|

The Group Securities: Weekly Report on QSE Performance, 1-5 April

2018

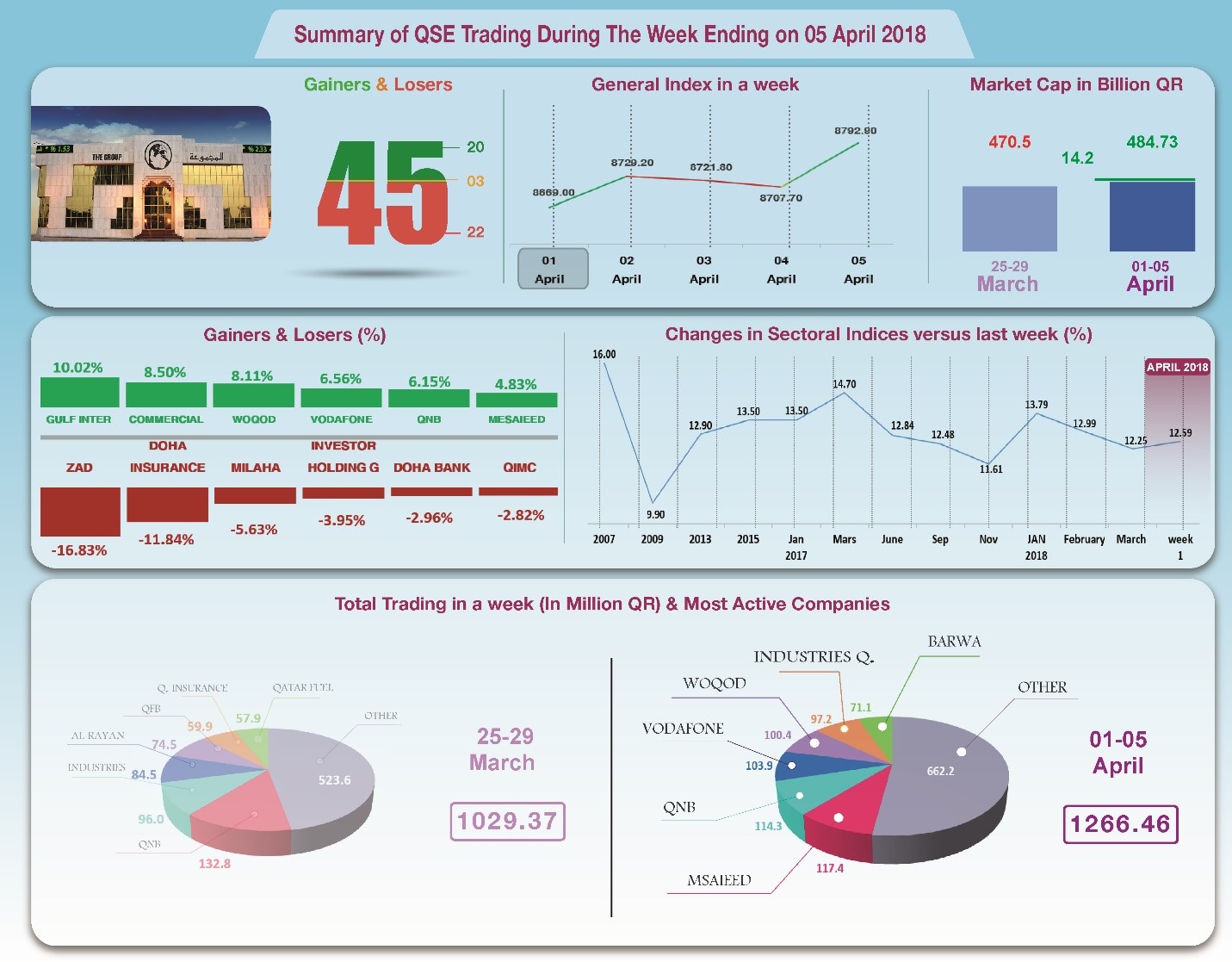

General Index Up 2.55% to 8793 Points

Amid successive developments -such as the increase in the minimum

foreign ownership ratio to 49% in Mesaieed, Woqod and Gulf

International Services, and the consequent demand for the shares

of the three companies- the performance of the stock market

improved in terms of trading volume, which rose to QR1.26

billion at an average of QR253.3 million. The general index rose

by 2.55%, while Al Rayan index gained 1.33%. The total

capitalization increased by about 14.2 billion, and the

price-to-earnings ratio rose by a multiple of 12.59. On the

other hand, the share prices of 20 companies increased, while

the rest 22 companies witnessed their share prices decline.

In depth, the General Index increased by 219 points or 2.55%, to

the level of 8793 points, while Al Rayan Index rose by 1.33%.

During the week, six Sector Indices increased, namely Goods &

Services, Industry, and Banks. It has been noticed that the

share price of Zad Holding recorded the biggest loss with a

16.8% drop, followed by Doha Insurance by 11.8%, Milaha by 5.6%,

Investment Holding by 3.95%, and Doha Bank by 2.96%. In

contrast, the share price of Gulf International Services

recorded the biggest win with a 10% hike, followed by Commercial

Bank by 8.5%, Woqod by 8.1%, Vodafone by 6.6%, and finally QIB

by 6.2%.

Total trading volume increased by 23% during the week to QR1266

million, consequently the average daily trading went up to

QR253.3 million. Mesaieed led the traded shares with a volume of

QR117.4 million, followed by the share of QIB with QR114.3

million, Vodafone with QR103.9 million, and then Woqod with

QR100.4 million. It was noticed that Qatari portfolios made net

sales worth QR134.2 million, against net purchases of QR75.1

million made by non-Qatari portfolios. Qatari individuals made

net purchases of QR51.1 million, and non-Qatari individual

investors made net purchases worth QR8 million. As a result,

QSE’s total capitalization increased by QR14.2 billion to reach

QR484.7 billion. P/E ratio climbed to a multiple of 12.59

compared to 12.22 a week earlier.

Corporate News:

1.

Mesaieed, Gulf International Services, and Woqod announced the

increase of non-Qatari ownership ratio from 25% to 49%.

2.

The sale of the foreign partner's stake in Vodafone to Qatar

Foundation was completed in its entirety on March 29.

Consequently, Qatar Foundation’s direct and indirect ownership

in Vodafone Qatar's capital has increased to 50%.

3.

Investment Holding and Dlala General Assembly meetings approved

that no dividends will be distributed to shareholders for 2017.

4.

Islamic Insurance announced that it will disclose its first

quarter financial statements on April 16, Commercial Bank set

April 17, Al Ahli and Al Khaliji scheduled the disclosure on

April 19, Salam on 23, QIMC and Ooredoo on 25, and finally Woqod

and Alkhaleej Takaful on April 29.

5.

Standard & Poor's has affirmed Qatar Islamic Bank's credit

rating at A-. The agency attributed this to the fact that the

bank is the second largest bank in Qatar, with good financial

performance and strong capital.

Economic Developments:

1.

OPEC oil dropped until Wednesday, March 4, by US $1.57 to US

$64.48 per barrel, compared to the previous month’s price tag of

US $66.05 per barrel.

Qatar Petroleum announced a drop of about a quarter of a US

dollar in the price of Qatari land crude oil in March to US

$65.25 a barrel.

2.

Dow Jones index gained 402 points to go up to the level of 24505

points until closing on Thursday. U.S. dollar settled at $1.22

against the euro, and it rose by ¥1.1 against the yen to ¥107.31

per dollar. Gold rose by US $3 to the level of $1330 per ounce.

|