|

The Group

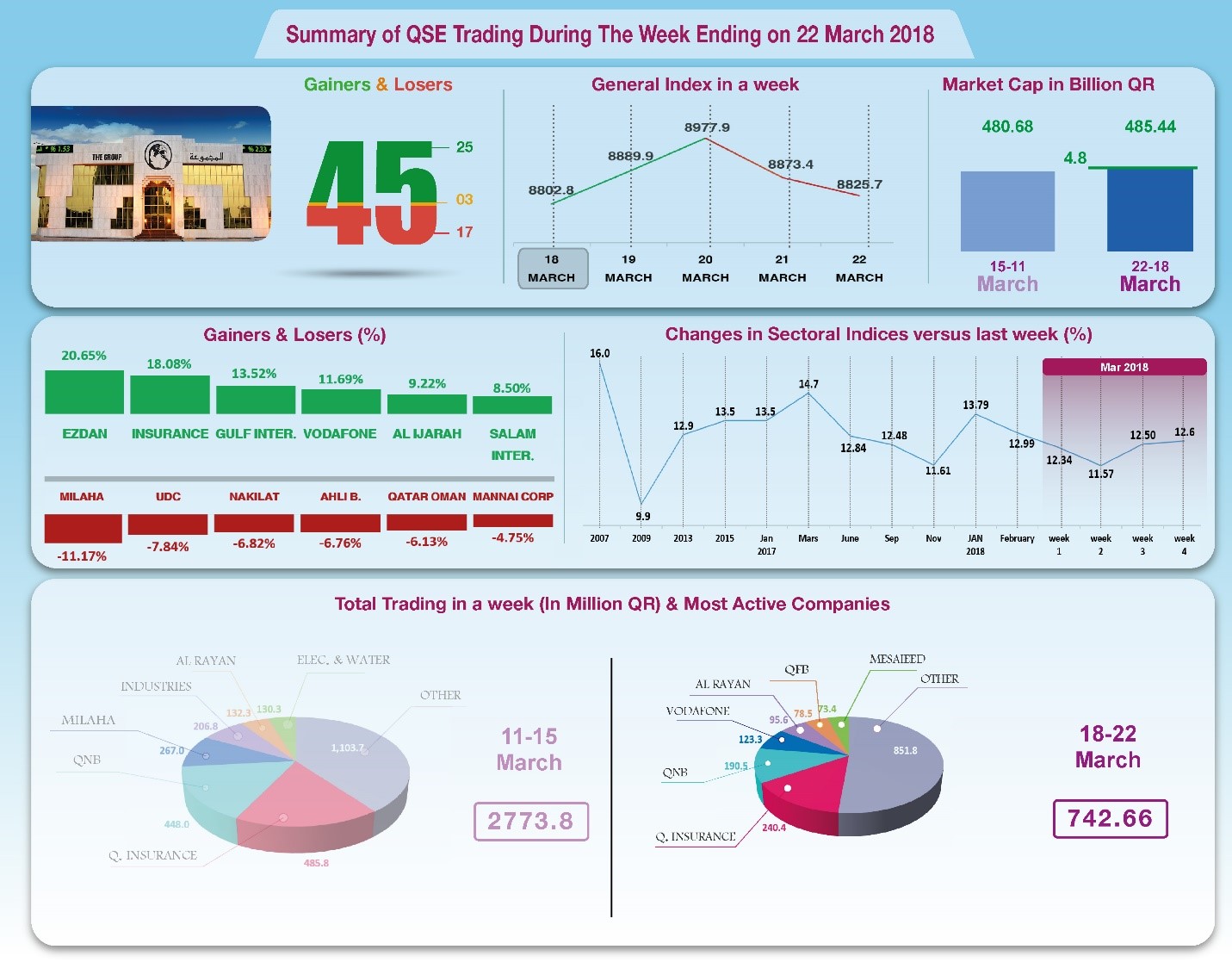

Securities: Weekly Report on QSE Performance, 18-22 Mar2018

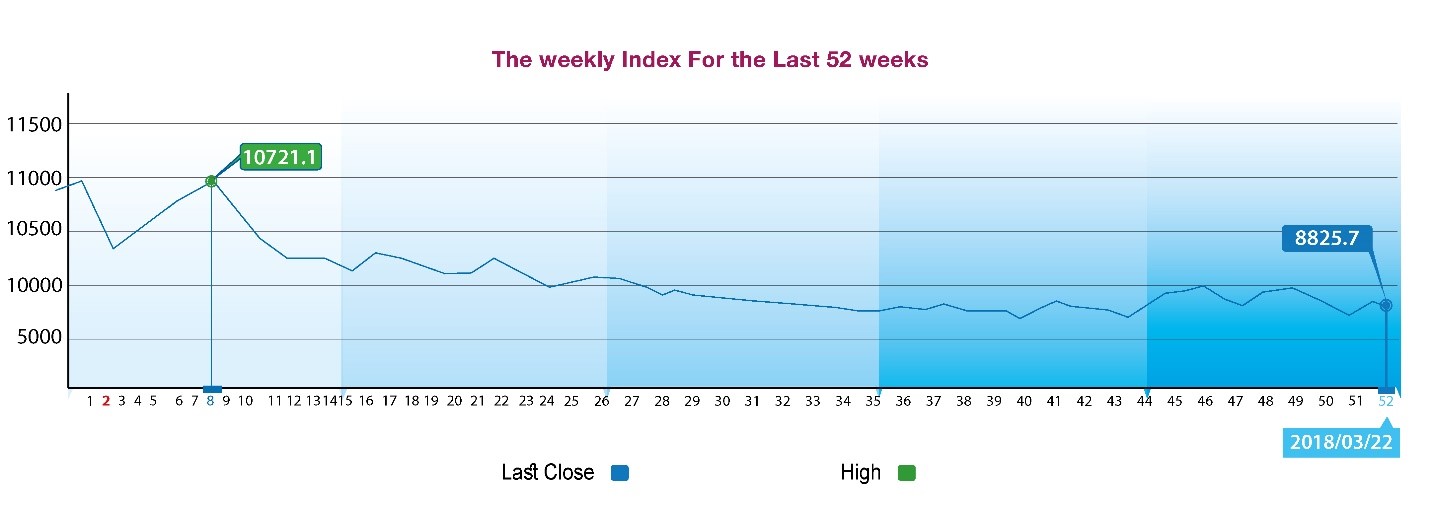

General Index

Drops to 8726 Points Amid the Rise of Other Indices

The overall performance of the stock market was quite different

from the previous week after the launch of the Al Rayan Islamic

Fund. Trades focused on Islamic classified shares, followed by

Al Rayan Fund, while the leading stocks and the general index

trades diminished, and the total trading volume dropped to

QR1.65 billion. The final outcome of the week is a drop in the

general index by about 22 points to 8826 points, while Al Rayan

gained 1.5%. 25 companies saw their shares go up, whereas the

prices of the shares of 17 companies declined. The total

capitalization increased by about QR4.8 billion and the

profit-to-earnings ratio rose by a multiple of 12.6.

In depth, the General Index decreased by 22 points or 0.25%, to the

level of 8826 points. All-Share Index and Al Rayan Index rose by

2.5% and 1.5% respectively, as well as 6 Sector Indices, namely

Real Estate, Telecommunication and Insurance. It has been

noticed that the share price of Ezdan recorded the biggest win

with a 20.7% hike, followed by Qatar Insurance by 18.1%, Al

Khaleej International by 13.5%, Vodafone by 11.7%, and then

Alijarah by 9.2%. In contrast, the share price of Milaha

recorded the biggest loss with a 10.3% drop, followed by UDC by

8%, Nakilat by 5.4%, Ahli Bank by 5.1%, and finally Qatar-Oman

by 4.5%.

