|

The Group Securities:

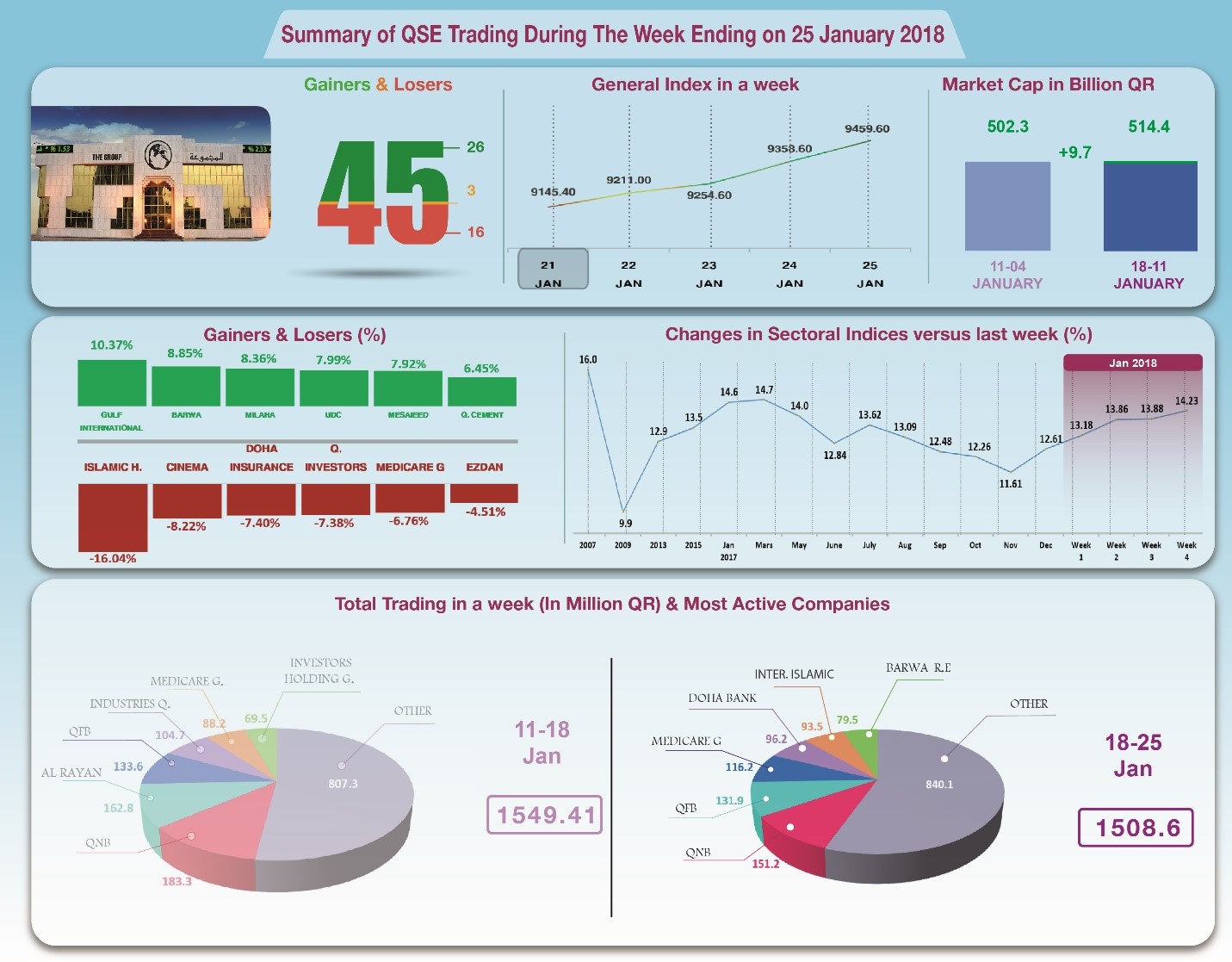

Weekly Report on QSE Performance, 21-25 Jan 2018

General Index Hovers

Close to 9500 Points

The general

index managed to break through the 9200 points barrier, and

recorded continuous gains in all sessions, although some of the

results and disclosures were not enticing to investors,

including Ezdan not distributing any returns to shareholders,

and the drop in Islamic Holding performance, a financial

brokerage, which ended the year in the red. However, the overall

mood was favorable as Qatar's banking system assets rose by

QR40.9 billion, and Dow Jones continued its record hikes, while

oil prices remained high. In depth,

General Index increased 259.5 points or 2.82%, to the level of

9459.6 points, while All Shares index increased by 2.24%, along

with Al Rayan Islamic Index, which rose by 1.63%. Five sectors

indices ended on the positive, mainly transport, industry and

commodities, while insurance and telecommunication both dropped.

The share price Gulf International topped the market with a rise

of 10.37%, followed by Barwa by 8.85%, Milaha by 8.36%, UDC by

7.99% then Mesaieed by 7.92%. The share price of Islamic Holding

recorded the biggest loss, with a drop of 16.04%, followed by

Cinema Qatar by 8.22%, Doha Insurance by 7.40%, then Qatari

Investors by 7.38% and finally Medicare at 6.76%. Total trading

volume dropped by 2.63% to QR1549.4 million, and average daily

trading decreased to QR309.7 million. QNB shares led the trading

with a volume of QR151.2 million, followed by Qatar First Bank

(QFB) with QR131.9 million, MediCare with QR116.2 million, Doha

Bank share with QR96.2 million, and then QIIB with 93.5. It was

noticed that Qatari portfolios made net purchases worth QR114.6

million, against net purchases of QR1.5 million made by

non-Qatari portfolios. Qatari individuals made net sales of

QR126.1 million, and non-Qatari individual investors made net

sales worth QR2 million. Consequently, QSE’s total

capitalization rose by QR9.7 billion to reach QR514.4 billion.

P/E ratio rose slightly to a multiple of 14.23 compared to 13.88

last week.

Corporate News:

1.

Islamic Holding Group recorded a net

loss of about QR530.4 thousand in 2017, compared to a net profit

of QR4.1 million for the same period in 2016. The Group’s

earnings per share saw a loss of QR0.09 compared to QR0.72 from

