|

The Group Securities: Weekly Report on QSE Performance, 25-29 Mar

2018

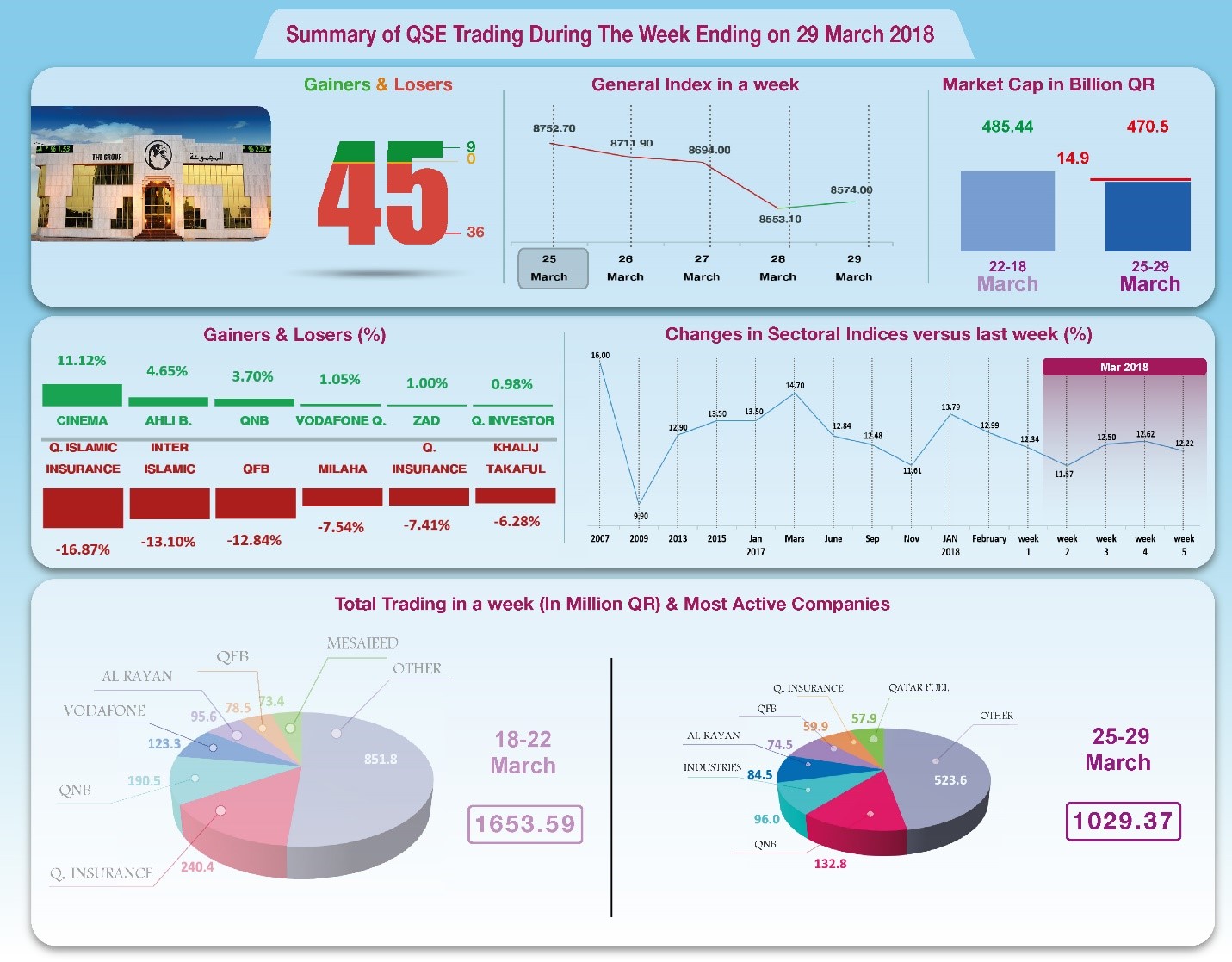

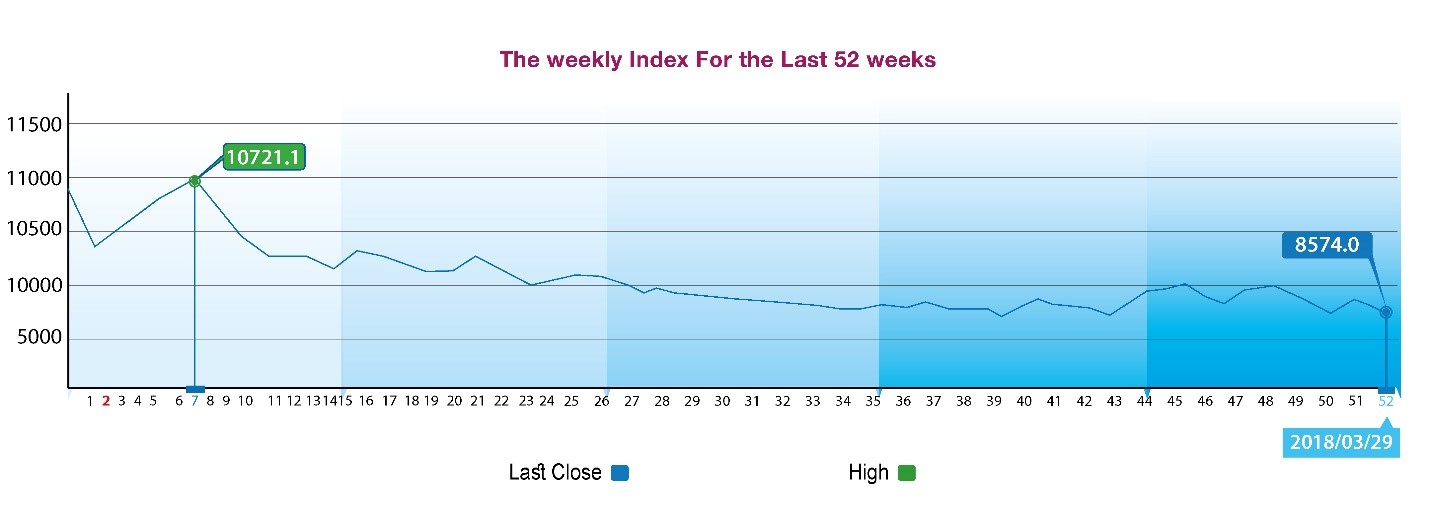

General Index Drops 2.85% to 8574 Points

Al Rayan Islamic Index Loses 3.81%

Five general assemblies were held during the week, and the proposed

dividends were approved, which in turn created a pressure on

shares prices. The prices were also adversely affected by the

disclosure of the results of Qatari German Medical Devices

Company and Qatar First Bank, since the losses of the two

companies deepened. Also, despite the rise of OPEC oil price

during the week to more than US $66 per barrel, the news of

general assemblies and disclosures have dragged down the shares

prices of all companies in general and Islamic companies in

particular. As a result, indices, trading volumes, total

capitalization, and the price-earnings ratio decreased.

In depth, the General Index decreased by 252 points or 2.85%, to

the level of 8574 points, while Al Rayan Index declined by

3.81%. 6 Sector Indices, namely Real Estate, Telecommunication

and Goods & Services. It has been noticed that the share price

of Islamic Insurance recorded the biggest loss with a 16.9%

drop, followed by QIIB by 13.1%, Qatar First Bank by 12.8%,

Milaha by 7.5%, and then Qatar Insurance by 7.4%. In contrast,

the share price of Qatar Cinema recorded the biggest win with an

11.1% hike, followed by Ahli Bank by 4.7%, QIB by 3.7%, Vodafone

by 1.1%, and finally Zad Holding by 1%.