Total trading volume dropped by 40.4% during the week to QR1.65

billion, consequently the average daily trading retreated to

QR330.7 million. Qatar Insurance led the traded shares with a

volume of QR240.4 million, followed by the share of QNB with

QR190.5 million, Vodafone with QR123.3 million, and then Al

Rayan with QR95.6 million. It was noticed that Qatari portfolios

made net sales worth QR4.3 million, against net purchases of

QR110.5 million made by non-Qatari portfolios. Qatari

individuals made net sales of QR59.5 million, and non-Qatari

individual investors made net sales worth QR46.6 million. As a

result, QSE’s total capitalization increased by QR4.8 billion to

reach QR485.4 billion. P/E ratio increased to a multiple of

12.62 compared to 12.50 a week earlier.

Corporate News:

1-

Effective 21

March 2018, the Al Rayan Qatar ETF was listed for trading. The

Fund tracks the QE Al Rayan Islamic Index and measures the price

performance of Shari’a compliant stocks listed on Qatar Stock

Exchange. The Group Securities will act as the Liquidity

Provider for the fund.

2-

Mazaya

Qatar Real Estate Development Co. net profit dropped by 62% to

QR28.14 million in the financial year of 2017, compared to

QR74.62 million for the same period of the previous year, while

the company’s earnings per share recorded QR0.243, compared to

QR0.645 in 2016. Mazaya’s Board advised against the distribution

of dividends to shareholders this year; instead, carry them over

to the next. The Group noted a decrease in Mazaya’s total

operating profit, which dropped by 43% to QR84.2 million as a

result of construction doubling in costs. Rental and other

income decreased by 33% to QR84.2 million. In contrast, general

and administrative expenses increased by 4.8% to QR17.4 million,

and financing costs skyrocketed by 23.4% to QR38.5 million. As a

result, the company’s net profit fell 62.3% to QR28.1 million.

3-

The net profit of Qatar Cinema & Film Distribution amounted to

about QR7.8 million in 2017, compared to QR4.3 for the same

period of the previous year. The company’s earnings per share

amounted to QR1.24, compared to QR0.68 for the corresponding

period in 2016, and the Board decided to distribute a dividend

of QR1 per share. The Group noted an increase in operating

losses in 2017 to QR1.1 million, while other income remained

stable at QR19.4 million, of which QR17.2 million was generated

from real estate. General expenses remained stable at QR4.1

million, while investment losses and depreciation decreased to

about QR6.5 million compared to QR9 million in the corresponding

period. As a result, there was a fair value loss on investments

of about QR4.7 million. The total comprehensive income decreased

to QR3.1 million compared to QR9.1 million in the corresponding

period.

4-

During

the previous week, Qatar-Oman approved a 5% cash dividend

proposal, while Vodafone's General Assembly approved the Board's

recommendation not to distribute dividends and reduce the

capital from QR4,844 million to QR4,227 million by reducing the

nominal value of the company's shares from QR10 to QR5, and

agreed to cover the remaining losses through the company's

distributable reserves. As for Nakilat, its General Assembly

approved the distribution of a cash dividend of QR4 per share.

5-

Milaha

announced that Sheikh Ali bin Jassim, Mr. Ali Hussein Al-Sada,

and Mr. Ahmed Al-Asmakh, regretfully withdrew their nomination

for membership of the Council.

Economic

Developments:

1-

Inflation rates decreased in Qatar during the month of February

to 0.8% compared to 0.9% in January.

2-

OPEC oil in Qatar increased during the previous week until

Wednesday 20th March by US $2.14 to US $64.11 per barrel,

compared to the previous month’s price tag of US $61.97 per

barrel.

3-

Dow Jones index lost 916 points to go down to the level of 23958

points until closing on Thursday. U.S. dollar held its $1.23

position against the euro, while it dropped once again against

the yen to ¥104.76 per dollar. Gold rose to the level of $1324

per ounce.

|