|

The Group Securities:

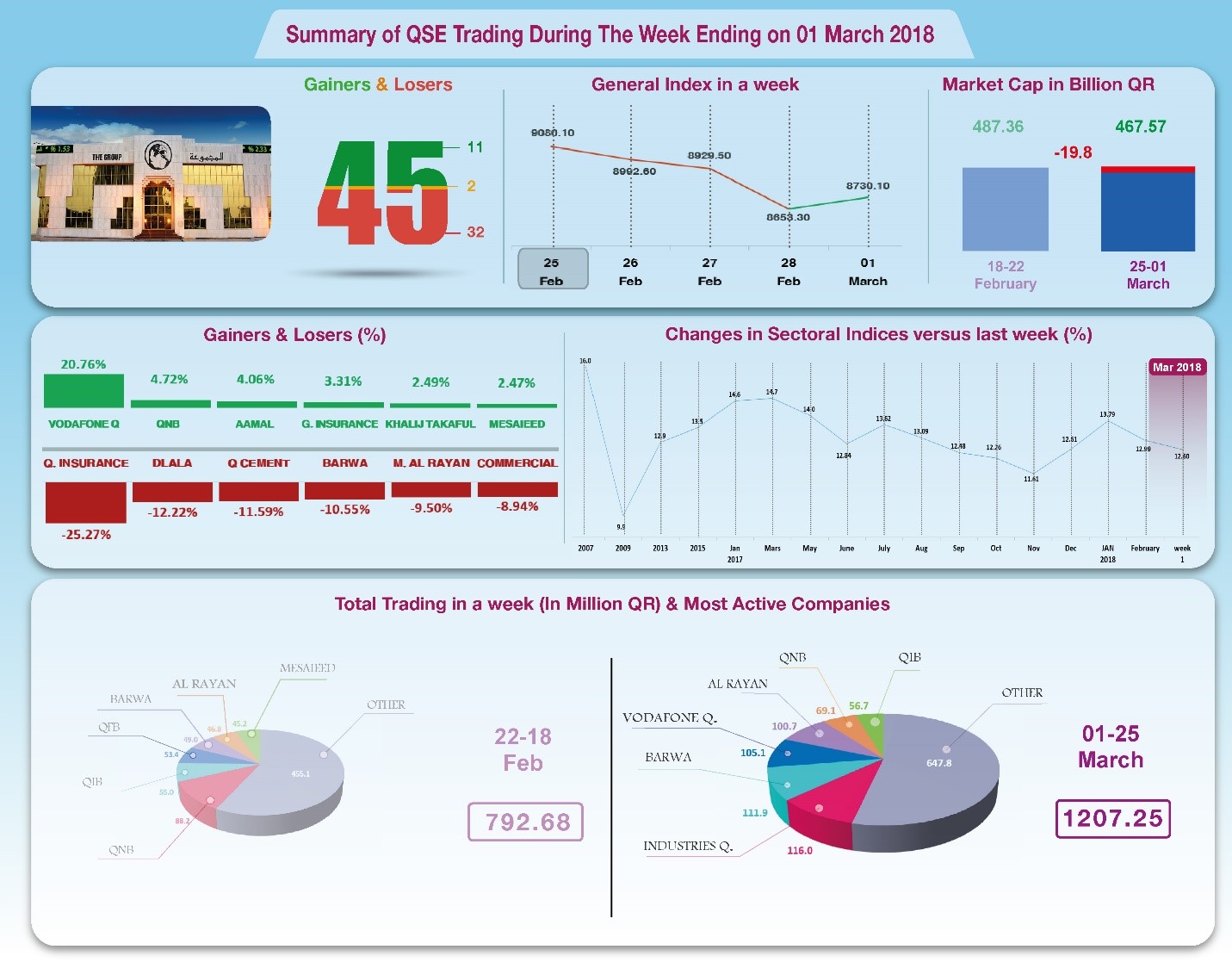

Weekly Report on QSE Performance, 25 Feb-01 Mar 2018 General Index Drops to 8730 Points

