|

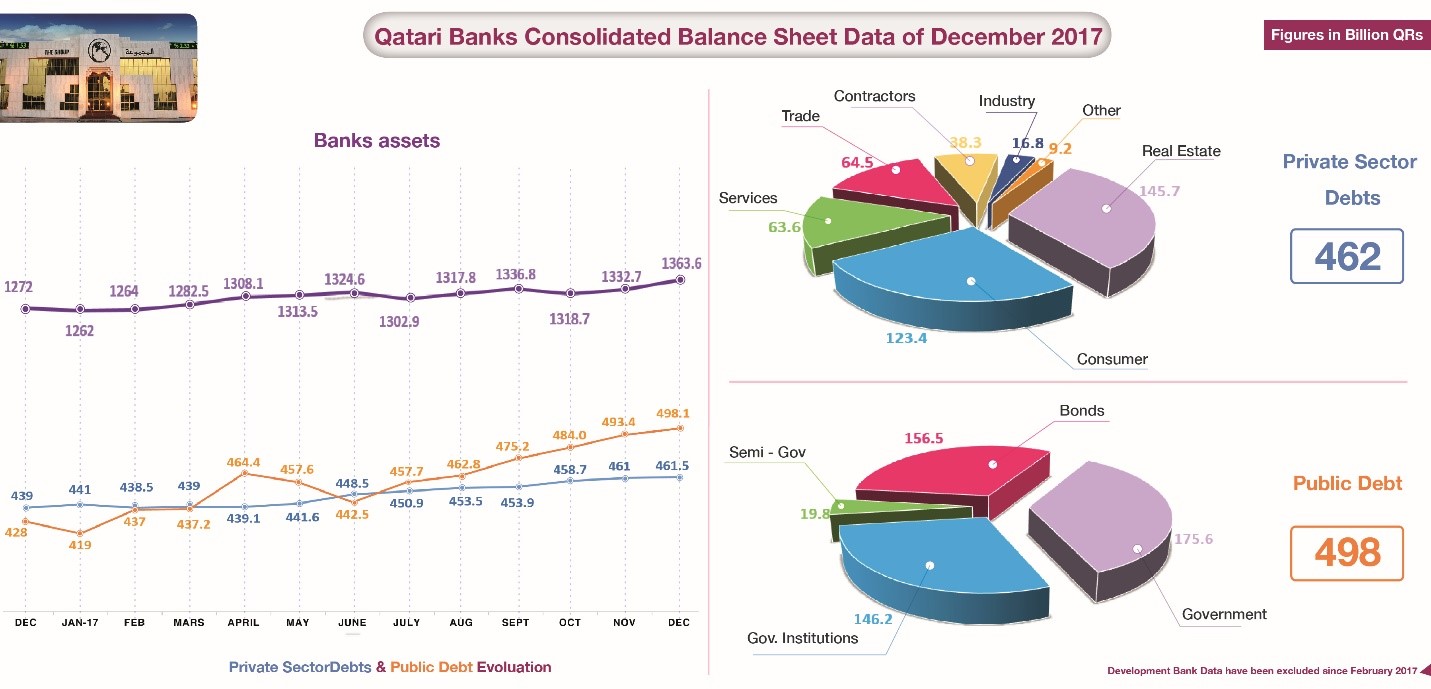

The Group Securities: Overview of Banks’ Consolidated Balance Sheet

Data for December 2017

January 24, 2018

The Group Securities presents a detailed reading of banks'

consolidated balance sheet figures as of December 2017, compared

to the previous month of November. Figures show that banks'

assets (and liabilities) increased by QR40.9 billion to QR1363.6

billion by the end of December, compared to QR1332.7 billion by

the end of November, 4.8% higher than a year earlier, which

represents an increase of QR60.9 billion.

Government and Public

Sector:

Government and public sector deposits have increased by QR7.4

billion to QR315.4 billion. Government deposits recorded QR97.1

billion, while the deposits of government institutions settled

at QR188.8 billion. The deposits of semi-government

institutions, in which government share is less than 100% and

more than 50%, stood at QR29.5 billion. On the other hand, the

total loans of the government and public sector decreased by

QR9.2 billion to reach QR341.7 billion, broken down as follows:

· Government:

QR175.6 billion, down by QR8.9 billion;

· Government

institutions: QR146.2 billion, same as the previous month;

· Semi-governmental

institutions: QR19.9 billion, a drop of QR0.3 billion.

In addition to the foregoing, figures suggest that the balance of

government bonds and bills increased by QR14 billion to QR156.5

billion. As a result, the total domestic public debt

(government, government institutions and semi-government

institutions, as well as bonds, bills and sukuk) increased by

QR5.2 billion to QR498.2 billion.

Private Sector:

The total domestic private sector deposits at local banks increased

by QR8.2 billion to QR356.5 billion, by the end of December,

which is QR8.8 billion higher than a year ago in December 2016,

this translates to an annual growth rate of 2.5%. Total domestic

loans and credit facilities provided by banks to the local

private sector increased by QR0.5 billion to QR461.5 billion;

out of which QR145.7 billion for the real estate sector, QR123.4

billion for individuals’ consumer loans, QR64.5 billion for

trade and QR63.6 billion for services. In addition, there were

loans and facilities amounting to QR17.5 billion for the

non-banking financial sector.

Foreign Sector:

Commercial banks' investments in securities outside Qatar dropped

by QR0.4 billion to QR18.4 billion, while their assets at

foreigner banks increased by QR10 billion to QR77.3 billion.

Local banks' loans to foreign parties decreased by QR1.3 billion

to QR90.5 billion, as well as their investments in foreign

companies by QR0.2 billion to QR40 billion. Other assets outside

the country increased by about QR0.5 billion to reach QR4.3

billion.

In contrast, foreign banks deposits from local banks dropped by

QR2.4 billion to QR174.3 billion. Domestic banks' foreigner

debt, in the form of bonds and certificates of deposit,

increased by QR0.4 billion to QR46.7 billion. The balance of

foreign deposits at Qatari banks rose by QR2.2 billion to

QR137.1 billion.

By comparing domestic and foreign assets with liabilities, we

deduce that net liabilities of the banking sector to foreigner

entities decreased by QR8.4 billion by the end of December to

QR128 billion.

|