|

The Group Securities:

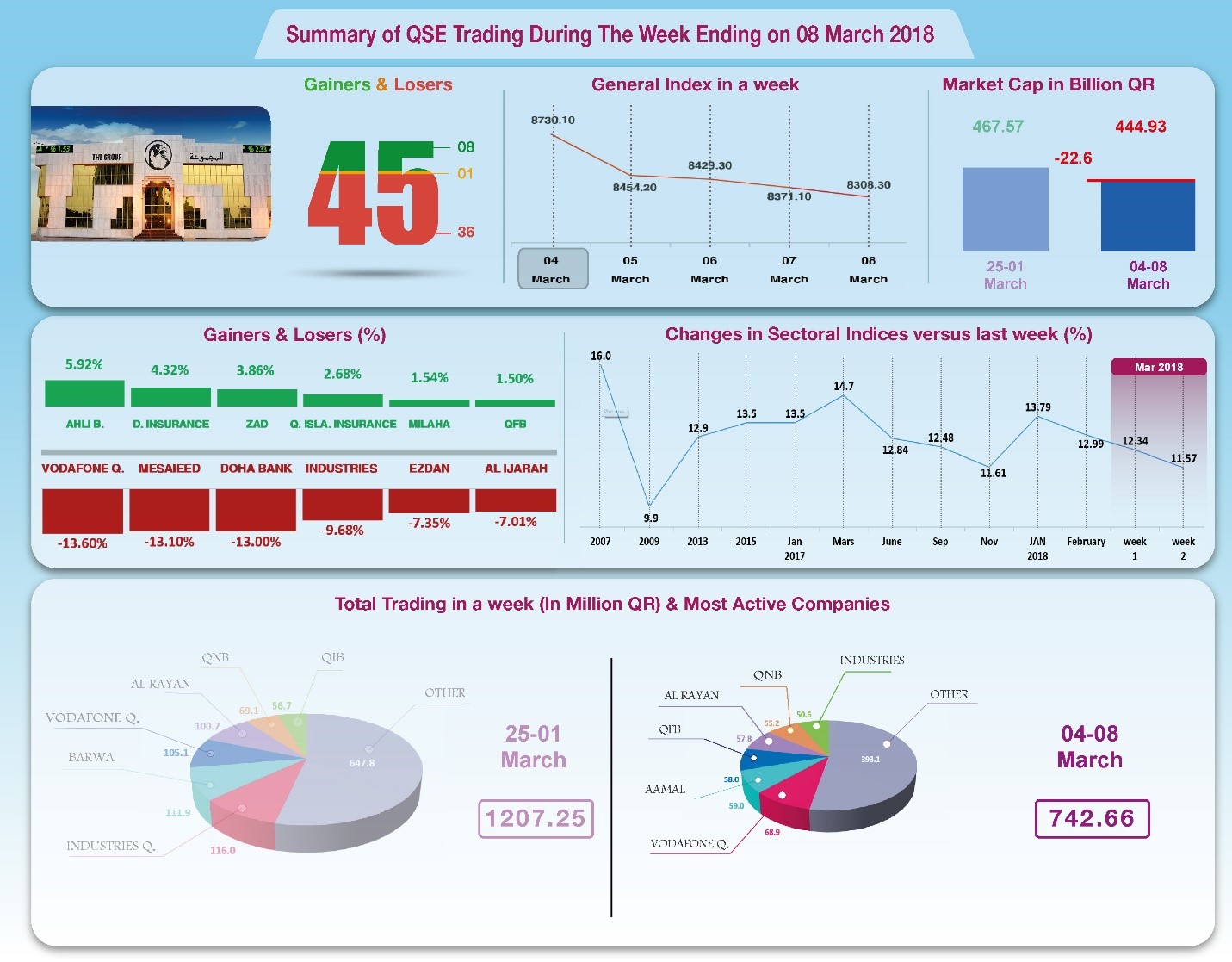

Weekly Report on QSE Performance, 4-8 Mar 2018

General Index Drops to

8308 Points

The negative

performance of the stock exchange continued in the previous

week, with the convening of 6 Ordinary General Assembly meetings

to approve recommendations to distribute dividends, which was

followed by a drop in those 6 companies’ shares equal to the

amounts of approved dividends. Vodafone’s share incurred some

damage from profit taking following its exceptional rise during

the week before last. The final result shows a 4.83% decline in

the general index or a drop of 422 points, to 8308 points.

Shares of 36 companies dropped, while the shares of only 8

managed to close on the positive. The total capitalization

decreased by QR22.6 billion and the profit-to-earnings ratio

fell to 11.57. In depth, the

General Index decreased by 422 points or 4.83%, to the level of

8308 points. All sectors indices dropped, more so Real Estate,

Telecommunication and the Banking industry. It has been noticed

that the share price of Vodafone recorded the biggest loss, with

a drop of 13.6%, followed by Mesaieed by 13.1%, Doha Bank by

13%, Industries Qatar by 9.68%, and then Ezdan by 7.35%. In

contrast, the share price of Ahli Bank recorded the biggest win

of a 5.92% increase, followed by Doha Insurance with a 4.32%

hike, Zad by 3.86%, Islamic Insurance by 2.68%, and then Milaha

by 1.54%. Total trading

volume dropped by 38.5% during the week to QR742.7 million, as

well as the average daily trading, which retreated to QR185.7

million. Vodafone led the traded shares with a volume of QR68.9

million, followed by the share of Aamal with QR59 million, Qatar

First Bank with QR58 million, and then Al Rayan with QR57.8

million. It was noticed that Qatari portfolios made net

purchases worth QR14.1 million, against net sales of QR79.4

million made by non-Qatari portfolios. Qatari individuals made

net purchases of QR51.8 million, and non-Qatari individual

investors made net purchases worth QR13.4 million. Consequently,

QSE’s total capitalization dropped by QR22.6 billion to reach

QR444.9 billion. P/E ratio retreated to a multiple of 11.57

compared to 12.34 last week.

Corporate News:

1.

Qatar Stock Exchange listed

Qatar Exchange Index ETF on March 5th, which is the

first Exchange Traded Fund (ETF) listed on Qatar Stock Exchange.

The Fund will track the QE Index that measures the price

performance of the top 20 largest and most liquid companies.

Standard Chartered Bank will act as custodian and fund

administrator, while the Group Securities will be the Liquidity

Provider and will support trading by making competitive

“two-way” pricing, allowing investors to trade on the fund with

ease. The Group will maintain the supply of ETF units, ensure

the ETF’s price is in line with the value of its underlying

index portfolio, and manage the fund.

2.

Six Ordinary

General Assembly meetings convened during the previous week,

namely Mesaieed, Industries Qatar, Ooredoo, Alijarah, Gulf

International Services, and Doha Bank to approve their agenda

items and the distribution of dividends. Also, the extraordinary

general assembly of Barwa convened and approved its agenda

items.

Economic Developments:

1.

Qatar Petroleum (QP) announced that Qatar's onshore crude oil

for February at US $65.50 per barrel, compared to the previous

month’s price tag of US $69.10 per barrel. On another hand, OPEC

price lost QR1.31 per barrel to settle at US $62.68 per barrel,

compared to US $63.97 in the previous month.

2.

Dow Jones index

gained 287 points to hit the level of 24895 points until

Thursday. U.S. dollar dropped to $1.23 per euro and gained 3%

against the yen to ¥106.69 per dollar. Gold fell by $41 to the

level of $1319 per ounce.

|