|

The Group Securities:

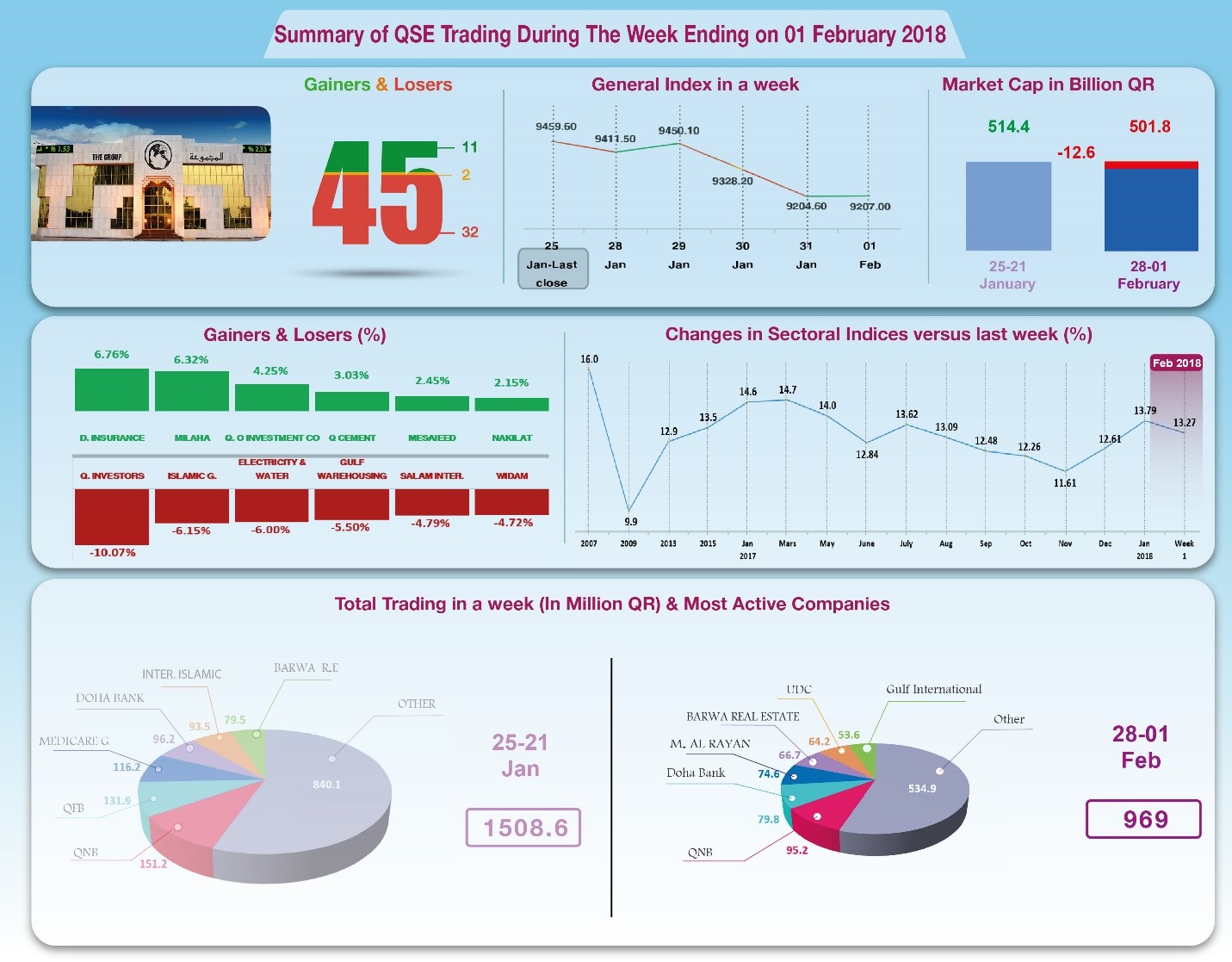

Weekly Report on QSE Performance, 28 Jan-1 Feb 2018

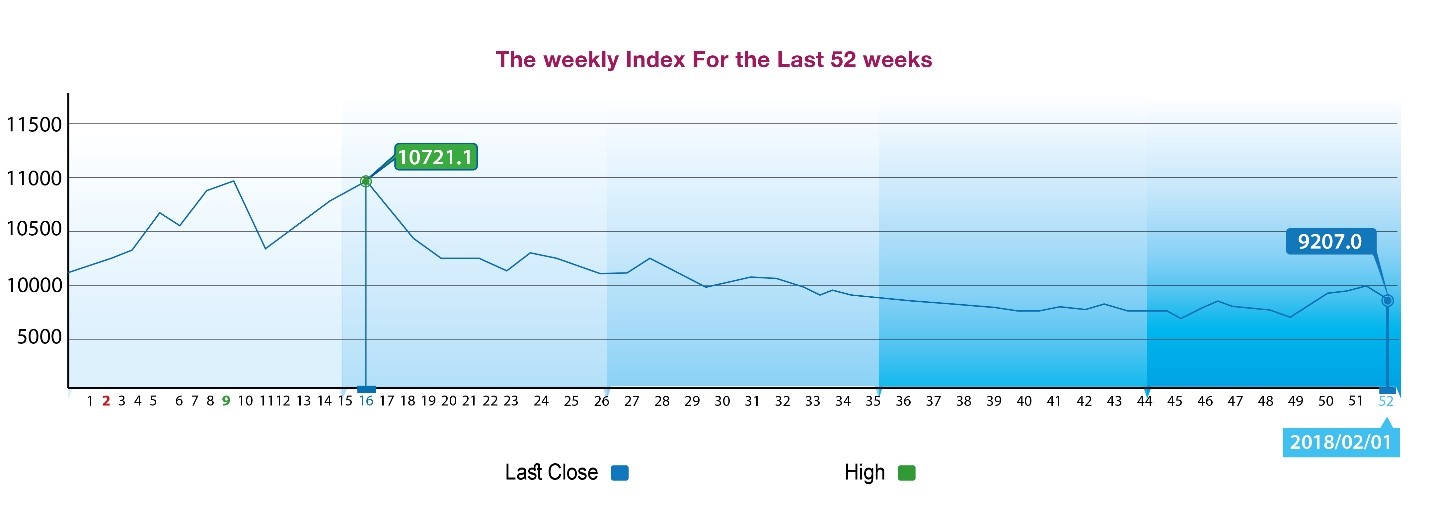

General Index Retreats

to Support Level at 9200 Points

The general index hit

the strong resistance barrier at the level of 9450 points, to

retreat once again to the support level at 9200 points. These

movements took place under unfavorable conditions, such as a

drop in the total trading volume that fell below QR1 billion,

and the stop in the rise of oil prices with the OPEC price

dropping to $66.28 per barrel. Financial results disclosures

were limited to the results of only two companies during this

week, namely the Commercial Bank and Qatar Electricity & Water.

Qatari Investors results were released late Sunday. Disclosures

showed no surprises, as the Commercial Bank recommended

distributing QR1 per share in dividends, Qatar Water &

Electricity Co. recommended QR7.75 per share, while Qatari

Investors decided on QR0.75 per share.

In depth, General

Index decreased by 252.6 points or 2.67%, to the level of 9207

points, while six sectors indices ended on the negative, mainly

telecommunication, industry, insurance and banks, while

transportation went up. The share price of Qatari Investors

recorded the biggest loss with a drop of 10.07%, followed by

Islamic Holding by 6.15%, Kahramaa by 6%, GWC by 5.50% then

Salam International by 4.79%. The share price of Doha Insurance

recorded the biggest gain, with a rise of 6.76%, followed by

Milaha by 6.32%, Qatar-Oman by 4.25%, then Qatar National Cement

by 3.03% and finally Mesaieed by 2.45%.