Last week’s

stock market performance was negatively affected by a number of

factors, particularly the holding of eight general assemblies

–seven of which were ordinary– and the disclosure of the results

of eight companies. The seven listed companies who had their

ordinary general assembly held during the previous week

witnessed a drop in their shares equal to the amounts of

dividends they approved to distribute. Dlala's share price was

affected by the company’s decision not to distribute any

dividends, while Vodafone's share price was positively affected

by the company's decisions to correct its situation after the

cumulative losses it incurred, which amounted to half of the

company’s capital. The final result shows a 4% decline in the

general index or a drop of 366 points, to 8730 points. Shares of

32 companies dropped, while the shares of the remaining 11

managed to close on the positive. The total capitalization

decreased by QR19.8 billion and the profit-to-earnings ratio

dropped to 12.16.

Corporate News:

1.

Al

Meera Consumer Goods net profit recorded QR194 million in the

fiscal year of 2017, compared to QR199 million for the same

period last year. The company’s earnings per share made QR9.70

compared to QR9.96 for the same period in 2016. The Board of

Directors recommended the distribution of QR8.5 per share. Al

Meera’s gross profit from sales rose by 8.9% to QR481.6 million

in 2017, while revenues generated by rent and other streams fell

slightly to QR85.8 million. In contrast, general and

administrative expenses increased by 11.9% to QR311.4 million,

and depreciation and amortization increased by 19.7% to QR57.7

million. Adding other expenses, the net profit fell 2.6% to

QR194 million, and the comprehensive income dropped to QR163.3

million due to a fair value loss.

2.

Dlala

Holding net profit recorded QR16.65 million for the year 2017,

compared to QR3.80 million for the same period last year. The

Holding’s earnings per share amounted to QR0.59 compared to

QR0.13 in the same period of 2016. Dlala's net operating income

increased by 70.4% to QR46.7 million in 2017, of which QR36.9

million was generated from brokerage activities and commissions.

General and administrative expenses increased by 18.2% to QR28.6

million, and depreciation increased slightly and stood at QR1.8

million. As a result, the net profit increased by 338% to

QR16.65 million, (it should be noted that the holding’s

quarterly profit fell from QR10.1 million in the first quarter

to QR3.9 million in the second, to QR3.3 million in the third,

to a loss of QR600,000 in the fourth quarter). The company had a

fair value loss of QR42.1 million in 2017, raising the

comprehensive loss by 311% to QR25.5 million.

3.

Milaha’s net profit amounted to about QR470 million in 2017,

compared to QR711 million in 2016. The company’s earnings per

share recorded QR4.14, compared to QR6.26 for the previous year.

The Board recommended the distribution of QR3.5 per share in

cash dividends. Milaha’s revenues declined by 2.4% to QR2.49

billion in 2017, and operating profit decreased by 19.3% to

QR448.2 million. After adding the company’s share in the profits

of associates and subsidiaries represented by QR388.1 million,

and deduct the net financing cost of QR52 million and the

depreciation in the value of vessels that amounted to QR283.3

million, the result is a drop in the net profit of 34% to

QR469.8 million. There was a fair value loss on

available-for-sale financial assets of QR704.6 million, which

resulted in the net profit turning into a comprehensive loss of

QR234.5 million, against a comprehensive income of QR1,0093

million in the previous year.

4.

Vodafone Qatar's net loss amounted to QR182.2 million in the

shortened fiscal year of 2017, compared to a net loss of QR269.2

million for the financial year ended 31 March 2017. The loss per

share for the nine month period was QR0.22, compared to a loss

of QR0.32. The company’s board did not recommend to distribute

any dividends. The comparison is between 9 months in 2017, and

12 months in 2016, which shows a drop of about 25%. Vodafone's

revenues decreased by 28.1% to QR1,481 million in the nine

months ended 31 December 2017. Connectivity expenses decreased

by 27% to QR540.7 million, as well as employee expenses that

dropped by 24.7% to QR174.6 million. As a result, profits fell

by 24.1% to QR407.4 million, while depreciation and amortization

expenses decreased to QR568.7 million, resulting in losses of

QR182.2 million.

