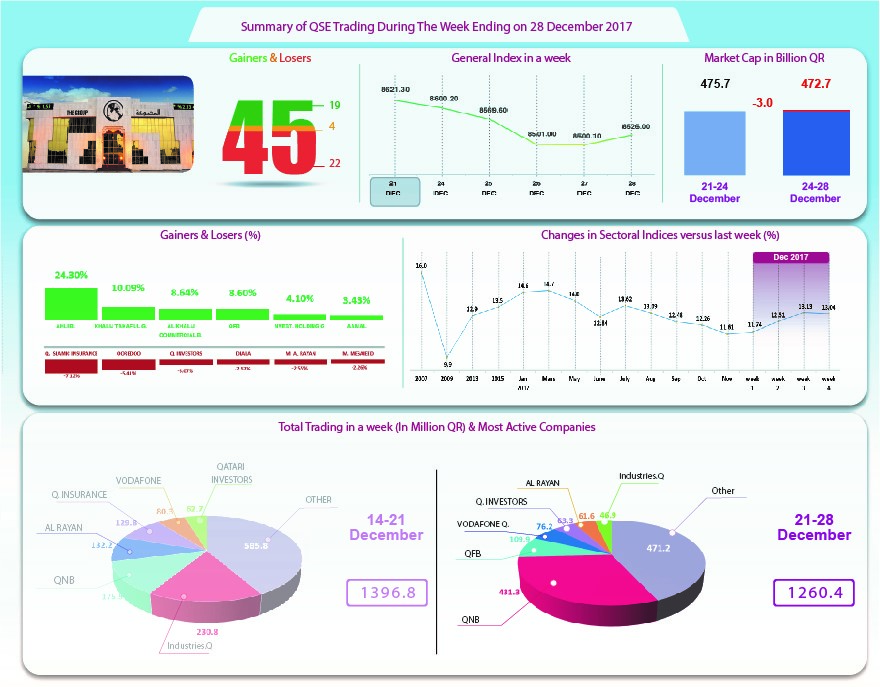

The Group Securities: Weekly Report on QSE Performance,

24-28 December 2017

General Index

Slides to 8526 Points

In the last

week of this year, Qatar Stock Exchange's performance dampened,

though numerous positive factors were still in play, including

an increase in oil prices, and a remarkable rise of Qatar’s

trade surplus. It seems that the need of some portfolios for

liquidity forced it to scale down purchases and increase its

sales of stocks, particularly that the index created a strong

resistance barrier at the level of 8550 points. By the end of

the week, General Index fell by 95 points, or 1.11% to 8526

points, and the All Shares index by 0.49%. Moreover, the indices

of three sectors dropped, especially telecommunications and

banking; while four recorded a rise, most notably Insurance. It

was noted that the share price of Islamic Insurance was the

biggest loser, falling by 7.12%, followed by Ooredoo's share

price by 5.41%, and Qatar Investors’ share by 3.1%. On the other

hand, Alahlibank topped the list of gainers, by 24.3%; followed

by Al Khaleej Takaful with 10.1%, Al Khaliji Commercial Bank by

8.6%, Qatar First Bank by 8.6% , then Investment Holding Group

by 4.1%.

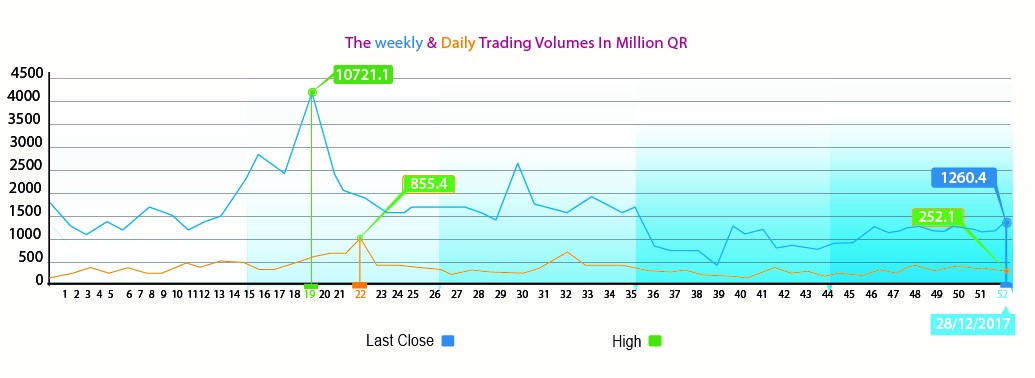

On the other

hand, the total trading volume decreased by 9.8% to QR1260.4

million in this week, as well as the average daily trading to

QR252.1 million. QNB’s share led the trading with a volume of

QR431.3 million, followed by Qatar First Bank with QR109.9

million, Vodafone with QR76.2 million, and then Investment

Holding with QR63.3 million. Qatari portfolios made net sales

worth QR59.3 million, against net purchases of QR45.9 million by

non-Qatari portfolios. Qatari individuals made net purchases

worth QR13.4 million. Consequently, the QSE’s total

capitalization fell by QR3 billion to reach QR472.7 billion. P/E

ratio dropped to a multiple of 13.04, compared to last week’s

13.13.

Corporate News:

1.

Commercial

Bank agreed to extend the grace period granted to “Tabarak

Investment” Company for a period of 30 days until 24 January

2018, in respect of the potential acquisition of the share of

Commercial Bank in United Arab Bank, listed on the Abu Dhabi

Securities Exchange.

2.

Gulf

Warehousing Company announced that it opened candidacy to elect

new Board of Directors members for a three-year tenor

(2018-2020). Nomination will be open from January 1st 2018, to

January 15th 2018. The Company’s AGM on the other hand will be

held on 05/02/2018.

3.

Barwa Real

Estate Company announced the signing of a QR1,295 million

contract to build a new laborers city, the construction of which

is expected to be come to end in 12 months. Located along Salwa

road, the project will include 3,170 residential units, retail

outlets and mosques.

4.

General

Insurance announced signing a marketing agreement with Ahlibank

to promote the latter’s insurance products.

Economic Developments:

1.

Banks'

consolidated balance sheet figures for November were recently

released Data showed banks' assets increased by QR14 billion to

QR1332.7 billion. Government and public sector deposits

increased by QR9.6 billion to QR308 billion. On the other hand,

the total loans of the government and public sector increased to

reach QR491.2 billion, while the total private sector deposits

increased to QR348.3 billion, and its loans surged to reach

QR461 billion.

2.

The

commodity trade balance achieved a surplus of QR12.8 billion,

during the month of November, an increase of QR3.2 billion or

32.9% compared to the same month of the previous year, and a

rise of QR4.5 billion, or 54.8% from October 2017.

3.

OPEC oil

prices expected to have increased to the level of $63, compared

to $62.16 a barrel in the previous week.

4.

Dow Jones

index rose gained 55 points to hit the level of 24827 points

until Thursday. U.S. dollar dropped to $1.20 per euro, and it

fell to ¥112.66 per dollar. Gold rose by $25 to the level of

$1297 per ounce.

|