|

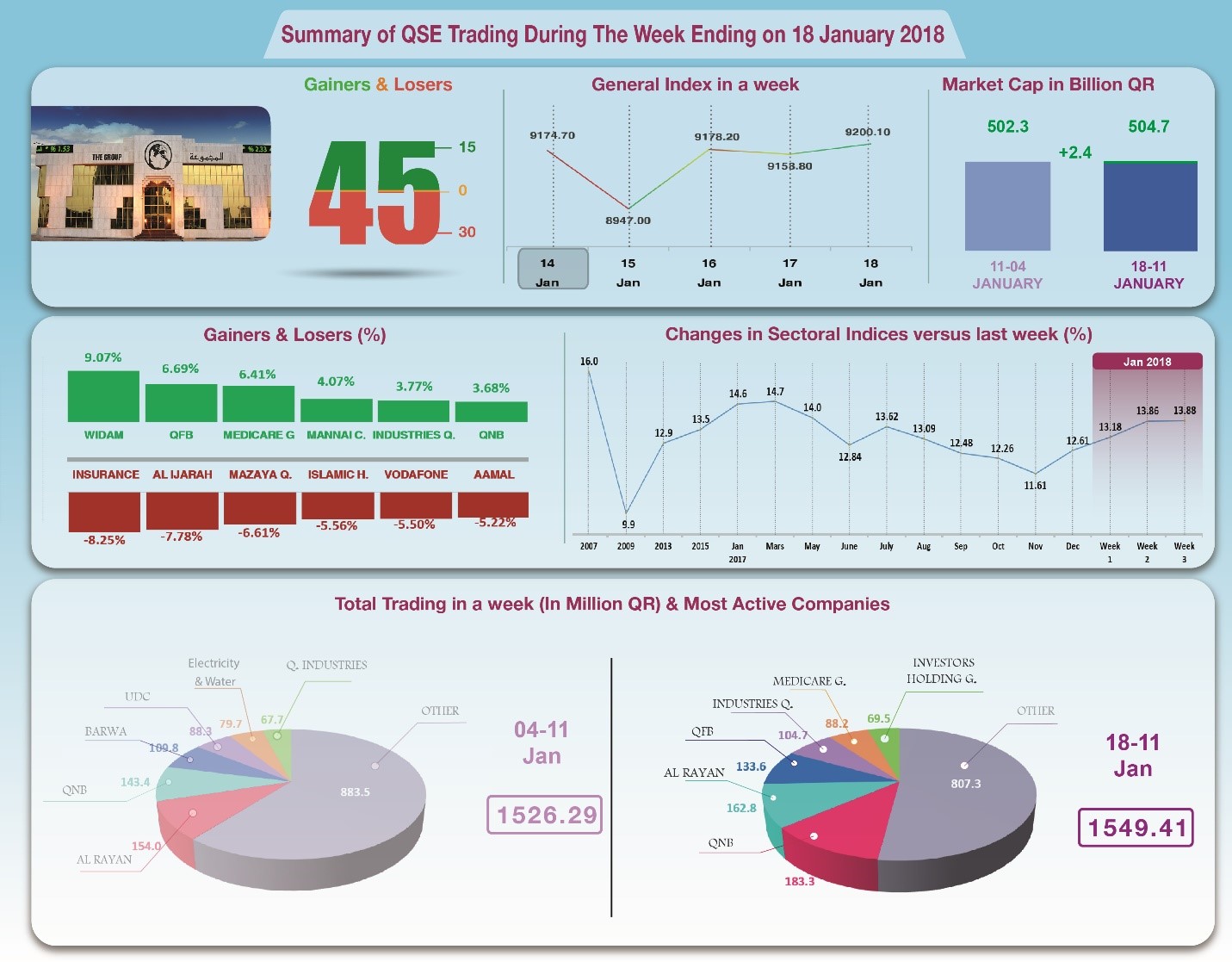

The Group Securities: Weekly Report on QSE Performance, 14-18 Jan 2018

General Index Halts at 9200 Points

General index

hit the level of 9200 points and rebounded down below several

times in the last week's trading. Trading was boosted by the

surprising decisions of QNB, QIB and Widam to distribute

dividends of QR6, QR5, and QR4.25 per share respectively. QSE

also benefited from the stable oil prices that remained above

$67 a barrel. However, closing out positions to take profit was

outstanding, namely by individual investors.

The share price of 30 companies declined, while only

those of 15 companies rose. Both the average daily trading

volume and the overall capitalization remained steady with minor

increments. In depth,

General Index increased 64 points or 0.70%, to the level of 9200

points, contrary to All Shares index that dropped by 0.26%,

along with Al Rayan Islamic Index, which fell by 0.67%. All

sectors indices ended on the positive, topped by Services &

Commodities, followed by Industry, Services, and then Banks. The

share price of Qatar Insurance recorded the biggest loss, with a

drop of 8.25%, followed by Alijarah by 7.8%, Mazaya by 6.6%. In

contrast, the share price of Widam was the biggest winner

notching a 9.1% increase, followed by Qatar First Bank by 6.7%,

MediCare by 6.4% and Al Mannai by 4.07%. Total trading

volume held steady with a slight increase of 1.5% to QR1549.4

million, and average daily trading increased to QR309.9 million.

