|

The Group

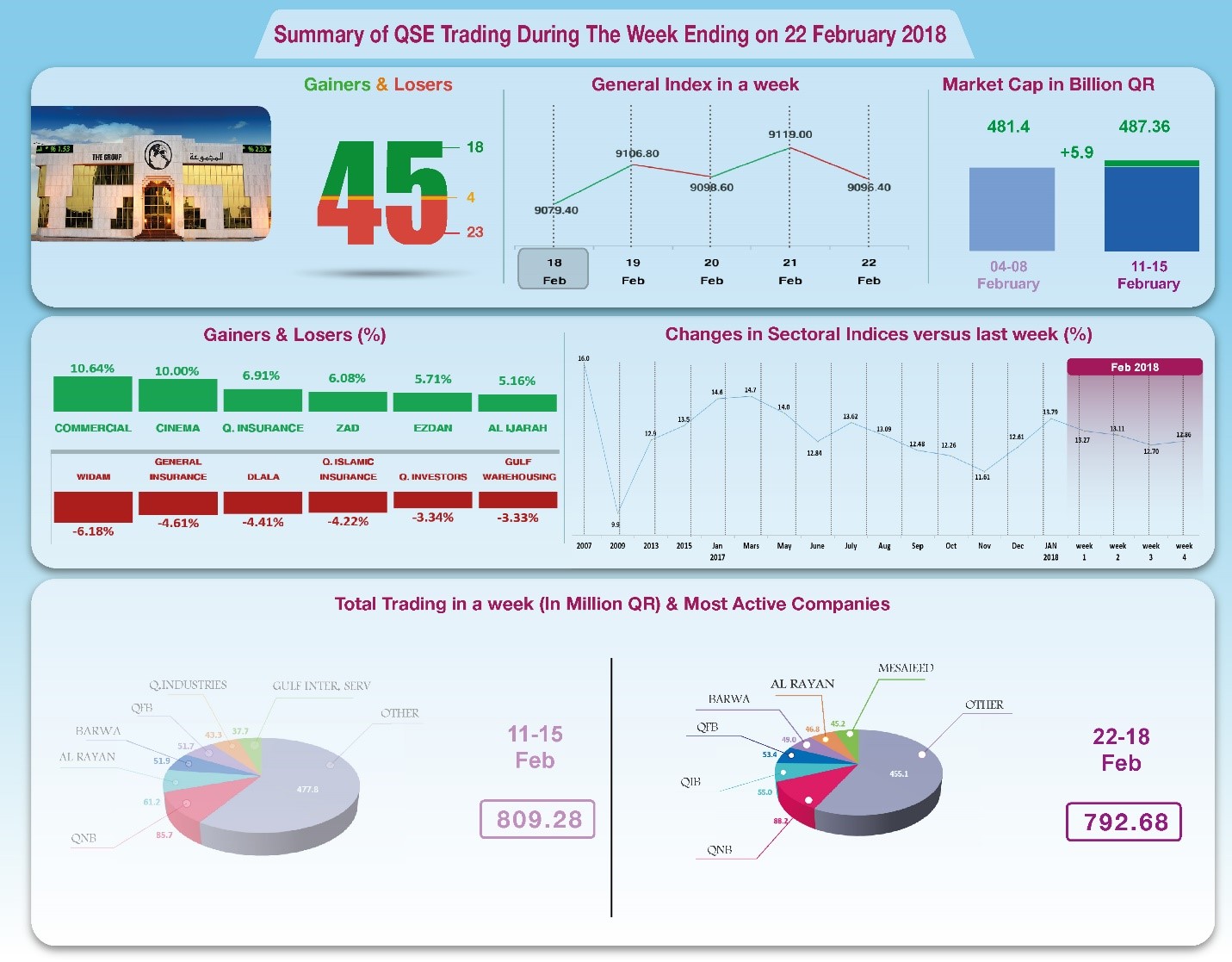

Securities: Weekly Report on QSE Performance, 18-22 Feb 2018 General Index

Settles Below 9100 Points

The previous week was slow in terms of

disclosures and trading volume, which once again plummeted to

below the level of QR800 million. Besides, the only disclosures

released during the week were of the Islamic Insurance and

Alkhaleej Takaful, with expected dividends distribution rates.