5.

Nakilat (Qatar Gas Transport Company) net profit amounted to

QR846.2 million, compared to QR954.2 million made in 2016. The

company’s earnings per share hit QR1.53, compared to QR1.72 per

share in 2016. The Board of Directors recommended distributing

QR 1 per share. Nakilat's total income for 2017 dropped by 3.8%

to QR 3.62 million, including 3.06 billion returns from the

operating of vessels, which remained unchanged from last year's

figures. The declined of the comprehensive income came from the

decline of the returns on its shares in joint projects. Total

expenses fell by 1.4% to QR2.77 billion, including QR1.17

billion spent on financing. As result, the company net profit

declined by 11.3% to QR846.2 million, and comprehensive income

slid by 19.3% to QR 1237.1 million.

6.

Qatar Fuel (Woqod) net profit amounted to about QR964 million in

2017, compared to QR883 million for the same period last year.

The company’s earnings per share recorded QR9.7 versus QR8.9 in

2016, while the Board of Directors recommended a distributing

QR8 per share in cash dividends. Woqod’s gross profit generated

from sales decreased by 6.6% to QR1,078.7 million in 2017. Other

income increased by 29.4% to QR395.9 million, while all expenses

decreased by 22% to QR378.6 million. As a result, the net profit

increased by 9.2% to QR964.1 million, but the comprehensive

income decreased to QR710.5 million.

7.

Al Mannai Corporation net profit amounted to QR506.1 million for

the year 2017, compared to QR535.1 million for the same period

last year. The corporation’s earnings per share stood at

QR11.09, compared to QR11.73 for the same period of the previous

year. The Board of Directors recommended distributing QR4 per

share in cash dividends. Mannai’s gross profit generated from

sales increased by 46.3% to QR1.18 billion in 2017, and other

income and profit from associates increased by 7.7% to QR356.6

million. On the other hand, all expenses increased by 67% to

QR1,241 million. Deducting financing expenses, which increased

by 35.9% to QR173.6 million, and depreciation expenses that

increased to QR123.1 million, the result is a net profit of

QR506.1 million, a decrease of 5.4% from the previous year.

However, the comprehensive income rose to QR653 million due to

an increase in fair value.

8.

Aamal Company net profit recorded QR500.9 million in the financial

year of 2017, compared to QR462.3 million in 2016, while its

earnings per share amounted to QR0.80 compared to QR0.73 for the

same period of the previous year. The company’s Board of

Directors recommended distributing cash dividends of QR0.60 per

share. Aamal’s operating profit decreased by 20.2% in 2017 to

settle at QR545.6 million, and all expenses decreased by 12% to

QR152 million. However, the company's share of the profits of

its associates increased by 47.4% to QR102 million, while

financing costs decreased to QR18.4 million. As a result, the

net profit attributable to shareholders increased by 8.3% to

QR500.9 million.

9.

During the week, seven general assemblies were held, namely Qatar

Cement, Qatar Insurance, QEWC, Khaliji, Barwa, Al Rayan and

Salam. All recommendations of these assemblies were adopted,

including the Salam board’s recommendation against distributing

any dividends. The only extraordinary general assembly that was

held during last week was of Qatari Investors.

Economic Developments:

1.

OPEC oil price

increased on Wednesday notching an upsurge of $1.46 to $63.97 a

barrel from $62.51 a barrel the previous week.

2.

Dow Jones index

lost 600 points to hit the level of 24608 points until Thursday.

U.S. dollar dropped to $1.25 per euro and 3% against the yen to

¥105.91 per dollar. Gold notched a $38 increase to the level of

$1360 per ounce.

|