|

The Group Securities: Weekly Report on QSE Performance, 31 Dec 2017– 4

Jan 2018

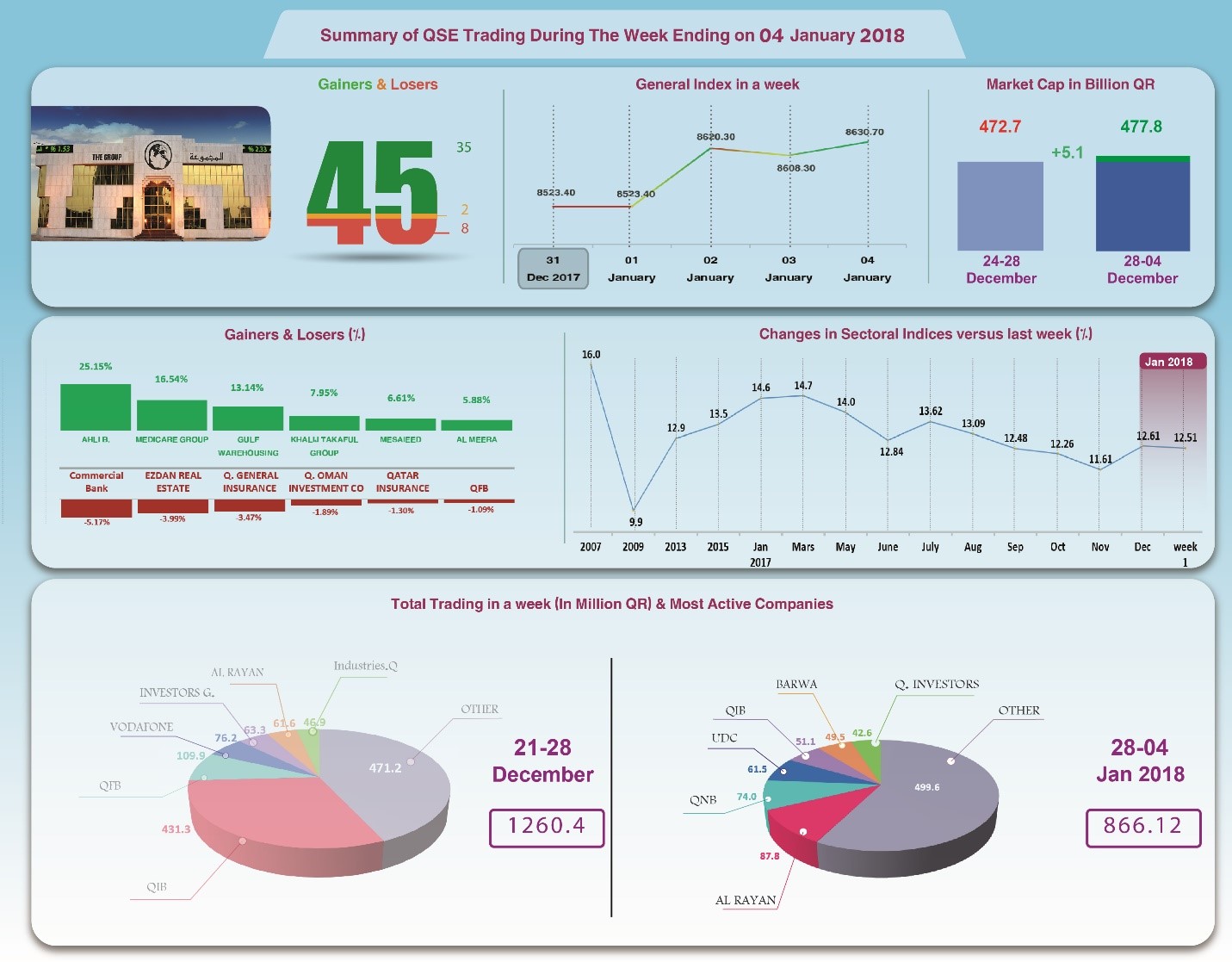

Despite Sagging Trade Volumes General Index Surges

Last week,

Qatar Stock Exchange’s performance slowed down again, clearly

evidenced by a decline in the average daily trading volume to

about QR173 million. Yet, key indices recorded new highs, with

the general index hitting 8631 points; and total capitalization

and P/E ratio also ended on a positive note. Overall, the

stability of the market was driven by rising oil prices

amounting to $65 per barrel; in addition to the upcoming

dividends dates, presumably starting from next week. In depth,

General Index increased 105 points or 1.23%, to the level of

8631 points. All Shares index rose by 0.72%, while Al Rayan

Islamic Index increased by 3.49%. All sectors indices ended on

the positive; particularly, Transport, Services, and Industry.

The share price of Ahli Bank hit the highest level, scoring a

25.15% increase, followed by Medicare by 16.54%, Gulf

Warehousing by 13.14%, Al Khaleej Takaful by 7.95%, and Mesaieed

6.61%. In contrast, the share price of Commercial Bank recorded

the biggest loss with a drop of 5.17%, followed by Ezdan by

3.99%, General Insurance by 3.47%, Qatar-Oman Investment Company

by 1.89%, and Qatar Insurance by 1.30%. Total trading

volume dropped by 31.3% to QR866.1 million, average daily

trading dropped to QR173.2 million. Al Rayan shares led the

trading with a volume of QR87.8 million, followed by QNB with

QR74.0 million, United Development with QR61.5 million, and QIB

with QR51.1 million. It Qatari portfolios made net sales worth

QR17.4 million, against net purchases of QR10.3 million by

non-Qatari portfolios. Qatari individuals made net sales of

QR4.0 million, while non-Qatari individual investors made net

purchases worth QR11.1 million. Consequently, QSE’s total

capitalization rose by QR5.1 billion to reach QR477.8 billion.

P/E ratio rose to a multiple of 13.18 compared to 13.04 a week

earlier.

Corporate News:

1.

The General Assembly of Vodafone Qatar approved, at its

extraordinary meeting held on 18 October 2017, the decision to