Total trading volume

dropped by 35.8% to QR969 million, and average daily trading

decreased to QR193.8 million. QNB shares led the trading with a

volume of QR95.2 million, followed by Doha Bank with QR79.8

million, Al Rayan with QR74.6 million, Barwa share with QR66.7

million, and then UDC with QR64.2 million. It was noticed that

non-Qatari portfolios made all the net sales worth QR93 million,

against net purchases of QR39.4 million made by Qatari

portfolios. Qatari individuals made net purchases of QR46.5

million, while non-Qatari individual investors made net

purchases worth QR7.1 million. Consequently, QSE’s total

capitalization dropped by QR12.6 billion to reach QR501.8

billion. P/E ratio decreased to a multiple of 13.27.

Corporate News:

1.

Qatar Commercial Bank (QCB) recorded a

net profit of QR603.65 million in 2017, compared to QR500.75

million in the same period of 2016, while its earnings per share

amounted to QR0.90, compared to QR0.78. The Bank’s Board

recommended distributing cash dividends of QR1 per share.

QCB's total revenue fell by 1.4% to

QR3.53 billion. The Bank’s all expenses increased by 1.25% to

QR3.07 billion; QR713.5 million went to personnel expenses and

QR1.7 billion to loan and lease losses. It was noted that

personnel expenses were reduced by QR169 million, while other

expenses dropped by QR168 million. On another hand, investment

losses decreased by half, and cash flow from subsidiary

companies went from a loss to a profit of QR147 million. As a

result, the net profit increased to QR603.6.

2.

Qatari Investors Group’s net profits

dropped to about QR253 million in 2017, compared to a net profit

of QR277 million for the same period in 2016. The Group’s

earnings per share also fell down to QR2.04, compared to QR2.23

from the previous year. The Holding’s Board recommended

distributing QR0.75 per share in cash dividends. Qatari

Investors Group total revenue dropped by 8% to QR394.7 million

in 2017, QR363.5 million of which was generated by direct

activities. The Group’s all expenses held steady with a slight

slip to QR79.2 million. Deducting the financing cost of QR55.8

million, and QR13.2 million loss from the fair value of

investments (this figure was QR36.3 million in the previous

year), the result is a net profit decrease of 8.6% to QR253.1

million.

3.

Qatar

Electricity & Water Co. (QEWC) net profits increased to about

QR1,616 million in 2017, compared to a net profit of QR1,542

million for the same period in 2016. QEWC’s earnings per share

also rose to QR14.69, compared to QR14.02 from the previous

year. The Company’s Board recommended distributing QR7.75 per

share in cash dividends.

QEWC’s total operating profit dropped by 6.2% to QR1.316 billion in

2017, while other revenues increased by 6% to QR156.7 million.

On another hand, general and administrative expenses increased

by 9.3% to QR219.7 million, whereas the financing cost increased

by 21.5% to QR180.3 million. The Company's share of profits from

joint ventures increased by 52.3% to QR566.9 million. As a

result, the net profit attributable to shareholders increased by

4.8% to QR1616 million.

Economic Development:

1.

Banks'

assets (and liabilities) increased by QR40.9 billion to QR1363.6

billion by the end of December, compared to QR1332.7 billion by

the end of November. The Government and public sector deposits

surged by QR7.4 billion to QR315.4 billion, while their total

loans declined by QR9.2 billion to reach QR341.7 billion.

2.

The

trade balance recorded a surplus of QR14.9 billion during the

month of December, up QR4.2 billion, or 39.1% over the same

month of 2016.

3.

OPEC

oil price dropped on Wednesday by about $0.20 to $66.28 a

barrel.

4.

Dow

Jones index lost 207 points to hit the level of 26186 points

until Thursday. U.S. dollar settled at $1.25 per euro and

against the yen at ¥109.67 per dollar. Gold dropped by $2 to the

level of $1353 per ounce.

|