|

The Group Securities: Weekly Report on QSE Performance, 22-26 April

2018

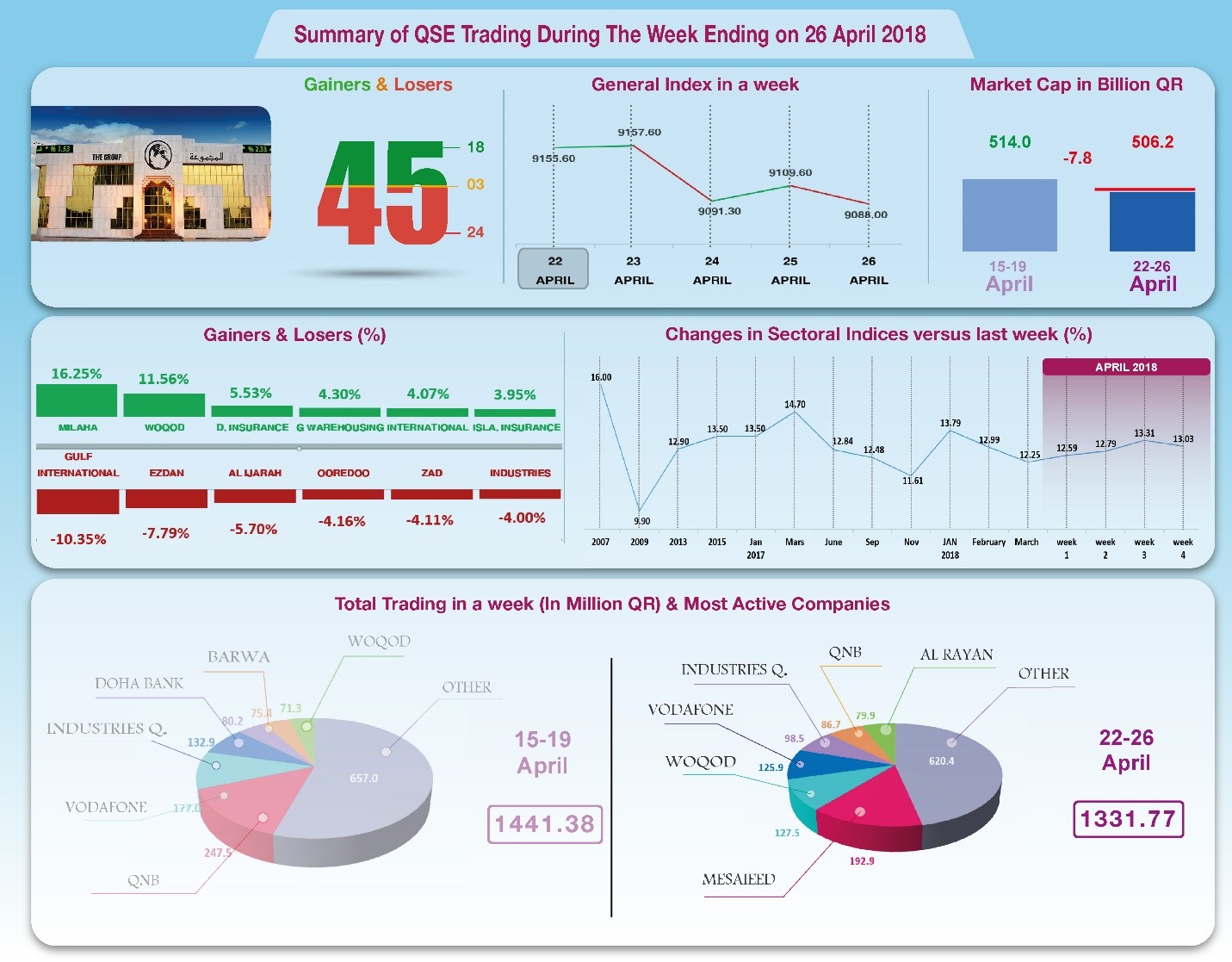

General Index Withdraws to 9088 Points

Companies’ results that were disclosed last week did not keep the

same momentum that those of the previous week initiated. The

profits of six companies surged, namely those of Industries

Qatar, which were released late on Thursday, followed by Doha

Bank, Electricity & Water Co., General Insurance, Al Khaliji,

and Nakilat. In the meanwhile, the profits of seven companies

dropped; specifically those of Gulf International, Ooredoo,

Qatar Insurance, Barwa, Khaleej, QIMC, and Islamic Group, as for

Salam, the company recorded a net loss. As a result, the general

index was unable to continue its upsurge, shedding 1.18% to 9088

points. Moreover, Al Rayan index fell 0.25% as well. Following

suit is the trading volume that fell to QR1.33 billion, total

capitalization dropped by QR7.8 billion, and the profit margin

fell to QR13.03.