amend its financial year-end from 31 March to 31 December.

Consequently, the Company’s financial year-end will start on 1

January and end on 31 December. This will ensure alignment of

the Company’s financial results announcements and other

reporting requirements with the rest of companies listed in

Qatar.

2.

Salam International Investment’s BoD announced that candidacy to

its membership is going to be open from January 3 until the end

of February 1.

3.

Qatar Reinsurance Company Limited, a subsidiary of Qatar Insurance

Group (QIC), signed a purchase agreement to acquire a group of

Gibraltar-domiciled insurance companies. The said companies is

working under the umbrella of Markerstudy Group.

4.

Medicare Group said it had no explanation for the increase in the

company's share price, and confirmed that it had no information

or passed any resolutions that could have been behind the

increase in demand for the company's shares in the past two

days.

5.

The Board of Directors of Al Khalij Commercial Bank (al

khaliji) announced the opening of nominations for the Board

membership. Two independent shareholders candidates will be

elected to fill two seats of the board for a three-year tenor.

Applications will be received from Sunday, January 7, 2018 until

the end of the day on Sunday, January 21, 2018.

Economic Development:

1.

Banks'

consolidated balance sheet figures for November have been

recently released. Data showed banks' assets increased by QR14

billion to QR1332.7 billion. Government and public sector

deposits increased by QR9.6 billion to QR308 billion. On the

other hand, the total loans of the government and public sector

increased to reach QR491.2 billion, while the total private

sector deposits increased to QR348.3 billion, and its loans

surged to reach QR461 billion.

2.

OPEC

oil prices expected to have increased to the level of $65.12

until last Wednesday, compared to $63 a barrel in the previous

week.

3.

Dow

Jones index gained 356 points to hit the level of 25075 points

until Thursday. U.S. dollar dropped to $1.21 per euro, while it

saw an increase against the yen to ¥113.21 per dollar. Gold rose

by $30 to the level of $1321 per ounce.

|