the previous year. The Holding’s Board did not recommend the

distribution of any cash dividends for this year. Islamic

Holding Group revenue dropped by 38% to QR8.5 million in 2017,

QR5.14 million of which was generated by brokerage revenues. The

Holding’s all expenses decreased to QR8.5 million, which led the

Holding to end the year in a loss amounting to QR530 thousand.

The comprehensive loss amounted to QR1.1 million when the change

in the fair value of certain investments is added.

2.

Ezdan Holding Group recorded a net

profit of QR1.7 billion in 2017, compared to QR1.8 billion in

2016, while its earnings per share settled on QR0.64, compared

to QR0.68 in the previous year. The Group’s Board did not

recommend distributing any cash dividends. Ezdan’s total

operational revenue decreased by 10.3% to QR2.28 billion, QR1.49

billion of which was generated by rent and QR0.5 billion from

the sale of financial assets. After adding other items, such as

a profit of QR427.7 million from the evaluation of realty

investments, and deducting QR242 million in general and

administration expenses, QR229 million in investment losses, as

well as QR703.3 in funding expenses, the result is a drop of

6.8% in the net profit to QR1,693 million. Comprehensive items

recorded a loss of QR314 million, which lowered the total

comprehensive income down to QR1,379 million.

3.

Qatar Insurance Company made a net

profit of QR418 million in 2017, compared to QR1,034 million in

the previous year. Qatar Insurance earnings per share recorded

QR1.28 for the fiscal year of 2017, compared to QR3.73 from

2016. The Company’s Board of Directors recommended the

distribution of 15% of the nominal value of the share in cash

dividends. It has been noticed that the company’s total revenue

dropped by 38% to QR677.3, of which only QR115 million was

generated by insurance subscriptions, while QR902.8 million from

investment income. Total expenses and amortization decreased by

4.2% to QR677.3 million. Consequently, net profit attributable

to shareholders stood at 59.6% to QR417.6 million. It is worth

mentioning that the distribution of QR1.5 per share requires a

total distribution of QR416 million, which translates to all

profits made this year. However, the company has huge reserves

amounting to QR2,554.5 million of premiums, using it the amount

required to distribute bonus shares and capital increase will be

capitalized.