In depth, the General Index decreased by about 109 points or 1.18%,

to the level of 9088 points. Al Rayan Islamic Index dropped by

0.25%, as well as 6 Sector Indices, most noticeably Industry,

Insurance, and Transportation. It has been noticed that the

share price of Gulf International recorded the biggest loss with

a 10.4% hike, followed by Ezdan by 7.8%, Alijarah by 5.7%, and

Ooredoo by 4.2%, then ZAD by 4.1%. In contrast, the share price

of Milaha recorded the largest win with a 16.25% hike, followed

by Woqod by 11.56%, Doha Insurance by 5.5%, and GWC by 4.3, then

QNB by 4.1%.

Total trading volume decreased by 7.6% during the week to QR1331.8

million, consequently the average daily trading increased to

QR286.9 million. Mesaieed led the traded shares with a volume of

QR192.9 million, followed by the share of Woqod with QR127.5

million, Vodafone with QR125.9 million, and then QIMC with

QR98.5 million. It was noticed that Qatari portfolios made net

sales of QR32.4 million, while non-Qatari portfolios made net

purchases of QR25.9 million. On another hand, Qatari individual

investors made a total net purchases of QR9.4 million, as for

non-Qatari individuals, they made net sales of QR2.8 million. As

a result, QSE’s total capitalization decreased by QR7.8 billion

to reach QR506.2 billion. P/E ratio decreased to a multiple of

13.03.

Corporate News:

1.

Doha Bank's net

profit amounted to QR381 million in the first quarter of 2018,

compared to QR364 million for the same period last year. The

bank’s earnings per share recorded QR1.23, versus QR1.41 for the

corresponding period of 2017. Doha Bank's net income for the

first quarter decreased by 2% to QR707.9 million. The drop was

from fees, commissions and other income streams. On the other

hand, total expenses decreased by 8.3% to QR324.8 million, of

which QR132.1 million spent on personnel and QR44.7 million from

losses in value of loans. As a result, the net profit increased

by 4.7% to QR364.4 million. It should be noted that there was a

loss of fair value of QR68 million. The comprehensive income

fell to QR 313.4 million, compared to QR400.4 million in the

corresponding period of 2017.

2.

The net profit of Qatar Electricity & Water Co. (QEWC) amounted to

QR394 million in the first quarter of 2018, compared to QR350

million for the corresponding period. The company’s earnings per

share recorded QR3.59, versus QR3.18 for the corresponding

period of 2017. Although QEWC’s revenues fell by 8.4% in the

first quarter, the 19.5% decrease in operating costs led to a

14.6% increase in total profit to QR302.1 million. Other incomes

increased by 58.6% to QR66.3 million, while general and

administrative expenses stood at QR50.3 million. The cost of

financing increased by 24.8% to QR47.8 million, and the

company's share in the profits of associates increased slightly

to QR131 million. As a result, the net profit increased by 12.7%

to QR401.4 million, and the comprehensive income increased to

QR849 million due to an increase in fair value.

3.

Khaliji net profit amounted to QR169.49 million in the first

quarter of 2018, compared to QR160.94 million for the same

period last year. The bank’s earnings per share recorded QR0.47,

versus QR0.45 for the corresponding period of 2017. Khaliji’s

gross profit increased by 1.2% to QR316 million in the first

quarter of 2018, of which QR244 million were generated from

interest. Expenses decreased by 4.3% to QR141.8 million; of

which QR44.1 million were spent on the bank’s personnel, and

QR47.5 million went to impairment losses of loans. As a result,

the net profit increased by 5.6% to QR169.5 million. Despite the

increase in fair value of QR9.8 million, and the comprehensive

income decreased by 29.3% to QR179.3 million, compared to

QR253.5 million in the corresponding period of 2017.

4.