The week closed on the share drop of 23 companies, while the

remaining 18 companies witnessed an increase in their shares. On

a wider picture, the general index made a move of 69 points up,

but settled below 9100 points, while all sectors indices

increased ever so slightly, and the total capitalization

recorded a QR5.9 billion upsurge. In depth, the

General Index increased by 69 points or 0.76%, to the level of

9096 points, alike Al Rayan Islamic Index, which made a climb of

0.12% only. All sectors indices ended on the positive,

especially Insurance and Real Estate. It has been noticed that

the share price of Widam recorded the biggest loss, with a drop

of 6.18%, followed by General Insurance by 4.61%, Dlala by

4.41%, Islamic Insurance by 4.22%, and then Qatari Investors by

a slide of 3.34%. In contrast, the share price of Commercial

Bank recorded the biggest win notching a 10.64% increase,

followed by Qatar Cinema with a 10% hike, Qatar Insurance by

6.91%, Zad Holding by 6.08%, and then Ezdan by 5.71%. Total trading

volume dropped by 2.05% during the week to QR792.7 million, as

well as the average daily trading, which retreated to QR158.5

million. QNB shares led the trading with a volume of QR88.2

million, followed by QIB with QR55 million, Qatar First Bank

with QR53.4 million, and then Barwa with QR49 million. It was

noticed that Qatari portfolios made net purchases with QR57.4

million, against net purchases of QR1.3 million made by

non-Qatari portfolios. Qatari individuals made net sales of

QR55.8 million, and non-Qatari individual investors made net

sales worth QR2.8 million. Consequently, QSE’s total

capitalization rose by QR5.9 billion to reach QR487.4 billion.

P/E ratio climbed to a multiple of 12.86 compared to 12.70 last

week. Corporate

News:

1.

Islamic

Insurance net profit amounted to QR61.9 million in the fiscal

year of 2017, versus QR63.5 million in 2016, while the company’s

earnings per share reached QR4.13 compared to QR4.23 for the

corresponding period. The Board recommended distributing cash

dividends of QR3.5 per share. Islamic Insurance net surplus more

than doubled in 2017, hitting a percentage of 108.4% to QR24.8

million, but the year-end surplus remained steady at QR83.5

million, unchanged from the previous year. With additional

revenues, the total revenue amounted to QR99.9 million, compared

with QR104.3 million in the previous year, and the company’s all

expenses decreased by 6.9% to QR37.97 million. Consequently the

net income fell by 2.5% to QR61.9 million.

2.

Alkhaleej Takaful Group net profit amounted to OR14.6 million for

the fiscal year of 2017, compared to QR13.2 million for 2016.

Alkhaleej earnings per share recorded QR0.58, compared to QR0.52

for the same period last year. The Board of Directors

recommended distributing cash dividends amounting to QR0.50 per

share. The company’s financial statements were not released.

3.

Widam’s

Ordinary General Assembly approved the distribution of cash

dividends of QR4.25 per share, while Al Ahli approved the

distribution of 10% in cash dividends as well as 5% in bonus

shares. On another hand, QIB’s General Assembly approved the

distribution of cash dividend of QR5 per share and increase the

maximum percentage of foreign ownership in the bank's shares to

49%, whereas Doha Bank’s Assembly discussed and approved the

distribution of QR3 per share in dividends, among other things.

As for Alijarah, the company announced the postponement of its

Extraordinary General Assembly meeting for lack of quorum.

4.

Both Gulf

International (GIS) and Milaha announced the opening of

candidacy to their Board of Directors memberships for the next 3

year tenor, with GIS specifying the number of openings to 4

seats.

Economic Developments:

1.

Banks'

assets (and liabilities) increased by QR3.1 billion to QR1366.7

billion by the end of January, compared to QR1363.6 billion by

the end of December. The Government and public sector deposits

dropped by QR18.9 billion to QR296.5 billion, while their total

loans – excluding bonds – increased by QR7.5 billion to reach

QR349 billion. The total private sector loans surged by QR1.9

billion to QR463.4, alike its deposits, which increased by QR2.1

billion to QR358.6 billion.

2.

OPEC

oil price increased on Wednesday notching an upsurge of $2.21 to

$62.81 a barrel from $60.62 a barrel the previous week.

3.

Dow

Jones index gained 102 points to hit the level of 24962 points

until Thursday. U.S. dollar rose to $1.23 per euro and 1%

against the yen to ¥106.95 per dollar. Gold lost about $30 to

settle at the level of $1330 per ounce.

|