QNB shares led the trading with a volume of QR183.3 million,

followed by Al Rayan with QR162.8 million, Qatar First Bank with

QR133.6 million, and then Qatar Industries share with QR104.7

million. It was noticed that Qatari portfolios made net

purchases worth QR48.2 million, against net purchases of QR36.1

million made by non-Qatari portfolios. Qatari individuals made

net sales of QR55.9 million, and non-Qatari individual investors

made net sales worth QR28.4 million. Consequently, QSE’s total

capitalization rose by QR2.4 billion to reach QR504.7 billion.

P/E ratio rose slightly to a multiple of 13.88 compared to 13.86

last week.

Corporate News:

1.

Qatar National Banks profits increased

in 2017 by 5.6% to QR13.1 billion, compared to QR12.4 billion

for the same period of 2016. The bank’s Board of Directors

recommended a cash dividend of QR6 per share. The Group

Securities noticed QNB’s net operating income held steady in

2017 with a slight slip of less than half a percent to QR22.8

billion, of which QR17.9 billion in interests. The bank’s all

expenses decreased by 9% to QR8.87 billion, including QR3.43

billion for employees, QR2 billion in loan losses and QR2.75

billion for other expenses. As a result, the net profit

attributable to shareholders increased by 6.2% to QR13.13

billion. It was noted that other comprehensive income items had

improved significantly, especially currency differences, as

recorded losses dropped, resulting in the increase of the total

income to QR11.56 billion from a mere QR1.87 billion in the

previous year.

2.

Masraf Al Rayan net profit decreased

by 2.3% to QR2028 million in 2017. Masraf Al Rayan’s Board of

Directors recommended cash dividends of QR2 per share. The

Group’s Securities noticed that Al Rayan's total revenue

increased by 15.7% to QR4.35 billion in 2017, QR3.89 billion of

which generated by financing and investments. This increase is

the result of the rise in clients’ investment deposits by 17.7%

or QR55.9 billion. However, the bank’s all expenses increased by

30.9% to QR1,072 million, QR494.8 million went to finance

expenses, QR327.7 million for personnel costs and QR232.6

million for other expenses. The profit share attributable to

owners of investment increased 29.6% to QR1115.4 million. As a

result, the net return on shareholders’ equity decreased by 2.3%

to QR2,028.1 million.

3.

Gulf Warehousing Company profits increased in 2017 to QR215.4

million, compared to QR205 million in 2016. The company’s Board

of Directors recommended distributing dividends of QR1.70 per

share for the year 2017. The Group Securities noticed that

Gulf Warehousing profits from its activities

increased by 13.4% in 2017 to QR349.9 million. The company also

had other sources of income worth QR16.1 million. On the other

hand, the company’s all expenses increased by 14.1% to QR106.7

million, while its net financing cost increased by 57.6% to

QR43.8 million. As a result, the company's total income

increased by 4.8% to QR215.46 million.

4.

Qatar Islamic Bank recorded a net profit of QR2,405 million in

2017, compared to QR2,155 in 2016. The Bank’s Board recommended

distributing cash dividends of QR5 per share. The Group

Securities noticed that QIB's total revenue increased by 13% to

QR6.2 billion, QR5.46 billion of which was generated by

financing and investments. The Bank’s all expenses increased by

6.3% to QR1.32 billion; QR622.4 million went to personnel

expenses, QR218.4 million to Sukuk holders. Deducting QR1818.6

million of unrestricted investment accounts holders, the net

profit for the year rose 11.6% to QR2405.4 million.

5.

Ahli Bank recorded a net profit of QR639.7 million in 2017,

compared to QR631.7 in 2016. The Bank’s Board recommended

distributing cash dividends of QR1 per share and bonus shares of

5%. The Group Securities noticed that Ahli Bank's total revenue

increased by 8.9% to QR1,044.4 million. The Bank’s all expenses

increased by 23.8% to QR404.7 million; QR182.7 million went to

personnel expenses, QR85.4 million in investments and loan

losses. As a result, the net profit for the year increased by

1.27% to QR639.7 million.

6.

Widam Food recorded a net profit of QR108.1 million in 2017,

compared to QR91.3 in the previous year. The Company’s Board

recommended distributing cash dividends of QR4.25 per share. The

Group Securities noticed that Widam's total revenue increased by

11.6% to QR495.7 million, while its sales expenses went up by

19.1% to QR779 million. As a result, the Widam’s sales loss rose

by 35% to QR 283.3 million, while government subsidization rose

by 26.3% to QR430.8 million. In contrast, the company’s all

expenses increased by 18.8% to QR49.4 million. The resulting net

profit, after adding and deducting other items, increases by

18.3% in 2017, to settle at QR108.1 million.

Economic Development:

1.

Inflation rate rose by 0.6% in the month of December, compared to

0.2% in November

2.

OPEC oil price of held steady on Wednesday, with a slight drop to

$67.07 a barrel from $67.24 a barrel the previous week.

3.

Dow

Jones index gained 447 points to hit the level of 26018 points

until Thursday. U.S. dollar dropped to $1.23 per euro and

against the yen at ¥110.76 per dollar. Gold rose by $3 to the

level of $1332 per ounce.

|