4.

MediCare recorded a net profit of

QR80 million in 2017, compared to QR65.1 million in 2016, while

its earnings per share amounted to QR2.84, compared to QR2.31.

The Bank’s Board recommended distributing cash dividends of QR4

per share. MediCare's operational profit rose by 3.1% to QR202.4

million, while other profit resources held steady at the level

of QR12.1 million. The company’s all expenses decreased by 6.1%

to QR134.5 million; QR104.7 million went to general admin

expenses. As a result, the net profit increased by 22.6% to QR80

million. It should be mentioned that the profit for the first

nine months of 2017 was only around QR36 million, but jumped in

the last quarter due to two reasons; first, the fourth quarter

revenues surpass the previous ones in the absence of the holiday

season, and second, the decrease in the provision for doubtful

debts to QR16 million instead of QR32 million, a debt on

National Health Insurance Co. (Seha).

5.

Doha Bank recorded a net profit of

QR1,110 million in 2017, compared to QR1,054 in 2016, while its

earnings per share amounted to QR3.02, compared to QR3.12. The

Bank’s Board recommended distributing cash dividends of QR3 per

share. Doha Bank's total operational revenue increased by 7.5%

to QR2,945.8 million, QR2,255.5 million of which was generated

by interests. The Bank’s all expenses increased by 8.8% to

QR1,837.2 million; QR531.1 million went to personnel expenses,

QR592.5 million in loan losses, and QR142 million from decrease

in investments value. As a result, the net profit for the year

increased by 5.3% to QR1,110.1 million, while the overall

revenue rose to QR1,157.5 million.

6.

Al Khaliji Commercial Bank recorded

a net profit of QR550.5 million in 2017, compared to QR426.9 in

2016, while its earnings per share amounted to QR1.38, compared

to QR1.07. The Bank’s Board recommended distributing cash

dividends of QR7.50 per share. Al Khaliji Bank's total revenue

increased by 4.7% to QR1,215 million, QR984.5 million of which

was generated by interests. The Bank’s operation expenses

decreased 12.2% to QR653.4 million. As a result, the net profit

for the year increased by 29% to QR550.5 million, as well as the

overall revenue recording QR597.5 million due to profits in the

fair value.

7.

Qatar International Islamic Bank

recorded a net profit of QR832.2 million in 2017, compared to

QR784.8 in 2016, while its earnings per share amounted to

QR5.50, compared to QR5.18. The Bank’s Board recommended

distributing cash dividends of QR4 per share. QIIB's total

revenue increased by 8.8% to QR1,866.4 million, QR1,724.3

million of which was generated by financing and investments. The

Bank’s all expenses increased by 10.5% to QR498 million; QR161.4

million went to funding expenses, QR63.5 million to investment

losses and funding assets. Deducting QR472.6 million of

unrestricted investment accounts holders, the net profit for the

year rose by 6% to QR832.2 million.

Economic Development:

1.

Banks' assets (and liabilities)

increased by QR40.9 billion to QR1363.6 billion by the end of

December, compared to QR1332.7 billion by the end of November.

The Government and public sector deposits surged by QR7.4

billion to QR315.4 billion, while their total loans declined by

QR9.2 billion to reach QR341.7 billion. On bonds and bills

level, it has been noted that the balance of government bonds

and bills rose by QR14 billion to QR156.5 billion. The total

domestic private sector deposits at local banks increased by

QR8.2 billion to QR356.5 billion, by the end of December, while

the total domestic loans and credit facilities provided by banks

to the local private sector increased by QR0.5 billion to

QR461.5 billion.

2.

OPEC oil price dropped on Wednesday

by about $0.63 to $66.48 a barrel from $67.07 a barrel the

previous week.

3.

Dow Jones index gained 375 points to

hit the level of 26393 points until Thursday. U.S. dollar

dropped to $1.25 per euro and against the yen at ¥109.12 per

dollar. Gold rose by $21 to the level of $1353 per ounce.

|