|

The Group Securities: Weekly Report on QSE Performance, 8-12 April

2018

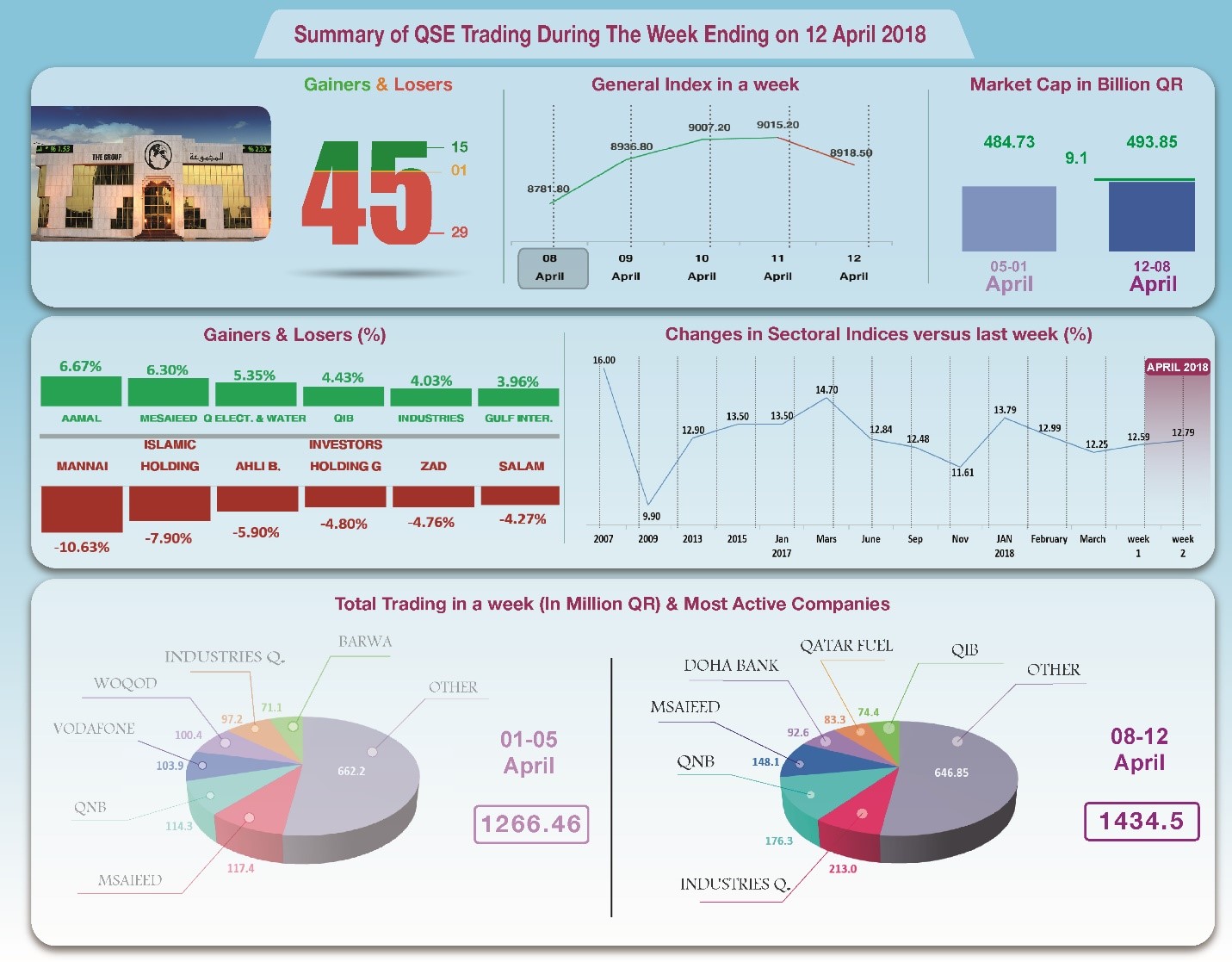

General Index Up 1.43% Despite End of Week Drop

Stock indices dropped by the end of the week in reaction to

concerns about the situation in the Middle East worsening

following American threats to strike the Syrian regime. As a

result, the general index retreated to below the level of 9000

points, after having exceeded it in the Tuesday and Wednesday

sessions. By the end of the week the general index was still up

1.43% compared to the previous week, and settled at 8918.5

points, while Al Rayan gained 0.68%. Indices of four sectors

made an increase, while those of three other sectors dropped.