Salam International Investment Limited (SIIL) net loss amounted to

QR8.22 million for the first quarter of 2018, compared to

QR20.39 million for the same period last year. The company’s

loss per share was recorded QR0.07, versus QR0.18 for the

corresponding period in 2017. SIIL’s operating income for the

first quarter of 2018 decreased by 17.4% to QR152.8 million,

while other incomes and investments generated QR13.5 million,

and its total expenses and costs dropped by 14.5% to QR146.4

million. As a result, the company achieved a net loss of QR6.48

million compared to a net profit of QR20.4 million in the

corresponding period of 2017. It should be noted that there was

a fair value loss of QR3.48 million, bringing the overall loss

to QR11.7 million.

5.

The net profit of Islamic Holding amounted to QR237 thousand in the

first quarter of 2018, compared to QR1.3 million in the same

period of 2017. The company’s earnings per share recorded QR0.04

in this first quarter, versus QR0.23 for the corresponding

period of 2017. Islamic Holding’s operating income decreased in

the first quarter of 2018 by 35% to QR2.21 million, of which

QR1.02 million were generated from commissions (compared to

QR2.78 million in the corresponding period of 2017), and QR842

thousand from savings accounts. After deducting expenses of

QR1.83 million and taking into account depreciation and

commissions, the net profit shrank to QR237 thousand compared to

QR1.31 million in the corresponding period of 2017. It should be

noted that there was a fair value loss of QR333 thousand, with a

net loss of QR95.8 thousand.

6.

Barwa net profit amounted to QR405 million in the first quarter of

2018, compared to QR479 million for the same period last year.

The company’s earnings per share recorded QR1.04 compared to

QR1.23 for the corresponding period in 2017. The company’s net

rental and leasing income increased by QR5 million to QR255.1

million in the first quarter of 2018, while the net revenues

generated from advisory services stood at QR25.6 million with a

slight increase. On another hand, the fair value gains on real

estate investments declined by 12.3% to QR211 million, and

general and administrative expenses dropped by half to reach

QR25.9 million. After deducting depreciation and other expenses,

the net profit fell by 15.5% to QR404.9 million, and

comprehensive income reached QR407 million.

7.

Gulf International Services disclosed its financial statements for

the three months ended 31 March 2018, with a net profit of QR9.5

million, a drop of 37%, compared to QR15.1 million for the same

period last year. The company’ earnings per share amounted to

QR0.05 for the financial period ended 31 March 2018, versus

QR0.08 for the same period in 2017. Gulf international Services'

total income from core business increased by 7.5% to QR 94.4

million in the first quarter of this year; while other sources

of income rose by 17.8%. On the other side, public and

administrative expenses dropped by 4.5% to QR 58.8 million,

though net financing cost went up by 51% to QR 43.8 million. As

result, net profit slid by 37.1 % to QR9.5 million, and

comprehensive income to QR 7.1 million.

8.

Qatar Insurance Company disclosed its financial statements for the

period ended 31 March 2018, with a net profit of QR230 million,

a drop of 23.8%, compared to QR302 million for the same period

last year. The company’s earnings per share for the first

quarter of 2018 amounted to QR0.66, versus QR0.95 for the same

period in 2017. Qatar Insurance Company net income from

insurance policy sales fell by 65.8% to 115 million in the first

quarter of this year, and net investment profit dropped by 3.6%

to QR 274.6 million. Hence, comprehensive income went down to

QR407.1 million, compared to QR 478.6 in the corresponding

period. Total expenses stood at QR 166.4 million, slightly

edging up. As result, net profit decreased by 23.6% to QR 230.2

million. As there was a negative change in the fair value worth

163.5 million, comprehensive income dipped to QR 73.6 million,

compared to QR 223.1 million.

9.

Qatar Gas Transport Company Ltd. (Nakilat) disclosed its

financial statements for the period ended on 31 March 2018, with

a net profit of QR216.4 million, an increase of 13.2%, compared

QR191 million for the same period last year. The company’s

earnings per share amounted to QR0.39 for the first quarter

ended 31 March 2018, versus QR0.34 for the same period of 2017.

Nakilat total income increased by 1.5% to QR 890.3 million the

first quarter, including 757.6 million form ships operations.