Total trading volume dropped by 37.8% during the week to QR1029.4

million, consequently the average daily trading retreated to

QR205.9 million. QNB led the traded shares with a volume of

QR132.8 million, followed by the share of Industries Qatar with

QR96 million, Al Rayan with QR84.5 million, and then Qatar First

Bank with QR74.5 million. It was noticed that Qatari portfolios

monopolized the net sales with transactions worth QR109.3

million, against net purchases of QR65.6 million made by

non-Qatari portfolios. Qatari individuals made net purchases of

QR26.9 million, and non-Qatari individual investors made net

purchases worth QR16.8 million. As a result, QSE’s total

capitalization decreased by QR14.9 billion to reach QR470.5

billion. P/E ratio dropped to a multiple of 12.22 compared to

12. a week earlier.

Corporate News:

1.

Investment Holding Group will replace Mazaya Qatar in QE Index,

effective April 1st, 2018, while Qatar Electricity & Water Co.

will join QE Al Rayan Islamic Index.

2.

The profits of

all companies listed on the Qatar Exchange rose by 1.1% to

QR38.56 billion in 2017, compared to QR38.14 billion during the

same period in 2016.

3.

Qatar First

Bank net loss in 2017 amounted to QR269.2 million, compared to a

net loss of QR265.6 million in 2016. The bank’s loss per share

recorded QR1.35, compared to a loss of QR1.33 for the previous

year. The Group noted that the bank’s total revenue decreased by

15.4% to QR334.2 million in 2017 as a result of the following:

Revenues recorded QR370.2 million, investment profits and

dividends amounted to QR186.1 million, fair value loss stood at

QR142.4 million and the share of unrestricted investment

accounts holders was QR79.6 million. On the other hand, total

expenses decreased by 7.9% to QR579 million, of which QR421.2

million went to non-banking activities. As a result, the net

loss for the year rose slightly to QR269.2 million.

4.

The net loss of

Qatari German Medical Devices Co. (QGMD) amounted to QR21.6

million in 2017, compared to a net loss of QR10.3 million in the

previous year. The company’s loss per share amounted to QR1.88

compared to a loss of QR0.90 in 2016. The Board did not

recommend to distribute any dividends. In 2017, the Company's

total profit from its direct activities dropped by 16% to QR2.55

million, however, QGMD made QR2.7 million from other revenues.

General, administrative and distribution expenses increased by

26% to QR16.4 million. This year, the company recorded a decline

in real estate value of QR6.6 million. After adding the

financing cost of QR3.9 million, the company’s net loss for the

year more than doubled to QR21.6 million. It should be noted

that the net equity of the company has fallen to less than half

of the capital of QR115.5 million.

5.

Zad Holding

Company’s General Assembly decided to distribute QR6.5 per share

in cash dividends, and 10% bonus shares instead of 5%.

Accordingly, the share will be traded with the right to cash

dividends and bonus shares for two working days starting

Thursday 29 March 2018.

6.

QIIB’s general

assembly approved the distribution of QR4 in cash dividend,

while Islamic Insurance approved QR3.5, WOQOD approved QR8, and

Al Meera Okayed QR8.5

7.

QNB fixed

10/04/2018 to disclose its Q1 2018 financial statements, while

UDC did set 25th April, Al Rayan scheduled the

disclosure on 25th, Alijarah on 12th

April, QWC on 16th April, Doha Insurance on 18th

April, and Islamic Holding on 17th April.

Economic Developments:

1.

OPEC oil continued its rising trend during the previous week,

until Wednesday 27th March, increasing by US $1.94 to

US $66.05 per barrel, compared to the previous month’s price tag

of US $64.11 per barrel.

2.

Qatar’s foreign

merchandise trade balance, showed a surplus of about QR14.1

billion, i.e. an increase of about QR2.7 billion or 23.7%

compared to February 2017; and a decreased of nearly QR1.7

billion or 10.7% compared to January 2018.

3.

Dow Jones index gained 145 points to go up to the level of 24103

points until closing on Thursday. U.S. dollar held its position

at $1.23 against the euro, and it rose by ¥1.44 against the yen

to ¥106.20 per dollar. Gold rose by US $3 to the level of $1327

per ounce.

|