The total capitalization increased to QR491.9 billion, and the

profit-to-earnings ratio rose by a multiple of 12.79.

In depth, the General Index increased by about 125.6 points or

1.43%, to the level of 8918.5 points. Al Rayan Islamic Index

rose by 0.68%, as well as 3 Sector Indices, most noticeably

insurance, while the indices of 4 other sectors dropped, mainly

real estate. It has been noticed that the share price of Aamal

made the largest gain with a 6.67% hike, followed by Mesaieed by

6.3%, Water & Electricity by 5.35%, and then QIB by 4.43%. In

contrast, the share price of Al Mannai recorded the biggest loss

with a 10.6% drop, followed by Islamic Holding by 7.9%, Ahli

Bank by 5.9%, and finally Investment Holding by 4.8%.

Total trading volume increased by 13.3% during the week to QR1.43

billion, consequently the average daily trading increased to

QR286.9 million. Industries Qatar led the traded shares with a

volume of QR213 million, followed by the share of QNB with

QR176.3 million, Mesaieed with QR148.1 million, and then Doha

Bank with QR92.6 million. It was noticed that Non-Qatari

portfolios made net purchases worth QR44.9 million. Qatari

individual investors made net sales of QR44.9 million, while

Qatari portfolios made a total net sales of QR11 million, as for

non-Qatari individuals, they made net sales of QR18.5 million.

As a result, QSE’s total capitalization increased by QR9.1

billion to reach QR493.9 billion. P/E ratio increased to a

multiple of 12.79 compared to 12.59 a week earlier.

Corporate News:

1-

Qatar National

Bank's net profit rose to QR3.4 billion in the first quarter of

2018, compared to QR3.2 billion for the same period last year.

The bank’s earnings per share amounted to QR3.6 compared to

QR3.3 for the same period last year. Total operating revenues

for the first quarter increased by 11% to QR5.96 billion, of

which QR4.67 billion in net interests. All expenses increased by

17% to QR2.34 billion for the same period, of which QR882.8

million went to the personnel, and QR599.1 million for

impairment losses on loans. Consequently, the net profit

increased by 7.1% to QR3.43 million.

There were fair

value of investments losses among others amounting to QR1.47

billion. As a result, the comprehensive income attributable to

shareholders amounted to QR2009 million.

2-

Doha Bank

announced that Fitch Ratings has affirmed the bank’s credit

rating at ‘A’ for “its ability to meet its long-term financial

obligations”. Moreover, QIIB said that the international rating

agencies Fitch and Capital Intelligence gave the bank a rating

of ‘A’. As for QIB, Fitch had established the bank's long-term

credit rating at A, while Standard & Poor's confirmed the bank's

rating at A-.

3-

Qatar Central

Securities Depository announced that it has raised the maximum

ownership of non-Qatari investors in Electricity & Water Co.,

QIB, Qatar Industrial Manufacturing Co., and Industries Qatar to

49% instead of 25%.

4-

Qatar Cinema

general assembly approved the distribution of a 10% cash

dividend to shareholders for the financial year 2017.

5-

QIIB set 15

April to disclose its first quarter financial statements for

2018, while Nakilat and Qatar Insurance chose 24 April, General

Insurance will release them on 25 April, and Qatar-Oman and Al

Meera will follow suit on 29 April. Ezdan Holding slated the

release of its first quarter figures on 30 April, while UDC

postponed it to 29 April.

6-

Al Meera

announced the opening of its 49th shopping center in

Aba Al Heran, Qatar.

Economic

Developments:

1-

Ministry of

Development Planning & Statistics issued the consumer price

index for March 2018, which shows a decrease in inflation to

0.4% compared to 0.8% in February 2018.

2-

OPEC oil in Qatar increased during the previous week until

Wednesday 11th April by US $3.81 due to the tension

in the Middle East to US $68.29 per barrel, compared to the

previous month’s price tag of US $64.48 per barrel.

3-

Dow Jones index lost 22 points to go down to the level of 24483

points until closing on Thursday. US dollar held its $1.23

position against the euro, and held steady once again against

the yen at ¥107.56 per dollar. Gold rose by about US $10 to the

level of $1340 per ounce.

.

|