Total expenses decreased by 1.8% to QR 673.6 million, of which

QR 288.3 allotted to the cost of financing, and QR 164.6 million

to public expenses. As result, net profit shot up by 13.2% to

QR216 million. The company also registered positive change in

the fair value of investments in hedging derivatives instruments

worth 310.6 million. Comprehensive income thus jumped up to

606.6 million, compared to QR 194.4 million in the corresponding

period.

10.

Ooredoo’s net profit amounted to QR486 million in the first

quarter of 2018, compared to QR584 million for the same period

of the previous year. The company’s earnings per share recorded

QR1.52, versus QR1.82 for the corresponding period in 2017.

Ooredoo’s gross operational revenues fell by 3.5% to QR7.76

billion in the first quarter of 2018. Total expenditure stood

unchanged at QR7.17 billion, of which QR3.1 billion were

operating expenses, QR1.55 billion were general and

administrative expenses, and QR2 billion were depreciation and

amortization expenses. After adding other income and

expenditures, the net profit attributable to the shareholders

decreased by 16.2% to QR486 million, and after adding currency

and other income, the comprehensive income amounted to QR647.9

million compared to QR872.5 million during the corresponding

period in 2017.

11.

ZAD’s net profit increased to QR49.76 million in the first

quarter of 2018, compared to QR49.25 million for the same period

of the previous year. The holding’s earnings per share recorded

QR2.10, versus QR2.08 for the corresponding period in 2017.

Zad’s gross revenues increased by 20% to QR316.8 million in this

first quarter, of which QR24.9 million were generated from

government compensation. On another hand, operating costs

increased by 31% to QR243 million, and the total profit

decreased by 6% to QR73.7 million. General and administrative

expenses rose by 3% to QR33 million, and other income doubled to

QR12.2 million. As a result, the net profit settled at QR49.8

million, slightly higher than the corresponding period in 2017.

12.

General Insurance’s net profit amounted to QR55.1 million in the

first quarter of 2018, compared to QR43 million for the same

period of the previous year. The company’s earnings per share

recorded QR63, versus QR49 for the corresponding period of 2017.

Insurance results for the first quarter increased by 14.1% to

QR26 million, while investment and other operations decreased by

6.9% to QR87.2 million, and total expenses decreased by 17.6% to

QR63.4 million. As a result, the net profit attributable to

shareholders increased by 28% to QR55.1 million and the

comprehensive income amounted to QR52 million, double that of

the corresponding period of 2017.

13.

Qatar Industrial Manufacturing Co. (QIMC) net profit amounted to

QR50.82 million in the first quarter of 2018, compared to

QR60.44 million for the same period last year. QIMC’s earnings

per share recorded QR1.07, versus QR1.27 for the corresponding

period of 2017. The company’s total conversion profit from sales

in the first quarter decreased by 17.3% to QR25.8 million, and

total expenses decreased by 5% to QR17.2 million. Other incomes

decreased by 12.4% to QR43.6 million, including other income

from investments in other companies. As a result, the net profit

decreased by 15.9% to QR50.8 million and the comprehensive

income fell by 29.1% to QR38.2 million.

14.

Qatar International Islamic Bank’s net profit for the first

quarter of 2018 amounted to QR253.2 million compared to QR236.5

million for the same period last year. The bank’s earnings per

share recorded QR1.67, versus QR1.56 for the corresponding

period of 2017. QIIB’s gross domestic revenue increased by 12.5%

to QR517.2 million in the first quarter of 2018. However, the

total expenses also increased by 3% to QR125.6 million, of which

QR38 million were spent on personnel costs, and QR44.5 million

went to financing expenses. On the other hand, return on

investment for account holders increased by 35.4% to QR134.1

million. As a result, the net profit rose by 7.1% to QR253.2

million.

15.

Industries Qatar’s net profit amounted to QR1268 million in the

first quarter of 2018, compared to QR928 million for the same

period last year. The company’s earnings per share recorded

QR2.10 in this quarter, versus QR1.53 for the corresponding

period of 2017.

Economic Developments:

1.

OPEC oil price in Qatar increased during the previous week until

Thursday 26th April by US $1.61 to US $71 per barrel,

compared to the previous month’s price tag of US $69.39 per

barrel.

2.

Dow Jones index gained 161 points to go up to the level of 24322

points until closing on Thursday. US dollar increased to $1.21

against the euro, but decreased against the yen at ¥109.33 per

dollar. Meanwhile, gold decreased by about US $26 to the level

of $1318.5 per ounce.

|